Mexico Forklift Trucks Market Size, Share, Trends and Forecast by Product Type, Technology, Class, Application, and Region, 2025-2033

Mexico Forklift Trucks Market Overview:

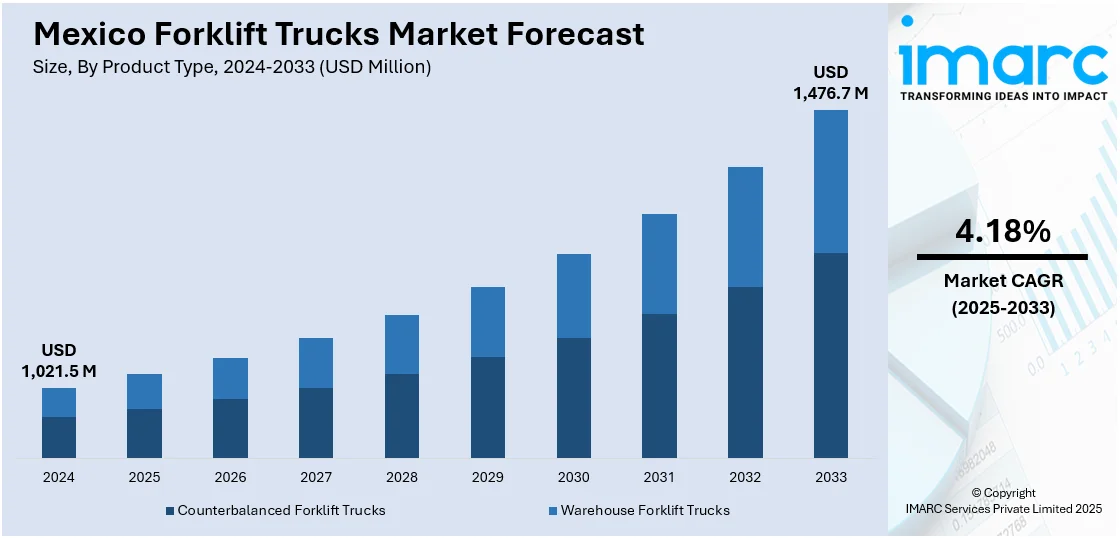

The Mexico forklift trucks market size reached USD 1,021.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,476.7 Million by 2033, exhibiting a growth rate (CAGR) of 4.18% during 2025-2033. The rapid industrialization, expanding logistics and warehousing sectors, growth in e-commerce, rising demand for efficient material handling, increasing infrastructure development, technological advancements in automation, implementation of supportive government initiatives, and the need for enhanced productivity across various manufacturing industries are some of the factors augmenting Mexico forklift trucks market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,021.5 Million |

| Market Forecast in 2033 | USD 1,476.7 Million |

| Market Growth Rate 2025-2033 | 4.18% |

Mexico Forklift Trucks Market Trends:

Growth in E-commerce and Warehousing Expansion

The rapid growth of e-commerce in Mexico is significantly contributing to Mexico forklift trucks market growth. According to an industry report, the e-commerce market in Mexico is projected to reach USD 176.6 Billion by 2033, registering a robust compound annual growth rate (CAGR) of 14.5% during the period 2025–2033. As more consumers shift toward online shopping platforms, there has been a corresponding increase in the development of warehouses and distribution centers, particularly in major urban hubs such as Mexico City, Monterrey, and Guadalajara. This rise necessitates efficient and scalable material handling solutions, prompting businesses to invest in modern forklifts equipped for high-volume, fast-paced environments. Additionally, e-commerce operations require a high degree of accuracy, speed, and flexibility in logistics, and forklifts play a crucial role in facilitating the movement of goods within facilities. Moreover, reach trucks, pallet jacks, and narrow aisle forklifts are especially popular in fulfillment centers due to their ability to operate in compact spaces. In addition to this, seasonal fluctuations in demand and last-mile delivery expectations are pushing warehouses to adopt forklifts that can support dynamic operational shifts. As digital commerce continues to expand in Mexico, the associated warehousing infrastructure will remain a critical growth driver for the forklift trucks market.

Emphasis on Sustainable and Electric Forklift Solutions

Environmental sustainability has become a core consideration in Mexico’s industrial and logistics sectors, driving increased interest in electric-powered forklift trucks. According to an industry report, Mexico targets a 35% reduction in greenhouse gas emissions across its economy by 2030, including a 22% reduction specifically from the transport sector. These national sustainability commitments, along with rising fuel costs, stricter emissions regulations, and growing corporate environmental responsibility, are collectively driving a market-wide shift toward cleaner technologies. This push toward decarbonization is accelerating the adoption of electric forklifts, which produce zero direct emissions and offer multiple operational advantages. Furthermore, the Mexican government’s push for cleaner energy usage and carbon reduction in manufacturing further encourages the transition from diesel or LPG-powered forklifts to battery-operated models. Also, continual advances in lithium-ion battery technology have addressed earlier concerns related to charging time, battery lifespan, and performance, which is enhancing Mexico forklift trucks market outlook. These forklifts offer lower maintenance costs, quieter operation, and improved ergonomics, making them well-suited for industries. In line with this, global forklift manufacturers are introducing hybrid and energy-efficient models tailored to the Latin American market. This green transition reflects a broader commitment across Mexico to adopt cleaner, more sustainable industrial practices.

Mexico Forklift Trucks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, technology, class, and application.

Product Type Insights:

- Counterbalanced Forklift Trucks

- Warehouse Forklift Trucks

The report has provided a detailed breakup and analysis of the market based on the product type. This includes counterbalanced forklift trucks and warehouse forklift trucks.

Technology Insights:

- Electricity Problem

- Internal Combustion Engine Powered

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes electricity problem and internal combustion engine powered.

Class Insights:

- Class I

- Class II

- Class III

- Class IV

- Class V

The report has provided a detailed breakup and analysis of the market based on the class. This includes class I, class II, class III, class IV, and class V.

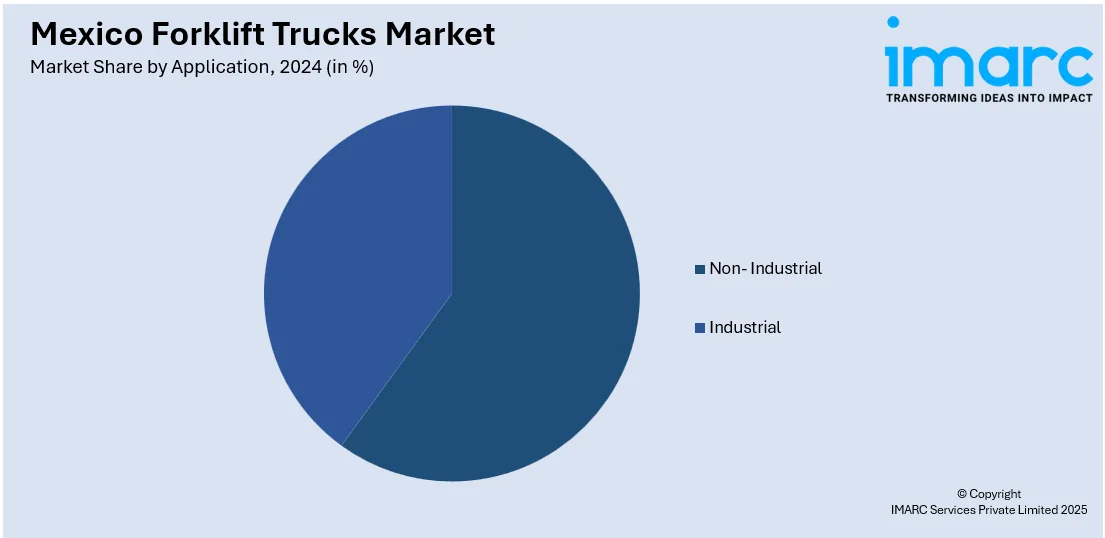

Application Insights:

- Non- Industrial

- Warehouse and Distribution Centers

- Construction Sites

- Dockyards

- Snow Plows

- Industrial

- Manufacturing

- Recycling Operations

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes non-industrial (warehouse and distribution centers, construction sites, dockyards, and snow plows) and industrial (manufacturing and recycling operations).

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Forklift Trucks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Counterbalanced Forklift Trucks, Warehouse Forklift Trucks |

| Technologies Covered | Electricity Problem, Internal Combustion Engine Powered |

| Classes Covered | Class I, Class II, Class III, Class IV, Class V |

| Applications Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico forklift trucks market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico forklift trucks market on the basis of product type?

- What is the breakup of the Mexico forklift trucks market on the basis of technology?

- What is the breakup of the Mexico forklift trucks market on the basis of class?

- What is the breakup of the Mexico forklift trucks market on the basis of application?

- What is the breakup of the Mexico forklift trucks market on the basis of region?

- What are the various stages in the value chain of the Mexico forklift trucks market?

- What are the key driving factors and challenges in the Mexico forklift trucks?

- What is the structure of the Mexico forklift trucks market and who are the key players?

- What is the degree of competition in the Mexico forklift trucks market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico forklift trucks market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico forklift trucks market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico forklift trucks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)