Mexico Fortified Dairy Products Market Size, Share, Trends and Forecast by Product, Ingredient, Flavor, Distribution Channel, and Region, 2025-2033

Mexico Fortified Dairy Products Market Overview:

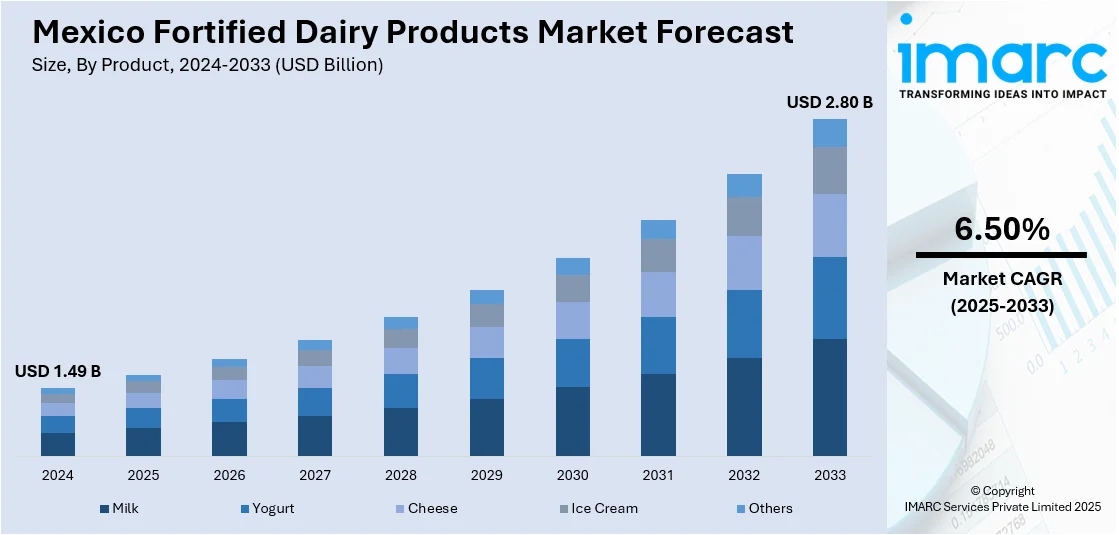

The Mexico fortified dairy products market size reached USD 1.49 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.80 Billion by 2033, exhibiting a growth rate (CAGR) of 6.50% during 2025-2033. The growing health awareness among consumers is offering a favorable market outlook. Moreover, the implementation of government initiatives aimed at tackling prevalent nutritional deficiencies among the masses is propelling the market growth. Apart from this, the shift in lifestyle of consumers is expanding the Mexico fortified dairy products market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.49 Billion |

| Market Forecast in 2033 | USD 2.80 Billion |

| Market Growth Rate 2025-2033 | 6.50% |

Mexico Fortified Dairy Products Market Trends:

Health Awareness Among Consumers

The Mexico fortified dairy products sector is driven by the growing health awareness among consumers. People belonging to different age groups are becoming more health-conscious and placing greater importance on well-being and preventive care, thus demanding more nutrient-dense food and drinks. Customers are actively looking for fortified dairy foods with essential nutrients including calcium, probiotics, vitamin D, and omega-3 fatty acids that are known to promote bone health, immunity, and heart function. The trend is also supported by public health messages and educational programs emphasizing the role of micronutrient consumption in fighting deficiency. Parents are also emphasizing significantly and providing their kids with products that will improve physical development and cognitive performance, hence catalyzing the demand for fortified milk and yogurt. The change in consumer psyche from treating to preventing is constantly modifying dietary choice and is encouraging manufacturers to innovate and present diversified fortified dairy products addressing this changing need.

Government Initiatives Addressing Nutritional Deficiencies

Government initiatives propelling the Mexico fortified dairy products market by tackling prevalent nutritional deficiencies among the masses. Health ministries and regulatory bodies are constantly putting in place policies favoring consumption of fortified foods as part of national nutrition initiatives. These efforts are reaching out to susceptible populations like children, pregnant women, and the elderly, who are highly prone to deficiencies in vitamins and minerals. Public health agencies are collaborating with dairy producers to see that staple dairy products such as milk and cheese are fortified with important nutrients such as iron, vitamin A, and folic acid. School feeding programs are also introducing fortified dairy to improve students from poor households' dietary intake. These actions are not just enhancing public health results but are also boosting producers' adherence to fortification requirements. Through the institutionalization of fortified food distribution, the government is improving market penetration and heightened product availability. In 2025, the federal government of Mexico allocated 13.5 billion pesos for the building and development of milk processing plants to double the acquisition of milk by 2030.

Shifting Lifestyle Habits of People

Shifts in lifestyles of consumers are impelling the Mexico fortified dairy products market growth. Urban areas are seeing more working professionals and nuclear families opting for fast lifestyles and giving preference to convenience without sacrificing nutrition. Consequently, consumers are preferring ready-to-eat (RTE), fortified milk-based foods such as single-serve milk, flavored yogurt, and probiotic beverages that are convenient for busy lifestyles with added health benefits. The rising number of supermarkets, hypermarkets, and online grocery sites in the urban cities is also increasing the availability of these products to consumers. At the same time, various diet trends and heightened exposure to international wellness movements are conditioning tastes towards functional foods. These urban consumption patterns are being met by food companies that are launching fortified dairy versions with enhanced shelf life, new packaging, and diversified nutritional profiles. In 2024, UK-based ProBiotix Health plc finalized a new agreement with Mexico's Raff, a specialist in raw materials and ingredients, for the distribution of probiotics aimed at promoting cardiometabolic health.

Mexico Fortified Dairy Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, ingredient, flavor, and distribution channel.

Product Insights:

- Milk

- Yogurt

- Cheese

- Ice Cream

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes milk, yogurt, cheese, ice cream, and others.

Ingredient Insights:

- Vitamins

- Minerals

- Probiotics

- Omega-3 Fatty Acids

- Proteins

- Others

The report has provided a detailed breakup and analysis of the market based on the ingredient. This includes vitamins, minerals, probiotics, omega-3 fatty acids, proteins, and others.

Flavor Insights:

- Unflavored/Natural

- Flavored

The report has provided a detailed breakup and analysis of the market based on the flavor. This includes unflavored/natural and flavored.

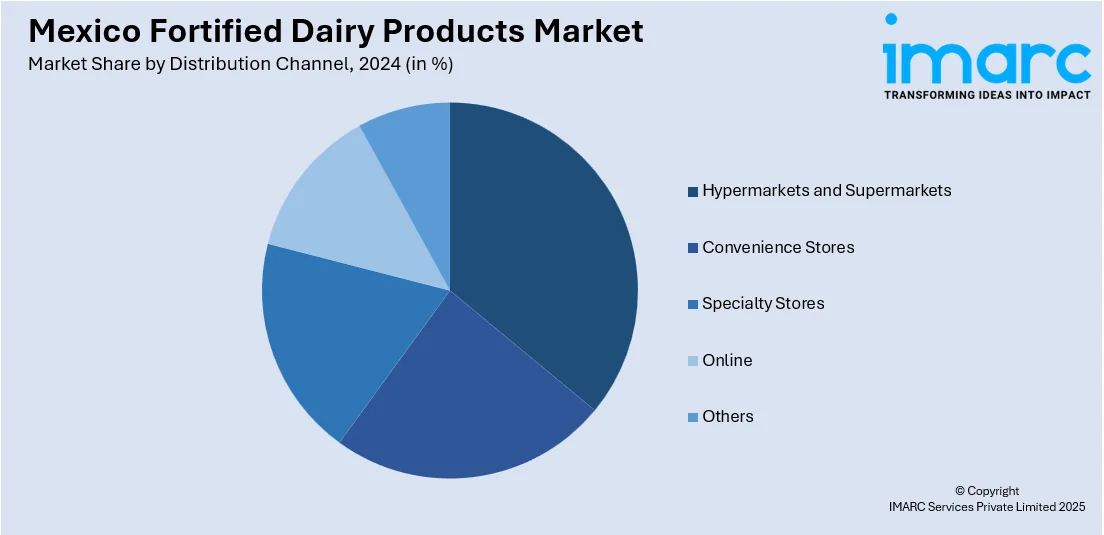

Distribution Channel Insights:

- Hypermarkets and Supermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hypermarkets and supermarkets, convenience stores, specialty stores, online, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Fortified Dairy Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Milk, Yogurt, Cheese, Ice Cream, Others |

| Ingredients Covered | Vitamins, Minerals, Probiotics, Omega-3 Fatty Acids, Proteins, Others |

| Flavors Covered | Unflavored/Natural, Flavored |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Convenience Stores, Specialty Stores, Online, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico fortified dairy products market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico fortified dairy products market on the basis of product?

- What is the breakup of the Mexico fortified dairy products market on the basis of ingredient?

- What is the breakup of the Mexico fortified dairy products market on the basis of flavor?

- What is the breakup of the Mexico fortified dairy products market on the basis of distribution channel?

- What is the breakup of the Mexico fortified dairy products market on the basis of region?

- What are the various stages in the value chain of the Mexico fortified dairy products market?

- What are the key driving factors and challenges in the Mexico fortified dairy products market?

- What is the structure of the Mexico fortified dairy products market and who are the key players?

- What is the degree of competition in the Mexico fortified dairy products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico fortified dairy products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico fortified dairy products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico fortified dairy products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)