Mexico Foundry and Casting Market Size, Share, Trends and Forecast by Casting Type, Manufacturing Process, End Use Industry, and Region, 2025-2033

Mexico Foundry and Casting Market Overview:

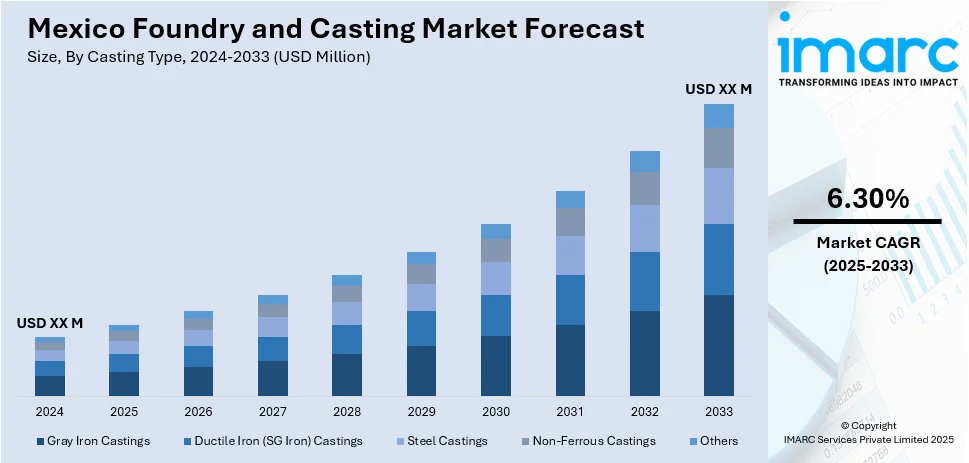

The Mexico foundry and casting market size is anticipated to exhibit a growth rate (CAGR) of 6.30% during 2025-2033. The market is driven by strong demand from the automotive, aerospace, and manufacturing sectors, supported by technological advancements and increased local production capabilities. The growth of infrastructure projects and expanding industrial activities further boost the Mexico foundry and casting market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 6.30% |

Mexico Foundry and Casting Market Trends:

Growing Demand from the Automotive Sector

The automotive sector is one of the primary drivers of the Mexico foundry and casting market. Mexico has become a global hub for automotive manufacturing, with major automakers establishing production facilities in the region. As these companies expand, there is a heightened demand for precision-cast metal components, including engine blocks, transmission parts, and suspension systems. With Mexico's strategic position in the supply chain and the increasing need for high-quality cast components, the Mexico foundry and casting market growth remains robust. Moreover, the demand for lightweight materials, such as aluminum castings, is pushing for innovations in casting technologies that improve vehicle performance and fuel efficiency. For instance, GIFA Mexico FUNDIEXPO 2024, held in October 2024, at Centro Citibanamex, is a major trade fair for the foundry industry in Mexico and Latin America. The event aligns with the growing demand in Mexico’s automotive sector, especially in electromobility, attracting key industry players. Exhibitors include international giants, showcasing advancements in metal casting and forging technologies, reinforcing Mexico's pivotal role in the foundry sector.

Expansion in Aerospace and Industrial Manufacturing

Mexico foundry and casting market growth is also benefiting from the expansion of the aerospace and industrial manufacturing sectors. Aerospace companies are investing in Mexico for the production of critical cast parts used in aircraft engines, landing gears, and structural components. Additionally, Mexico’s focus on bolstering its industrial capabilities, particularly in heavy machinery and oil and gas, has created more opportunities for casting foundries. For instance, in October 2024, Savelli Technologies secured a €78 million order, which includes installations in Mexico for MAT Foundry and Brembo. The company is deploying advanced high-performance molding lines and sand preparation systems to enhance its capabilities. This strengthens Savelli’s leadership position in the global foundry industry, showcasing its adaptability to geopolitical challenges and its commitment to supporting multinational clients. These technologies are crucial across various industrial sectors where precision and high-quality castings are essential. Savelli’s expertise in delivering customized solutions continues to drive its success in these diverse industrial applications.

Mexico Foundry and Casting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on casting type, manufacturing process, and end use industry.

Casting Type Insights:

- Gray Iron Castings

- Ductile Iron (SG Iron) Castings

- Steel Castings

- Non-Ferrous Castings

- Others

The report has provided a detailed breakup and analysis of the market based on the casting type. This includes gray iron castings, ductile iron (SG Iron) castings, steel castings, non-ferrous castings, and others.

Manufacturing Process Insights:

- Sand Casting

- Investment Casting

- Die Casting

- Centrifugal Casting

- Others

A detailed breakup and analysis of the market based on the manufacturing process have also been provided in the report. This includes sand casting, investment casting, die casting, centrifugal casting, and others.

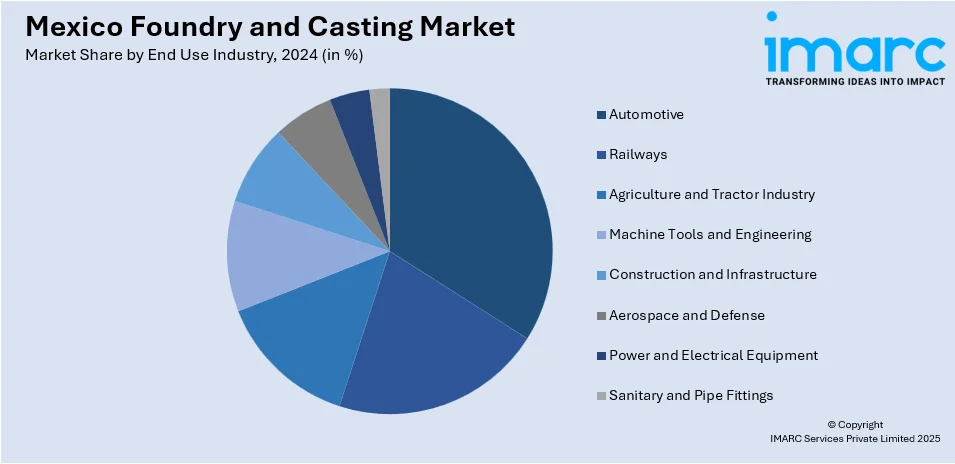

End Use Industry Insights:

- Automotive

- Railways

- Agriculture and Tractor Industry

- Machine Tools and Engineering

- Construction and Infrastructure

- Aerospace and Defense

- Power and Electrical Equipment

- Sanitary and Pipe Fittings

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes automotive, railways, agriculture and tractor industry, machine tools and engineering, construction and infrastructure, aerospace and defense, power and electrical equipment, and sanitary and pipe fittings.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Foundry and Casting Market News:

- In March 2025, MAGMA Foundry Technologies Inc. announced the opening of their new office in San Pedro Garza García, Mexico, offering local technical support, tailored software solutions, and training through MAGMAacademy. This expansion aims to improve Mexico’s metal casting industry, enhancing operational efficiency and production processes.

- In May 2024, Ryobi Die Casting invested $50 million to expand its aluminum diecasting plant in Irapauto, Mexico, adding five large high-pressure diecasting machines to meet future electric vehicle component demand. The expansion, expected to complete by April 2025, will add 91,500 square feet of space and create 124 new jobs.

- In February 2024, Brakes India announced a $70 million investment to build its first foundry plant in Aguascalientes, Mexico. This marks a significant expansion in the global automotive market. The project will develop in two phases, with completion expected by January 2026, and is expected to create new jobs while boosting the region's economic growth.

Mexico Foundry and Casting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Casting Types Covered | Gray Iron Castings, Ductile Iron (SG Iron) Castings, Steel Castings, Non-Ferrous Castings, Others |

| Manufacturing Processes Covered | Sand Casting, Investment Casting, Die Casting, Centrifugal Casting, Others |

| End Use Industries Covered | Automotive, Railways, Agriculture and Tractor Industry, Machine Tools and Engineering, Construction and Infrastructure, Aerospace and Defense, Power and Electrical Equipment, Sanitary and Pipe Fittings |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico foundry and casting market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico foundry and casting market on the basis of casting type?

- What is the breakup of the Mexico foundry and casting market on the basis of manufacturing process?

- What is the breakup of the Mexico foundry and casting market on the basis of end use industry?

- What are the various stages in the value chain of the Mexico foundry and casting market?

- What are the key driving factors and challenges in the Mexico foundry and casting market?

- What is the structure of the Mexico foundry and casting market and who are the key players?

- What is the degree of competition in the Mexico foundry and casting market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico foundry and casting market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico foundry and casting market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico foundry and casting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)