Mexico Fraud Detection and Prevention Market Size, Share, Trends and Forecast by Component, Application, Organization Size, Vertical, and Region, 2025-2033

Mexico Fraud Detection and Prevention Market Overview:

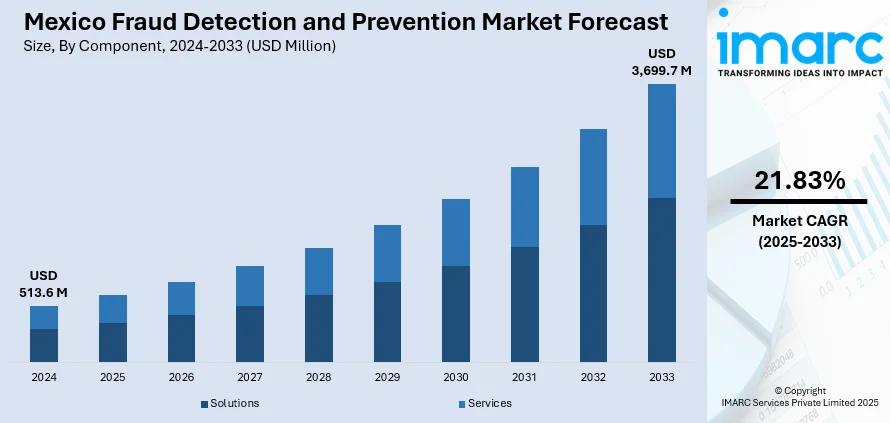

The Mexico fraud detection and prevention market size reached USD 513.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,699.7 Million by 2033, exhibiting a growth rate (CAGR) of 21.83% during 2025-2033. The market is driven by rising digital transactions, stricter regulatory compliance, and increasing cyber fraud. Businesses are adopting AI and biometric solutions to enhance security and reduce financial losses. Growth in e-commerce, mobile banking, and government mandates for fraud prevention further propel demand for advanced detection technologies in Mexico.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 513.6 Million |

| Market Forecast in 2033 | USD 3,699.7 Million |

| Market Growth Rate 2025-2033 | 21.83% |

Mexico Fraud Detection and Prevention Market Trends:

Increasing Adoption of AI and Machine Learning in Fraud Detection

The rising adoption of machine learning (ML) and artificial intelligence (AI) technologies is majorly driving the Mexico fraud detection and prevention market growth. Businesses across banking, e-commerce, and telecommunications are leveraging AI-powered tools to detect fraudulent transactions in real time. These systems analyze vast amounts of data, identify unusual patterns, and flag suspicious activities faster than traditional rule-based methods. With the rise in digital payments and online transactions, companies are investing in advanced fraud prevention solutions to minimize financial losses and enhance security. Additionally, regulatory pressures from the Mexican government and financial authorities are pushing organizations to implement stronger fraud detection mechanisms. AI-driven solutions improve accuracy and reduce false positives, ensuring smoother customer experiences. As cybercriminals employ more sophisticated tactics, AI and ML will remain critical in staying ahead of emerging fraud risks in the country. Mexico is facing a rise in cyber attacks, with 77% of state-sponsored phishing attacks being leveled by China, Russia, and North Korea. Ransomware campaigns are most targeted at the manufacturing, finance, and government sectors, making Mexico the second most affected nation in Latin America. Cyberattackers are using tax schemes, including SAT impersonation and banking trojans, increasing the need for fraud discovery in financial services. While Chrome OS has a zero record of ransomware attacks, the number of malware campaigns through malicious PDFs and fake utilities identifies the critical need for enhanced threat intelligence in Mexico's digital economy.

Growth of Biometric Authentication for Fraud Prevention

The increasing use of biometric authentication to combat identity theft and unauthorized access is also expanding the Mexico fraud detection and prevention market share. Financial institutions, government agencies, and retail businesses are integrating fingerprint, facial recognition, and voice authentication to verify user identities securely. Unlike traditional passwords or PINs, biometric data is unique to each individual, making it significantly harder for fraudsters to replicate. The rise in mobile banking and digital onboarding has further accelerated demand for biometric solutions, as they provide a seamless yet secure customer experience. Mexico's digital payments increased in 2024, with e-commerce hitting 74 billion and, mobile wallets growing to 1774 billion and mobile wallets growing to 1766.2 billion. Real-time systems such as DiMo (around 7 million users) and SPEI (USD 25.7 Billion processed) are accelerating secure transactions, yet cash vouchers (10% of online payments) and BNPL fraud risks challenge detection systems. Fraud tech adoption rises as 33% of e-commerce growth by 2026 demands stronger safeguards against scams in mobile-dominated (79%) purchases. Mexico’s regulatory environment, including anti-money laundering (AML) and know-your-customer (KYC) requirements, is also driving adoption. As biometric technology becomes more affordable and accessible, its implementation will expand across industries, reducing fraud risks while improving operational efficiency. This trend highlights a shift toward more robust and user-friendly fraud prevention methods and creates a positive Mexico fraud detection and prevention market outlook.

Mexico Fraud Detection and Prevention Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the county and regional levels for 2025-2033. Our report has categorized the market based on component, application, organization size, and vertical.

Component Insights:

- Solutions

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solutions and services.

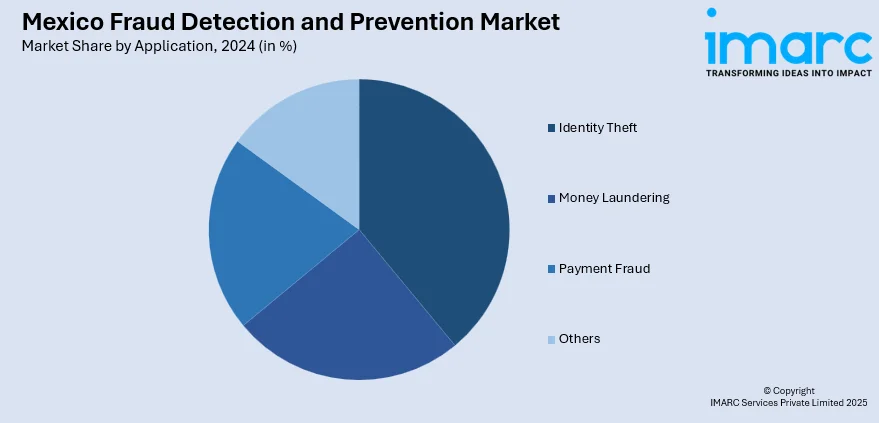

Application Insights:

- Identity Theft

- Money Laundering

- Payment Fraud

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes identity theft, money laundering, payment fraud, and others.

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium enterprises and large enterprises.

Vertical Insights:

- BFSI

- Government and Defense

- Healthcare

- IT and Telecom

- Manufacturing

- Retail and E-Commerce

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes BFSI, government and defense, healthcare, IT and telecom, manufacturing, retail and e-commerce, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Fraud Detection and Prevention Market News:

- December 04, 2024: Inter.mx partnered with Stripe to launch a freemium insurance model in Mexico, integrating fraud detection using Stripe Radar to make transactions secure. The platform went live within seven weeks, with an 8% conversion rate from the free to paid tier during a six-month window. The project aims to increase the availability of insurance while maintaining low fraud rates across Mexico.

Mexico Fraud Detection and Prevention Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solutions, Services |

| Applications Covered | Identity Theft, Money Laundering, Payment Fraud, Others |

| Organization Sizes Covered | Small And Medium Enterprises, Large Enterprises |

| Verticals Covered | BFSI, Government and Defense, Healthcare, IT and Telecom, Manufacturing, Retail and E-Commerce, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico fraud detection and prevention market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico fraud detection and prevention market on the basis of component?

- What is the breakup of the Mexico fraud detection and prevention market on the basis of application?

- What is the breakup of the Mexico fraud detection and prevention market on the basis of organization size?

- What is the breakup of the Mexico fraud detection and prevention market on the basis of vertical?

- What is the breakup of the Mexico fraud detection and prevention market on the basis of region?

- What are the various stages in the value chain of the Mexico fraud detection and prevention market?

- What are the key driving factors and challenges in the Mexico fraud detection and prevention market?

- What is the structure of the Mexico fraud detection and prevention market and who are the key players?

- What is the degree of competition in the Mexico fraud detection and prevention market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico fraud detection and prevention market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico fraud detection and prevention market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico fraud detection and prevention industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)