Mexico Freight Transportation Market Size, Share, Trends and Forecast by Offering, Transport, End Use, and Region, 2025-2033

Mexico Freight Transportation Market Overview:

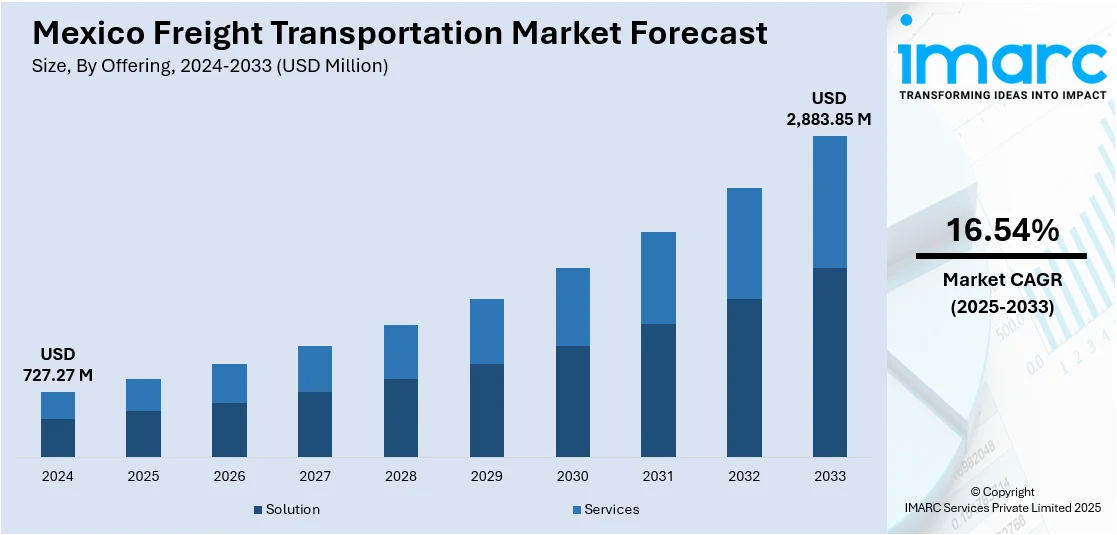

The Mexico freight transportation market size reached USD 727.27 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,883.85 Million by 2033, exhibiting a growth rate (CAGR) of 16.54% during 2025-2033. The market is driven by technological innovations, including automation and real-time tracking, which streamline operations and reduce costs. Proximity to the United States and favorable trade agreements like USMCA ensure robust trade activity, thereby creating continuous demand for freight transportation services. Ongoing investments in infrastructure, such as upgraded highways and modernized ports, enhance the efficiency of logistics networks, further augmenting the Mexico freight transportation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 727.27 Million |

| Market Forecast in 2033 | USD 2,883.85 Million |

| Market Growth Rate 2025-2033 | 16.54% |

Mexico Freight Transportation Market Trends:

Technological Advancements in Logistics

The market is significantly shaped by the ongoing integration of state-of-the-art technologies aimed at enhancing logistics efficiency. Automation, real-time tracking platforms, and data analytics are progressively being used for refining working processes and cutting down delivery times. Predictive analytics, for instance, enable businesses to customize routes and streamline operations according to real-time data, which yields more budget-friendly solutions. Besides, the use of digital platforms has made it possible to have improved transparency and communication throughout the supply chain, so that customers are able to monitor their products at each level of transportation. As businesses seek more reliable and faster transportation solutions, these technologies are essential in meeting the growing demand for improved logistics performance. On July 17, 2024, XPO announced the expansion of its cross-border LTL (Less-Than-Truckload) services between the United States and Mexico with the launch of XPO Mexico+. This expansion includes more capacity, coverage to 99% of postal codes in Mexico, and the addition of seven border-crossing points, improving delivery times and ensuring real-time tracking for shipments. The move responds to growing demand driven by nearshoring trends, enhancing XPO’s presence in the evolving North American supply chain. Mexico has made significant investments in improving its transportation infrastructure, which is helping to enhance the efficiency and capacity of its freight transportation sector. The development of new highways, modern rail systems, and upgraded ports has improved connectivity within Mexico and to key international markets. Consequently, technological advancements are expected to remain a key driver of Mexico freight transportation market growth and expansion.

Proximity to the United States and NAFTA/USMCA Trade

Mexico’s strategic location, particularly its proximity to the United States, has been a significant factor in the growth of its freight transportation industry. Mexico plays a vital role as a key trading partner of the United States, with significant amounts of goods crossing the U.S.-Mexico border each day. Trade agreements such as the North American Free Trade Agreement (NAFTA) and its replacement, the United States-Mexico-Canada Agreement (USMCA), have streamlined trade processes and strengthened Mexico's integration into supply chains across North America. As per recent industry reports, Mexican trucking freight experienced a record year in 2024, with truck freight valued at nearly USD 78 billion hauled across borders in December. The 10% year-over-year increase in Mexican truck freight, led by a 54% surge in computer-related imports, was driven by nearshoring trends as U.S. companies moved manufacturing from China to Mexico. This trade relationship has led to a steady increase in the demand for both inbound and outbound freight services. Mexico’s role as a manufacturing hub, coupled with its access to the U.S. market, has created a strong and growing demand for transportation services, driving the freight transportation sector forward. Furthermore, the expansion of airport facilities and border crossings has also facilitated smoother cross-border trade, enabling more efficient movement of goods. The government has actively supported these infrastructure projects as part of its economic development plans, seeing them as a way to increase competitiveness and attract more foreign investments.

Mexico Freight Transportation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on offering, transport, and end use.

Offering Insights:

- Solution

- Freight Transportation Cost Management

- Freight Mobility Solution

- Freight Security and Monitoring System

- Freight Information Management System

- Fleet Tracking and Maintenance Solution

- Freight Operational Management Solutions

- Freight 3PL Solution

- Warehouse Management System

- Services

The report has provided a detailed breakup and analysis of the market based on the offering. This includes solution (freight transportation cost management, freight mobility solution, freight security and monitoring system, freight information management system, fleet tracking and maintenance solution, freight operational management solutions, freight 3PL solution, and warehouse management system) and services.

Transport Insights:

- Roadways

- Railways

- Waterways

- Airways

The report has provided a detailed breakup and analysis of the market based on the transport. This includes roadways, railways, waterways, and airways.

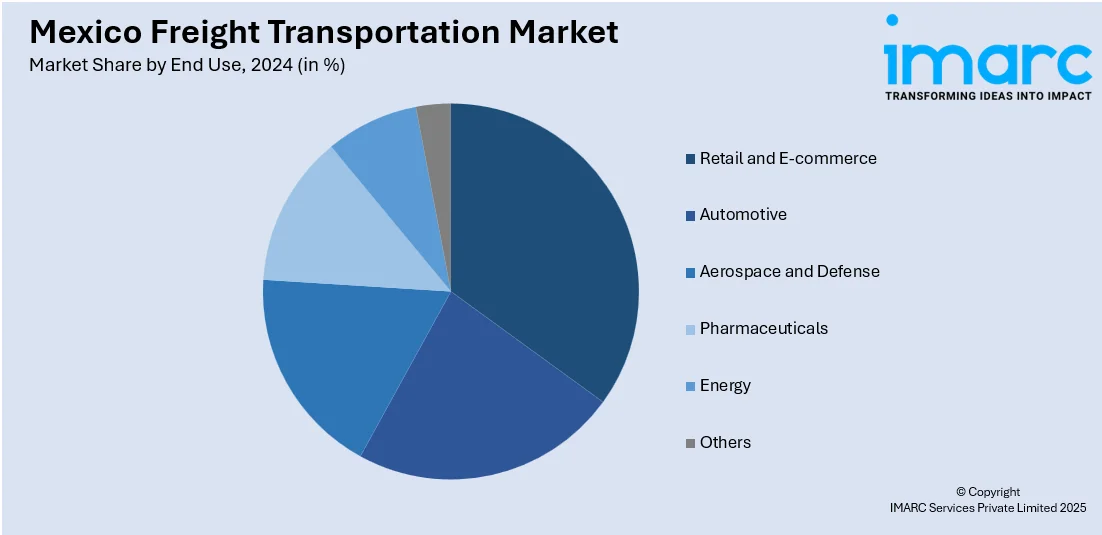

End Use Insights:

- Retail and E-commerce

- Automotive

- Aerospace and Defense

- Pharmaceuticals

- Energy

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes retail and e-commerce, automotive, aerospace and defense, pharmaceuticals, energy, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Freight Transportation Market News:

- On February 14, 2025, Freight Technologies launched Fleet Rocket, a transportation management system designed to optimize cross-border logistics across the US-Mexico-Canada Agreement (USMCA) region. The system offers real-time tracking, shipment visibility, and compliance tools to support both domestic and cross-border operations. It aims to streamline supply chain management amid growing demand for nearshoring.

- On November 11, 2024, Schneider launched a new intermodal service connecting the Southeastern U.S. with Mexico, utilizing a partnership between CSX and Canadian Pacific Kansas City (CPKC). The service, set to begin in December, offers enhanced efficiency and reliability for shippers, including a seamless border crossing and daily truck-like transit times. This expansion supports the growing demand for nearshoring and provides a sustainable, secure alternative to traditional truck transportation.

Mexico Freight Transportation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offerings Covered |

|

| Transports Covered | Roadways, Railways, Waterways, Airway |

| End Uses Covered | Retail and E-commerce, Automotive, Aerospace and Defense, Pharmaceuticals, Energy, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico freight transportation market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico freight transportation market on the basis of offering?

- What is the breakup of the Mexico freight transportation market on the basis of transport?

- What is the breakup of the Mexico freight transportation market on the basis of end use?

- What is the breakup of the Mexico freight transportation market on the basis of region?

- What are the various stages in the value chain of the Mexico freight transportation market?

- What are the key driving factors and challenges in the Mexico freight transportation market?

- What is the structure of the Mexico freight transportation market and who are the key players?

- What is the degree of competition in the Mexico freight transportation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico freight transportation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico freight transportation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico freight transportation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)