Mexico Frozen Fruits and Vegetables Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Mexico Frozen Fruits and Vegetables Market Overview:

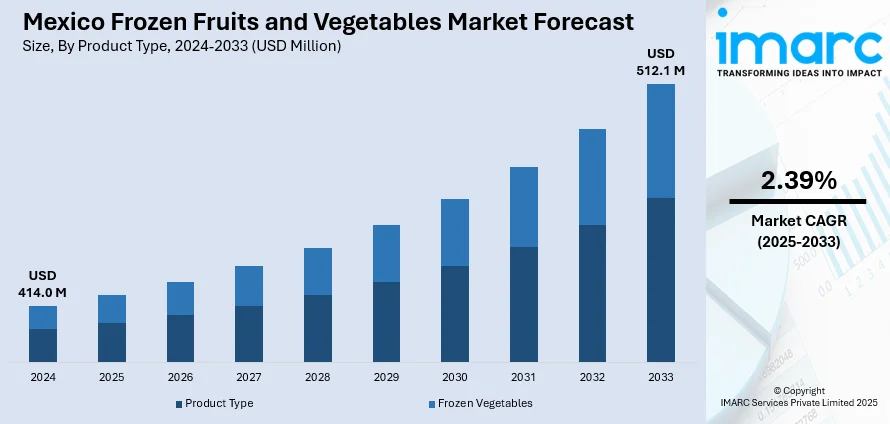

The Mexico frozen fruits and vegetables market size reached USD 414.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 512.1 Million by 2033, exhibiting a growth rate (CAGR) of 2.39% during 2025-2033. The market is driven by rising health consciousness, growing demand for convenience foods, rapid urbanization, increasing export opportunities, improved cold chain logistics, expanding retail sectors, and increasing adoption of Western dietary patterns.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 414.0 Million |

| Market Forecast in 2033 | USD 512.1 Million |

| Market Growth Rate 2025-2033 | 2.39% |

Mexico Frozen Fruits and Vegetables Market Trends:

Rising Demand for Convenient and Health-Conscious Food Options

The Mexico frozen fruits and vegetables market is expanding as consumers are now choosing nutritious, and convenient food options. In line with this, modern living conditions alongside rapid urbanization have resulted in people searching for speedy meal alternatives that maintain their health standards. Moreover, health-conscious customers find frozen fruits and vegetables appealing because they maintain necessary nutrients while providing longer preservation times. Besides this, the booming market for frozen produce is directly linked to supermarkets and hypermarkets as they are expanding their retail networks to make diverse frozen food items available to customers. For instance, in 2024, Amazon Mexico collaborated with digital supermarket Jüsto to expand its grocery offerings. This partnership enabled Amazon customers in specific regions of Mexico City to order frozen foods and other products with a delivery time of just four hours, enhancing convenience for consumers. Furthermore, freezing technology advancements now produce products that maintain better nutritional content and taste quality. As a result, consumers are becoming more aware of food waste reduction, whereas frozen produce is helping reduce spoilage and promotes sustainable consumption habits, thereby boosting the Mexico frozen fruits and vegetables market share.

Expansion of E-Commerce and Online Grocery Shopping

The expansion of e-commerce and online grocery shopping is revolutionizing the distribution methods of frozen fruits and vegetables across the region. This shifting trend is driving the Mexico frozen fruits and vegetables market growth. In addition to this, modern consumers find online grocery shopping appealing because it provides them with simple ordering of wide frozen produce selections that they can buy from their homes. During El Buen Fin 2024, the Mexican Association of Online Sales (AMVO) reported a 23.8% increase in online retail sales. Notably, 30% of consumers relied exclusively on online channels, reflecting a significant shift towards digital shopping for products like frozen fruits and vegetables. Concurrently, the combination of internet penetration and smartphone adoption, with consumer interest in contactless shopping, drives this change, particularly after the pandemic. In confluence with this, online retailers boost their services with intuitive interfaces and large product variety, and fast delivery methods. Furthermore, this market trend provides technology-conscious buyers and people living in remote locations the chance to get frozen produce that local stores might not stock. As a result, the Mexican frozen produce market is maintaining its upward trajectory because of the ongoing benefits provided by online shopping platforms, significantly enhancing the Mexico frozen fruits and vegetables market outlook.

Mexico Frozen Fruits and Vegetables Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Frozen Fruits

- Frozen Vegetables

The report has provided a detailed breakup and analysis of the market based on the product type. This includes frozen fruits and frozen vegetables.

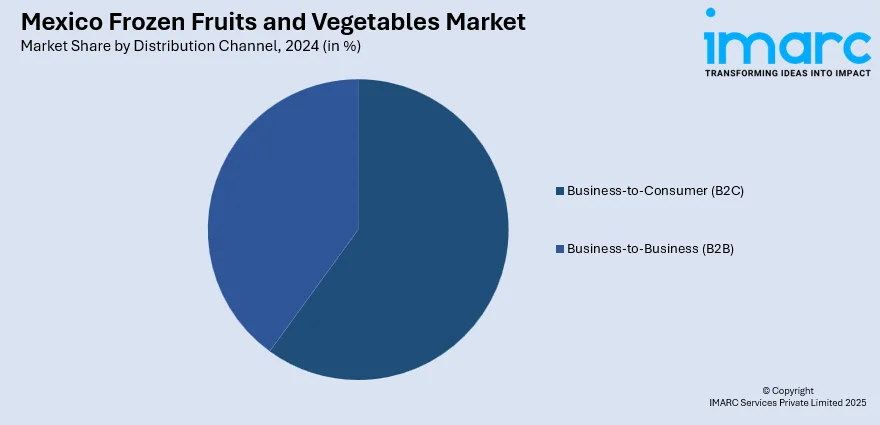

Distribution Channel Insights:

- Business-to-Consumer (B2C)

- Supermarkets/Hypermarkets

- Independent Retailers

- Convenience Stores

- Online

- Others

- Business-to-Business (B2B)

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes business-to-consumer (B2C) (supermarkets/hypermarkets, independent retailers, convenience stores, online, and others) and business-to-business (B2B).

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Frozen Fruits and Vegetables Market News:

- In April 2025, Ecuandureo, a frozen fruit and vegetable company in Michoacán, expanded its facilities, generating 850 direct jobs and over 2,000 indirect jobs in the agro-livestock sector. This expansion enhances production capacity and stimulates local economic growth.

- In July 2024, Fresh Farms partnered with Driscoll's Mexico to offer innovative grape and strawberry combinations, simplifying consumer choices and introducing seasonal fresh products at special prices. This collaboration leverages both companies' strengths to enhance product offerings and market reach.

Mexico Frozen Fruits and Vegetables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Frozen Fruits, Frozen Vegetables |

| Distribution Channels Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico frozen fruits and vegetables market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico frozen fruits and vegetables market on the basis of product type?

- What is the breakup of the Mexico frozen fruits and vegetables market on the basis of distribution channel?

- What is the breakup of the Mexico frozen fruits and vegetables market on the basis of region?

- What are the various stages in the value chain of the Mexico frozen fruits and vegetables market?

- What are the key driving factors and challenges in the Mexico frozen fruits and vegetables?

- What is the structure of the Mexico frozen fruits and vegetables market and who are the key players?

- What is the degree of competition in the Mexico frozen fruits and vegetables market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico frozen fruits and vegetables market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico frozen fruits and vegetables market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico frozen fruits and vegetables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)