Mexico Fuel Cell Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Mexico Fuel Cell Market Overview:

The Mexico fuel cell market size reached USD 79.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 528.4 Million by 2033, exhibiting a growth rate (CAGR) of 20.90% during 2025-2033. The market share is expanding, driven by rising investments in fuel cell research and infrastructure, along with the growing development of renewable energy projects, which is creating the need for stable backup power solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 79.2 Million |

| Market Forecast in 2033 | USD 528.4 Million |

| Market Growth Rate 2025-2033 | 20.90% |

Mexico Fuel Cell Market Trends:

Growing adoption of EVs

The increasing adoption of EVs is impelling the Mexico fuel cell market growth. As reported by the INEGI, sales of EVs and hybrid vehicles (HVs) in Mexico rose 58% in February 2024, compared to 2023, indicating 17 consecutive months of expansion. As more people and companies are looking for cleaner transportation options, fuel cell technology is gaining traction for its ability to offer longer driving ranges and quicker refueling. Fuel cells generate electricity through a chemical reaction, often employing hydrogen, which makes them an attractive alternative in the growing EV space. In Mexico, the encouragement for greener mobility is motivating both public and private sectors to explore different EV technologies, including those enabled by fuel cells. Automakers and energy companies are wagering on fuel cell research and infrastructure. This entails developing supply chains for fuel cell materials and components, as well as constructing hydrogen filling stations. The commercial electric vehicle segment, particularly trucks and buses, is exhibiting great interest since fuel cells can sustain heavier loads and travel longer distances without the need for frequent recharging.

.webp)

Rising shift towards renewable energy

The ongoing shift towards renewable energy is offering a favorable Mexico fuel cell market outlook. As per the CFE, in 2024, Mexico added 1.09 GW of distributed solar energy, increasing the total capacity to 4.42 GW by the end of the year. With the country looking for cleaner and more sustainable ways to meet its growing energy needs, the demand for technologies like fuel cells that can complement solar, wind, and other renewable sources, is increasing. Fuel cells can generate clean electricity using hydrogen, with water being the only byproduct. This fits well with national and corporate sustainability goals. As more renewable projects are being funded, there is a need for stable and flexible backup power solutions, and fuel cells step in as a reliable option. They help smooth out the energy supply when intermittent sources cannot meet demand. Industries, commercial buildings, and residential areas are utilizing fuel cells to increase energy efficiency while staying green. This transition is opening new investment opportunities and encouraging innovations in fuel cell technologies. As Mexico continues to support renewable initiatives, fuel cells are becoming a natural part of the country’s broader clean energy strategy.

Mexico Fuel Cell Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Proton Exchange Membrane Fuel Cells (PEMFC)

- Solid Oxide Fuel Cells (SOFC)

- Molten Carbonate Fuel Cells (MCFC)

- Direct Methanol Fuel Cells (DMFC)

- Phosphoric Acid Fuel Cells (PAFC)

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes proton exchange membrane fuel cells (PEMFC), solid oxide fuel cells (SOFC), molten carbonate fuel cells (MCFC), direct methanol fuel cells (DMFC), phosphoric acid fuel cells (PAFC), and others.

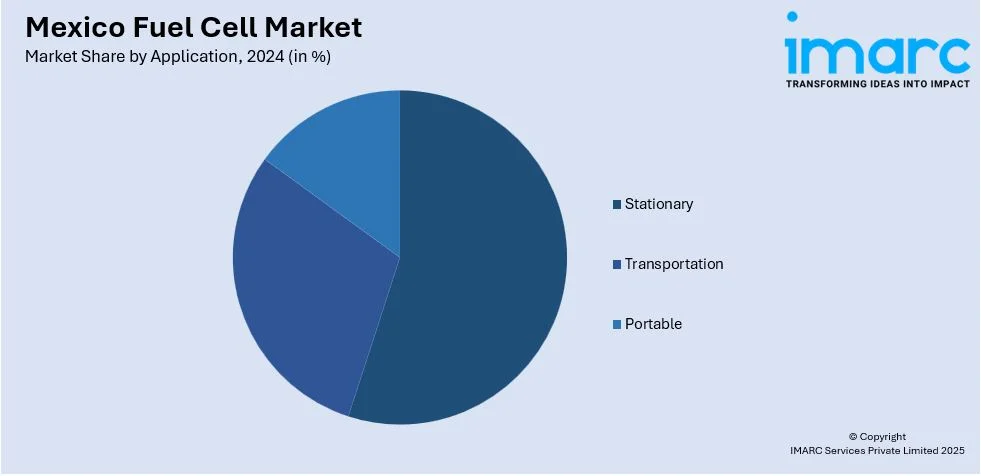

Application Insights:

- Stationary

- Transportation

- Portable

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes stationary, transportation, and portable.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Fuel Cell Market News:

- In May 2024, Stellantis announced the plans to manufacture a Ram commercial truck powered by hydrogen fuel cells in Mexico. The firm aimed to increase output to 100,000 vehicles annually by 2030, focusing on achieving 40% sales in fuel-cell commercial vehicles.

- In February 2024, FOTON introduced the HC12 hydrogen fuel cell bus at the 16th Expo Foro Movilidad in Mexico, marking the first bus in the country to utilize this clean and efficient technology, transforming transportation standards in the country. Measuring 12 Meters in length and accommodating 49 passengers, the HC12 was equipped with a 120kW fuel cell engine and a 35MPa hydrogen system, offering a range of up to 550 Kilometers.

Mexico Fuel Cell Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Proton Exchange Membrane Fuel Cells (PEMFC), Solid Oxide Fuel Cells (SOFC), Molten Carbonate Fuel Cells (MCFC), Direct Methanol Fuel Cells (DMFC), Phosphoric Acid Fuel Cells (PAFC), Others |

| Applications Covered | Stationary, Transportation, Portable |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico fuel cell market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico fuel cell market on the basis of type?

- What is the breakup of the Mexico fuel cell market on the basis of application?

- What is the breakup of the Mexico fuel cell market on the basis of region?

- What are the various stages in the value chain of the Mexico fuel cell market?

- What are the key driving factors and challenges in the Mexico fuel cell market?

- What is the structure of the Mexico fuel cell market and who are the key players?

- What is the degree of competition in the Mexico fuel cell market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico fuel cell market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico fuel cell market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico fuel cell industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)