Mexico Fuel Station Market Size, Share, Trends and Forecast by Fuel Type, End Use, and Region, 2025-2033

Mexico Fuel Station Market Overview:

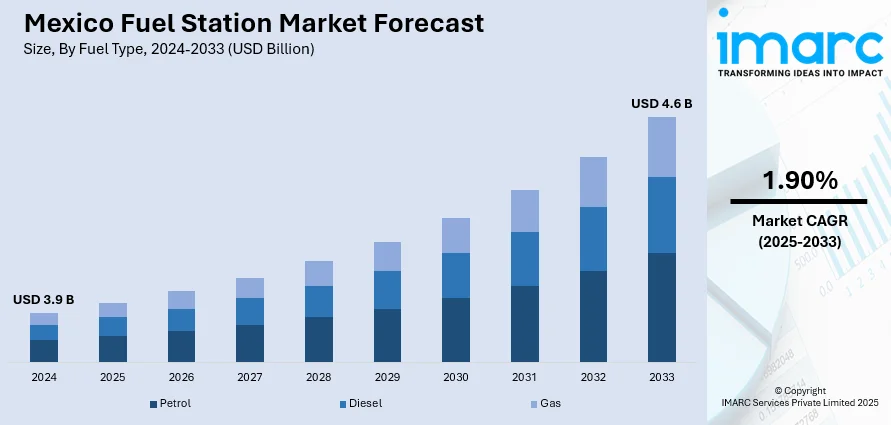

The Mexico fuel station market size reached USD 3.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.6 Billion by 2033, exhibiting a growth rate (CAGR) of 1.90% during 2025-2033. The market is growing due to rising vehicle numbers, fuel demand shifts, and expanding road infrastructure. Policy reforms and foreign investments are also supporting modernization, while digital tools and retail add-ons drive new business models across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.9 Billion |

| Market Forecast in 2033 | USD 4.6 Billion |

| Market Growth Rate 2025-2033 | 1.90% |

Mexico Fuel Station Market Trends:

Expansion of Private Fuel Retail

The deregulation of Mexico's fuel market has created space for private and international companies to enter and compete directly with state-run Pemex. This change is reshaping the country's retail fuel network by introducing competition in branding, pricing, and service delivery. Foreign players are investing in consumer-centric upgrades such as better fuel quality checks, real-time pricing transparency, and station redesigns that focus on ease of use. With rising vehicle ownership and increasing highway connectivity, demand for accessible, reliable refueling points has grown. This has prompted both legacy and new entrants to enhance their footprint across urban and semi-urban zones. Many retailers are now incorporating retail outlets, fast food chains, and digital kiosks into their service stations to create a more engaging customer environment. Loyalty programs and app-based payment methods are increasingly becoming standard, pushing traditional operators to modernize. Besides this, recent developments have seen global companies like BP, Shell, Repsol, and TotalEnergies actively opening outlets across various Mexican states. These firms are offering premium fuel, value-added services, and brand-specific experiences that differ from older Pemex models. Their expansion encourages local retailers to revamp strategies and improve operational efficiency, fueling market transformation at both the infrastructure and consumer levels.

Shift Towards Energy Diversification

Mexico's fuel station operators are gradually transitioning toward energy diversification in response to environmental pressures, changing transport patterns, and policy shifts. With growing awareness of climate concerns and increased adoption of alternative mobility solutions, stations are beginning to evolve beyond fossil fuel dependency. National goals that support a reduction in carbon emissions are encouraging the inclusion of cleaner energy options like compressed natural gas (CNG), liquefied petroleum gas (LPG), and electric vehicle (EV) charging infrastructure. The shift is also driven by a rising urban middle class looking for sustainable choices and better fueling experiences. Operators are identifying high-density areas with elevated electric vehicle usage as early targets for deploying EV chargers. Some companies have also started pilot projects using solar panels to reduce station power consumption. Moreover, transport corridors with heavy commercial traffic are witnessing increased LPG and CNG station development to support long-haul trucking needs. In the lower part of this trend, recent expansions include CNG refueling outlets in central and northern Mexico and EV charging networks in Mexico City and Monterrey, introduced by both public and private players. These changes signal that fuel stations are preparing for multi-energy operations, aiming to remain relevant in an evolving transport landscape by offering flexible, future-ready fueling options.

Mexico Fuel Station Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on fuel type and end use.

Fuel Type Insights:

- Petrol

- Diesel

- Gas

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes petrol, diesel, and gas.

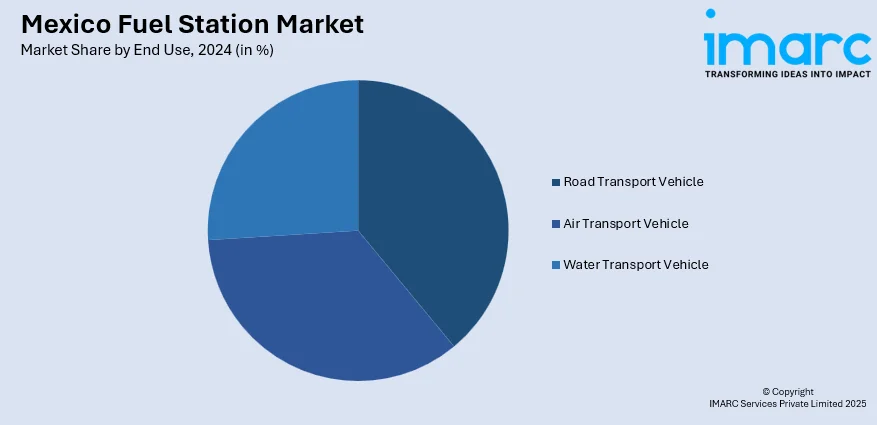

End Use Insights:

- Road Transport Vehicle

- Air Transport Vehicle

- Water Transport Vehicle

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes road transport vehicle, air transport vehicle, and water transport vehicle.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Fuel Station Market News:

- December 2024: Soriana and FAZT announced plans to install 1,000 ultra-fast EV charging stations across Mexico by 2030. Beginning with seven stations in early 2025, the initiative boosted competition in the fuel station industry and supported the shift toward electric vehicle infrastructure nationwide.

- July 2024: OXXO announced plans to expand its fuel station network in Mexico from 570 to 1,000 locations within 5–10 years. Focused on Nuevo León, this move aimed to challenge Pemex’s dominance, enhance competition, and diversify service options in the fuel retail sector.

Mexico Fuel Station Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | Petrol, Diesel, Gas |

| End Uses Covered | Road Transport Vehicle, Air Transport Vehicle, Water Transport Vehicle |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico fuel station market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico fuel station market on the basis of fuel type?

- What is the breakup of the Mexico fuel station market on the basis of end use?

- What is the breakup of the Mexico fuel station market on the basis of region?

- What are the various stages in the value chain of the Mexico fuel station market?

- What are the key driving factors and challenges in the Mexico fuel station market?

- What is the structure of the Mexico fuel station market and who are the key players?

- What is the degree of competition in the Mexico fuel station market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico fuel station market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico fuel station market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico fuel station industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)