Mexico Full-Service Carrier Market Size, Share, Trends and Forecast by Service, Application, and Region, 2025-2033

Mexico Full-Service Carrier Market Overview:

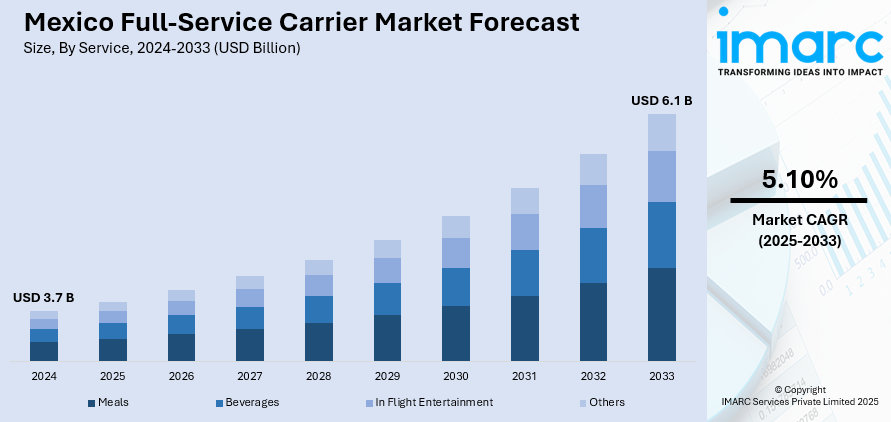

The Mexico full-service carrier market size reached USD 3.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.1 Billion by 2033, exhibiting a growth rate (CAGR) of 5.10% during 2025-2033. The market is growing due to rising digital adoption, increasing demand for automated customer interactions, and improved AI tools. As a result, full-service carrier market share is steadily expanding, with businesses turning to these solutions to streamline communication, reduce wait times, and improve user satisfaction.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.7 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Market Growth Rate 2025-2033 | 5.10% |

Mexico Full-Service Carrier Market Trends:

Expansion of Full-Service Carriers in Mexico

The trend in the Mexican full-service carrier market has been marked by significant expansion from international airlines into Mexican destinations. The demand for travel between Mexico and key international markets has led to carriers seeking to increase their flight frequencies and diversify their service offerings. As airlines look to tap into the growing tourism and business opportunities, the expansion of route networks has become a significant driver. In December 2024, American Airlines, one of the largest full-service carriers, launched flights to Puerto Escondido, marking its 30th Mexican destination. This development was part of American's strategy to strengthen its presence in the Mexican market, offering a record 780 weekly flights to Mexico by the end of the year. With a robust network and increased seat capacity, American Airlines solidified its position as a market leader, outpacing other competitors. This move also enhanced the overall competitiveness of the market, offering more travel options and fostering healthy competition among other airlines. The expansion reflects the rising demand for direct, convenient connections to major Mexican cities, contributing to a Mexico full-service carrier market growth.

Strengthening Connectivity Between Mexico and Global Markets

Full-service carriers have been enhancing their connectivity to key global destinations, contributing to a more interconnected Mexico. The rise in international trade, tourism, and business exchanges has created a greater need for seamless and efficient travel options. This demand has prompted significant network expansions by major international carriers, allowing passengers to access a broader range of destinations and services. In January 2025, Delta and Aeromexico responded to this demand by expanding their joint operations with two new routes, further strengthening their position in the full-service carrier market. Delta and Aeromexico added daily services connecting Mexico City to Philadelphia and San Luis Potosi to Atlanta. These new routes increased the travel options for passengers and reflected the airlines’ commitment to enhancing connectivity between Mexico and key international markets. By offering more daily flights, the carriers responded to rising passenger demand, providing more flexibility for travelers and improving the overall air travel experience. The expanded network also highlights the growing importance of Mexico as a key hub for transborder travel, boosting not only tourism but also facilitating business ties between the countries. These developments emphasize how full-service carriers are shaping the future of Mexico’s aviation sector.

Mexico Full-Service Carrier Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on service and application.

Service Insights:

- Meals

- Beverages

- In Flight Entertainment

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes meals, beverages, in flight entertainment, and others.

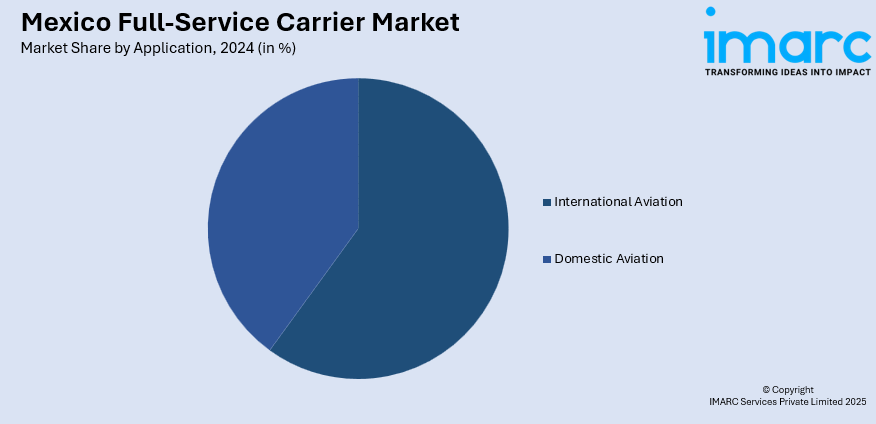

Application Insights:

- International Aviation

- Domestic Aviation

As per Mexico full-service carrier market outlook, a detailed breakup and analysis of the market based on the application have also been provided in the report. This includes international aviation and domestic aviation.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Full-Service Carrier Market News:

- January 2025: Delta and Aeromexico expanded connectivity with two new routes between Mexico and the U.S. These additions increased travel options, enhancing the full-service carrier market. The expansion, including daily flights to Philadelphia and Atlanta, further solidified their dominant position in transborder air travel.

- January 2025: Aeromexico was named the most on-time global airline for 2024 by Cirium, achieving 86.70% punctuality. This recognition reinforced Aeromexico’s reputation in the full-service carrier market, enhancing its competitive edge and strengthening customer trust in its operational excellence, particularly in international travel.

Mexico Full-Service Carrier Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Meals, Beverages, In Flight Entertainment, Others |

| Applications Covered | International Aviation, Domestic Aviation |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico full-service carrier market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico full-service carrier market on the basis of service?

- What is the breakup of the Mexico full-service carrier market on the basis of application?

- What is the breakup of the Mexico full-service carrier market on the basis of region?

- What are the various stages in the value chain of the Mexico full-service carrier market?

- What are the key driving factors and challenges in the Mexico full-service carrier market?

- What is the structure of the Mexico full-service carrier market and who are the key players?

- What is the degree of competition in the Mexico full-service carrier market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico full-service carrier market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico full-service carrier market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico full-service carrier industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)