Mexico Functional Food Market Size, Share, Trends and Forecast by Product Type, Ingredient, Distribution Channel, Application, and Region, 2025-2033

Mexico Functional Food Market Overview:

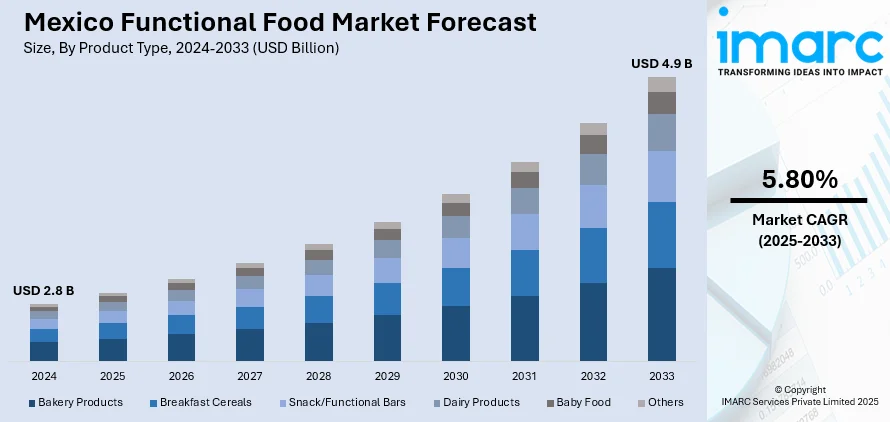

The Mexico functional food market size reached USD 2.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. The market in Mexico is growing due to rising health concerns including obesity and diabetes, driving demand for fortified and probiotic-rich products. Urbanization and busy lifestyles enhance demand for convenient, nutrient-dense snacks. Government health initiatives, increasing vegan preferences, and e-commerce expansion are further encouraging innovation in clean-label and sustainable products and augmenting the functional food market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.8 Billion |

| Market Forecast in 2033 | USD 4.9 Billion |

| Market Growth Rate 2025-2033 | 5.80% |

Mexico Functional Food Market Trends:

Growing Demand for Functional Foods with Health Benefits

The Mexico functional food market is experiencing significant growth due to rising consumer awareness regarding health and wellness. With increasing rates of obesity, diabetes, and cardiovascular diseases, Mexican consumers are actively seeking functional foods that offer added health benefits, such as fortified dairy products, probiotic-rich foods, and whole-grain snacks. According to industry reports, the demand for digestive health products, including yogurt with live cultures and fiber-enriched foods, has accelerated. Additionally, the popularity of plant-based functional foods, such as protein-fortified almond milk and chia seed snacks, is rising as more consumers adopt flexitarian or vegan diets. According to a recent research, Mexico has a rich agrobiodiversity, which is an important source of plant-based functional foods. This research identifies significant phytochemicals with anti-cancer and anti-diabetic properties from over 20 native species, including quercetin, mangiferin, and capsaicin. While much of the evidence is based on in-vitro and animal studies, experts call for human clinical trials to assess possible nutraceutical and pharmaceutical uses. This progress mimics the situation of Mexico and the need to lead the world's multi-billion functional food market innovation. Manufacturers are responding by launching innovative products with clean-label ingredients, non-GMO claims, and reduced sugar content. The trend is further supported by government initiatives promoting healthier eating habits, making functional foods a key growth segment in Mexico’s food and beverage industry.

Expansion of Functional Snacks for On-the-Go Consumers

Busy lifestyles and urbanization in Mexico are driving the demand for convenient yet healthy functional snacks. Consumers are increasingly opting for nutrient-dense, portable options such as protein bars, fortified nuts, and energy-enhancing granola. Brands are capitalizing on this trend by introducing functional snacks with added vitamins, minerals, and superfoods, such as quinoa and moringa. Mexico's quinoa commerce for 2023 reached USD 2.31 Million, with Estado de México leading imports, amounting to USD 992,000, followed by Ciudad de México, at USD 826,000. Bolivia and Peru were the main suppliers, with USD 1.35 Million and USD 876,000, respectively. E-commerce platforms and health-focused retail stores are making these products more accessible, especially among young professionals and fitness enthusiasts. Additionally, the influence of global health trends has led Mexican consumers to prefer snacks with immune-enhancing ingredients, such as vitamin C-infused dried fruits or turmeric-spiced trail mixes. As convenience remains a priority, manufacturers are focusing on sustainable packaging and transparent labeling to attract health-conscious buyers. This shift toward functional snacking is expected to sustain long-term growth in Mexico’s food market.

Mexico Functional Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, ingredient, distribution channel, and application.

Product Type Insights:

- Bakery Products

- Breakfast Cereals

- Snack/Functional Bars

- Dairy Products

- Baby Food

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes bakery products, breakfast cereals, snack/functional bars, dairy products, baby food, and others.

Ingredient Insights:

- Probiotics

- Minerals

- Proteins and Amino Acids

- Prebiotics and Dietary Fiber

- Vitamins

- Others

A detailed breakup and analysis of the market based on the ingredient have also been provided in the report. This includes probiotics, minerals, proteins and amino acids, prebiotics and dietary fiber, vitamins, and others.

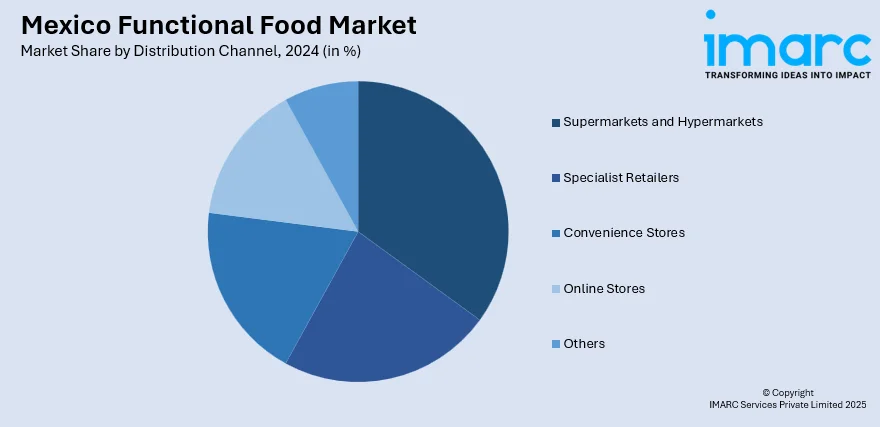

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialist Retailers

- Convenience Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, specialist retailers, convenience stores, online stores, and others.

Application Insights:

- Sports Nutrition

- Weight Management

- Clinical Nutrition

- Cardio Health

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes sports nutrition, weight management, clinical nutrition, cardio health, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Functional Food Market News:

- October 23, 2024: ProBiotix Health signed an exclusive partnership with Raff in Mexico to distribute the cardiometabolic probiotic Lactobacillus plantarum LPLDL in spring 2025. Considering that Mexico's cardiovascular medicine market is worth USD 2.2 Billion and high cholesterol is related to 3.6 million deaths a year, this initiative addresses a vital health concern. With access to patented precision probiotics, this is an alliance that expands the market of functional foods and supplements in Mexico, allowing for the incorporation of new scientific evidence that is much needed in this area.

Mexico Functional Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Bakery Products, Breakfast Cereals, Snack/Functional Bars, Dairy Products, Baby Food, Others |

| Ingredients Covered | Probiotics, Minerals, Proteins and Amino Acids, Prebiotics and Dietary Fiber, Vitamins, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialist Retailers, Convenience Stores, Online Stores, Others |

| Applications Covered | Sports Nutrition, Weight Management, Clinical Nutrition, Cardio Health, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico functional food market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico functional food market on the basis of product type?

- What is the breakup of the Mexico functional food market on the basis of ingredient?

- What is the breakup of the Mexico functional food market on the basis of distribution channel?

- What is the breakup of the Mexico functional food market on the basis of application?

- What is the breakup of the Mexico functional food market on the basis of region?

- What are the various stages in the value chain of the Mexico functional food market?

- What are the key driving factors and challenges in the Mexico functional food market?

- What is the structure of the Mexico functional food market and who are the key players?

- What is the degree of competition in the Mexico functional food market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico functional food market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico functional food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico functional food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)