Mexico Functional Gummies Market Size, Share, Trends and Forecast by Nature, Application, Distribution Channel, End User, and Region, 2026-2034

Mexico Functional Gummies Market Summary:

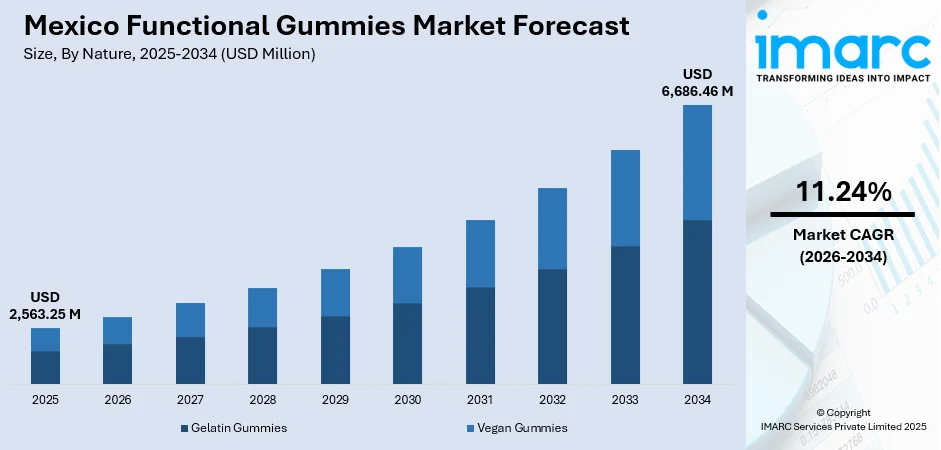

The Mexico functional gummies market size was valued at USD 2,563.25 Million in 2025 and is projected to reach USD 6,686.46 Million by 2034, growing at a compound annual growth rate of 11.24% from 2026-2034.

The Mexico functional gummies market is experiencing robust growth driven by rising health consciousness, increasing preference for convenient supplement formats, and growing acceptance of preventive healthcare practices among Mexican consumers. The market benefits from the widespread appeal of gummies as a palatable alternative to traditional supplement forms, particularly among children and health-conscious adults seeking essential vitamins and minerals.

Key Takeaways and Insights:

- By Nature: Gelatin Gummies dominate the market with a share of 82% in 2025, owing to their widespread availability, cost-effectiveness in manufacturing, superior texture and binding properties, and established consumer preference for the familiar chewy consistency that gelatin-based formulations deliver.

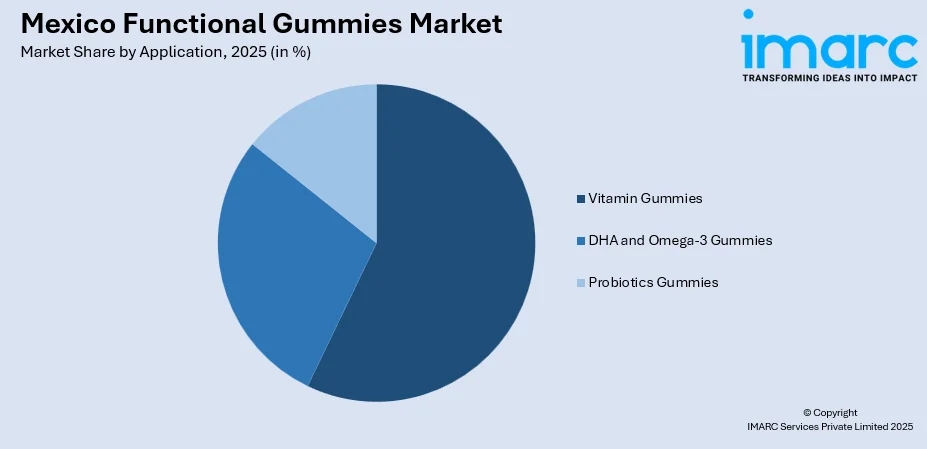

- By Application: Vitamin Gummies lead the market with a share of 60% in 2025, driven by growing consumer awareness of nutritional deficiencies, parental demand for child-friendly vitamin delivery formats, and increasing focus on immunity support and overall wellness maintenance among Mexican households.

- By Distribution Channel: Offline Stores represent the largest segment with a market share of 78% in 2025, supported by the extensive pharmacy retail network, consumer preference for in-person purchasing of health products, and strong presence of chain pharmacies offering diverse gummy supplement selections.

- By End User: Children exhibit a clear dominance with a 55% share in 2025, reflecting parental preference for gummies as an enjoyable method to ensure adequate vitamin intake, combined with increasing awareness of childhood nutritional requirements and immunity-building needs.

- Key Players: The Mexico functional gummies market exhibits a moderately fragmented competitive landscape, with multinational health and wellness corporations competing alongside regional manufacturers. Companies are focusing on product innovation, natural ingredient formulations, and strategic partnerships to strengthen their market positions.

To get more information on this market, Request Sample

The Mexico functional gummies market has witnessed accelerated growth as health-conscious consumers increasingly seek convenient, enjoyable methods to incorporate essential nutrients into their daily routines. A recent survey found that about 37.1% of Mexican adults are now classified as obese — underscoring the scale of diet‑related health pressures and the appeal of preventive nutritional solutions. The prevalence of lifestyle-related health conditions, including obesity affecting adults and rising diabetes rates, has intensified demand for preventive health solutions. Functional gummies offer a practical approach to supplementing diets with vitamins, minerals, and other beneficial compounds while appealing to diverse age groups through their palatable taste profiles. The expansion of modern retail channels, including pharmacy chains and e-commerce platforms, has enhanced product accessibility across urban and rural regions. Additionally, the influence of social media and wellness influencers has educated consumers about nutraceutical benefits, positioning functional gummies as an attractive option for health maintenance.

Mexico Functional Gummies Market Trends:

Rising Demand for Immunity and Mental Wellness Support

Mexican consumers are increasingly prioritizing immunity-boosting and mental wellness supplements following heightened health awareness. In fact, the overall functional supplements market in Mexico was estimated at about USD 19.5 billion in 2024—underscoring the growing scale of demand for preventive and wellness‑oriented nutrition. Functional gummies formulated with vitamin C, zinc, elderberry, and adaptogenic ingredients are gaining significant traction as consumers seek proactive approaches to health maintenance. This trend is particularly pronounced among working adults and parents seeking convenient solutions for family wellness needs.

Growing Preference for Natural and Clean-Label Ingredients

Consumer demand for transparency and natural formulations is reshaping product development in the functional gummies sector. Manufacturers are responding by introducing organic, plant-based, and clean-label gummy products free from artificial colors, flavors, and preservatives. In October 2024, COFEPRIS, Mexico’s federal health regulator, issued an alert warning consumers about irregular and misleading supplements, including products marketed online as “dietary supplements” or “beauty/figure enhancement” pills without required sanitary permits. The incorporation of traditional Mexican ingredients such as nopal cactus and chamomile into modern supplement formulations appeals to health-conscious consumers seeking culturally relevant wellness solutions.

Digital Transformation and E-Commerce Integration

The rapid expansion of digital health platforms and e-pharmacy services is transforming how Mexican consumers access functional gummies. With internet penetration exceeding seventy-five percent, online pharmacies and health marketplaces are experiencing significant growth. In 2024, online pharmacy sales in Mexico grew by about 30%, significantly higher than the overall retail‑ecommerce growth, as health & pharmacy emerged among the fastest‑rising online categories. Same-day delivery capabilities, personalized recommendations, and subscription services are enhancing consumer convenience and driving repeat purchases through digital channels.

Market Outlook 2026-2034:

The Mexico functional gummies market is positioned for sustained expansion over the forecast period, driven by evolving consumer preferences toward convenient health supplementation and increasing prevalence of preventive healthcare practices. Rising disposable incomes, urbanization, and health literacy are expected to fuel demand across diverse demographic segments. Innovation in product formulations, including specialized gummies targeting specific health concerns such as digestive wellness, sleep support, and beauty enhancement, will create new growth opportunities. The market generated a revenue of USD 2,563.25 Million in 2025 and is projected to reach a revenue of USD 6,686.46 Million by 2034, growing at a compound annual growth rate of 11.24% from 2026-2034.

Mexico Functional Gummies Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Nature | Gelatin Gummies | 82% |

| Application | Vitamin Gummies | 60% |

| Distribution Channel | Offline Stores | 78% |

| End User | Children | 55% |

Nature Insights:

- Gelatin Gummies

- Vegan Gummies

The gelatin gummies dominate with a market share of 82% of the total Mexico functional gummies market in 2025.

Gelatin-based functional gummies maintain market leadership due to their superior texture, binding properties, and cost-effective production capabilities. Gelatin provides the characteristic chewy consistency that consumers associate with traditional gummy formulations, ensuring widespread acceptance across age groups. At the same time, recent dietary‑habit data suggest that about 9% of Mexicans now identify as vegan and another 19% as vegetarian — indicating a growing consumer base likely to prefer pectin‑ or agar‑based gummies over gelatin. The ingredient's ability to encapsulate various vitamins and minerals while maintaining product stability contributes to its dominance in the Mexican market.

Manufacturing efficiencies and established supply chains for gelatin-based products enable competitive pricing strategies that appeal to price-sensitive consumer segments. However, the growing vegan and vegetarian population is driving increased demand for pectin and agar-agar alternatives. Manufacturers are responding by expanding plant-based product lines to capture this emerging consumer segment while maintaining their core gelatin offerings.

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Vitamin Gummies

- DHA and Omega-3 Gummies

- Probiotics Gummies

The vitamin gummies lead with a share of 60% of the total Mexico functional gummies market in 2025.

Vitamin gummies command the largest application segment owing to widespread consumer awareness of nutritional deficiencies and the essential role vitamins play in maintaining overall health. Multivitamin formulations, vitamin C immunity boosters, and B-complex energy supplements represent the most popular product categories. The appealing taste profiles and convenient consumption format make vitamin gummies particularly attractive to children and adults who struggle with traditional supplement forms.

The rising prevalence of vitamin deficiencies, particularly vitamin D among urban populations with limited sun exposure and vitamin B12 among health-conscious consumers, drives sustained demand for targeted supplementation. Parents increasingly rely on vitamin gummies to ensure adequate micronutrient intake for children, while adults seek formulations supporting immunity, energy metabolism, and skin health. Product innovation continues to expand the vitamin gummy category with specialized formulations for prenatal care, senior nutrition, and athletic performance.

Distribution Channel Insights:

- Online Stores

- Offline Stores

The offline stores dominate with a market share of 78% of the total Mexico functional gummies market in 2025.

Offline retail channels continue to dominate the Mexico functional‑gummies market through supermarkets, health sections, and specialty health stores. Consumer preference for in‑person consultation regarding health supplements reinforces the offline channel’s market position. The physical retail environment allows product examination, immediate availability, and trusted purchasing experiences that many Mexican consumers value for health‑related products.

In parallel, the government is also pushing to modernize healthcare distribution: under the COFEPRIS — the Federal Commission for Protection against Sanitary Risks — new guidelines issued in mid‑2025 simplify the registration process for health products and medical supplies, enabling faster regulatory approvals for imported or new health items.

End User Insights:

- Children

- Adults

The children lead with a share of 55% of the total Mexico functional gummies market in 2025.

The children's segment leads the market driven by parental concern for adequate childhood nutrition and the inherent appeal of gummy formats among younger consumers. Functional gummies provide an effective solution for parents facing challenges in ensuring consistent vitamin and mineral intake for children who resist traditional supplements. The enjoyable taste and candy-like appearance transform nutritional supplementation into a positive daily experience for children. In 2025, the Mexican Ministry of Health launched the “Nutrición Infantil” campaign, promoting fortified foods and supplements for children to improve immunity and overall nutrition, which has driven greater parental interest in products like functional gummies.

Rising awareness of childhood nutritional requirements, particularly following health campaigns emphasizing immunity development, has intensified parental investment in children's supplements. Product manufacturers have responded with age-appropriate formulations featuring appealing shapes, flavors, and packaging designs that resonate with young consumers. The growing prevalence of childhood obesity and associated health concerns has further motivated parents to incorporate functional gummies as part of comprehensive wellness strategies for their children.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents a significant market for functional gummies, characterized by higher disposable incomes and strong cross-border influences from the United States. The region demonstrates elevated health awareness and early adoption of wellness trends, with consumers in states like Nuevo León, Chihuahua, and Baja California showing preference for premium supplement products. The expanding modern retail infrastructure and proximity to American health product trends drive market growth.

Central Mexico, anchored by Mexico City and surrounding states, commands the largest regional market share due to its substantial population concentration and well-developed retail networks. The region benefits from advanced healthcare infrastructure, high urban density, and elevated household incomes that support premium health product consumption. Strong presence of national pharmacy chains and e-commerce adoption positions Central Mexico as the primary market driver.

Southern Mexico presents emerging opportunities for functional gummies market growth, with increasing health awareness penetrating traditionally underserved regions. States including Yucatán, Oaxaca, and Chiapas are witnessing gradual expansion of modern retail channels and healthcare access. The region demonstrates growing demand for affordable vitamin supplements, particularly those addressing nutritional deficiencies prevalent among lower-income populations.

Other regions, including coastal tourist areas and developing industrial zones, contribute to market diversification with varying consumption patterns. These areas demonstrate potential for expansion as retail infrastructure improves and health awareness campaigns reach broader populations. Regional variations in dietary preferences and traditional wellness practices influence product adoption rates and formulation preferences across different geographic markets.

Market Dynamics:

Growth Drivers:

Why is the Mexico Functional Gummies Market Growing?

Escalating Health Consciousness and Preventive Healthcare Adoption

Mexican consumers are increasingly prioritizing preventive health through balanced nutrition and supplementation, shifting focus from reactive treatments. Functional gummies have gained popularity as a convenient alternative to traditional pills, appealing especially to millennials and Generation Z seeking immunity, energy, and mental wellness support. In 2025, the government of Mexico launched the national strategy Vive Saludable, Vive Feliz (“Live Healthy, Live Happy”), which among other measures promotes healthier nutrition and physical‑activity habits — especially among younger populations — by banning junk‑food sales in schools and promoting healthy eating education nationwide. Social media, health influencers, and digital wellness content have played a pivotal role in educating consumers about nutraceutical benefits, normalizing supplement use, and promoting functional gummies as an accessible, attractive solution for daily health management.

Rising Prevalence of Lifestyle-Related Health Conditions

Lifestyle-related conditions like obesity, diabetes, and micronutrient deficiencies are widespread in Mexico, driving awareness of preventive nutrition and supplementation. Consumers increasingly recognize the importance of vitamins and minerals for metabolic health, immunity, and chronic disease prevention. Functional gummies, often fortified with vitamins D, C, B complex, zinc, and magnesium, offer a practical approach to addressing dietary gaps. Public health campaigns and healthcare professionals emphasize proper nutrition, boosting interest in convenient, accessible supplementation options that support long-term health management.

Expansion of Modern Retail and E-Commerce Channels

The growth of national pharmacy chains and modern retail networks has improved functional gummies accessibility across Mexico, including semi-urban and rural areas. Pharmacies offer extensive health product assortments and professional guidance, while e-commerce platforms provide personalized recommendations, automated refills, and home delivery. According to sources, the government backed Pharmacies for Well Being (in Spanish, “Bienestar” pharmacies) program began installing new pharmacies nationwide, including in underserved rural and remote communities, as part of a broader effort to expand access to essential medicines and nutritional supplements across the country. Online pharmacy sales are rapidly increasing, and integration with telemedicine services enables seamless consultations and product fulfillment. These developments enhance convenience and expand reach, making functional gummies more accessible to consumers managing chronic conditions or seeking daily preventive supplementation.

Market Restraints:

What Challenges the Mexico Functional Gummies Market is Facing?

Regulatory Compliance and Ingredient Restrictions

The Mexican regulatory framework governing food supplements requires manufacturers to navigate complex registration and labeling requirements administered by COFEPRIS. Compliance with ingredient restrictions, maximum daily limits for vitamins and minerals, and prohibited health claims creates operational challenges for market participants. These requirements can delay product launches and increase costs for companies seeking to introduce innovative formulations.

Premium Pricing and Cost Sensitivity

Functional gummies typically command higher price points compared to traditional tablet or capsule supplements due to specialized manufacturing processes and ingredient costs. Price sensitivity among significant consumer segments limits market penetration, particularly in lower-income regions where basic nutrition remains the primary concern. Manufacturers face challenges balancing product quality with competitive pricing to expand market accessibility.

Limited Awareness in Rural Markets

Consumer awareness of functional gummies and their health benefits remains limited in rural and underserved regions where traditional healthcare practices predominate. The concentration of modern retail channels in urban areas restricts product accessibility for rural populations. Educational initiatives and distribution network expansion are required to unlock growth potential in these untapped market segments.

Competitive Landscape:

The Mexico functional gummies market exhibits a moderately competitive environment characterized by the presence of multinational health and wellness corporations alongside domestic manufacturers and emerging specialty brands. Established players leverage strong brand recognition, extensive distribution networks, and research capabilities to maintain market positions. Companies are increasingly focusing on product differentiation through innovative formulations, natural ingredient sourcing, and targeted health benefit positioning. Strategic partnerships between international supplement manufacturers and Mexican distributors facilitate market entry and expansion. The competitive landscape is evolving as e-commerce enables direct-to-consumer brands to challenge traditional retail-focused competitors. Market participants are investing in marketing campaigns emphasizing product quality, efficacy, and alignment with consumer wellness goals to capture market share in this rapidly growing sector.

Recent Developments:

- In Oct 2025: Mexican supplement brand NUVI+ launched “NUVI+ RSV”, a new gummy product featuring resveratrol plus blueberry extract, vitamin C, vitamin E and zinc — marketed for antioxidant support, skin health, immunity, cell protection and cognitive wellness.

- In July 2025: Jungbunzlauer unveiled new “bioavailable mineral innovations for gummies” at IFT FIRST 2025, featuring micronised organic citrate salts (zinc, calcium, magnesium) that reportedly enhance nutrient absorption, texture and taste — offering smoother, more effective gummy supplements.

Mexico Functional Gummies Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Natures Covered | Gelatin Gummies, Vegan Gummies |

| Applications Covered | Vitamin Gummies, DHA and Omega-3 Gummies, Probiotics Gummies |

| Distribution Channels Covered | Online Platforms, Offline Stores |

| End Users Covered | Children, Adults |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico functional gummies market size was valued at USD 2,563.25 Million in 2025.

The Mexico functional gummies market is expected to grow at a compound annual growth rate of 11.24% from 2026-2034 to reach USD 6,686.46 Million by 2034.

Gelatin gummies dominated the market with an 82% share, driven by their superior texture, cost-effective manufacturing, established consumer acceptance, and versatile formulation capabilities for various vitamin and mineral supplements.

Key factors driving the Mexico functional gummies market include rising health consciousness among consumers, increasing prevalence of lifestyle-related diseases, growing preference for convenient supplement formats, expansion of pharmacy retail networks, and e-commerce channel growth.

Major challenges include regulatory compliance requirements with COFEPRIS, premium pricing limiting accessibility for price-sensitive consumers, limited awareness in rural markets, competition from traditional supplement formats, and the need for consumer education regarding functional gummy benefits.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)