Mexico Functional Supplements Market Size, Share, Trends and Forecast by Product Type, Formulation Type, Health Benefit, Distribution Channel, and Region, 2025-2033

Mexico Functional Supplements Market Overview:

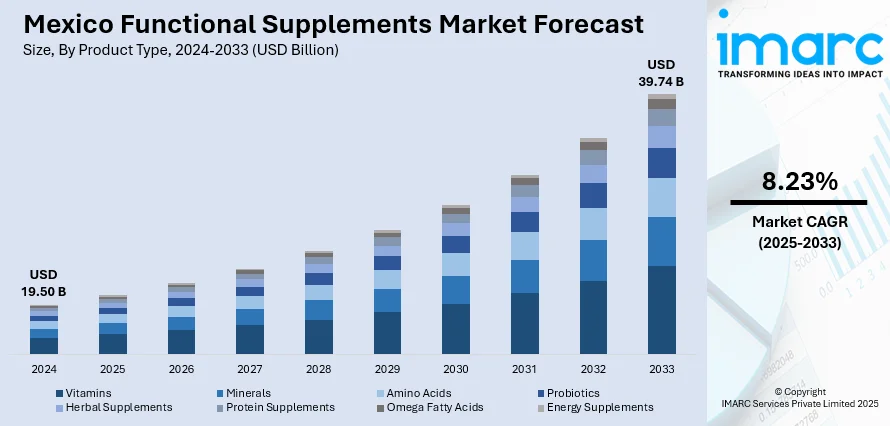

The Mexico functional supplements market size reached USD 19.50 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 39.74 Billion by 2033, exhibiting a growth rate (CAGR) of 8.23% during 2025-2033. The increasing health awareness, a rising middle class with higher disposable income, and an aging population focused on wellness are propelling the market growth. Moreover, urbanization, busy lifestyles, and higher prevalence of lifestyle diseases are supporting the market growth. Apart from this, expansion of modern retail and e-commerce, government health initiatives, growing interest in natural and plant-based products, innovations in supplement formulations, strong social media influence, and strategic trade agreements boosting export opportunities are boosting the Mexico functional supplements market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 19.50 Billion |

| Market Forecast in 2033 | USD 39.74 Billion |

| Market Growth Rate 2025-2033 | 8.23% |

Mexico Functional Supplements Market Trends:

Increasing Health Awareness Among Consumers

One of the main drivers of the Mexico functional supplements market is the growing health awareness among consumers. More people are becoming conscious of the importance of maintaining good health and preventing diseases before they occur. This shift in mindset encourages individuals to look for ways to boost their immunity, improve digestion, and support overall wellness through natural and functional supplements. People now understand that supplements can fill nutritional gaps caused by poor diet or busy lifestyles. Awareness campaigns by health organizations, media coverage on health topics, and advice from healthcare professionals have played a key role in educating consumers about the benefits of supplements. As a result, many Mexicans are now willing to invest in products that promote long-term health benefits rather than just seeking treatment for illnesses. This growing demand for preventive healthcare products fuels the expansion of the functional supplements market in the country, making it an important factor for manufacturers and retailers to consider.

To get more information on this market, Request Sample

Growing Middle-Class Population with Rising Disposable Incomes

Mexico's growing middle class is another key driver of the functional supplements market. With an increasing number of individuals moving into the middle-income group, disposable income levels have risen, allowing for higher expenditures on health and wellness goods. The middle class is more health-oriented and is more likely to invest in goods that improve their lifestyle. As their spending power increases, so does their exposure to a greater range of supplements, including high-end and niche products that in the past have been defined as luxuries. This is a big, steady consumer base for functional supplements, and firms are responding by launching new products oriented around the tastes and price ranges of middle-class buyers. Moreover, urbanization and increased levels of education within this group facilitate well-informed purchasing choices, again driving market expansion.

Aging Population with an Emphasis on Maintaining Vitality and Controlling Chronic Diseases

Mexico's elderly population is also a significant driver of the functional supplements market. As people grow older, they desire to maintain their health, vigor, and autonomy. Forecasts suggest that by 2050, there will be more than 30 million people 65 and older in Mexico, 277% more than in 2015. Older citizens become prone to developing chronic medical conditions such as arthritis, cardiovascular disease, and osteoporosis that must be controlled regularly. Functional supplements like vitamins, minerals, and joint support supplements are considered helpful adjuncts in managing these conditions and in improving quality of life. This age group is ever more using supplements for managing health problems related to aging, from improving immunity to improving brain function. Increased life expectancy, combined with rising consciousness regarding health among elderly citizens, has created persistent demand for functional supplements specifically designed for their needs. With this population segment growing, so does the potential for companies to develop age-targeted products, and thus the aging population becomes the prime catalyst for the Mexico functional supplements market growth.

Mexico Functional Supplements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, formulation type, health benefit, and distribution channel.

Product Type Insights:

- Vitamins

- Minerals

- Amino Acids

- Probiotics

- Herbal Supplements

- Protein Supplements

- Omega Fatty Acids

- Energy Supplements

The report has provided a detailed breakup and analysis of the market based on the product type. This includes vitamins, minerals, amino acids, probiotics, herbal supplements, protein supplements, omega fatty acids, and energy supplements.

Formulation Type Insights:

- Pills and Capsules

- Powders

- Liquids

- Gummies

- Bars

A detailed breakup and analysis of the market based on the formulation type have also been provided in the report. This includes pills and capsules, powders, liquids, gummies, and bars.

Health Benefit Insights:

- Weight Management

- Digestive Health

- Joint Health

- Immunity Boosting

- Energy Enhancement

- Heart Health

- Mental Wellbeing

- Bone Health

A detailed breakup and analysis of the market based on the health benefit have also been provided in the report. This includes weight management, digestive health, joint health, immunity boosting, energy enhancement, heart health, mental wellbeing, and bone health.

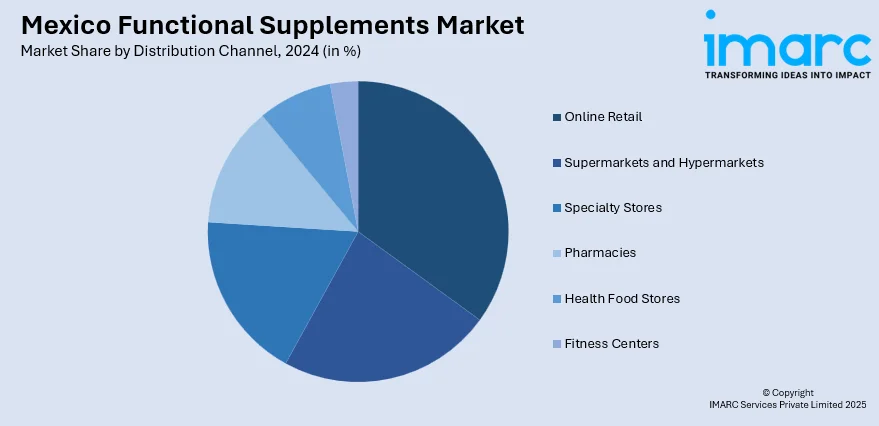

Distribution Channel Insights:

- Online Retail

- Supermarkets and Hypermarkets

- Specialty Stores

- Pharmacies

- Health Food Stores

- Fitness Centers

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online retail, supermarkets and hypermarkets, specialty stores, pharmacies, health food stores, and fitness centers.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Functional Supplements Market News:

- In 2024, UK-based ProBiotix Health plc partnered with Mexico’s Raff to distribute probiotics targeting cardiometabolic health. This collaboration expands ProBiotix’s reach in Latin America, aiming to improve heart and metabolic wellness through scientifically formulated supplements. The deal strengthens market presence amid rising demand for functional health products in Mexico.

Mexico Functional Supplements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Vitamins, Minerals, Amino Acids, Probiotics, Herbal Supplements, Protein Supplements, Omega Fatty Acids, Energy Supplements |

| Formulation Types Covered | Pills and Capsules, Powders, Liquids, Gummies, Bars |

| Health Benefits Covered | Weight Management, Digestive Health, Joint Health, Immunity Boosting, Energy Enhancement, Heart Health, Mental Wellbeing, Bone Health |

| Distribution Channels Covered | Online Retail, Supermarkets and Hypermarkets, Specialty Stores, Pharmacies, Health Food Stores, Fitness Centers |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico functional supplements market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico functional supplements market on the basis of product type?

- What is the breakup of the Mexico functional supplements market on the basis of formulation type?

- What is the breakup of the Mexico functional supplements market on the basis of health benefit?

- What is the breakup of the Mexico functional supplements market on the basis of distribution channel?

- What is the breakup of the Mexico functional supplements market on the basis of region?

- What are the various stages in the value chain of the Mexico functional supplements market?

- What are the key driving factors and challenges in the Mexico functional supplements market?

- What is the structure of the Mexico functional supplements market and who are the key players?

- What is the degree of competition in the Mexico functional supplements market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico functional supplements market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico functional supplements market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico functional supplements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)