Mexico Furniture Fittings Market Size, Share, Trends and Forecast by Product, Material, Application, Distribution Channel, End User, and Region, 2026-2034

Mexico Furniture Fittings Market Summary:

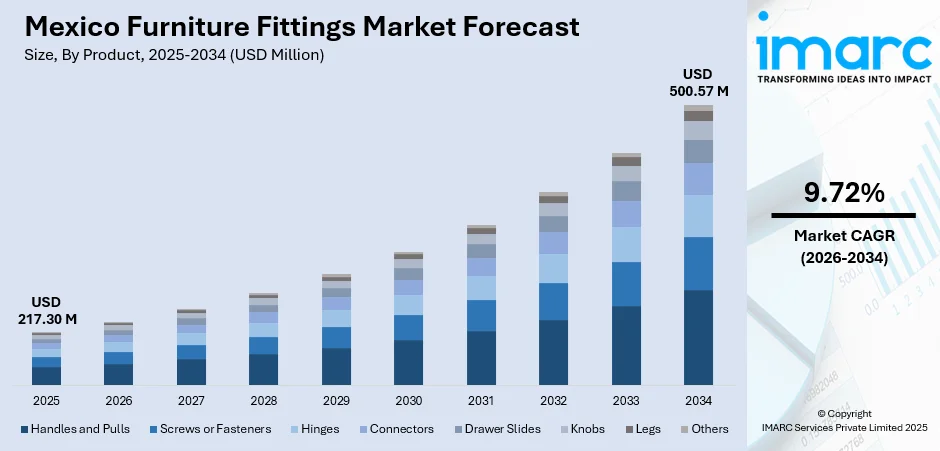

The Mexico furniture fittings market size was valued at USD 217.30 Million in 2025 and is projected to reach USD 500.57 Million by 2034, growing at a compound annual growth rate of 9.72% from 2026-2034.

Mexico's furniture fittings market is experiencing robust expansion driven by accelerated residential construction, nearshoring-induced manufacturing growth, and increasing consumer preference for premium interior solutions. The thriving housing sector, supported by government initiatives targeting new homes, coupled with rising disposable incomes and urbanization trends across major metropolitan areas, is fueling demand for diverse hardware components. Additionally, the integration of smart home technologies and sustainable design practices is reshaping consumer expectations, driving manufacturers to innovate with multifunctional and aesthetically appealing fittings that expand Mexico furniture fittings market share.

Key Takeaways and Insights:

- By Product: Handles and pulls dominate the market with a share of 18% in 2025, driven by the widespread adoption in kitchen cabinetry and living room furniture.

- By Material: Stainless steel leads the market with a share of 24% in 2025, owing to its superior corrosion resistance, durability, and modern aesthetic appeal that aligns with contemporary interior design trends.

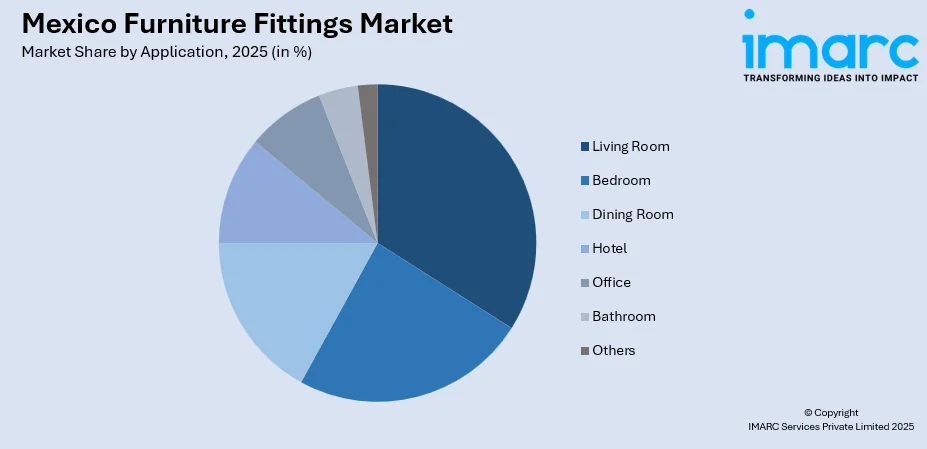

- By Application: Living room furniture represents the largest segment with a market share of 21% in 2025, reflecting the Mexican cultural emphasis on family gathering spaces and entertainment areas.

- By Distribution Channel: In-direct distribution channel leads the market with a share of 54% in 2025, driven by the extensive network of hardware stores, specialty retailers, and building material outlets across urban and suburban areas.

- By End User: Residential/household leads the market with a share of 61% in 2025, supported by sustained housing construction activity, increasing home renovation spending, and growing middle-class purchasing power that enables Mexican families to invest in quality furniture hardware components for new homes and interior improvement projects.

- Key Players: Major furniture-fitting companies in Mexico emphasize quality products, strong customer relationships, and market presence. Local suppliers and manufacturers enhance online sales, competitive pricing, and extensive product selections. Global brands and retailers collaborate to grow networks and provide contemporary, convenient fittings that meet the increasing urban demand.

To get more information on this market Request Sample

The Mexico furniture fittings market encompasses essential hardware components including handles, hinges, drawer slides, knobs, and connectors manufactured from materials such as stainless steel, aluminum alloy, zinc alloy, and plastic. Market dynamics reflect strong residential construction momentum, with housing starts showing consistent growth alongside nearshoring-driven industrial expansion that is stimulating commercial furniture demand. The integration of smart furniture technologies and the rising popularity of modular designs are creating new opportunities for innovative fitting solutions. Recent government housing initiatives, including INFONAVIT's expanded construction target of 1.2 million homes announced in 2025, exemplify the institutional support driving residential furniture hardware demand. Manufacturers are responding to evolving consumer preferences by developing eco-friendly materials and customizable designs that align with sustainable building practices and personalized interior aesthetics prevalent in contemporary Mexican homes.

Mexico Furniture Fittings Market Trends:

Nearshoring-Driven Commercial Furniture Demand Surge

Mexico's emergence as a premier nearshoring destination is catalyzing unprecedented demand for commercial furniture fittings across manufacturing facilities, office complexes, and industrial parks. The country received USD 31 billion in foreign direct investment during the first half of 2024, representing a seven percent year-over-year increase, with manufacturing accounting for more than half of total FDI. This industrial expansion, particularly concentrated in automotive, electronics, and aerospace sectors across states like Nuevo León, Querétaro, and Chihuahua, necessitates substantial office infrastructure equipped with ergonomic furniture systems, modular workstations, and storage solutions that rely heavily on quality hardware components. The trend is reinforcing demand for durable, high-performance fittings capable of withstanding intensive commercial use while meeting aesthetic standards of modern workplace design.

Integration of Smart and Multifunctional Furniture Hardware

The Mexican furniture fittings sector is witnessing accelerated adoption of intelligent hardware solutions incorporating soft-close mechanisms, touch-activated opening systems, and integrated lighting features. Smart home technology penetration is rising, incorporating automated lighting and climate control systems that extend to furniture applications. Individuals are progressively looking for furniture hardware that provides greater convenience with elements like push-to-open drawer slides, hydraulic lift mechanisms for vertical storage, and cable management options for home office arrangements. This technological evolution reflects broader lifestyle changes driven by remote work adoption and digital integration in residential spaces, compelling manufacturers to innovate beyond traditional mechanical fittings toward electronically-enabled, multifunctional hardware components that deliver superior user experiences.

Sustainable Materials and Circular Economy Practices

Environmental consciousness is reshaping material selection and manufacturing processes within Mexico's furniture fittings industry, with manufacturers increasingly adopting recycled metals, bio-based plastics, and sustainably sourced materials. The Mexican government implemented circular economy regulations in 2024 requiring furniture manufacturers to incorporate at least 30% recycled materials in mass-market products while mandating waste reduction practices throughout production processes. This regulatory framework is driving innovation in eco-friendly coating technologies, water-based finishing systems, and energy-efficient manufacturing methods. These sustainability imperatives are influencing purchasing decisions across both residential and commercial sectors, compelling traditional hardware manufacturers to adapt their material sourcing and production strategies.

Market Outlook 2026-2034:

The Mexico furniture fittings market trajectory reflects strong fundamentals in housing sector recovery, with residential construction expected to accelerate following government initiatives targeting affordable housing and infrastructure modernization. The market generated a revenue of USD 217.30 Million in 2025 and is projected to reach a revenue of USD 500.57 Million by 2034, growing at a compound annual growth rate of 9.72% from 2026-2034. Additionally, demographic shifts toward urbanization combined with evolving interior design preferences favoring premium, customizable hardware solutions will support premium segment growth, while technological integration in furniture systems presents opportunities for innovation-driven market expansion across both residential and commercial applications.

Mexico Furniture Fittings Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Handles and Pulls | 18% |

| Material | Stainless Steel | 24% |

| Application | Living Room | 21% |

| Distribution Channel | In-Direct | 54% |

| End User | Residential/Household | 61% |

Product Insights:

- Handles and Pulls

- Screws or Fasteners

- Hinges

- Connectors

- Drawer Slides

- Knobs

- Legs

- Others

Handles and pulls dominate with a market share of 18% of the total Mexico furniture fittings market in 2025.

The segment's prominence stems from its versatility in design options, ranging from contemporary minimalist styles in brushed stainless steel to traditional ornate patterns in bronze or brass finishes, enabling consumers to customize furniture aesthetics according to interior design preferences. Available in extensive variety including vintage glass, hand-painted porcelain, leather-wrapped, and crystal-embedded options, handles and pulls provide crucial tactile interface for furniture interaction while serving as prominent visual elements that influence overall furniture character.

Manufacturers are innovating with ergonomic designs, soft-touch materials, and integrated smart features including fingerprint sensors and LED illumination that enhance user experience. Apart from this, the segment benefits from universal applicability across kitchen cabinetry, wardrobes, dressers, and storage furniture, creating consistent demand across both residential renovations and new construction projects, while growing preference for customized, high-quality hardware drives premiumization trends that favor branded products with superior finish quality and durability.

Material Insights:

- Stainless Steel

- Aluminium Alloy

- Zinc Alloy

- Plastic

- Iron

- Others

Stainless steel leads with a share of 24% of the total Mexico furniture fittings market in 2025.

The material's inherent properties including rust resistance, easy maintenance, and sustained appearance over extended periods make it ideal for high-humidity environments like kitchens and bathrooms where inferior materials deteriorate rapidly. Stainless steel furniture fittings withstand frequent use without degradation, supporting load-bearing applications with capacities ranging from 200 to 230 pounds for heavy-duty drawer slides and hinges. The material's versatility enables diverse finish options including brushed, polished, satin, and matte variants that complement different furniture styles from ultra-modern minimalist to industrial chic aesthetics.

Apart from this, the growing preference for hygienic, antimicrobial surfaces, particularly following health awareness trends, reinforces stainless steel's appeal for furniture applications requiring easy sanitization. The material commands premium pricing that reflects its longevity and performance advantages, attracting middle and upper-income consumers investing in durable, high-quality home furnishings. Manufacturing advances enabling cost-effective production combined with increased availability of recycled stainless steel align with sustainability trends while maintaining competitive pricing for mass-market segments. In 2024, Sunon Technology Co., Ltd. reached another important milestone in its global strategy with the official inauguration of its first factory outside China, the Sunon Mexico Manufacturing base and Experience center, situated in the Hofusan Industrial Park in Monterrey, Nuevo León, Mexico. Focusing on the North American market, this action signifies a significant advancement in localized manufacturing; it also provides fresh energy to our global expansion strategy. Established in 1991, Sunon Technology Co., Ltd. has focused on delivering comprehensive solutions for commercial and office environments, such as space planning, office furnishings, healthcare furniture, educational furniture, soft furnishings, and intelligent office solutions.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Bedroom

- Living Room

- Dining Room

- Hotel

- Office

- Bathroom

- Others

Living room exhibits a clear dominance with a 21% share of the total Mexico furniture fittings market in 2025.

The living room furniture segment commands a major market share in Mexican home furniture market in 2024, demonstrating the critical importance of these spaces in residential design priorities. Affluent and luxury classes in Mexico demonstrate high concern for style and quality in living room furniture selections, with growing preference for international-standard furniture featuring premium hardware that ensures smooth operation and lasting durability. The segment benefits from increasing focus on multifunctional living spaces as Mexican homes adapt to modern lifestyle needs, with furniture pieces incorporating innovative storage solutions, convertible designs, and technology integration requiring sophisticated fittings.

Manufacturers are bringing high-quality pre-laminated storage products to Mexico, coupled with rising popularity of wall units combining aesthetics with functionality, all necessitating reliable, attractive hardware components. Urban living trends favoring open-concept designs place living room furniture under high visibility, elevating importance of aesthetically pleasing fittings that complement overall interior schemes while withstanding frequent daily use across extended furniture lifecycles. In 2025, luxury furniture company Marge Carson announced the plans of opening a new 60,000-square-foot manufacturing facility in Mexico.

Distribution Channel Insights:

- Direct

- In-Direct

In-direct dominates with a market share of 54% of the total Mexico furniture fittings market in 2025.

The channel's dominance reflects fundamental shifts in consumer purchasing behavior, with Mexico's DIY and hardware store market expected to generate massive revenue by 2025, demonstrating robust growth in retail infrastructure supporting furniture hardware distribution. E-commerce adoption is accelerating dramatically, with online platforms offering extensive product catalogs, detailed specifications, customer reviews, and virtual design tools that enable informed decision-making from home convenience. Specialty stores provide expert consultation, product demonstrations, and hands-on evaluation opportunities that assist consumers in selecting appropriate fittings for specific applications.

Distribution partners maintain substantial inventory breadth accommodating diverse consumer preferences across price points, styles, and performance specifications, while offering value-added services including delivery, installation assistance, and after-sales support. The channel benefits from established logistics networks enabling efficient product distribution across Mexico's diverse geography, reaching customers in metropolitan centers and regional markets alike. Growing retailer emphasis on branded products, quality assurance, and warranty coverage enhances consumer confidence in indirect channel purchases, particularly for premium furniture fittings requiring professional guidance and reliable performance guarantees.

End User Insights:

- Residential/Household

- Commercial

Residential/household leads with a share of 61% of the total Mexico furniture fittings market in 2025.

The household applications segment comprises around 60% of global furniture hardware market revenue, reflecting universal demand for furniture fittings across residential construction, renovation, and maintenance activities. Mexico's residential real estate market growth demonstrates robust housing sector expansion creating sustained furniture fittings demand. Rising disposable incomes among Mexican middle class are amplifying household budgets available for home improvement and quality furnishing investments. Home furniture market in Mexico is projected to reach USD 13.9 Billion by 2033, exhibiting a growth rate (CAGR) of 6.64% during 2025-2033, according to IMARC Group.

Government housing programs including INFONAVIT's construction target of 1.2 million homes generate substantial residential furniture fittings procurement across affordable and mid-segment developments. Urban households increasingly prioritize modern, aesthetically pleasing interiors with functional storage solutions, driving demand for premium hardware featuring soft-close mechanisms, sleek designs, and durable construction supporting extended furniture lifecycles in family environments. Moreover, people are looking for ergonomic and functional furniture for their homes, which is further supporting the Mexico furniture fittings market growth.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico benefits from proximity to the US, supporting strong furniture manufacturing clusters in states like Nuevo León and Chihuahua. Demand for furniture fittings is driven by export-oriented factories, modular furniture producers, and OEM suppliers. Market players focus on precision hardware, metal fittings, and bulk supply contracts. Cross-border logistics, faster delivery times, and compliance with international quality norms shape purchasing decisions.

Central Mexico acts as the core consumption and distribution zone, led by Mexico City, Estado de México, and Jalisco. Growth comes from residential construction, office furniture demand, and renovation activity. Furniture fitting suppliers emphasize variety, design compatibility, and cost efficiency. Wholesalers and retailers play a strong role, while manufacturers invest in local warehouses, dealer networks, and customized solutions for carpentry workshops and mid-scale producers.

Southern Mexico shows slower but steady demand, supported by housing projects, tourism infrastructure, and small furniture workshops. Furniture fittings sales are largely price-sensitive, with higher demand for basic hinges, handles, and slides. Local distributors dominate, supplying imported and domestic products. Market activity focuses on affordability, regional availability, and durable fittings suited for humidity-prone environments common in coastal and tropical areas.

Other regions, including coastal and emerging industrial zones, contribute through hospitality furniture, retail interiors, and institutional projects. Demand rises from hotels, resorts, and public facilities requiring functional and corrosion-resistant fittings. Suppliers target niche requirements like stainless steel hardware and decorative fittings. Market players rely on project-based sales, partnerships with contractors, and flexible supply models to serve irregular but high-value orders.

Market Dynamics:

Growth Drivers:

Why is the Mexico Furniture Fittings Market Growing?

Accelerated Urbanization and Ambitious Housing Construction Programs

Mexico's rapid urban expansion, with a major portion of the population now concentrated in metropolitan areas, is fundamentally reshaping housing patterns and furniture requirements, creating sustained demand for quality fittings across residential construction and renovation projects. In July 2025, the National Workers' Housing Fund Institute (INFONAVIT) dramatically increased its housing construction target for the current presidential term to 1.2 million homes, representing a substantial rise from the initial goal of 500,000 homes and reflecting robust government commitment to addressing housing shortages and enhancing residential infrastructure nationwide. This ambitious initiative will generate approximately 600,000 jobs while establishing procurement pipelines for furniture components across affordable, mid-range, and premium housing segments. Government programs like CONAVI's 2025 mandate funding 100,000 new dwellings and 100,000 upgrades across 1,345 municipalities establish consistent public procurement channels for furniture hardware across diverse price points.

Rising Middle-Class Purchasing Power and Consumer Premiumization Trends

Mexico's expanding middle class with increasing disposable incomes is driving substantial growth in discretionary spending on home furnishings and quality hardware components that enhance residential living standards and property values. According to Mexico’s National Institute of Statistics and Geography (INEGI), household incomes consistently rose from 2020 to 2024, leading to a notable decrease in income inequality. Growing preference for modern, aesthetically pleasing furniture designs influenced by international trends is elevating demand for premium hardware featuring contemporary finishes, smooth operation, and integrated technology capabilities. Affluent and luxury classes in Mexico demonstrate high concern for style and quality in furniture selections, with particular emphasis on living and dining room furnishings where hardware visibility and performance directly impact perceived quality and user experience.

Nearshoring and Industrial Expansion Driving Commercial Infrastructure Development

The nearshoring phenomenon, with at least 453 foreign companies expected to establish operations in Mexico between 2024 and 2025, is generating substantial industrial and residential development that creates extensive furniture fittings demand across northern and central regions. Foreign direct investment in industrial facilities creates immediate requirements for commercial furniture including office systems, storage units, and employee amenities, all necessitating professional-grade hardware components. Commercial real estate expansion including offices, hotels, and retail facilities supporting industrial clusters creates professional-grade furniture hardware demand for conference rooms, hotel guest accommodations, restaurant seating, and retail fixtures requiring intensive-use rated components.

Market Restraints:

What Challenges the Mexico Furniture Fittings Market is Facing?

Fluctuating Raw Material Costs and Supply Chain Volatility

Volatile pricing for essential materials including steel, aluminum, zinc, and brass creates production cost uncertainty that compresses manufacturer margins and complicates pricing strategies across distribution channels. Construction materials inflation affects furniture hardware manufacturing economics, with metal prices subject to global commodity market fluctuations, international trade dynamics, and geopolitical tensions that periodically disrupt supply chains. Manufacturers face challenges maintaining consistent pricing when raw material costs experience sudden increases, creating pressure to either absorb margin reductions or implement price adjustments that risk customer resistance in competitive markets. Supply chain disruptions experienced during recent global events demonstrate ongoing vulnerability to transportation bottlenecks, port congestion, and logistics challenges that delay material deliveries and finished product distribution.

Complex Regulatory Environment and Permitting Obstacles

Bureaucratic complexities in obtaining construction permits, navigating zoning regulations, and complying with overlapping jurisdictional requirements create delays and costs that indirectly constrain furniture fittings market growth through reduced construction activity. Developers face lengthy approval processes for residential and commercial projects, with regulatory inconsistencies between federal, state, and municipal authorities creating confusion and extending project timelines that delay furniture procurement decisions. Environmental compliance requirements, building code standards, and safety regulations necessitate extensive documentation and inspections that increase administrative overhead for construction projects ultimately purchasing furniture fittings.

Intensifying Market Competition and Low-Quality Product Proliferation

The highly fragmented market structure with numerous small and medium-sized players creates intense price competition that pressures margins across the value chain from manufacturers to retailers. Import competition from countries including China offering lower-priced alternatives exerts downward pricing pressure on domestic manufacturers struggling to compete on cost while maintaining quality standards and local employment. The availability of counterfeit and low-quality hardware in informal markets compromises established brand reputations when inferior products fail prematurely, creating negative consumer experiences that undermine confidence in furniture fittings category. Economic volatility and periodic currency fluctuations affect consumer purchasing power and confidence, creating cyclical demand patterns that complicate inventory management and capacity planning for manufacturers and distributors.

Competitive Landscape:

The Mexico furniture fittings market demonstrates moderate concentration with a diverse competitive landscape encompassing multinational hardware manufacturers, regional suppliers, and specialized component producers serving distinct market segments. International industry leaders leverage advanced manufacturing capabilities, extensive product portfolios, and established distribution networks to maintain strong positions in premium and mid-market segments where quality, innovation, and brand reputation command pricing power. These global players invest substantially in research and development, introducing innovative products featuring soft-close mechanisms, silent operation, extended durability, and integrated smart technologies that appeal to quality-conscious individuals and commercial buyers. Regional Mexican manufacturers compete effectively in value-segment offerings by optimizing production efficiency, leveraging local market knowledge, and maintaining competitive cost structures enabling aggressive pricing strategies. The market exhibits dynamic competition across product categories, with specialized suppliers focusing on particular fitting types like hinges, drawer slides, or handles developing deep technical expertise and customer relationships within niche applications.

Recent Developments:

- In August 2025, Following the establishment of a 25% tariff on imported footwear, Mexico’s Confederation of Industrial Chambers (CONCAMIN) intends to pursue federal assistance to safeguard the furniture industry against affordable imports, particularly from China. The suggestion is to levy tariffs on completed furniture items from Asia, excluding components, accessories, or raw materials utilized in domestic manufacturing, as this would negatively impact the national furniture sector.

Mexico Furniture Fittings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Handles and Pulls, Screws or Fasteners, Hinges, Connectors, Drawer Slides, Knobs, Legs, Others |

| Materials Covered | Stainless Steel, Aluminum Alloy, Zinc Alloy, Plastic, Iron, Others |

| Applications Covered | Bedroom, Living Room, Dining Room, Hotel, Office, Bathroom, Others |

| Distribution Channels Covered | Direct, In-Direct |

| End Users Covered | Residential/ Household, Commercial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico furniture fittings market size was valued at USD 217.30 Million in 2025.

The Mexico furniture fittings market is expected to grow at a compound annual growth rate of 9.72% from 2026-2034 to reach USD 500.57 Million by 2034.

Handles and Pulls dominate the product segment with 18% market share, serving as the most broadly utilized furniture equipment components combining essential functionality with decorative appeal across diverse furniture applications including kitchen cabinetry, wardrobes, dressers, and storage units.

Key factors driving the Mexico furniture fittings market include accelerated urbanization with INFONAVIT's housing construction target of 1.2 million homes creating substantial residential procurement demand, rising middle-class purchasing power enabling discretionary spending on quality home furnishings, and nearshoring trends bringing at least 453 foreign companies to Mexico between 2024-2025 generating commercial and residential infrastructure development requiring extensive furniture hardware across northern and central regions.

Major challenges include fluctuating raw material costs for steel, aluminum, and zinc creating production cost volatility that compresses manufacturer margins, complex regulatory environment with bureaucratic obstacles in construction permitting and overlapping jurisdictional requirements delaying project timelines, and intensifying market competition from low-priced imports and counterfeit products that pressure pricing across distribution channels while undermining consumer confidence in furniture fittings quality and durability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)