Mexico Galvanization Market Size, Share, Trends and Forecast by Type, Combustion Chamber Type, Application, End Use Industry, and Region, 2026-2034

Mexico Galvanization Market Summary:

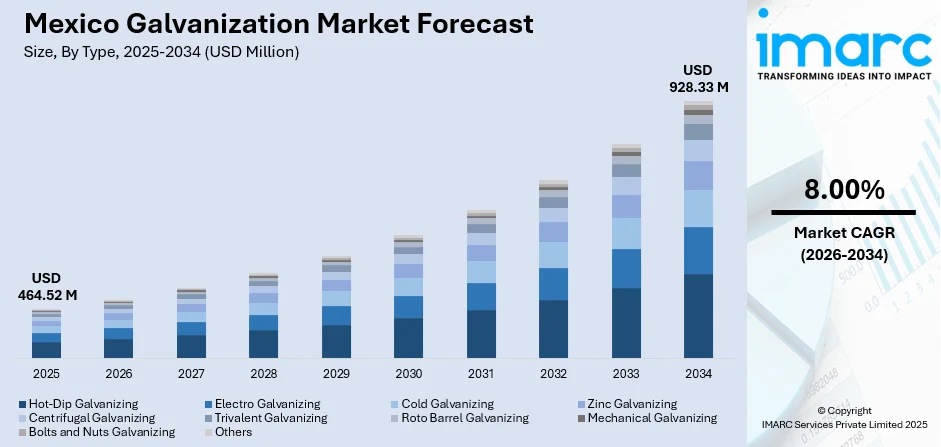

The Mexico galvanization market size was valued at USD 464.52 Million in 2025 and is projected to reach USD 928.33 Million by 2034, growing at a compound annual growth rate of 8.00% from 2026-2034.

The market is driven by increasing infrastructure development activities, rising demand from the construction and automotive sectors, and growing awareness regarding corrosion protection benefits. The expansion of manufacturing activities, coupled with government regulations promoting the use of galvanized steel, is further propelling industry growth. Additionally, the renewable energy sector's expansion and agricultural modernization initiatives are creating substantial demand for durable, corrosion-resistant materials, thereby strengthening the Mexico galvanization market share.

Key Takeaways and Insights:

- By Type: Hot-dip galvanizing dominates the market with a share of 50% in 2025, driven by its superior corrosion resistance properties, cost-effectiveness for large-scale industrial applications, and widespread adoption across construction and automotive manufacturing sectors requiring long-lasting protective coatings.

- By Combustion Chamber Type: Gas leads the market with a share of 60% in 2025, owing to its operational efficiency, lower environmental emissions compared to oil-based alternatives, and favorable government policies encouraging cleaner combustion technologies in industrial galvanizing facilities.

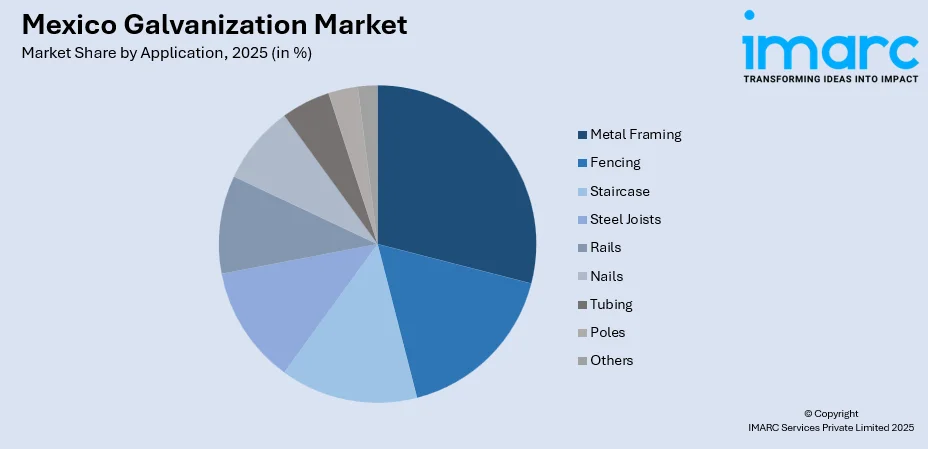

- By Application: Metal framing represents the largest segment with a market share of 18% in 2025, driven by increasing commercial and residential construction activities, demand for durable structural components, and the growing preference for galvanized steel framing in modern building designs.

- By End Use Industry: Building and construction dominates the market with a share of 34% in 2025, attributable to extensive infrastructure development projects, rising urbanization, and increasing demand for corrosion-resistant materials in residential, commercial, and industrial construction applications.

- Key Players: The market features established domestic manufacturers competing alongside international steel processing corporations across industrial and commercial segments, driving continuous technological advancements, service quality improvements, and geographic network expansion throughout the country.

To get more information on this market Request Sample

The Mexico galvanization market is experiencing robust growth propelled by multiple interconnected factors shaping the industrial landscape. The construction sector's continuous expansion, driven by urbanization and infrastructure modernization initiatives, has created sustained demand for galvanized steel products offering superior durability and corrosion resistance. The automotive industry's evolution, with manufacturers requiring high-quality coated materials for vehicle components, further amplifies market demand. Government policies promoting sustainable construction practices and regulatory frameworks mandating corrosion-resistant materials in public infrastructure have accelerated adoption rates. The renewable energy sector's expansion, particularly wind and solar installations requiring galvanized structural components, presents additional growth avenues. Agricultural modernization efforts necessitating durable fencing, storage facilities, and irrigation infrastructure contribute to market expansion, while the telecommunications industry's infrastructure development reinforces demand across multiple sectors.

Mexico Galvanization Market Trends:

Advancement in Hot-Dip Galvanizing Technologies

The galvanization industry in Mexico is witnessing significant technological evolution in hot-dip galvanizing processes, with manufacturers upgrading production facilities to enhance coating quality and operational efficiency. Modern galvanizing lines incorporate advanced temperature control systems, improved flux formulations, and sophisticated zinc bath management technologies. In August 2023, Ternium partnered with Fives to design an advanced hot‑dip galvanizing line at its Pesquería plant, with 600,000‑tonne capacity, serving construction and automotive sectors by end‑2025. Further, these innovations enable superior adhesion properties, uniform coating thickness, and enhanced corrosion protection capabilities. The integration of automated handling systems reduces processing times while ensuring consistent quality standards across high-volume production runs. Environmental considerations are driving the development of low-emission galvanizing techniques that minimize zinc fumes and optimize resource utilization, positioning Mexican galvanizers competitively in regional markets.

Integration of Sustainable Practices in Galvanizing Operations

Environmental sustainability is becoming increasingly central to galvanization operations across Mexico, with industry participants implementing comprehensive eco-friendly practices throughout production cycles. Manufacturers are adopting closed-loop water recycling systems, heat recovery mechanisms, and advanced filtration technologies to minimize environmental footprints. In March 2025, ArcelorMittal Mexico committed to invest in nine water-recycling projects, aiming to recover up to 9.5 Million Cubic Meters, reinforcing sustainable practices in its steel and galvanizing operations. Furthermore, the recyclability of galvanized steel positions it favorably within circular economy frameworks gaining traction across construction and manufacturing sectors. Energy optimization initiatives, including the utilization of renewable power sources for galvanizing operations, are becoming standard practice. These sustainable approaches not only address regulatory requirements but also appeal to environmentally conscious buyers seeking responsibly manufactured materials for green building certifications and sustainable development projects.

Expansion of Application Scope Across Emerging Sectors

The galvanization market is experiencing diversification as applications expand beyond traditional construction and automotive sectors into emerging industries requiring corrosion-resistant materials. Renewable energy infrastructure, including solar mounting structures and wind turbine components, represents a rapidly growing demand segment requiring specialized galvanized products. In February 2025, Mexico’s Secretaría de Energía announced plans to deploy 4.67 GW of large-scale solar by 2030, boosting demand for galvanized mounting structures and components in renewable energy projects. Moreover, the telecommunications industry's network expansion necessitates durable galvanized towers and support structures capable of withstanding varied environmental conditions. Agricultural modernization drives demand for galvanized storage systems, irrigation components, and protective enclosures. The water treatment and distribution sector increasingly specifies galvanized materials for pipelines and infrastructure, while the transportation sector requires galvanized components for rail systems, bridges, and highway infrastructure development.

Market Outlook 2026-2034:

The Mexico galvanization market demonstrates promising revenue growth potential throughout the forecast period, driven by sustained infrastructure development and industrial expansion. Construction sector investments, particularly in residential, commercial, and public infrastructure projects, will continue generating substantial demand for galvanized materials. The automotive industry's ongoing transformation and renewable energy installations will provide additional revenue streams for galvanization service providers. Manufacturing sector modernization and the expansion of industrial facilities requiring corrosion-resistant structural components will further support market revenue growth, positioning Mexico as a significant regional hub for galvanizing operations. The market generated a revenue of USD 464.52 Million in 2025 and is projected to reach a revenue of USD 928.33 Million by 2034, growing at a compound annual growth rate of 8.00% from 2026-2034.

Mexico Galvanization Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Hot-Dip Galvanizing | 50% |

| Combustion Chamber Type | Gas | 60% |

| Application | Metal Framing | 18% |

| End Use Industry | Building and Construction | 34% |

Type Insights:

- Hot-Dip Galvanizing

- Electro Galvanizing

- Cold Galvanizing

- Zinc Galvanizing

- Centrifugal Galvanizing

- Trivalent Galvanizing

- Roto Barrel Galvanizing

- Mechanical Galvanizing

- Bolts and Nuts Galvanizing

- Others

The hot-dip galvanizing dominates with a market share of 50% of the total Mexico galvanization market in 2025.

Hot-dip galvanizing maintains its dominant market position due to its proven effectiveness in providing comprehensive corrosion protection for steel products across diverse applications. In October 2023, Mexico’s hot-dip galvanized sheet (HDG) consumption reached a record 425,000 metric tons, up 31.6% year-on-year, reflecting sustained demand growth across construction and automotive sectors. Moreover, this process involves immersing steel components in molten zinc, creating metallurgically bonded coatings that offer superior durability compared to alternative galvanizing methods. The technique's ability to protect complex shapes, internal surfaces, and hard-to-reach areas makes it particularly valuable for structural components, hollow sections, and fabricated assemblies. Industrial manufacturers prefer hot-dip galvanizing for heavy-duty applications requiring extended service life in harsh environmental conditions.

The cost-effectiveness of hot-dip galvanizing for large-scale industrial projects reinforces its market leadership, as the process efficiently handles high-volume production requirements. Construction applications particularly benefit from hot-dip galvanized products, where structural steel, reinforcement bars, and architectural components require long-lasting protection. The technique's compatibility with various steel grades and product dimensions ensures versatility across manufacturing sectors. Continuous technological improvements in zinc bath composition, temperature management, and post-treatment processes enhance coating quality while optimizing operational efficiency for galvanizing service providers.

Combustion Chamber Type Insights:

- Oil

- Gas

- Electric

- Others

The gas leads with a share of 60% of the total Mexico galvanization market in 2025.

Gas leads the market segment due to their operational efficiency, environmental performance, and cost-effectiveness in industrial galvanizing applications. These systems provide precise temperature control essential for maintaining optimal zinc bath conditions, ensuring consistent coating quality across production batches. The availability of natural gas infrastructure throughout Mexico's industrial corridors supports widespread adoption, while lower fuel costs compared to alternatives enhance operational economics. In August 2025, Mexico announced a national electricity expansion plan emphasizing combined-cycle and cogeneration gas plants, aiming to strengthen domestic natural gas capacity and energy self-sufficiency for industrial applications. Further, gas combustion produces fewer emissions than oil-based systems, aligning with increasingly stringent environmental regulations governing industrial operations.

The flexibility of gas-fired heating systems accommodates varying production requirements, enabling galvanizing facilities to adjust capacity based on demand fluctuations. Modern gas combustion technologies incorporate advanced burner designs, recuperative heat exchangers, and automated control systems that maximize thermal efficiency. These innovations reduce fuel consumption while maintaining the high temperatures necessary for proper zinc metallurgy. The reliability and maintenance simplicity of gas systems minimize operational disruptions, supporting continuous production schedules essential for meeting customer delivery requirements in competitive market conditions.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Fencing

- Metal Framing

- Staircase

- Steel Joists

- Rails

- Nails

- Tubing

- Poles

- Others

The metal framing exhibits a clear dominance with a 18% share of the total Mexico galvanization market in 2025.

Metal framing applications represent a significant demand segment as construction practices increasingly favor galvanized steel framing systems for commercial, industrial, and residential buildings. Galvanized metal framing offers exceptional strength-to-weight ratios, dimensional stability, and resistance to fire, termites, and moisture damage compared to traditional building materials. Architects and structural engineers specify galvanized framing for diverse applications, including commercial interiors, curtain wall systems, and prefabricated building components. In March 2024, the value of construction works in Mexico increased by 15.5 percent year-over-year, marking 37 consecutive months of positive growth, with key contributions from states like Quintana Roo, Durango, and Hidalgo. Moreover, the material's recyclability appeals to green building initiatives pursuing sustainability certifications.

The construction industry's adoption of modular and prefabricated building techniques drives demand for precision-manufactured galvanized framing components. Off-site fabrication of galvanized metal framing reduces construction timelines and labor costs while ensuring consistent quality standards. Commercial renovation projects increasingly utilize galvanized metal framing for interior partitions, suspended ceiling systems, and structural modifications. The durability of galvanized coatings ensures long-term performance in demanding environments, including coastal areas and industrial zones where corrosion resistance is critical for maintaining structural integrity.

End Use Industry Insights:

- Electrical and Electronics

- Wind and Solar Industries

- Energy Industry

- Telecommunications Industry

- Transportation

- Aerospace

- Marine

- Automotive

- Others

- Building and Construction

- Residential Construction

- Commercial Construction

- Industrial

- Infrastructure

- Others

The building and construction dominate with a market share of 34% of the total Mexico galvanization market in 2025.

The building and construction sector dominates end-use demand as infrastructure development and urbanization initiatives drive extensive consumption of galvanized materials. Residential construction projects utilize galvanized products for roofing systems, structural components, window frames, and exterior cladding requiring weather resistance. Commercial construction applications include structural steel frameworks, curtain wall supports, HVAC ductwork, and architectural features demanding aesthetic appeal combined with durability. Industrial facilities require heavy-duty galvanized structures capable of withstanding chemical exposure and mechanical stress.

Infrastructure development programs throughout Mexico create sustained demand for galvanized materials in bridges, highway barriers, transmission towers, and water management systems. Public infrastructure projects mandate corrosion-resistant materials to ensure long-term serviceability and minimize maintenance expenditures. In May 2025, the Mexican government mandated that all steel used in public infrastructure projects must be domestically sourced, aiming to strengthen national production and support over 1,450 planned public works. Further, urban development initiatives incorporating mixed-use complexes, transit facilities, and public amenities specify galvanized components for structural and architectural applications. The construction industry's emphasis on lifecycle cost optimization favors galvanized products offering extended service life without requiring frequent repainting or replacement, supporting continued market demand across building segments.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents the largest galvanization market driven by concentrated automotive manufacturing activities and heavy industrial operations along the United States border corridor. Major industrial clusters in Nuevo León, Coahuila, and Chihuahua generate substantial demand for galvanized products across automotive, construction, and manufacturing sectors requiring proximity to galvanizing services.

Central Mexico serves as a significant market encompassing manufacturing hubs and the country's largest metropolitan construction market. Industrial activities in Querétaro, Guanajuato, and the Mexico City metropolitan region create diversified demand for galvanized products serving construction, consumer goods manufacturing, and infrastructure development projects.

Southern Mexico presents emerging growth opportunities driven by infrastructure development initiatives addressing regional connectivity and economic development priorities. Agricultural modernization, energy sector investments, and construction activities in Veracruz, Oaxaca, and other southern states contribute to expanding galvanization demand for structural and agricultural applications.

Other regions contribute to market demand through localized construction activities, agricultural sector requirements, and industrial operations serving regional markets. Coastal areas require enhanced corrosion protection, driving galvanized material specifications for infrastructure and commercial applications exposed to marine environments.

Market Dynamics:

Growth Drivers:

Why is the Mexico Galvanization Market Growing?

Infrastructure Development and Urbanization Acceleration

Mexico's ongoing infrastructure modernization programs are creating substantial demand for galvanized steel products across transportation, utilities, and public facilities sectors. Government investments in highway expansion, bridge construction, and railway development require extensive quantities of corrosion-resistant structural materials capable of withstanding environmental exposure over extended service periods. According to reports, in June 2025, Mexico’s government announced a MX$53.3 Billion investment under the National Highway Infrastructure Program to modernize and expand roads, bridges, and priority corridors nationwide. Furthermore, urban development initiatives addressing housing shortages and commercial space requirements drive construction activities consuming galvanized roofing, framing, and reinforcement products. The expansion of industrial zones and manufacturing corridors necessitates durable building materials for factory structures, warehouses, and logistics facilities. Municipal infrastructure improvements, including water treatment plants, drainage systems, and public transit facilities, specify galvanized components for long-term reliability.

Automotive Industry Expansion and Manufacturing Growth

The automotive manufacturing sector's continued expansion in Mexico generates consistent demand for galvanized steel used in vehicle body panels, chassis components, and structural elements requiring corrosion protection. Automakers' increasing quality standards and warranty requirements drive specifications for premium galvanized materials ensuring vehicle durability. The establishment of additional assembly plants and expansion of existing manufacturing capacities by global automotive producers reinforces demand growth. In March 2025, JAC Motors expanded its Ciudad Sahagún, Hidalgo plant by 30%, adding new assembly lines for electric and combustion SUVs, pickups, trucks, and LCVs to meet growing domestic demand. Moreover, tier-one suppliers manufacturing automotive components locally require reliable galvanizing services to meet just-in-time delivery schedules. The electrification of vehicle fleets presents new opportunities as battery enclosures and electric vehicle platforms require specialized corrosion-resistant materials capable of protecting sensitive components.

Renewable Energy Sector Expansion

Mexico's growing renewable energy installations create emerging demand for galvanized structural components supporting solar and wind power generation facilities. Solar mounting systems require galvanized steel frameworks capable of maintaining structural integrity over extended operational periods in varied climatic conditions. As of February 2025, Mexico installed 1.09 GW of distributed solar in 2024, increasing total capacity to 4.42 GW through 106,934 new interconnection contracts. Additionally, wind turbine installations utilize galvanized towers, foundations, and ancillary structures demanding superior corrosion resistance in coastal and desert environments. Transmission infrastructure connecting renewable generation facilities to distribution networks employs galvanized towers and poles for electricity distribution. The government's commitment to increasing renewable energy capacity establishes long-term demand visibility for galvanizing service providers positioning themselves within this growing sector.

Market Restraints:

What Challenges the Mexico Galvanization Market is Facing?

Volatile Raw Material Pricing

Zinc price fluctuations present significant challenges for galvanization service providers managing operational costs and customer pricing. Global commodity market dynamics, currency exchange rate variations, and supply chain disruptions influence zinc availability and pricing, creating uncertainty for business planning. Galvanizers must balance cost absorption against maintaining competitive pricing while protecting profit margins during periods of elevated raw material costs. Long-term contract negotiations become complicated when material costs remain unpredictable, potentially affecting customer relationships and market positioning.

Environmental Regulatory Compliance Burdens

Increasingly stringent environmental regulations governing industrial emissions, wastewater discharge, and hazardous waste management impose compliance costs on galvanizing operations. Facilities must invest in pollution control equipment, monitoring systems, and treatment technologies to meet regulatory requirements. Permitting processes may delay capacity expansion projects, while ongoing compliance monitoring consumes administrative resources. Smaller galvanizing operations may struggle to absorb environmental compliance expenditures, potentially affecting competitive positioning against larger, better-capitalized facilities capable of implementing advanced environmental controls.

Competition from Alternative Coating Technologies

Emerging protective coating technologies offering corrosion resistance through alternative application methods present competitive pressure for traditional galvanizing services. Powder coating, electroplating, and organic coating systems may offer advantages for specific applications regarding appearance, application flexibility, or environmental considerations. Customers evaluating total lifecycle costs may consider alternatives based on specific performance requirements, potentially reducing galvanizing demand for particular product categories. Galvanizing service providers must continuously demonstrate value propositions emphasizing coating durability, coverage completeness, and lifecycle cost advantages.

Competitive Landscape:

The Mexico galvanization market exhibits moderate competitive intensity, characterized by a mix of established regional operators and facilities serving specific geographic markets. Market participants compete based on processing capacity, turnaround times, coating quality, and service reliability to attract customers across construction, manufacturing, and infrastructure sectors. Geographic distribution of galvanizing facilities influences competitive dynamics, with proximity to customer concentrations providing logistical advantages. Investment in modern processing equipment, quality management systems, and environmental controls differentiates market leaders. Customer relationships, technical expertise, and reputation for consistent quality influence purchasing decisions across industrial segments. The market structure supports both specialized operators focusing on particular product categories and diversified facilities serving broad customer bases across multiple industries.

Recent Developments:

- In April 2025, Mexican steelmaker TYASA announced a $450 million expansion to boost domestic steel supply. The plan includes a new special steel bar rolling mill ($250 million) and upgraded galvanizing and finishing lines ($200 million), aiming to replace 40% of imports and strengthen its presence in automotive, mining, and aerospace sectors.

Mexico Galvanization Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hot-Dip Galvanizing, Electro Galvanizing, Cold Galvanizing, Zinc Galvanizing, Centrifugal Galvanizing, Trivalent Galvanizing, Roto Barrel Galvanizing, Mechanical Galvanizing, Bolts and Nuts Galvanizing, Others |

| Combustion Chamber Types Covered | Oil, Gas, Electric, Others |

| Applications Covered | Fencing, Metal Framing, Staircase, Steel Joists, Rails, Nails, Tubing, Poles, Others |

| End Use Industries Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico galvanization market size was valued at USD 464.52 Million in 2025.

The Mexico galvanization market is expected to grow at a compound annual growth rate of 8.00% from 2026-2034 to reach USD 928.33 Million by 2034.

Hot-dip galvanizing held the largest market share, driven by its strong corrosion resistance, long-term cost efficiency, and widespread adoption across construction, automotive, and heavy industrial sectors, where durable protective metal coatings are essential for extending component lifespan and reducing maintenance requirements.

Key factors driving the Mexico galvanization market include growing construction sector demand, expanding automotive manufacturing, infrastructure development initiatives, renewable energy installations, rising awareness of corrosion protection benefits, and government regulations promoting galvanized steel usage.

Major challenges include volatile zinc pricing affecting operational costs, stringent environmental compliance requirements, competition from alternative coating technologies, infrastructure limitations in certain regions, skilled labor availability, and supply chain complexities affecting raw material procurement.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)