Mexico Gardening Tools Market Size, Share, Trends and Forecast by Product Type, Tool Holder, Distribution Channel, End Use, and Region, 2026-2034

Mexico Gardening Tools Market Summary:

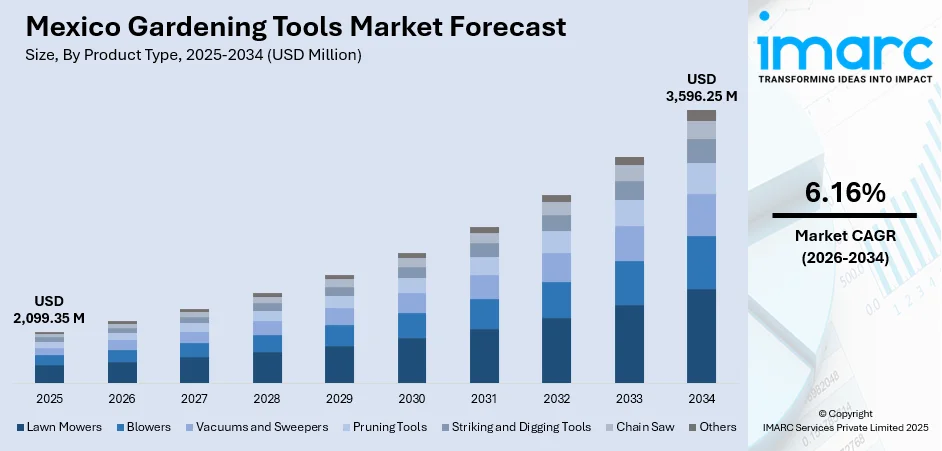

The Mexico gardening tools market size was valued at USD 2,099.35 Million in 2025 and is projected to reach USD 3,596.25 Million by 2034, growing at a compound annual growth rate of 6.16% from 2026-2034.

The Mexico gardening tools market is experiencing robust expansion, driven by the growing adoption of gardening as a leisure activity among Mexican households and rising urbanization across major metropolitan areas. Increased consumer awareness regarding sustainable living practices and the desire to create green spaces within residential properties are fueling demand for diverse gardening equipment. The proliferation of home improvement retail outlets and enhanced accessibility to a wide range of gardening products through both physical stores and online platforms are contributing to the Mexico gardening tools market share.

Key Takeaways and Insights:

-

By Product Type: Lawn mowers dominate the market with a share of 24% in 2025, driven by the essential requirement for lawn maintenance across residential properties and commercial landscapes. The segment benefits from technological advancements in battery-powered and robotic mowing solutions, along with increasing emphasis on aesthetically maintained outdoor spaces throughout Mexico.

-

By Tool Holder: Hand tools lead the market with a share of 55% in 2025, owing to their affordability, versatility, and widespread application across diverse gardening tasks, including digging, planting, pruning, and weeding. Their minimal maintenance requirements and ease of use make them indispensable for both novice gardeners and experienced professionals.

-

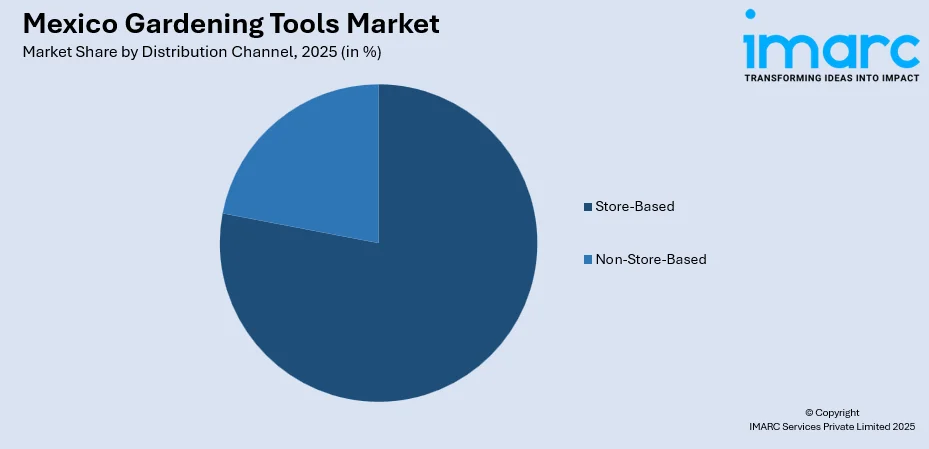

By Distribution Channel: Store-based represents the largest segment with a market share of 78% in 2025, reflecting strong consumer preference for physical retail experiences that offer product demonstrations, expert guidance, and immediate availability. Home improvement chains and specialty garden centers continue to expand their footprint throughout Mexico.

-

By End Use: Residential prevails the market with a share of 57% in 2025, driven by the surging adoption of home gardening as a recreational activity and growing consumer interest in creating functional outdoor living spaces. Rising homeownership rates and disposable incomes are enabling greater investments in residential garden maintenance.

-

By Region: Central Mexico comprises the largest region with 38% share in 2025, attributed to the concentration of population in Mexico City and surrounding metropolitan areas, higher disposable incomes, and the presence of numerous home improvement retail establishments serving urban consumers.

-

Key Players: Leading market participants drive the Mexico gardening tools market through continuous product innovations, strategic retail partnerships, and expansion of distribution networks. Major players are investing in developing eco-friendly and technologically advanced gardening solutions to meet evolving consumer preferences for sustainable and efficient lawn care equipment.

To get more information on this market Request Sample

The Mexico gardening tools market is witnessing significant growth, propelled by multiple converging factors that are reshaping consumer behavior and industry dynamics. The rising popularity of urban gardening initiatives, particularly in densely populated metropolitan areas like Mexico City, Guadalajara, and Monterrey, is creating substantial demand for compact and efficient gardening equipment suitable for balconies, rooftops, and small residential plots. Mexican consumers are increasingly embracing gardening as a wellness-oriented lifestyle activity that promotes mental health, physical exercise, and connection with nature. Furthermore, the growing environmental consciousness among Mexican households is encouraging the adoption of sustainable gardening practices and eco-friendly tools that align with broader sustainability goals. In February 2025, the Home Depot announced a significant investment of USD 1.3 Billion in Mexico over a five-year period, demonstrating strong retailer confidence in the country's home improvement and gardening market potential.

Mexico Gardening Tools Market Trends:

Rising Adoption of Smart and Automated Gardening Solutions

The Mexico gardening tools market is experiencing a transformative shift towards intelligent and automated gardening solutions, as consumers are seeking convenience and efficiency in lawn care activities. Robotic lawn mowers equipped with global positioning system (GPS) navigation, obstacle detection sensors, and smartphone connectivity are gaining popularity among affluent Mexican households seeking time-saving alternatives to traditional lawn maintenance. Smart agriculture systems utilizing weather data and soil moisture sensors are enabling water-efficient gardening practices. As per IMARC Group, the Mexico smart agriculture market size is set to attain USD 437.3 Million by 2033, exhibiting a growth rate (CAGR) of 6.9% during 2025-2033.

Growing Demand for Eco-Friendly and Sustainable Gardening Equipment

Environmental sustainability has become a key purchasing consideration for Mexican consumers selecting gardening tools, driving manufacturers to develop products incorporating recycled materials and sustainable production practices. Battery-powered and cordless equipment is rapidly displacing traditional gasoline-powered tools as consumers prioritize reduced emissions, lower noise levels, and decreased environmental impact. Manufacturers are responding to this demand by expanding their portfolios of electric lawn mowers, trimmers, and blowers that offer comparable performance to conventional models while supporting green initiatives and aligning with emerging environmental regulations.

Expansion of Urban Gardening and Compact Tool Solutions

Accelerating urbanization across Mexico is driving the demand for gardening tools specifically designed for small spaces, including balconies, patios, rooftop gardens, and compact residential yards. The urban population in Mexico was 81.86% in 2024, as reported by the World Bank's development indicators collection. Consumers residing in urban areas are increasingly seeking miniature trowels, compact pruners, and space-efficient cultivators that enable productive gardening within limited environments. Vertical gardening systems and container gardening accessories are witnessing heightened demand, as city dwellers strive to incorporate green spaces into their living environments despite spatial constraints, creating new product development opportunities for manufacturers.

Market Outlook 2026-2034:

The Mexico gardening tools market is poised for sustained expansion throughout the forecast period, supported by favorable demographic trends, rising disposable incomes, and growing consumer engagement with outdoor living activities. The increasing penetration of organized retail channels and e-commerce platforms is enhancing product accessibility across urban and semi-urban regions. The market generated a revenue of USD 2,099.35 Million in 2025 and is projected to reach a revenue of USD 3,596.25 Million by 2034, growing at a compound annual growth rate of 6.16% from 2026-2034. Continued investments by major retailers in expanding their Mexican operations and government initiatives aimed at promoting urban greening are expected to further accelerate the market growth.

Mexico Gardening Tools Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Lawn Mowers |

24% |

|

Tool Holder |

Hand Tools |

55% |

|

Distribution Channel |

Store-Based |

78% |

|

End Use |

Residential |

57% |

|

Region |

Central Mexico |

38% |

Product Type Insights:

- Lawn Mowers

- Blowers

- Vacuums and Sweepers

- Pruning Tools

- Striking and Digging Tools

- Chain Saw

- Others

Lawn mowers dominate with a market share of 24% of the total Mexico gardening tools market in 2025.

Lawn mowers maintain their leading position within the Mexico gardening tools market due to their essential role in maintaining residential lawns, commercial landscapes, public parks, and recreational facilities. Mexican consumers are increasingly investing in technologically advanced lawn mowing solutions that offer enhanced efficiency, reduced noise levels, and lower environmental impact. Battery-powered walk-behind mowers and robotic lawn mowers are gaining significant traction among urban households seeking convenient and time-saving lawn maintenance alternatives.

The segment is benefiting from continuous product innovations, as manufacturers introduce features, including smartphone connectivity, automatic scheduling capabilities, and advanced navigation systems. These technological advancements are attracting environmentally conscious Mexican consumers who prioritize sustainable gardening practices while maintaining well-manicured outdoor spaces.

Tool Holder Insights:

- Engine Tools

- Hand Tools

Hand tools lead with a share of 55% of the total Mexico gardening tools market in 2025.

Hand tools maintain dominant market positioning owing to their affordability, simplicity, and widespread application across diverse gardening tasks performed by both residential consumers and professional landscapers. These tools, including trowels, pruners, rakes, shovels, and weeding implements, require minimal maintenance and offer intuitive operation, making them accessible to gardeners of all skill levels. The versatility of hand tools enables their use across various gardening activities, ranging from soil preparation and planting to pruning and harvesting.

The segment continues to witness steady demand, as manufacturers introduce ergonomically designed hand tools featuring comfortable grips, lightweight construction, and durable materials that reduce user fatigue during extended gardening sessions. The affordability of hand tools makes them particularly attractive to first-time gardeners and budget-conscious consumers entering the hobby. Additionally, the growing urban gardening trend in Mexico is driving demand for compact hand tools suitable for container gardening and small-space applications.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Store-Based

- Non-Store-Based

Store-based exhibits a clear dominance in the market with 78% share of the total Mexico gardening tools market in 2025.

Store-based retail channels maintain commanding market share driven by Mexican consumers' strong preference for physical shopping experiences that enable product inspection, expert consultation, and immediate purchase gratification. Home improvement retail chains, including, the Home Depot, which operates 140 stores across more than 100 cities in Mexico, provide comprehensive gardening tool assortments alongside knowledgeable staff assistance. Traditional hardware stores, garden specialty retailers, and agricultural supply outlets further contribute to the robust store-based distribution network.

Major retailers continue to broaden their presence throughout Mexico to capture growing gardening tool demand. This strategic expansion includes strengthening logistics infrastructure with new specialized distribution hubs and enhancing e-commerce capabilities, demonstrating retailer commitment to serving Mexican consumers through integrated omnichannel approaches.

End Use Insights:

- Commercial

- Residential

Residential represents the leading segment with a 57% share of the total Mexico gardening tools market in 2025.

The residential segment dominates the Mexico gardening tools market, as Mexican households increasingly embrace home gardening as a fulfilling recreational activity that promotes wellness, provides fresh produce, and enhances property aesthetics. Rising homeownership rates, coupled with growing disposable incomes, are enabling Mexican families to invest in comprehensive gardening tool collections for maintaining lawns, vegetable gardens, and ornamental landscapes. In Mexico, 82% of individuals favor purchasing property in 2025, reflecting a robust culture of homeownership. The influence of gardening content across social media platforms has inspired younger demographics to engage with outdoor cultivation activities.

Urban residential gardening is experiencing particular growth as city dwellers seek to create green spaces within apartments, townhouses, and compact properties. Container gardening, rooftop gardens, and balcony plantings have become popular among urban Mexican residents, driving demand for appropriately sized hand tools and compact power equipment. The segment also benefits from government initiatives promoting urban agriculture and community gardening programs that encourage residential participation in local food production efforts.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Central Mexico dominates with a market share of 38% of the total Mexico gardening tools market in 2025.

Central Mexico maintains its position as the largest regional market driven by the concentration of Mexico's population within the Mexico City metropolitan area and surrounding states, including Estado de México, Puebla, and Querétaro. As per World Population Review, the population of Queretaro for 2025 is projected to be 1,459,290. The region benefits from higher average household incomes, greater urbanization rates, and extensive retail infrastructure that enhances gardening tool accessibility. The presence of numerous home improvement retail outlets, garden centers, and specialty stores throughout Central Mexico ensures comprehensive product availability for diverse consumer segments.

The region's gardening tools market is further supported by significant urban greening initiatives and community garden programs operating within densely populated metropolitan areas. Mexico City's government has implemented programs supporting urban agriculture, providing grants to families for rooftop gardens and promoting sustainable gardening practices. The concentration of professional landscaping services serving commercial properties, hospitality establishments, and residential communities generates substantial demand for both hand tools and power equipment throughout Central Mexico.

Market Dynamics:

Growth Drivers:

Why is the Mexico Gardening Tools Market Growing?

Rising Adoption of Gardening as a Recreational and Wellness Activity

The growing recognition of gardening's mental health benefits and its role as a fulfilling leisure activity is significantly driving gardening tools demand across Mexican households. Contemporary consumers are increasingly viewing gardening as a form of stress relief, physical exercise, and meaningful outdoor engagement that promotes overall wellbeing. The desire to create personalized green spaces that provide relaxation, aesthetic enjoyment, and connection with nature is motivating Mexican families to invest in comprehensive gardening equipment. Social media platforms and online gardening communities have amplified interest in home cultivation projects, inspiring new generations of Mexican gardeners to develop their outdoor spaces. According to Mexico’s National Survey on ICT Usage (ENDUTIH), released by the Mexican National Institute of Statistics and Geography, Mexico was positioned within the top 5 worldwide markets for time dedicated to social media in 2024. The trend of establishing edible gardens that provide fresh vegetables, herbs, and fruits is further encouraging households to acquire diverse tool collections supporting various cultivation activities.

Expansion of Organized Retail and Distribution Networks

The continued expansion of organized retail channels specializing in home improvement and gardening products is significantly enhancing market accessibility throughout Mexico. Major retailers are investing substantially in new store openings, distribution center development, and omnichannel capabilities to better serve growing consumer demand. Enhanced retail presence is improving product availability in previously underserved secondary cities and emerging urban markets. The integration of digital commerce platforms with physical store networks is creating seamless shopping experiences that enable consumers to research, purchase, and receive gardening tools through their preferred channels. Improved in-store product demonstrations and expert advisory services are also helping consumers make informed purchasing decisions. Retailers increasingly offer bundled tool kits and seasonal promotions that stimulate demand. Efficient logistics and last-mile delivery capabilities reduce purchase friction. As per IMARC Group, the Mexico retail market size is set to attain USD 698.8 Billion by 2034, exhibiting a growth rate (CAGR) of 4.38% during 2026-2034.

Growth of Landscaping, Hospitality, and Commercial Gardening Services

Rising demand for professional landscaping and commercial gardening services is a strong driver of the market expansion in Mexico. Expansion of hotels, resorts, office parks, industrial zones, and public infrastructure projects increases the need for regular landscape maintenance. Commercial service providers require reliable, high-performance tools capable of continuous operation, driving demand for power tools, cutting equipment, and specialized maintenance tools. Tourism-driven development boosts investment in aesthetically appealing outdoor spaces, supporting frequent tool replacement and upgrades. In 2024, Mexico welcomed 45.04 million international tourists. Municipal landscaping projects for parks, green corridors, and public spaces further contribute to consistent demand. Landscaping companies increasingly focus on efficiency and labor productivity, encouraging adoption of advanced and ergonomic tools. As commercial and institutional landscaping activities expand nationwide, they provide a stable, recurring revenue stream that supports long-term growth in Mexico’s gardening tools market.

Market Restraints:

What Challenges the Mexico Gardening Tools Market is Facing?

High Costs Associated with Advanced Gardening Equipment

The premium pricing of technologically advanced gardening tools, including robotic lawn mowers, smart irrigation systems, and professional-grade power equipment, presents affordability challenges for price-sensitive Mexican consumers. The significant upfront investment required for sophisticated battery-powered and automated gardening solutions may deter adoption among middle-income households seeking cost-effective alternatives.

Limited Consumer Awareness in Rural and Semi-Urban Areas

Insufficient awareness regarding modern gardening tools and their operational benefits among consumers residing in rural and semi-urban regions constrains market expansion beyond major metropolitan areas in Mexico. Traditional gardening practices employing basic implements remain prevalent in less developed regions, limiting penetration of innovative products and advanced equipment categories.

Seasonal Demand Fluctuations and Climate Variability

The gardening tools market is experiencing notable seasonal demand variations, influenced by climate patterns and agricultural calendars that affect consumer purchasing behavior. Extended dry seasons and unpredictable weather conditions in certain regions may discourage gardening activities, reducing tool consumption during particular periods and creating inventory management challenges for retailers.

Competitive Landscape:

The Mexico gardening tools market features a competitive landscape comprising global equipment manufacturers, regional distributors, and specialized retailers, competing through product innovation, pricing strategies, and distribution network expansion. Leading international brands maintain significant market presence by leveraging established brand recognition, comprehensive product portfolios, and strategic partnerships with major retail chains. Competition intensifies, as manufacturers introduce technologically advanced products, featuring smart connectivity, enhanced battery performance, and ergonomic designs that address evolving consumer preferences. Market participants are increasingly focusing on sustainability credentials, developing eco-friendly products utilizing recycled materials and energy-efficient technologies to distinguish their products and attract eco-aware customers.

Mexico Gardening Tools Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Lawn Mowers, Blowers, Vacuums and Sweepers, Pruning Tools, Striking and Digging Tools, Chain Saw, Others |

| Tool Holders Covered | Engine Tools, Hand Tools |

| Distribution Channels Covered | Store-Based, Non-Store-Based |

| End Uses Covered | Commercial, Residential |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico gardening tools market size was valued at USD 2,099.35 Million in 2025.

The Mexico gardening tools market is expected to grow at a compound annual growth rate of 6.16% from 2026-2034 to reach USD 3,596.25 Million by 2034.

Lawn mowers dominated the market with a share of 24%, driven by their essential role in maintaining residential lawns and commercial landscapes, along with growing adoption of battery-powered and robotic mowing solutions.

Key factors driving the Mexico gardening tools market include rising adoption of gardening as a recreational activity, accelerating urbanization creating demand for green spaces, expansion of organized retail networks, and growing consumer interest in sustainable and technologically advanced gardening equipment.

Major challenges include high costs associated with advanced gardening equipment, limited awareness in rural and semi-urban regions regarding modern tools, seasonal demand fluctuations influenced by climate patterns, and competition from traditional gardening implements in less developed areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)