Mexico Gaskets and Seals Market Size, Share, Trends and Forecast by Product, Material, Application, End Use, and Region, 2025-2033

Mexico Gaskets and Seals Market Overview:

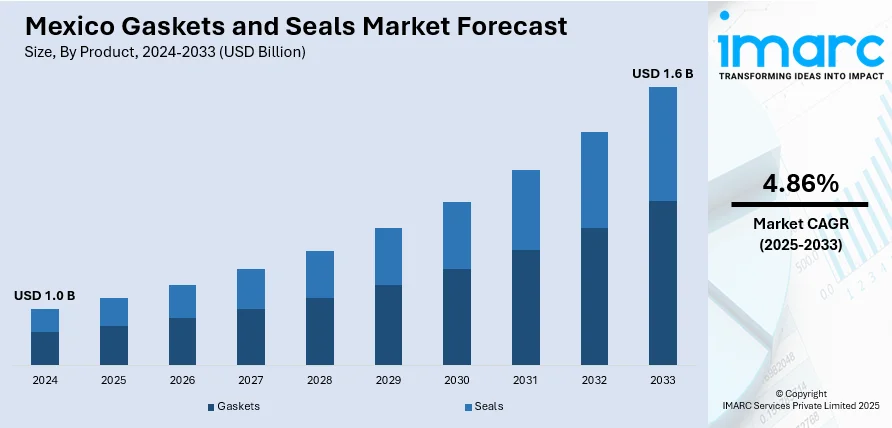

The Mexico gaskets and seals market size reached USD 1.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.6 Billion by 2033, exhibiting a growth rate (CAGR) of 4.86% during 2025-2033. The market is predominantly fueled by growth in major sectors like automotive, oil and gas, and manufacturing. This development is also driven by strategic trade agreements such as the United States-Mexico-Canada Agreement (USMCA), stimulating greater demand for sealing solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.0 Billion |

| Market Forecast in 2033 | USD 1.6 Billion |

| Market Growth Rate 2025-2033 | 4.86% |

Mexico Gaskets and Seals Market Trends:

Customization and Value-Added Services

The market is witnessing a growing demand for customized gaskets and seals tailored to specific industry requirements. To address this need, manufacturers are offering value-added services such as design consultation, prototyping, and aftermarket support. This trend reflects a shift towards providing comprehensive solutions that align closely with the operational demands of various sectors, thereby enhancing customer satisfaction and fostering long-term business relationships. For instance, in April 2025, Trelleborg Sealing Solutions launched a new Industrial Automation section on its website. This platform offers targeted sealing solutions for applications in electric motors, gearboxes, actuators, and factory automation robotics. Visitors can access expert video insights, technical brochures, engineering tools, and a virtual showroom to explore real-world applications.

Integration of Digital Technologies in Manufacturing

The incorporation of digital technologies, including the Internet of Things (IoT) and automation, is transforming the manufacturing processes of gaskets and seals in Mexico. These technologies enable real-time monitoring, predictive maintenance, and improved quality control, leading to increased operational efficiency and reduced downtime. Embracing digitalization allows manufacturers to optimize production workflows and respond more effectively to market demands, positioning them competitively in a rapidly evolving industry landscape. For instance, as per industry reports, form-in-place (FIP) and cure-in-place (CIP) liquid gaskets are replacing traditional gaskets in automotive and electronics manufacturing due to their precision, flexibility, and fast-curing properties. UV-curable materials like DELO’s Photobond SL4166 and Henkel’s Loctite SI 5972FC enable rapid, automated production. Advanced dispensing systems, such as Scheugenpflug’s DC803 and Nordson EFD’s PICO Nexμs, improve accuracy and integrate with Industry 4.0 technologies. These innovations enhance sealing reliability, reduce production time, and support growing demand for compact, high-performance electronic components.

Mexico Gaskets and Seals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, material, application, and end use.

Product Insights:

- Gaskets

- Metallic Gasket

- Rubber Gasket

- Cork Gasket

- Non-Asbestos Gasket

- Spiral Wound Gasket

- Others

- Seals

- Shaft Seals

- Molded Seals

- Motor Vehicle Body Seals

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes gaskets (metallic gasket, rubber gasket, cork gasket, non-asbestos gasket, spiral wound gasket, and others) and seals (shaft seals, molded seals, motor vehicle body seals, and others).

Material Insights:

- Fiber

- Graphite

- PTFE

- Rubber

- Silicones

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes fiber, graphite, PTFE, rubber, silicones, and others.

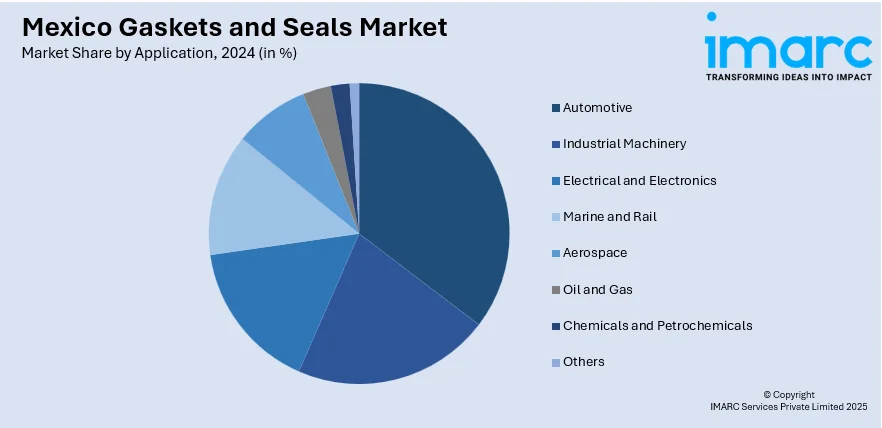

Application Insights:

- Automotive

- Industrial Machinery

- Electrical and Electronics

- Marine and Rail

- Aerospace

- Oil and Gas

- Chemicals and Petrochemicals

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive, industrial machinery, electrical and electronics, marine and rail, aerospace, oil and gas, chemicals and petrochemicals, and others.

End Use Insights:

- OEM

- Aftermarket

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes OEM and aftermarket.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, and Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Gaskets and Seals Market News:

- In February 2025, Aero-Plastics Inc., a U.S.-based specialist in high-performance plastics and aerospace interior components, was acquired by Trelleborg Sealing Solutions. Aero-Plastics brings decades of expertise in injection molding, thermoforming, and polymer machining, along with value-added services such as assembly and specialty coatings.

- In July 2023, Amsted Seals launched a new manufacturing facility in Sahagun, Mexico, aimed at producing seals for rail, commercial vehicle, automotive, and industrial sectors. The facility is expected to generate around 150 local jobs.

Mexico Gaskets and Seals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Materials Covered | Fiber, Graphite, PTFE, Rubber, Silicones, Others |

| Applications Covered | Automotive, Industrial Machinery, Electrical and Electronics, Marine and Rail, Aerospace, Oil and Gas, Chemicals and Petrochemicals, Others |

| End Uses Covered | OEM, aftermarket |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico gaskets and seals market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico gaskets and seals market on the basis of product?

- What is the breakup of the Mexico gaskets and seals market on the basis of material?

- What is the breakup of the Mexico gaskets and seals market on the basis of application?

- What is the breakup of the Mexico gaskets and seals market on the basis of end use?

- What are the various stages in the value chain of the Mexico gaskets and seals market?

- What are the key driving factors and challenges in the Mexico gaskets and seals market?

- What is the structure of the Mexico gaskets and seals market and who are the key players?

- What is the degree of competition in the Mexico gaskets and seals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico gaskets and seals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico gaskets and seals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico gaskets and seals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)