Mexico Gearbox Market Size, Share, Trends and Forecast by Type, Gear Type, End User, and Region, 2026-2034

Mexico Gearbox Market Summary:

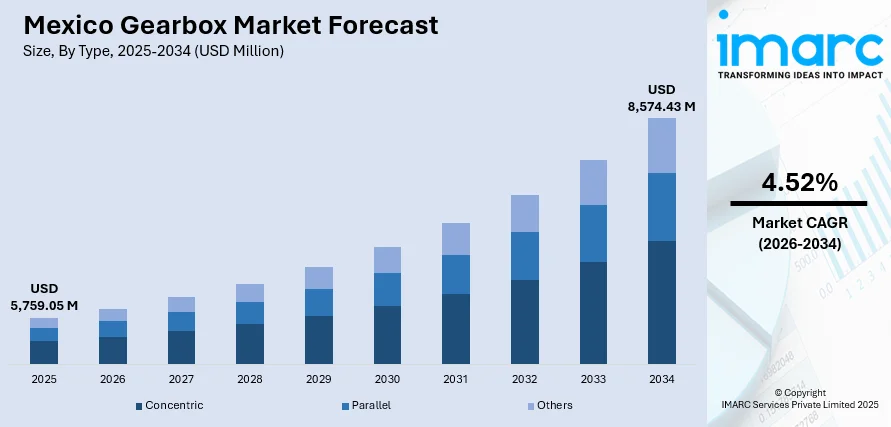

The Mexico gearbox market size was valued at USD 5,759.05 Million in 2025 and is projected to reach USD 8,574.43 Million by 2034, growing at a compound annual growth rate of 4.52% from 2026-2034.

The Mexico gearbox market is experiencing robust expansion, driven by accelerating industrial modernization and the country's strategic position as a manufacturing hub for North America. Growing investments in automotive production facilities, coupled with infrastructure development initiatives and expanding mining operations, are catalyzing the demand across multiple sectors. Technological advancements in gear manufacturing, increasing adoption of energy-efficient transmission systems, and the nearshoring trend bringing manufacturing closer to the United States market are reshaping the competitive landscape and strengthening the market share.

Key Takeaways and Insights:

-

By Type: Concentric dominates the market with a share of 41% in 2025, owing to its compact design efficiency, reduced installation footprint, and superior torque transmission capabilities. Growing demand from conveyor systems and industrial machinery applications is accelerating market expansion.

-

By Gear Type: Helical gear leads the market with a share of 38% in 2025. This dominance is driven by superior load-bearing capacity, quieter operation characteristics, and enhanced durability that meets demanding industrial requirements across automotive and manufacturing sectors.

-

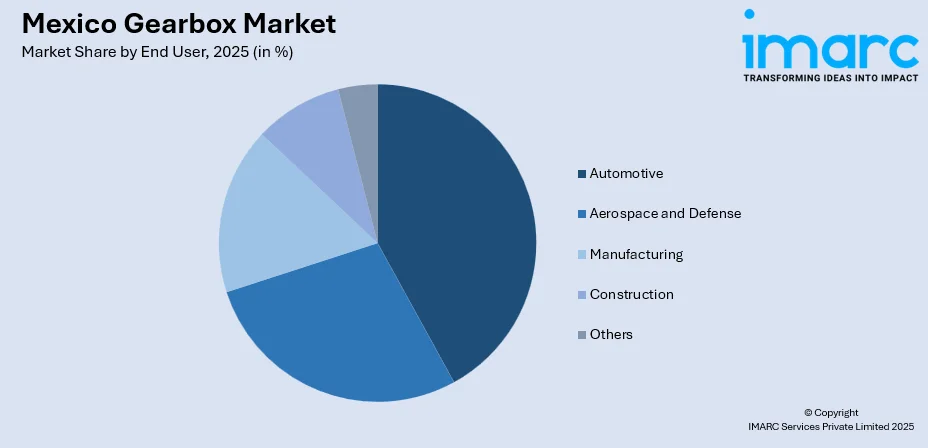

By End User: Automotive represents the largest segment with a market share of 42% in 2025, reflecting Mexico's established position as a global automotive manufacturing powerhouse with extensive vehicle production and export capabilities driving sustained gearbox demand.

-

Key Players: Key players drive the Mexico gearbox market by expanding manufacturing capabilities, investing in advanced gear technologies, and strengthening distribution networks. Their focus on energy efficiency, product customization, and strategic partnerships with automotive original equipment manufacturers (OEMs) enhances market penetration and competitive positioning.

To get more information on this market Request Sample

The Mexico gearbox market is advancing, as manufacturing industries embrace automation and precision engineering solutions to enhance operational efficiency. Industrial facilities across the country are upgrading legacy equipment with modern gearbox systems that deliver improved power transmission, reduced maintenance requirements, and enhanced energy efficiency. The automotive sector continues to anchor market growth, with major vehicle manufacturers expanding production capacity to meet domestic and export demands. Mexico's favorable trade agreements, skilled workforce, and proximity to North American markets make it an attractive destination for gearbox manufacturers seeking to establish regional production bases. In June 2025, Mexico's automobile sector set new records by manufacturing 362,047 light vehicles. According to data from the Mexican Automotive Industry Association (AMIA), this indicated a 4.8% rise compared to June 2024. This underscores the substantial demand for transmission components, including gearboxes. Infrastructure development projects and expanding renewable energy installations are creating additional opportunities for specialized gearbox applications across wind power and industrial machinery sectors.

Mexico Gearbox Market Trends:

Rising Adoption of Energy-Efficient Gearbox Systems

Industrial facilities across Mexico are increasingly prioritizing energy-efficient gearbox solutions to reduce operational costs and meet sustainability objectives. Manufacturers are developing advanced gear systems featuring optimized tooth profiles and premium lubricants that minimize friction losses and heat generation. The shift towards high-efficiency transmission components aligns with corporate environmental initiatives and regulatory requirements, promoting reduced energy consumption. Additionally, rising electricity costs are accelerating return on investment (ROI) considerations, prompting industrial operators to replace older gearboxes with modern, energy-efficient designs that deliver long-term savings and improved equipment reliability. As of March 2025, the cost of residential electricity in Mexico was MXN 2.025 for each kWh, equivalent to USD 0.113. The cost of electricity for companies was MXN 3.972 kWh or USD 0.221.

Integration of Smart Monitoring Technologies

The incorporation of condition monitoring sensors and predictive maintenance capabilities into gearbox systems is transforming industrial operations throughout Mexico. As per IMARC Group, the Mexico predictive maintenance market size reached USD 190.5 Million in 2024 and is set to reach USD 1,211.48 Million by 2033. Smart solutions enable real-time performance tracking, early fault detection, and optimized maintenance scheduling that reduces unplanned downtime. Manufacturing plants are embracing connected gearbox technologies as part of broader Industry 4.0 digitalization initiatives supporting Mexico gearbox market growth.

Expansion of Localized Manufacturing Capabilities

Global gearbox manufacturers are establishing and expanding production facilities within Mexico to serve growing regional demand and leverage favorable trade conditions. This localization trend reduces supply chain dependencies, shortens delivery timelines, and enables customized solutions tailored to local market requirements. The nearshoring movement is accelerating investments in Mexican manufacturing infrastructure across the gearbox industry. Local production also enhances cost competitiveness through lower logistics expenses and improved responsiveness to customer specifications, further strengthening Mexico’s position as a strategic gearbox manufacturing hub.

Market Outlook 2026-2034:

The Mexico gearbox market outlook remains positive, as industrial expansion and automotive manufacturing continue to drive the demand for advanced transmission solutions. Ongoing investments in manufacturing infrastructure, renewable energy projects, and mining operations are expected to sustain market momentum throughout the forecast period. The market generated a revenue of USD 5,759.05 Million in 2025 and is projected to reach a revenue of USD 8,574.43 Million by 2034, growing at a compound annual growth rate of 4.52% from 2026-2034. Technological advancements in gear design, increasing automation adoption, and favorable government policies supporting manufacturing investment are positioning Mexico as a key growth market within the broader Latin American region.

Mexico Gearbox Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Concentric |

41% |

|

Gear Type |

Helical Gear |

38% |

|

End User |

Automotive |

42% |

Type Insights:

- Concentric

- Parallel

- Others

Concentric dominates with a market share of 41% of the total Mexico gearbox market in 2025.

Concentric gearboxes have established dominance in the Mexico market due to their space-efficient inline shaft configuration that simplifies installation across diverse industrial applications. These systems deliver excellent torque multiplication capabilities while maintaining compact dimensions, making them ideal for conveyor systems, mixers, and packaging machinery prevalent throughout Mexican manufacturing facilities. The growing adoption of automated material handling equipment in warehouses and distribution centers is amplifying demand for reliable concentric gear solutions. Total tons of freight moved in Mexico increased by 3%, rising from 534 Million to 566 Million, from 2021 to 2024, driving substantial requirements for conveyor system gearboxes.

The versatility of concentric gearboxes extends across multiple speed reduction ratios, enabling manufacturers to address varied application requirements with standardized product platforms. Advanced manufacturing techniques are improving gear precision and surface finish quality, resulting in enhanced efficiency and reduced noise levels during operation. Mexican industrial facilities increasingly favor concentric designs for their straightforward maintenance characteristics and long service life intervals.

Gear Type Insights:

- Spur Gear

- Worm Gear

- Bevel Gear

- Helical Gear

- Others

Helical gear leads with a share of 38% of the total Mexico gearbox market in 2025.

Helical gears have achieved market leadership owing to their superior load distribution characteristics resulting from the angled tooth engagement pattern that ensures multiple teeth share forces simultaneously. This design delivers smoother operation with reduced vibration and noise levels compared to spur gear alternatives, making helical configurations preferred for automotive transmissions and industrial machinery requiring quiet performance. Mexican automotive plants extensively utilize helical gear systems in vehicle powertrains where smooth power delivery and durability are paramount.

The enhanced efficiency of helical gears under high-speed operating conditions positions them favorably for applications requiring sustained power transmission with minimal energy losses. Manufacturing advancements in gear grinding and finishing technologies are enabling Mexican suppliers to produce helical gears meeting stringent quality specifications demanded by global automotive OEMs.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Aerospace and Defense

- Manufacturing

- Construction

- Others

Automotive exhibits a clear dominance with a 42% share of the total Mexico gearbox market in 2025.

The automotive sector anchors Mexico gearbox market demand through extensive vehicle manufacturing operations serving both domestic consumption and substantial export volumes to North American markets. Major global automakers operate production facilities throughout Mexico, requiring consistent supplies of transmission gearboxes, differential assemblies, and powertrain components meeting rigorous quality standards. The sector's dominance reflects Mexico's established position among the world's leading vehicle producing nations with comprehensive supplier ecosystems supporting integrated manufacturing.

Automotive gearbox demand encompasses diverse product categories, ranging from manual and automatic transmission systems to specialized gearboxes for commercial vehicles and electric powertrains. The ongoing transition towards electrified vehicles is reshaping requirements as manufacturers develop single-speed and multi-speed reduction gearboxes optimized for electric motor characteristics. EMA indicated that in Mexico, electric vehicle (EV) and plug-in hybrid electric vehicle (PHEV) sales totaled 43,656 from January to June 2025, marking a 40% rise compared to 2024, derived from self-reported figures from its members, including Tesla and BYD of China. Mexican automotive suppliers are investing in advanced manufacturing capabilities to capture growing demand for precision gearbox components serving the EV segment.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico serves as the primary manufacturing hub for gearbox production and consumption, anchored by extensive automotive and industrial operations concentrated in states, including Nuevo León, Coahuila, and Chihuahua. The region benefits from strategic proximity to US markets, established logistics infrastructure, and skilled manufacturing workforce supporting advanced production requirements.

Central Mexico represents a significant market, driven by automotive manufacturing clusters in Guanajuato, Querétaro, and Aguascalientes, along with diverse industrial facilities requiring gearbox solutions. The Bajío region has emerged as a major automotive production corridor attracting continued investment from global vehicle manufacturers and component suppliers.

Southern Mexico presents growing opportunities linked to infrastructure development, renewable energy projects, and expanding industrial activities. Wind energy installations along the Isthmus of Tehuantepec create specialized demand for wind turbine gearboxes while emerging manufacturing operations generate requirements for industrial transmission systems.

Market Dynamics:

Growth Drivers:

Why is the Mexico Gearbox Market Growing?

Expanding Automotive Manufacturing Base

Mexico's automotive industry continues to expand, as global manufacturers establish and enlarge production facilities to serve North American markets under favorable trade conditions. Vehicle export reached a new peak, as Mexico exported 3,479,086 units in 2024, surpassing the former record of 3,451,157 units established in 2018. The sector's growth directly drives gearbox demand across vehicle transmission systems, powertrain components, and manufacturing equipment applications. Major automakers are increasing production capacity while attracting supplier investments that strengthen the domestic gearbox manufacturing ecosystem. The comprehensive automotive cluster development creates sustained demand for diverse gearbox types serving assembly operations and finished vehicle requirements. Rising adoption of EVs further expands demand for specialized reduction gearboxes and precision drive systems. Automation within automotive assembly plants increases the need for reliable industrial gearboxes supporting robotics and material handling. Additionally, localization of tier-1 and tier-2 suppliers enhances component sourcing efficiency, reinforcing long-term gearbox demand across Mexico’s automotive value chain.

Industrial Modernization and Automation Initiatives

Manufacturing facilities across Mexico are upgrading equipment and implementing automation solutions that require advanced gearbox systems for material handling, processing, and packaging applications. This modernization trend drives demand for precision gear reducers, servo gearboxes, and integrated motor-gear units optimized for automated production environments. Companies are investing in improved production capabilities to enhance competitiveness and product quality while reducing labor costs and improving throughput. The transition towards smart manufacturing creates opportunities for gearbox suppliers offering intelligent products with integrated monitoring capabilities. Rising adoption of Industry 4.0 technologies is accelerating demand for digitally enabled gearboxes that support data-driven maintenance and real-time performance optimization. As per IMARC Group, the Mexico Industry 4.0 market size reached USD 2,470.50 Million in 2024. Integration of sensors and condition monitoring systems helps reduce downtime and extend equipment life. Additionally, flexible manufacturing layouts increase the need for compact, high-torque gearboxes that can adapt to reconfigurable production lines.

Nearshoring Trend Attracting Manufacturing Investment

Global companies are relocating production facilities to Mexico to establish manufacturing bases closer to North American end markets, reducing supply chain risks and logistics costs. This nearshoring movement brings substantial investments in industrial facilities that require gearbox solutions for production equipment and material handling systems. The trend benefits Mexico's gearbox market, as manufacturers establish local sourcing relationships and suppliers invest in expanded domestic production capabilities. Mexico's competitive advantages, including trade agreements, workforce availability, and geographic proximity, position it favorably to capture continued nearshoring investments. Increased foreign direct investment also drives demand for high-quality, standardized gearboxes that meet international performance and compliance requirements. Foreign direct investment (FDI) in Mexico reached USD 36 Billion in 2023, with significant allocations directed towards automotive and industrial sectors, driving gearbox market expansion.

Market Restraints:

What Challenges the Mexico Gearbox Market is Facing?

Import Dependency for Specialized Components

Mexico relies substantially on imported specialty steels, precision bearings, and advanced gear materials required for high-performance gearbox manufacturing. This dependency creates supply chain vulnerabilities, extends lead times, and increases costs that challenge domestic manufacturers competing against established international suppliers with integrated material sourcing capabilities. Additionally, currency fluctuations and global trade disruptions can further amplify cost volatility, making long-term procurement planning more complex for domestic gearbox manufacturers.

Skilled Workforce Availability Constraints

Advanced gearbox manufacturing requires specialized technical expertise in precision machining, heat treatment, and quality assurance that remains limited across certain Mexican regions. Competition for skilled workers intensifies as manufacturing expands, potentially constraining production capacity growth and increasing labor costs for gearbox manufacturers. Moreover, limited access to advanced technical training programs slows workforce development, increasing reliance on costly in-house training and expatriate expertise.

Infrastructure Limitations in Developing Regions

Transportation infrastructure gaps and unreliable energy supplies in some Mexican regions complicate logistics and manufacturing operations for gearbox producers and end users. These limitations increase operational costs and restrict market expansion into underserved areas where infrastructure improvements lag behind industrial development needs. Furthermore, delays in infrastructure upgrades hinder timely project execution and discourage new industrial investments in emerging manufacturing clusters.

Competitive Landscape:

The Mexico gearbox market features competition among established international manufacturers and growing domestic suppliers, serving diverse industrial segments. Global leaders leverage extensive product portfolios, advanced engineering capabilities, and established brand recognition while investing in Mexican production facilities to enhance regional service levels. Local manufacturers compete through application expertise, customization flexibility, and responsive customer support tailored to Mexican market requirements. Competition intensifies around technological innovation, with companies developing energy-efficient designs, smart monitoring features, and application-specific solutions. Strategic partnerships between international suppliers and local distributors expand market coverage while acquisitions consolidate industry presence.

Mexico Gearbox Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Concentric, Parallel, Others |

| Gear Types Covered | Spur Gear, Worm Gear, Bevel Gear, Helical Gear, Others |

| End Users Covered | Automotive, Aerospace and Defense, Manufacturing, Construction, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico gearbox market size was valued at USD 5,759.05 Million in 2025.

The Mexico gearbox market is expected to grow at a compound annual growth rate of 4.52% from 2026-2034 to reach USD 8,574.43 Million by 2034.

Concentric dominated the market with a share of 41%, driven by compact inline shaft design delivering efficient torque transmission for conveyor systems, mixers, and industrial machinery requiring space-efficient power solutions.

Key factors driving the Mexico gearbox market include expanding automotive manufacturing operations, industrial modernization initiatives, nearshoring investments relocating production facilities, growing renewable energy installations, and increasing automation adoption across manufacturing sectors.

Major challenges include import dependency for specialized materials and components, skilled workforce availability constraints in certain regions, infrastructure limitations affecting logistics and operations, and competitive pressure from established international suppliers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)