Mexico Generator Market Size, Share, Trends and Forecast by Fuel Type, Power Rating, Sales Channel, Design, Application, End User, and Region, 2026-2034

Mexico Generator Market Summary:

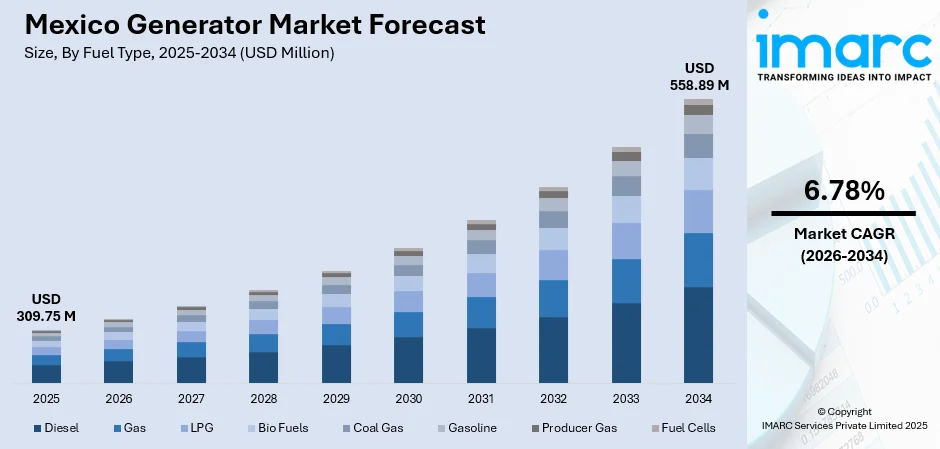

The Mexico generator market size was valued at USD 309.75 Million in 2025 and is projected to reach USD 558.89 Million by 2034, growing at a compound annual growth rate of 6.78% from 2026-2034.

Rising industrialization, growing demands for quality backup solutions for power, and rising infrastructural developments, particularly in the commercial and residential segments, are driving this market. In addition, growing investments in manufacturing units, combined with the need for continuous power supply for critical processes, is driving the market growth. Moreover, instability or occasional power cuts in the electricity supply are making end-use customers switch to generators, thereby increasing the Mexico generators market share.

Key Takeaways and Insights:

-

By Fuel Type: Diesel dominates the market with a share of 56% in 2025, driven by high fuel efficiency, strong power output, and reliability for heavy-duty industrial applications across commercial, residential, and industrial sectors.

-

By Power Rating: Up to 50 kW leads the market with a share of 30% in 2025, owing to adoption among small businesses and residential users seeking cost-effective, portable, and reliable backup power solutions for daily operations.

-

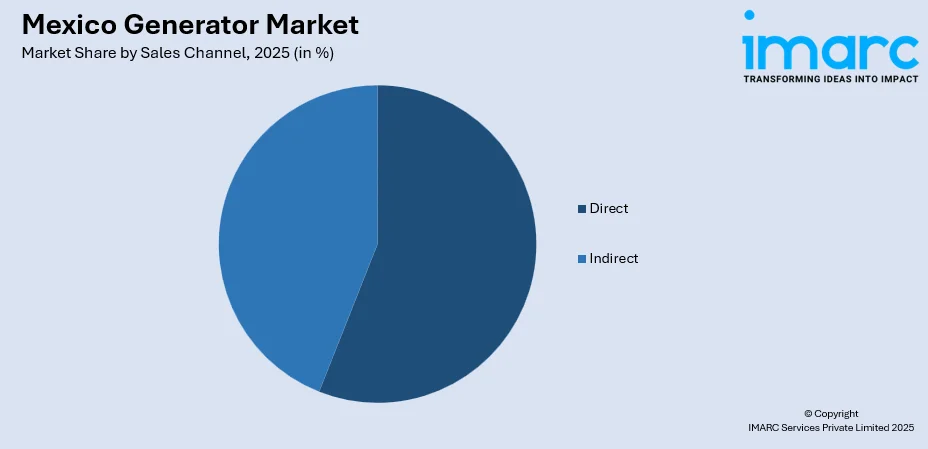

By Sales Channel: Direct represents the largest segment with a market share of 56% in 2025, driven by by industrial buyers preferring direct manufacturer engagement for customized solutions and comprehensive support.

-

By Design: Stationary dominates the market with a share of 68% in 2025, owing to by higher power capacity and suitability for permanent installations in industrial and commercial facilities.

-

By Application: Standby represents the market with a share of 59% in 2025, driven by increasing demand for emergency backup power across healthcare facilities, data centers, and telecommunications infrastructure.

-

By End User: Utilities/power generation leads the market with a share of 45% in 2025, owing to the widespread of generator deployment in oil and gas, mining, and industrial manufacturing sectors requiring continuous, reliable power supply.

-

By Region: Central Mexico dominates the market with a share of 40% in 2025, driven by concentration of industrial manufacturing hubs, commercial centers, and major metropolitan areas including Mexico City.

-

Key Players: The Mexico generator market features a moderately fragmented competitive landscape, where global manufacturers compete with regional distributors. Companies emphasize expanding service coverage, strengthening distribution partnerships, and improving after-sales support to enhance market presence and customer reach.

To get more information on this market Request Sample

The Mexico generator market is witnessing strong growth, driven by rapid industrialization and continued expansion of the manufacturing sector across the country. Increasing investments in infrastructure development, such as commercial real estate projects, healthcare facilities, data centers, and telecommunications networks, are significantly boosting demand for reliable backup power solutions. Frequent power grid instability and recurring outages, especially in remote and underdeveloped regions, are prompting both businesses and households to adopt generator systems to ensure uninterrupted operations. As per sources, in August 2025, Mexico announced an US$8.18 Billion expansion of its National Transmission Network, adding 275 transmission lines and 524 substations to improve electricity reliability for over 50 Million users. Moreover, rising urbanization and the growing presence of small and medium enterprises are further supporting the adoption of compact and portable generator units. Additionally, the expansion of the mining sector and ongoing oil and gas exploration activities are major contributors to market growth, as these industries require continuous and dependable power supply to maintain critical processes, enhance operational efficiency, and minimize downtime in challenging operating environments.

Mexico Generator Market Trends:

Growing Adoption of Hybrid and Multi-Fuel Generator Systems

The Mexico generator market is witnessing increasing adoption of hybrid and multi-fuel generator systems that offer enhanced operational flexibility and reduced fuel dependency. These advanced systems enable users to switch between different fuel sources based on availability and cost considerations, providing economic benefits during fluctuating fuel prices. Industrial and commercial users are increasingly preferring generators capable of operating on multiple fuel types, including natural gas, diesel, and liquefied petroleum gas, to optimize operational costs and ensure business continuity. In August 2025, Capstone Green Energy secured a 5.8 MW follow-on order for natural gas-fueled microturbines from a major Mexican food manufacturer, supporting multiple facilities with reliable power and thermal energy. Moreover, this trend is particularly prominent in manufacturing facilities and commercial establishments seeking sustainable and cost-effective power backup solutions.

Integration of Smart Monitoring and Remote Management Technologies

The integration of Internet of Things enabled monitoring systems and remote management capabilities is transforming generator operations across Mexico. Modern generators increasingly feature advanced telematics, predictive maintenance algorithms, and cloud-based monitoring platforms that enable real-time performance tracking and fault detection. This technological advancement allows facility managers to monitor multiple generator units across different locations through centralized dashboards, optimizing maintenance schedules and reducing downtime. As per sources, in 2025, WEG deployed its Smart Machine IoT platform across generator sets in Mexico, enabling remote monitoring, automated alerts, and improved operational efficiency for industrial facilities. Moreover, commercial and industrial users are increasingly demanding generators with smart connectivity features that provide actionable insights for improving operational efficiency and extending equipment lifespan.

Expansion of Rental and Leasing Services for Temporary Power Solutions

The generator rental and leasing segment is experiencing significant expansion across Mexico, driven by construction projects, outdoor events, and temporary power requirements in various industries. Businesses are increasingly opting for rental solutions to avoid substantial capital investments while gaining access to latest generator technologies and comprehensive maintenance support. The growing construction sector, coupled with rising demand for temporary power during festivals, exhibitions, and film productions, is fueling this trend. As per sources, in 2025, the Federal Electricity Commission (CFE) announced the installation of two portable generators in the Yucatán Peninsula to address electricity deficits and prevent blackouts during peak summer months. Further, rental service providers are expanding their fleets and geographic coverage to capture emerging opportunities in both urban centers and developing industrial regions across the country.

Market Outlook 2026-2034:

The Mexico generator market is projected to experience steady revenue growth over the forecast period, fueled by continued industrialization and the expansion of infrastructure across the country. Rising investments in manufacturing plants, data centers, healthcare facilities, and commercial real estate will continue to support demand for reliable backup power solutions. Expanding nearshoring activities and increasing foreign direct investment in Mexican manufacturing are creating additional opportunities for generator adoption. Moreover, grid modernization initiatives and a growing focus on energy security across critical infrastructure segments are further strengthening revenue growth, supporting the market’s sustained expansion over the forecast horizon. The market generated a revenue of USD 309.75 Million in 2025 and is projected to reach a revenue of USD 558.89 Million by 2034, growing at a compound annual growth rate of 6.78% from 2026-2034.

Mexico Generator Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Fuel Type | Diesel | 56% |

| Power Rating | Up To 50 kW | 30% |

| Sales Channel | Direct | 56% |

| Design | Stationary | 68% |

| Application | Standby | 59% |

| End User | Utilities/Power Generation | 45% |

| Region | Central Mexico | 40% |

Fuel Type Insights:

- Diesel

- Gas

- LPG

- Bio Fuels

- Coal Gas

- Gasoline

- Producer Gas

- Fuel Cells

Diesel dominates with a market share of 56% of the total Mexico generator market in 2025.

Diesel maintains a dominant position in the Mexico market due to their high-power output, strong fuel efficiency, and proven reliability in heavy duty applications. They are widely preferred across industrial facilities, construction sites, and large commercial buildings that require extended and stable backup power. In December 2025, Wells Fargo upgraded Generac Holdings due to rising demand for diesel generators as backup power for AI data centers in Mexico, highlighting potential large-scale industrial adoption. Moreover, the extensive availability of diesel fuel infrastructure throughout Mexico further strengthens this segment, allowing easy refueling and uninterrupted operations during prolonged power outages across urban, semi urban, and remote regions, supporting consistent performance in diverse operating conditions.

The preference for diesel is also fueled by the reliability and ability of the generators to respond to variable load requirements. Other industrial setups, such as manufacturing companies, mining operations, and the oil and gas sector, require the use of diesel generators due to their positive performance characteristics in challenging environments. Other factors, such as the relatively low initial setup costs and the presence of established after-sales and servicing networks, contribute to the driving factors of the market for diesel generators.

Power Rating Insights:

- Up To 50 kW

- 51–280 kW

- 281–500 kW

- 501–2,000 kW

- 2,001–3,500 kW

- Above 3,500 kW

Up to 50 kW leads with a share of 30% of the total Mexico generator market in 2025.

Up to 50 kW dominates the market due to its widespread adoption among residential users, small businesses, and light commercial establishments seeking affordable and reliable backup power solutions. Furthermore, these compact generators strike an effective balance between power capacity and portability, supporting applications such as home backup systems, small offices, and neighbourhood retail stores. Lower acquisition costs and comparatively modest fuel and maintenance expenses further enhance their attractiveness for budget conscious consumers and small enterprise owners prioritizing cost efficiency and operational reliability.

Rapid urbanization and the steady growth of small and medium enterprises across Mexico are accelerating demand for generators in this power category. Healthcare clinics, restaurants, convenience stores, and residential complexes increasingly depend on these systems to maintain essential operations during grid disruptions. Additional advantages include straightforward installation, limited space requirements, and reduced maintenance complexity compared to larger industrial units, making them accessible and practical for a wide range of end users.

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Direct

- Indirect

Direct exhibits a clear dominance with a 56% share of the total Mexico generator market in 2025.

Direct leads the Mexico generator market as industrial and commercial buyers increasingly prefer direct engagement with manufacturers for customized solutions and end to end support. Furthermore, this approach allows large volume purchasers to negotiate competitive pricing, obtain extended warranty coverage, and secure long term service contracts. Direct procurement also supports detailed technical consultations, on site assessments, and tailored generator configurations designed to meet specific operational needs across diverse industrial and commercial applications.

Preference for direct is especially strong among utility companies, large manufacturing plants, and infrastructure developers that require specialized and high-capacity generator systems. These buyers place strong value on direct access to manufacturer expertise, professional installation assistance, and dependable after sales support. Direct relationships also ensure comprehensive product training, faster availability of genuine spare parts, and priority maintenance services, all of which are essential for sustaining operational efficiency, minimizing downtime, and supporting mission critical applications across large scale industrial and infrastructure projects.

Design Insights:

- Stationary

- Portable

Stationary leads with a market share of 68% of the total Mexico generator market in 2025.

Stationary dominates the market due to their high-power output and suitability for permanent installation in industrial and commercial facilities. Engineered for continuous or extended operation, they reliably support critical loads in manufacturing plants, hospitals, data centers, and large commercial buildings. Their robust design, advanced cooling systems, and integrated control mechanisms ensure consistent performance during prolonged power outages, maintaining operational stability and efficiency under demanding conditions while meeting the requirements of diverse industrial and commercial applications.

Rising investments in industrial infrastructure and commercial real estate development are driving demand for stationary generator installations across Mexico. According to sources, in 2025, Mexico’s Federal Electricity Commission (CFE) launched a Power Assurance Plan to stabilize electricity in industrial parks, reduce outages, and support manufacturing growth and foreign investment nationwide. These systems integrate effectively with building electrical networks and automatic transfer switches, ensuring uninterrupted power supply during grid disruptions. Facility managers favor stationary generators for their lower operational noise, enhanced safety features, improved fuel efficiency, and compliance with environmental and regulatory standards governing permanent power generation solutions.

Application Insights:

- Standby

- Prime and Continuous

- Peak Shaving

Standby dominates with a market share of 59% of the total Mexico generator market in 2025.

Standby leads the market as businesses and institutions increasingly prioritize emergency backup power to minimize operational disruptions during grid failures. These generators activate automatically during outages, ensuring a seamless power transition and safeguarding sensitive equipment from damage. Healthcare facilities, financial institutions, telecommunications networks, and data centers are key adopters, relying on standby systems to maintain uninterrupted operations, meet regulatory requirements, and support critical services where power reliability is essential.

The increasing occurrence of power outages and the focus on business continuity are boosting demand for standby generator systems. Commercial and industrial facilities are investing in reliable backup solutions to minimize financial losses from unplanned downtime. Modern standby generators provide features such as real-time monitoring, automated load management, and extended runtime, allowing organizations of different sizes to maintain continuous operations, protect sensitive equipment, and achieve operational resilience efficiently across varying operational environments.

End User Insights:

- Utilities/Power Generation

- Oil and Gas

- Chemicals and Petrochemicals

- Mining and Metals

- Manufacturing

- Marine

- Construction

- Others

- Residential

- Commercial

- Healthcare

- IT and Telecommunications

- Data Centers

- Others

Utilities/power generation leads with a share of 45% of the total Mexico generator market in 2025.

Utilities/power generation leads the market, driven by widespread generator deployment across oil and gas operations, mining activities, and industrial manufacturing facilities. These sectors require high-capacity generators capable of supporting continuous operations in remote locations where grid connectivity is limited or unreliable. In April 2025, APR Energy deployed 150 MW of fast-track mobile power in Baja California, Mexico, using six high-output turbines to support the national grid and ensure reliable electricity during peak demand. Moreover, chemical processing plants, petrochemical refineries, and metal manufacturing facilities depend on generator systems for both primary and backup power generation to maintain safety reliability and production continuity during demanding conditions.

Marine operations and construction activities further contribute to the segment’s dominance, as these applications frequently operate in areas without established power infrastructure. The expansion of mining operations across Mexico and continued investments in oil exploration activities are sustaining demand for heavy duty generator systems. Industrial users in this segment typically require generators with advanced features including parallel operation capability, load sharing functions, and robust enclosures for harsh environmental conditions and long-term operational reliability in field.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Central Mexico dominates with a market share of 40% of the total Mexico generator market in 2025.

Central Mexico dominates the regional generator market due to its concentration of major industrial hubs, commercial centers, and the densely populated Mexico City metropolitan area. The region hosts significant manufacturing facilities, corporate headquarters, healthcare institutions, and retail establishments that rely on uninterrupted power supply. High electricity consumption, coupled with developed business infrastructure, generates strong demand for generator systems across diverse end-use sectors, including industrial, commercial, and residential applications, supporting operational continuity and minimizing disruptions during grid failures.

The economic significance and dense business activity in Central Mexico drive substantial investments in power security infrastructure, particularly in generator installations for industrial and commercial facilities. Expanding real estate projects, growth in logistics and warehousing operations, and the establishment of data centers contribute to rising market demand. Well-established distribution networks and service centers further facilitate the procurement, installation, and maintenance of generators, ensuring efficient support and operational reliability for businesses and institutions throughout the region.

Market Dynamics:

Growth Drivers:

Why is the Mexico Generator Market Growing?

Accelerating Industrial Growth and Manufacturing Expansion

The rapid industrialization across Mexico is creating substantial demand for reliable power generation equipment to support manufacturing operations. The country's strategic position as a nearshoring destination is attracting significant foreign investments in automotive, aerospace, electronics, and consumer goods manufacturing sectors. These industrial facilities require uninterrupted power supply to maintain production efficiency, protect sensitive equipment, and meet delivery commitments. The establishment of new manufacturing plants and expansion of existing facilities are driving procurement of generator systems across various power ratings and configurations. In January 2025, Guanajuato launched 15 energy projects with 1,227 MW electricity and 5,530 tons of green hydrogen to support industrial nearshoring, attract investment, and ensure reliable power for manufacturing.

Growing Infrastructure Development and Construction Activities

Extensive infrastructure development initiatives across Mexico are fueling demand for generator systems in construction and permanent installation applications. Major projects including commercial real estate developments, hospital construction, educational institutions, and transportation infrastructure require temporary power solutions during construction phases and permanent backup systems upon completion. The expansion of retail chains, hospitality establishments, and mixed-use developments is generating sustained demand for generators to ensure business continuity. Government investments in public infrastructure, including healthcare facilities and administrative buildings, are contributing to market growth.

Rising Grid Instability and Power Quality Concerns

Frequent power outages and grid instability issues across various regions of Mexico are compelling businesses and households to invest in backup generator systems. As per sources, Mexico’s southeast grid suffered widespread outages due to transmission failures, prompting industrial zones and healthcare facilities to deploy backup generators to maintain critical operations. Furthermore, the existing power infrastructure faces challenges in meeting growing electricity demand, particularly during peak consumption periods and extreme weather events. Industries sensitive to power fluctuations, including semiconductor manufacturing, food processing, and pharmaceutical production, require clean and stable power supply that generators with advanced voltage regulation can provide. Data centers and telecommunications facilities are expanding their backup power capacity to meet uptime requirements and service level agreements.

Market Restraints:

What Challenges the Mexico Generator Market is Facing?

High Initial Investment and Operational Costs

The substantial capital investment required for quality generator systems poses a barrier for small businesses and budget-constrained organizations. Beyond initial acquisition costs, ongoing expenses including fuel consumption, regular maintenance, spare parts replacement, and periodic overhauls represent significant operational commitments. These cost considerations particularly impact small and medium enterprises that may defer generator investments or opt for undersized units that inadequately address their power backup requirements.

Environmental Regulations and Emission Compliance Requirements

Increasingly stringent environmental regulations governing generator emissions are adding complexity and cost to market participation. Compliance with evolving emission standards requires manufacturers to incorporate advanced exhaust treatment technologies that increase equipment costs. Users operating generators in environmentally sensitive areas or densely populated urban zones face additional permitting requirements and operational restrictions that may limit generator utilization or necessitate investment in cleaner but more expensive alternatives.

Fuel Price Volatility and Supply Chain Uncertainties

Fluctuating fuel prices directly impact generator operational economics, creating uncertainty in budgeting and total cost of ownership calculations. Supply chain disruptions affecting fuel availability and generator component sourcing can delay equipment deliveries and maintenance activities. These uncertainties encourage some potential buyers to postpone investments or explore alternative power solutions, potentially limiting market growth in certain segments and geographic regions.

Competitive Landscape:

The Mexico generator market competitive landscape is characterized by a moderately fragmented structure with established global manufacturers competing alongside regional players and specialized distributors. Market participants differentiate through product range breadth, technological innovation, service network coverage, and pricing strategies tailored to specific customer segments. Leading players are expanding their presence through strategic partnerships with local distributors, establishment of regional service centers, and development of customized solutions for key industries. Competition is intensifying in the small and medium power segments where multiple brands offer comparable products, driving emphasis on after-sales service quality and financing options. The market also witnesses competition from rental service providers that offer flexible alternatives to ownership, particularly for temporary power requirements and cost-sensitive applications.

Recent Developments:

-

In June 2025, Generac showcased its latest energy solutions at Expo Eléctrica Internacional 2025 in Mexico, unveiling industrial generators from 10 kW to 3,100 kW, mobile and lighting units, battery storage systems, and residential backup generators, reinforcing its commitment to resilient, efficient, and sustainable power for industrial, commercial, and residential sectors.

Mexico Generator Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | Diesel, Gas, LPG, Bio Fuels, Coal Gas, Gasoline, Producer Gas, Fuel Cells |

| Power Ratings Covered | Up To 50 Kw, 51–280 Kw, 281–500 Kw, 501–2,000 Kw, 2,001–3,500 Kw, Above 3,500 Kw |

| Sales Channels Covered | Direct, Indirect |

| Designs Covered | Stationary, Portable |

| Applications Covered | Standby, Prime and Continuous, Peak Shaving |

| End Users Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico generator market size was valued at USD 309.75 Million in 2025.

The Mexico generator market is expected to grow at a compound annual growth rate of 6.78% from 2026-2034 to reach USD 558.89 Million by 2034.

Diesel held the largest market share in Mexico, supported by their high reliability, strong power output, fuel efficiency, suitability for heavy-duty industrial applications, and widespread availability of diesel fuel infrastructure across residential, commercial, and industrial segments.

Key factors driving the Mexico generator market include rapid industrialization, extensive infrastructure development, increasing investments in the manufacturing sector, frequent power grid instabilities, growing demand for reliable backup power solutions, and the expansion of nearshoring activities across commercial, industrial, and residential sectors.

Key challenges include high initial investment, ongoing fuel and maintenance costs, strict environmental and emission regulations, fuel price volatility, supply chain uncertainties, and rising competition from renewable energy solutions and alternative power sources across residential, commercial, and industrial applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)