Mexico Genomics Market Size, Share, Trends and Forecast by Component, Application, Technology, End-User, and Region, 2025-2033

Mexico Genomics Market Overview:

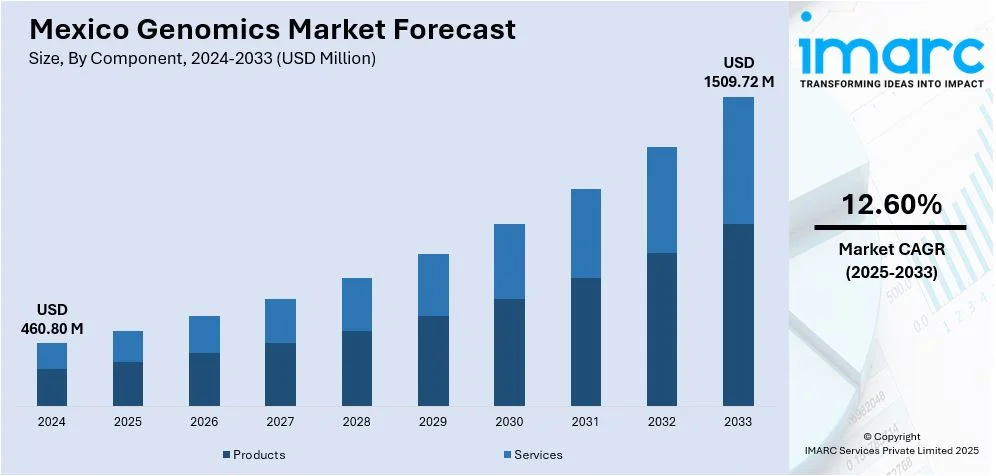

The Mexico genomics market size reached USD 460.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,509.72 Million by 2033, exhibiting a growth rate (CAGR) of 12.60% during 2025-2033. Government funding, public health integration of genomics, and institutional capacity building, combined with international research collaborations and regulatory alignment, contribute significantly to sector advancement. Private investment, adoption of next-generation sequencing technologies, demand for personalized medicine, and academic-industry partnerships further support its development. Improved IP frameworks, cloud-based analytics, and regional medical tourism are some of the factors positively impacting the Mexico genomics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 460.80 Million |

| Market Forecast in 2033 | USD 1509.72 Million |

| Market Growth Rate 2025-2033 | 12.60% |

Mexico Genomics Market Trends:

Government Initiatives and Public Sector Investments

A key factor contributing to the development of this sector is the Mexican government’s increasing commitment to strengthening genomic research infrastructure and public health outcomes. Strategic funding programs channeled through national institutions such as the National Institute of Genomic Medicine (INMEGEN) have laid the groundwork for advanced genetic studies. These initiatives are aligned with broader healthcare policies that prioritize precision medicine, hereditary disease screening, and preventive care models. The government's collaborations with international genomic research organizations and pharmaceutical firms have also facilitated access to cutting-edge technologies and data repositories. Furthermore, regulatory frameworks are progressively aligning with global standards, making the environment conducive for clinical trials and bioinformatics deployments. On October 11, 2023, the Mexican Biobank project published findings in Nature detailing the genotyping of 6,057 individuals from 898 localities across all 32 Mexican states, utilizing 1.8 million genome-wide markers. The study conducted genome-wide association analyses for 22 complex traits and found that several traits are better predicted using the Mexican Biobank GWAS compared to the UK Biobank GWAS. Institutional support for capacity building, including the training of geneticists and bioinformaticians, further reinforces the research pipeline. The integration of genomic data into national health records and disease control programs underscores a shift toward evidence-based medical policy. These coordinated actions by public entities are instrumental in shaping a stable and innovation-friendly ecosystem. Around the midpoint of this expansion, the Mexico genomics market growth has become a focal point of national healthcare advancement, reflecting both scientific and socio-political momentum.

Expanding Private Sector Involvement and Technological Advancements

The rapid advancement of sequencing technologies and increased involvement of private healthcare enterprises have significantly influenced the sector’s trajectory. Multinational corporations and regional startups are investing in infrastructure for next-generation sequencing (NGS), data analytics, and personalized treatment applications. These investments are largely driven by the growing demand for genetic testing among urban populations, particularly for oncology, prenatal diagnostics, and pharmacogenomics. The decreasing costs of genomic services and the emergence of cloud-based bioinformatics tools are encouraging greater adoption by laboratories and diagnostic centers. On October 11, 2023, Dr. Claudia Gonzaga-Jauregui from Universidad Nacional Autónoma de México highlighted significant financial and logistical barriers to implementing genomic medicine in Mexico. She noted that sequencing costs in Mexico are approximately two to three times higher than in the USA or Europe due to import taxes and a 16% federal tax on laboratory reagents. In addition, local biotech firms are forming partnerships with academic institutions to co-develop gene-editing protocols and rare disease research models. Intellectual property protections and incentives for innovation have improved, attracting venture capital and private equity interest. Medical tourism has also played a minor role, with regional patients seeking cost-effective genetic services in Mexico. The availability of trained personnel and scalable technologies has reduced entry barriers for new market participants. These dynamics illustrate how a competitive and well-capitalized private landscape is shaping the sector’s future. The synergy between enterprise innovation and clinical application highlights the comprehensive value chain influencing market dynamics.

Mexico Genomics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, application, technology, and end-user.

Component Insights:

- Products

- Instruments and Software

- Consumables and Reagents

- Services

- Core Genomics Services

- NGS-Based Services

- Biomarker Translation Services

- Computational Services

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes products (instruments and software, and consumables and reagents) and services (core genomics services, NGS-based services, biomarker translation services, computational services, and others).

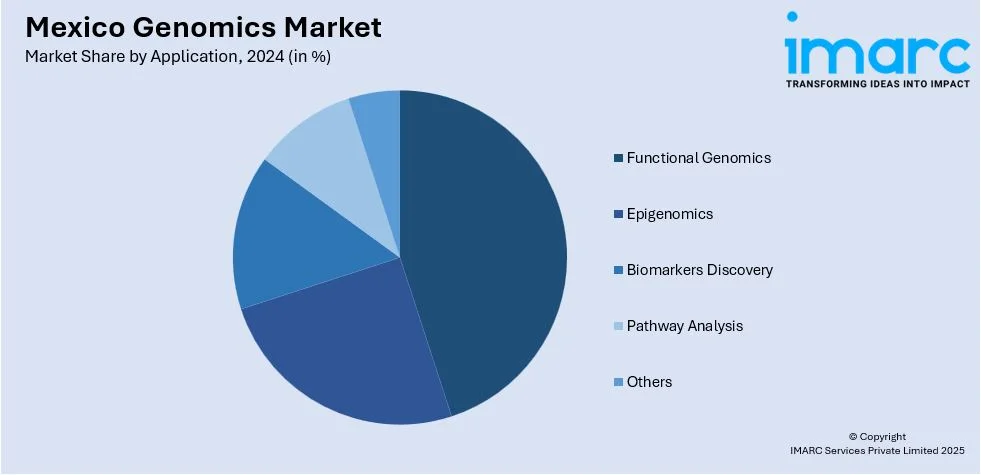

Application Insights:

- Functional Genomics

- Epigenomics

- Biomarkers Discovery

- Pathway Analysis

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes functional genomics, epigenomics, biomarkers discovery, pathway analysis, and others.

Technology Insights:

- Sequencing

- Microarray

- Polymerase Chain Reaction

- Nucleic Acid Extraction and Purification

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes sequencing, microarray, polymerase chain reaction, nucleic acid extraction and purification, and others.

End-User Insights:

- Research Centers

- Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Others

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes research centers, hospitals and clinics, pharmaceutical and biotechnology companies, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has provided a comprehensive analysis of all major regional markets. This includes Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Genomics Market News:

- On December 5, 2023, Precision BioSciences presented its PBGENE-HBV program at the Hep-DART 2023 conference in Los Cabos, Mexico, highlighting a gene editing strategy aimed at eliminating cccDNA and inactivating integrated HBV DNA. The company also showcased preclinical data on the safety and efficacy of its ARCUS-POL nucleases for chronic hepatitis B treatment.

Mexico Genomics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Applications Covered | Functional Genomics, Epigenomics, Biomarkers Discovery, Pathway Analysis, Others |

| Technologies Covered | Sequencing, Microarray, Polymerase Chain Reaction, Nucleic Acid Extraction and Purification, Others |

| End-Users Covered | Research Centers, Hospitals and Clinics, Pharmaceutical and Biotechnology Companies, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico genomics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico genomics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico genomics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The genomics market in Mexico was valued at USD 460.80 Million in 2024.

The Mexico genomics market is projected to exhibit a CAGR of 12.60% during 2025-2033, reaching a value of USD 1,509.72 Million by 2033.

The market is witnessing significant growth mainly driven by the heightened investments from both government and private sectors in genomic research, an increase in the occurrence of genetic disorders, and a rising interest in personalized medicine. Additionally, advancements in sequencing technologies, along with the development of biotechnology and healthcare infrastructure, are contributing to the market's expansion in the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)