Mexico Geriatric Healthcare Market Size, Share, Trends and Forecast by Product Type, Service Type, Disease Indication, End User, and Region, 2025-2033

Mexico Geriatric Healthcare Market Overview:

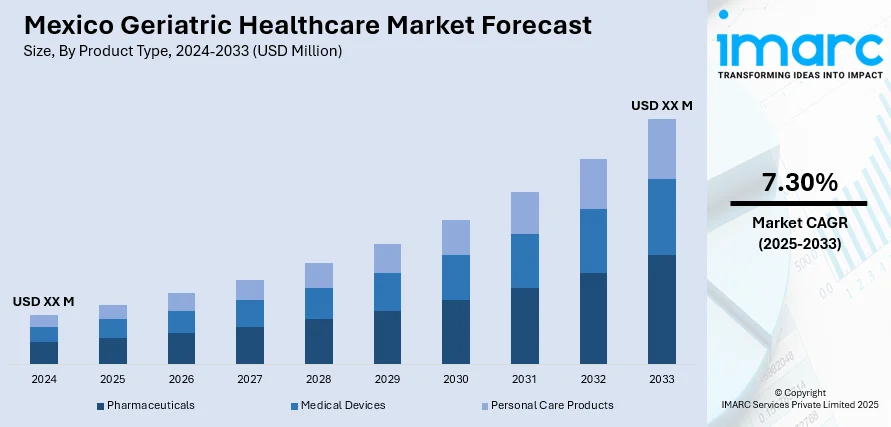

The Mexico geriatric healthcare market size is projected to exhibit a growth rate (CAGR) of 7.30% during 2025-2033. The market is driven by Mexico’s aging population, which is raising the demand for chronic disease management as well as long-term elderly care. Investments in specialized geriatric infrastructure and the emergence of home-based healthcare solutions are transforming service delivery across public and private sectors, thereby fueling the market. Integration of digital health technologies and preventive care frameworks is further augmenting the Mexico geriatric healthcare market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 7.30% |

Mexico Geriatric Healthcare Market Trends:

Aging Population and Changing Demographics

Mexico is experiencing a major demographic transition with the percentage of people aged 60 and older rising consistently owing to falling fertility and increasing life expectancy. This development puts increasing pressure on the country's health system to address the particular needs of older citizens, who are more prone to chronic disease, mobility impairments, and mental decline. As household sizes decline and urban living patterns prevail, the conventional caregiving patterns are being replaced by institutionalized and professional care of the elderly. Public health care systems and private sector providers are increasing home-based services, geriatric consultation, and long-term nursing. In addition, the prevalence of diseases like Alzheimer's, diabetes, hypertension, and arthritis among the elderly is forcing health planners to establish specialized geriatric units and preventive schemes. A recent study analyzed the relationship between in-hospital mortality and geriatric syndromes (GSs) in older adults (OAs) aged 65 and over, admitted to an emergency department (ED) in Guadalajara, Mexico. The study found that frailty (70.2%), risk of falls (60.3%), and dementia (57.4%) were the most prevalent GSs. A total of 202 patients participated, and each had an average of 4.65 GSs. The study identified cognitive impairment and dependence as independent predictors of mortality, with adjusted odds ratios of 6.88 (95% CI, 1.41–33.5) and 7.52 (95% CI, 1.95–29.98), respectively. The study highlights the need for improved geriatric care strategies in EDs, noting that only 20% of the patients had previously undergone a geriatric evaluation, primarily during prior hospitalizations. The state’s evolving role in elderly welfare, through pensions, subsidized health services, and senior support initiatives, is creating broader access to care. These demographic shifts and policy adaptations are key contributors to Mexico geriatric healthcare market growth, as aging becomes a central theme in healthcare planning.

To get more information on this market, Request Sample

Rise of Preventive and Home-Based Geriatric Healthcare Models

Preventive healthcare is gaining traction across Mexico’s aging population, with increasing emphasis on early diagnosis, lifestyle management, and aging-in-place solutions. Early detection of chronic conditions such as prediabetes has become a critical aspect of managing the health of older adults. Prediabetes affecting 26% of Mexicans aged 35-74, raises the risk of premature mortality from heart disease, kidney disease, and acute diabetic complications. A recent study presented at ENDO 2024 shows that Mexicans with prediabetes had 2.6 times the risk of dying from diabetes complications and 1.6 times the risk of premature death from kidney disease, reinforcing the importance of identifying and treating the condition early. Older adults prefer to remain in their own homes for as long as possible, giving rise to a strong demand for home health services, remote monitoring, and mobile diagnostics. Technological integration—such as telemedicine, wearable devices, and AI-based health platforms—is transforming how elderly care is delivered, allowing for continuous monitoring and timely interventions. These models also help reduce the strain on institutional infrastructure by decentralizing care. Moreover, families and caregivers are increasingly engaging with community-based programs and geriatric outreach services to maintain elderly well-being outside hospital settings. Policy developments support this trend, as health authorities advocate for decentralized and cost-effective approaches to managing age-related conditions. As these innovations become embedded in the standard continuum of care, private providers are investing in mobile clinics and digital health solutions to reach older adults in remote or underserved areas. These technology-enabled, patient-centric models are becoming instrumental in improving care accessibility, quality of life, and cost efficiency, fundamentally driving market growth in both urban and semi-urban zones.

Mexico Geriatric Healthcare Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, service type, disease indication, and end user.

Product Type Insights:

- Pharmaceuticals

- Medical Devices

- Personal Care Products

The report has provided a detailed breakup and analysis of the market based on the product type. This includes pharmaceuticals, medical devices, and personal care products.

Service Type Insights:

- Home Healthcare Services

- Hospital and Clinical Services

- Assisted Living and Nursing Care

- Palliative and Hospice Care

The report has provided a detailed breakup and analysis of the market based on the service type. This includes home healthcare services, hospital and clinical services, assisted living and nursing care, and palliative and hospice care.

Disease Indication Insights:

- Cardiovascular Diseases

- Neurological Disorders

- Diabetes and Endocrine Disorders

- Respiratory Disorders

- Osteoarthritis and Musculoskeletal Disorders

- Cancer

- Others

The report has provided a detailed breakup and analysis of the market based on the disease indication. This includes cardiovascular diseases, neurological disorders, diabetes and endocrine disorders, respiratory disorders, osteoarthritis and musculoskeletal disorders, cancer, and others.

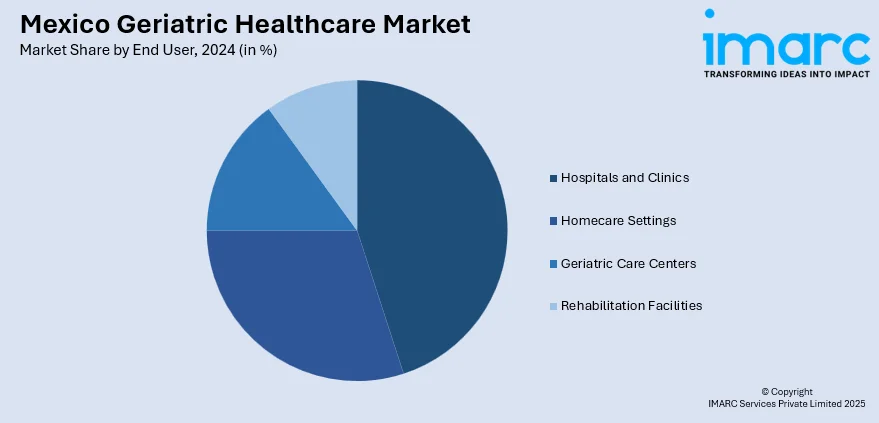

End User Insights:

- Hospitals and Clinics

- Homecare Settings

- Geriatric Care Centers

- Rehabilitation Facilities

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals and clinics, homecare settings, geriatric care centers, and rehabilitation facilities.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Geriatric Healthcare Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Pharmaceuticals, Medical Devices, Personal Care Products |

| Service Types Covered | Home Healthcare Services, Hospital and Clinical Services, Assisted Living and Nursing Care, Palliative and Hospice Care |

| Disease Indications Covered | Cardiovascular Diseases, Neurological Disorders, Diabetes and Endocrine Disorders, Respiratory Disorders, Osteoarthritis and Musculoskeletal Disorders, Cancer, Others |

| End User Covered | Hospitals and Clinics, Homecare Settings, Geriatric Care Centers, Rehabilitation Facilities |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico geriatric healthcare market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico geriatric healthcare market on the basis of product type?

- What is the breakup of the Mexico geriatric healthcare market on the basis of service type?

- What is the breakup of the Mexico geriatric healthcare market on the basis of disease indication?

- What is the breakup of the Mexico geriatric healthcare market on the basis of end user?

- What is the breakup of the Mexico geriatric healthcare market on the basis of region?

- What are the various stages in the value chain of the Mexico geriatric healthcare market?

- What are the key driving factors and challenges in the Mexico geriatric healthcare market?

- What is the structure of the Mexico geriatric healthcare market and who are the key players?

- What is the degree of competition in the Mexico geriatric healthcare market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico geriatric healthcare market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico geriatric healthcare market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico geriatric healthcare industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)