Mexico Geriatric Healthcare Products Market Size, Share, Trends and Forecast by Product, Distribution Channel, End-User, and Region, 2025-2033

Mexico Geriatric Healthcare Products Market Overview:

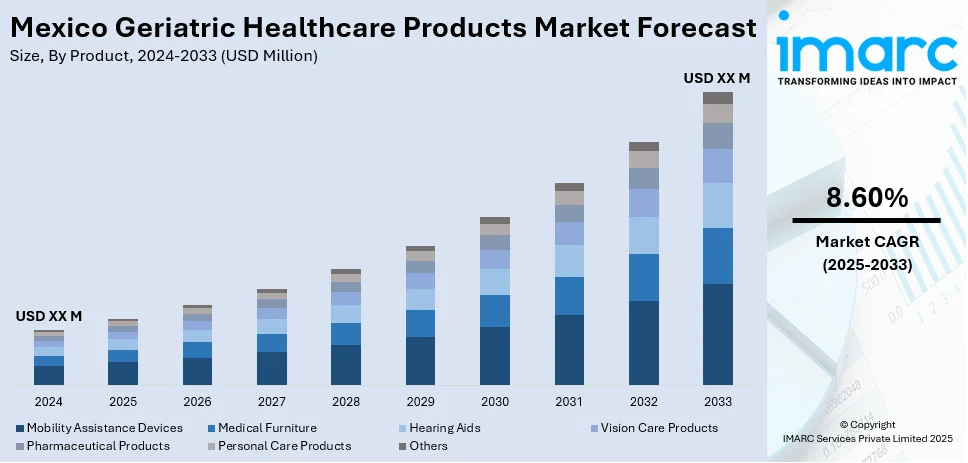

The Mexico geriatric healthcare products market size is projected to expand at a growth rate (CAGR) of 8.60% during 2025-2033. Presently, with the rise of the elderly population, a greater number of individuals are experiencing long-term health issues, including diabetes and respiratory ailments. These illnesses frequently necessitate continuous care, routine observation, and lifestyle changes, resulting in an increased need for healthcare products designed for older adults. Besides this, the growing implementation of government initiatives aimed at promoting elderly health is contributing to the expansion of the Mexico geriatric healthcare products market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 8.60% |

Mexico Geriatric Healthcare Products Market Trends:

Increasing incidence of chronic diseases

The high prevalence of chronic diseases is fueling the market growth in Mexico. As the elderly population is increasing, more people are suffering from long-term health conditions, such as arthritis, heart disease, diabetes, hypertension, and respiratory problems. As per industry reports, the population of Mexican people aged 65 and older rose by 3.25% from 8.6% in 2023 to 8.9% in 2024. Chronic conditions often require ongoing treatment, regular monitoring, and lifestyle adjustments, leading to higher demand for healthcare products tailored to seniors. Products like blood pressure monitors, glucose meters, mobility aids, orthopedic supports, and adult diapers are becoming essential for managing daily health needs. Many elderly individuals also need nutritional supplements and special diets to support their weakened immune systems and improve overall well-being. Families and caregivers rely on these products to provide comfort, safety, and independence to aging loved ones. Healthcare providers, including hospitals, clinics, and home care services, are increasing their use of geriatric healthcare products to support long-term care plans. Chronic illnesses also make elderly people more vulnerable to complications, so preventive care and constant health monitoring are becoming important.

Growing implementation of government initiatives

Rising execution of government initiatives is impelling the Mexico geriatric healthcare products market growth. The government is increasing investments in public health programs that support aging populations and focus on long-term disease management. It is launching awareness campaigns about elderly care, encouraging preventive healthcare, and supporting healthy aging through education and outreach. Policies are promoting the distribution of medical devices, mobility aids, and home care products for seniors, often through public clinics and social programs. The government is also partnering with private companies and non-government organizations (NGOs) to expand the availability of affordable healthcare products and services. In rural and underserved areas, mobile health units and telemedicine services help bring care directly to elderly patients, driving the demand for portable and easy-to-use products. Social security programs begin to cover more geriatric healthcare needs, making these products more accessible to a wider population. These efforts reduce hospital visits and encourage home-based care, further creating the need for geriatric products. Overall, as government initiatives continue to grow and focus more on aging-related issues, they are building a strong foundation for the steady expansion of the market across Mexico. In October 2024, the President of Mexico, Sheinbaum, unveiled a new ‘door-to-door’ medical service for elderly individuals. This initiative would have public servants going to the residences of elderly individuals throughout Mexico. They would carry out health evaluations using questionnaires aimed at assessing personal health status. To back this initiative, Sheinbaum pledged to recruit more than 20,000 healthcare workers, such as nurses and doctors, by January 2025, to guarantee that medical assistance reached seniors in their residences.

Mexico Geriatric Healthcare Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, distribution channel, and end-user.

Product Insights:

- Mobility Assistance Devices

- Wheelchairs

- Walkers

- Canes

- Medical Furniture

- Hospital Beds

- Lift Chairs

- Hearing Aids

- Vision Care Products

- Reading Glasses

- Contact Lenses

- Pharmaceutical Products

- Chronic Disease Medications

- Supplements

- Personal Care Products

- Adult Diapers

- Skincare

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes mobility assistance devices (wheelchairs, walkers, and canes), medical furniture (hospital beds and lift chairs), hearing aids, vision care products (reading glasses and contact lenses), pharmaceutical products (chronic disease medications and supplements), personal care products (adult diapers and skincare), and others.

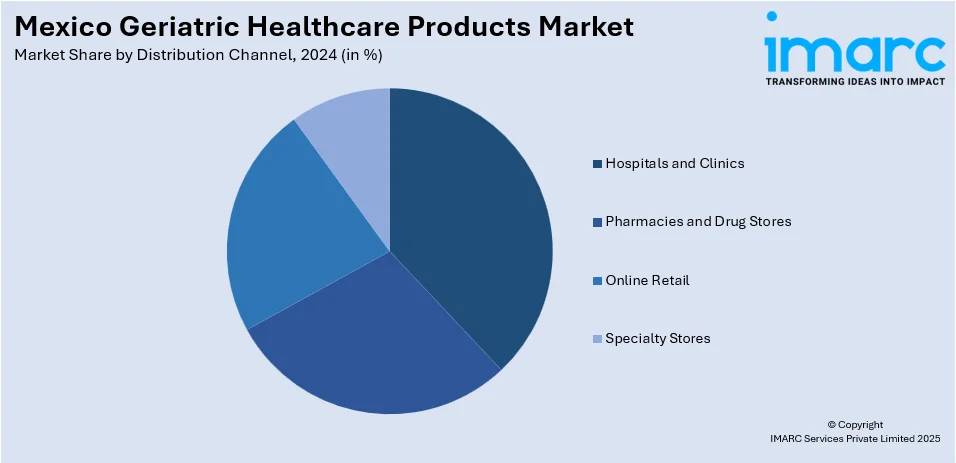

Distribution Channel Insights:

- Hospitals and Clinics

- Pharmacies and Drug Stores

- Online Retail

- Specialty Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hospitals and clinics, pharmacies and drug stores, online retail, and specialty stores.

End-User Insights:

- Home Healthcare

- Assisted Living Facilities

- Nursing Homes

- Hospitals

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes home healthcare, assisted living facilities, nursing homes, and hospitals.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Geriatric Healthcare Products Market News:

- In September 2024, Koltin, the inaugural company in Mexico providing private health insurance for seniors, revealed the completion of a USD 7.3M Series A funding round headed by Left Lane Capital. This funding round was set to support Koltin's goal of enhancing the health and financial stability of older Mexicans and their families. Eduardo and the Koltin team were pioneers in providing a holistic solution for seniors in Mexico, integrating customized care plans from a specialized clinical team along with individualized insurance options. Their proactive strategy was not only meeting the demands of an overlooked demographic but also creating a substantial chance to enhance health results and change how seniors paid for their care.

- In June 2024, the New Mexico Human Services Department, in collaboration with the Aging and Long-Term Services Department, provided extra food assistance to individuals aged over 60 and those with disabilities who participated in the Supplemental Nutrition Assistance Program (SNAP). An additional USD 135 in SNAP benefits was to be provided to 11,834 residents of New Mexico. This effort highlighted the organization’s dedication to guaranteeing that New Mexicans possessed the resources necessary to keep buying healthy foods.

Mexico Geriatric Healthcare Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Distribution Channels Covered | Hospitals and Clinics, Pharmacies and Drug Stores, Online Retail, Specialty Stores |

| End-Users Covered | Home Healthcare, Assisted Living Facilities, Nursing Homes, Hospitals |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico geriatric healthcare products market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico geriatric healthcare products market on the basis of product?

- What is the breakup of the Mexico geriatric healthcare products market on the basis of distribution channel?

- What is the breakup of the Mexico geriatric healthcare products market on the basis of end-user?

- What is the breakup of the Mexico geriatric healthcare products market on the basis of region?

- What are the various stages in the value chain of the Mexico geriatric healthcare products market?

- What are the key driving factors and challenges in the Mexico geriatric healthcare products market?

- What is the structure of the Mexico geriatric healthcare products market and who are the key players?

- What is the degree of competition in the Mexico geriatric healthcare products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico geriatric healthcare products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico geriatric healthcare products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico geriatric healthcare products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)