Mexico Glass Packaging Market Size, Share, Trends and Forecast by Product, End User, and Region, 2025-2033

Mexico Glass Packaging Market Overview:

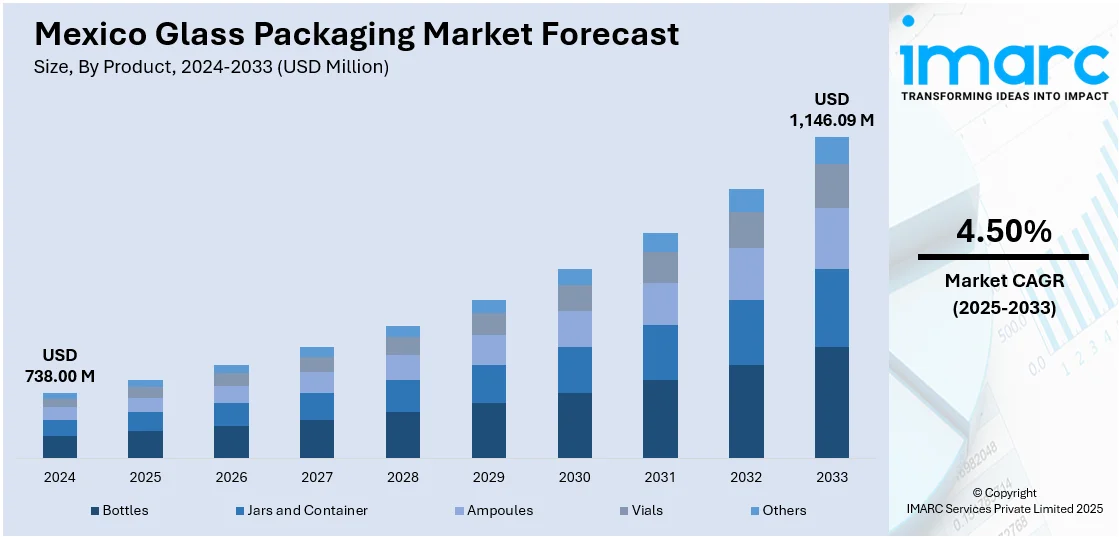

The Mexico glass packaging market size reached USD 738.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,146.09 Million by 2033, exhibiting a growth rate (CAGR) of 4.50% during 2025-2033. The market is driven by rising environmental awareness, government regulations promoting sustainability, and consumer preference for eco-friendly, non-toxic materials. Strong growth in the beverage industry, especially beer and tequila, and durability and premium appeal of glass making it ideal for protecting and marketing products effectively, further fuel the Mexico glass packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 738.00 Million |

| Market Forecast in 2033 | USD 1,146.09 Million |

| Market Growth Rate 2025-2033 | 4.50% |

Mexico Glass Packaging Market Trends:

Sustainability and Environmental Awareness

The increasing emphasis on sustainability is a major driver of the glass packaging market in Mexico. Glass is highly valued for being eco-friendly, as it can be recycled endlessly without losing quality. Growing environmental awareness among consumers has pushed brands to shift away from plastic toward greener alternatives. Government initiatives supporting recycling and waste reduction further encourage this trend. Businesses adopting sustainable packaging solutions are also seen more favorably by consumers, strengthening their brand image. As the demand for environmentally responsible products rises, manufacturers are investing in better recycling infrastructure and sustainable practices, making glass packaging a more viable long-term option across industries like food, beverage, and cosmetics. For instance, in August 2024, leading glass bottle manufacturer O-I Mexico teamed up with glass recycling business SILICE to open a cutting-edge glass recycling facility in Chihuahua. According to SEMARNAT, only 12% of Mexico's 2.5 million tons of glass garbage is recycled, making this partnership a major step in the right direction.

Growth in the Beverage Industry

Mexico's expanding beverage industry plays a vital role in boosting the Mexico glass packaging market growth. Glass is often the material of choice for alcoholic beverages due to its ability to preserve flavor, carbonation, and freshness. It also adds a premium look and feel to products, which is particularly important for brands targeting quality-conscious consumers. The increasing popularity of local and artisanal beverages has also led to a greater demand for distinctive and attractive glass bottles. From mainstream producers to boutique distilleries, companies rely on glass for its protective and aesthetic advantages, further strengthening its presence across retail shelves and export markets.

Consumer Preference for Premium and Safe Packaging

Modern consumers are becoming more selective about the materials used in product packaging. Glass is seen as a safer and more luxurious option compared to plastic, as it is non-toxic and preserves product purity. Its transparent, smooth, and clean appearance appeals to consumers who associate it with quality and trust. This is especially true in sectors like cosmetics, skincare, and gourmet food, where visual appeal and safety are top priorities. Glass packaging also enhances brand perception, helping products stand out on shelves. As demand for high-end and health-conscious products increases, glass continues to gain favor as the preferred packaging solution.

Mexico Glass Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product and end user.

Product Insights:

- Bottles

- Jars and Container

- Ampoules

- Vials

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes bottles, jars and container, ampoules, vials, and others.

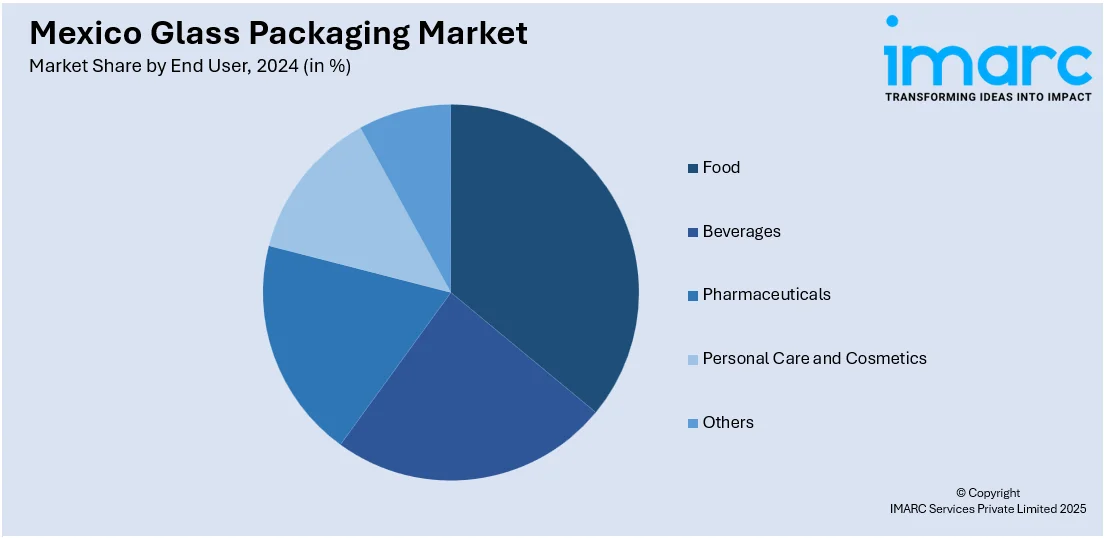

End User Insights:

- Food

- Beverages

- Alcoholic

- Non-Alcoholic

- Pharmaceuticals

- Personal Care and Cosmetics

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes food, beverages (alcoholic and non-alcoholic), pharmaceuticals, personal care and cosmetics, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Glass Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Bottles, Jars and Container, Ampoules, Vials, Others |

| End Users Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico glass packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico glass packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico glass packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The glass packaging market in Mexico was valued at USD 738.00 Million in 2024.

The Mexico glass packaging market is projected to exhibit a CAGR of 4.50% during 2025-2033, reaching a value of USD 1,146.09 Million by 2033.

The Mexico glass packaging market is driven by rising demand for sustainable and recyclable packaging, increasing beverage and food consumption, growing consumer preference for premium and eco-friendly products, expansion of the pharmaceutical and cosmetics sectors, innovations in design, and supportive regulatory initiatives promoting environmentally responsible packaging solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)