Mexico Graphite Market Size, Share, Trends and Forecast by Type, Application, End Use Industry, and Region, 2026-2034

Mexico Graphite Market Summary:

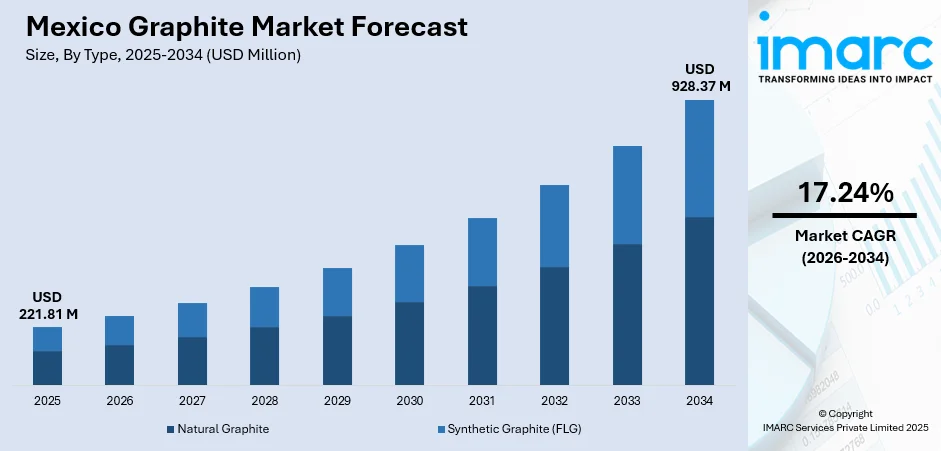

The Mexico graphite market size was valued at USD 221.81 Million in 2025 and is projected to reach USD 928.37 Million by 2034, growing at a compound annual growth rate of 17.24% from 2026-2034.

Mexico graphite market is experiencing robust expansion driven by the country's strategic position as a critical mineral supplier to North America and the accelerating transition toward clean energy technologies. The nation's established mining infrastructure in states like Sonora, combined with its proximity to United States manufacturing hubs, positions Mexico as an essential link in regional graphite supply chains serving the rapidly expanding electric vehicle and energy storage sectors within the Mexico graphite market share.

Key Takeaways and Insights:

-

By Type: Natural graphite dominates the market with a share of 58% in 2025, driven by Mexico's abundant amorphous graphite deposits in Sonora and cost advantages over synthetic alternatives for industrial applications.

-

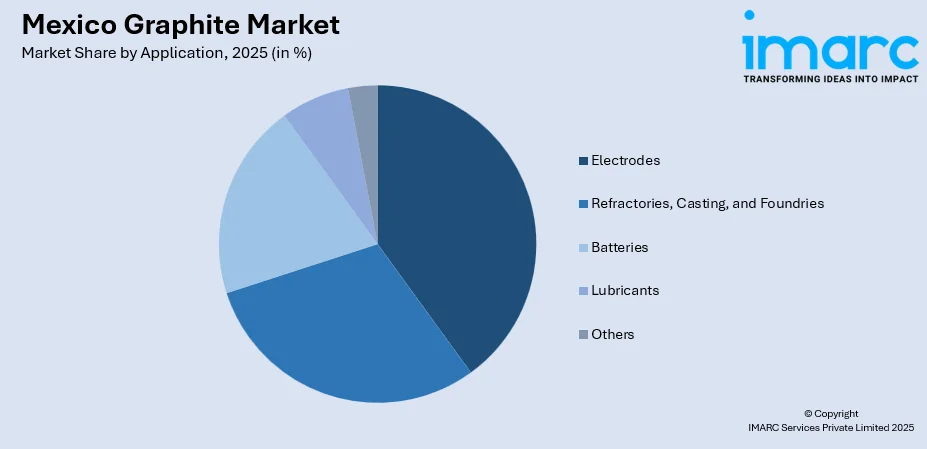

By Application: Electrodes lead the market with a share of 35% in 2025, supported by Mexico's expanding steel industry and the growing adoption of electric arc furnace technology for sustainable steel production.

-

By End Use Industry: Metallurgy represents the largest segment with a market share of 47% in 2025, owing to the country's position as a major steel producer and the integration of graphite in metal processing operations.

-

Key Players: The Mexico graphite market exhibits a moderately competitive landscape characterized by the presence of established international carbon material specialists alongside regional mining operators. Market participants are strategically expanding distribution networks and processing capabilities to capitalize on growing demand from steel manufacturing and emerging battery material applications.

To get more information on this market Request Sample

Mexico's graphite industry is undergoing significant transformation as global supply chain dynamics shift toward regional sourcing strategies. The market is benefiting from nearshoring trends in North American manufacturing, where companies are establishing production facilities closer to end markets. In February 2023, BMW announced an € 800 Million investment in its San Luis Potosí plant for high-voltage battery pack production beginning 2025, exemplifying the automotive industry's commitment to localizing electric vehicle component manufacturing in Mexico. This industrial expansion creates sustained demand for graphite materials across electrode, battery, and metallurgical applications, positioning Mexico as a strategic hub for critical mineral supply chains.

Mexico Graphite Market Trends:

Integration into North American Electric Vehicle Supply Chains

The rapid expansion of electric vehicle manufacturing in Mexico is creating substantial demand for graphite materials, particularly for lithium-ion battery anode applications. Mexico's EV production surged to 206,870 units by 2024, according to Directorio Automotriz Mapeo Electromobilidad 2025. This transformation is driving investment in battery component localization, with the Mexico EV battery components market size expected to reach USD 3,061.40 Million by 2033, exhibiting a growth rate (CAGR) of 30.73% during 2025-2033. Graphite suppliers are positioning themselves to serve both domestic battery assembly operations and export markets as automakers increasingly source materials regionally.

Nearshoring and Supply Chain Regionalization

Global manufacturers are increasingly relocating production to Mexico to shorten supply chains and reduce dependence on distant suppliers. The nearshoring trend gained momentum following supply chain disruptions and geopolitical tensions affecting traditional graphite sources. This industrial migration is benefiting graphite suppliers who can offer shorter lead times and reduced logistics costs compared to overseas alternatives, while helping customers comply with regional value content requirements under trade agreements.

Expansion of Sustainable Mining and Processing Operations

The Mexican mining industry is advancing sustainability initiatives while expanding critical mineral production capacity. According to the Mining Chamber of Mexico's 2025 Sustainability Report, the sector achieved significant environmental milestones in 2024, including water recycling rates of 70-71% and renewable energy adoption reaching 36% of total industry consumption. Mining companies obtained 221 national and 84 international certifications for environmental and safety management, positioning Mexico as a responsible source for critical minerals. The industry is expanding investment in graphite and other minerals essential for solar technologies, electric vehicle batteries, and clean energy systems.

Market Outlook 2026-2034:

The Mexico graphite market demonstrates strong growth prospects as the country solidifies its position within North American critical mineral supply chains serving rapidly expanding clean energy industries. Rising demand from electric vehicle battery manufacturing, steel production modernization, and renewable energy storage systems will sustain market expansion throughout the forecast period. Mexico's strategic geographic location adjacent to United States manufacturing hubs enables efficient supply chain integration while meeting regional content requirements under existing trade agreements. The country's established mining infrastructure, skilled workforce, and favorable business environment continue attracting foreign investment in graphite processing and downstream applications. Additionally, the global transition toward sustainable transportation and decarbonization of heavy industries creates lasting structural demand for graphite materials across multiple end-use sectors. These converging factors position Mexico as an increasingly important participant in international graphite markets. The market generated a revenue of USD 221.81 Million in 2025 and is projected to reach a revenue of USD 928.37 Million by 2034, growing at a compound annual growth rate of 17.24% from 2026-2034.

Mexico Graphite Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Natural Graphite | 58% |

| Application | Electrodes | 35% |

| End Use Industry | Metallurgy | 47% |

Type Insights:

- Natural Graphite

- Synthetic Graphite (FLG)

The natural graphite segment dominates with a market share of 58% of the total Mexico graphite market in 2025.

Natural graphite maintains market leadership in Mexico due to the country's significant amorphous graphite deposits concentrated in the Sonora region, which has historically been one of the world's most productive graphite mining districts. The material's lower production costs compared to synthetic alternatives make it particularly attractive for high-volume industrial applications including refractories, foundry facings, and brake linings where ultra-high purity specifications are not required, ensuring consistent demand from traditional manufacturing sectors.

Mexican producers have established integrated processing operations that convert mined graphite into specification-grade products serving diverse industrial customers across North America. The ongoing expansion of graphite applications in battery technologies is creating new opportunities for natural graphite producers to develop battery-grade materials through advanced purification and spheronization processes. This technological advancement enables suppliers to potentially capture higher-value market segments while diversifying revenue streams beyond traditional industrial applications.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Electrodes

- Refractories, Casting, and Foundries

- Batteries

- Lubricants

- Others

The electrodes segment leads with a share of 35% of the total Mexico graphite market in 2025.

Graphite electrodes serve as essential components in electric arc furnace steelmaking, where they conduct electricity to melt scrap metal at extremely high temperatures. Mexico's steel industry has increasingly adopted electric arc furnace technology as part of sustainability initiatives aimed at reducing carbon emissions, driving electrode demand growth. The superior thermal conductivity and heat resistance properties of graphite make it irreplaceable for these high-temperature metallurgical applications, ensuring sustained consumption across the country's expanding steel manufacturing operations.

The segment is further supported by Mexico's strategic position as a supplier to North American steel producers, with the country's competitive electricity costs and abundant scrap metal availability favoring electric arc furnace technology adoption. Major electrode manufacturers maintain operations within Mexico to serve regional customers efficiently. As steel industry decarbonization efforts accelerate globally, the shift toward electric arc furnace production methods over traditional blast furnaces is expected to sustain electrode demand growth throughout the forecast period.

End Use Industry Insights:

- Electronics

- Metallurgy

- Automotive

- Others

The metallurgy exhibits clear dominance with a 47% share of the total Mexico graphite market in 2025.

The metallurgy sector drives graphite consumption through diverse applications spanning steel production, foundry operations, and refractory manufacturing. Graphite electrodes remain indispensable for electric arc furnace steelmaking, while refractory bricks and crucibles incorporate graphite for thermal resistance in high-temperature metal processing. Mexico's automotive industry creates substantial downstream demand for steel and specialty metals that depend on graphite-intensive manufacturing processes.

The segment benefits from Mexico's position as a major metallurgical hub supplying North American manufacturing industries with essential materials and components. The country's integrated mining and processing infrastructure enables efficient production of graphite products for diverse industrial applications. According to the Mining Chamber of Mexico, the country's mining sector directly supports 192 productive industries including automotive, construction, and electronics, generating approximately MX$260 Billion in economic spillover during 2024.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico witnesses high demand for graphite due to its concentration of mining operations in Sonora state, which hosts the country's primary amorphous graphite deposits. The region benefits from established infrastructure, proximity to United States border crossings, and integration with manufacturing clusters in Nuevo León and Chihuahua serving automotive and aerospace industries.

Central Mexico represents a significant consumption center anchored by manufacturing hubs in Querétaro, Guanajuato, and San Luis Potosí. The Bajío region's automotive manufacturing concentration creates sustained demand for graphite materials in steel production and component manufacturing, while aerospace clusters drive specialty graphite applications.

Southern Mexico presents emerging opportunities as industrial development expands beyond traditional manufacturing corridors. The region's growing infrastructure investments and increasing industrial activity are gradually establishing graphite consumption patterns, though at lower volumes compared to northern and central markets.

Market Dynamics:

Growth Drivers:

Why is the Mexico Graphite Market Growing?

Accelerating Electric Vehicle Manufacturing and Battery Demand

Mexico's emergence as a major electric vehicle production hub is driving unprecedented demand for graphite materials used in lithium-ion battery anodes. The country's EV production capacity has expanded dramatically, supported by investments from global automakers establishing manufacturing operations to serve North American markets. Graphite constitutes the primary anode material in lithium-ion batteries, making it essential for vehicle electrification. The USMCA's regional content requirements are accelerating battery supply chain localization, creating opportunities for Mexican graphite suppliers to capture growing battery material demand as automakers increasingly source components domestically.

Strategic Positioning in Critical Mineral Supply Chains

Mexico's geographic proximity to United States manufacturing centers positions the country advantageously as global supply chains restructure toward regional sourcing strategies. The nearshoring trend is attracting substantial foreign investment in manufacturing sectors, strengthening industrial demand for graphite materials. Mexican producers have established reliable export channels to serve North American customers seeking alternatives to distant suppliers. This strategic location enables shorter lead times and reduced logistics costs, while helping manufacturers comply with regional value content requirements under trade agreements governing cross-border commerce.

Expanding Steel Industry and Electric Arc Furnace Adoption

The modernization of Mexico's steel industry through increased electric arc furnace adoption is sustaining robust demand for graphite electrodes. Electric arc furnaces offer environmental advantages over traditional blast furnace methods by recycling scrap steel with significantly lower carbon emissions. Mexico's steel sector benefits from abundant scrap metal availability and competitive electricity costs, making electric arc furnace technology economically attractive. The graphite electrode market for metal industry applications continues expanding globally, with Mexico representing an important consumption center. Steel production supports Mexico's automotive and construction sector, creating sustained downstream demand for graphite-intensive manufacturing processes.

Market Restraints:

What Challenges the Mexico Graphite Market is Facing?

Regulatory Uncertainty in Mining Sector

Mexico's 2023 mining law reform introduced shorter concession terms and tighter permitting requirements, creating uncertainty for investment in new graphite extraction projects. The suspension of new mining concessions since 2018 has limited exploration activity, potentially constraining future production capacity growth. These regulatory changes may slow the development of new graphite deposits needed to meet expanding demand.

Competition from Synthetic Graphite and Alternative Anode Materials

Synthetic graphite production, particularly from Chinese manufacturers, presents competitive pressure on natural graphite markets. Silicon anode technologies are emerging as potential alternatives offering higher energy density than graphite-based anodes. These technological advancements could potentially reduce long-term natural graphite demand in battery applications, though current battery chemistries continue relying predominantly on graphite materials.

Trade Policy Uncertainty and Tariff Risks

Potential changes to trade policies affecting Mexico-United States commerce create uncertainty for graphite supply chains integrated across borders. Proposed tariff measures could disrupt established trade flows and increase costs for manufacturers dependent on cross-border material sourcing. This uncertainty may delay investment decisions and complicate supply chain planning for graphite market participants.

Competitive Landscape:

The Mexico graphite market features a competitive structure comprising international carbon material specialists, regional mining operators, and integrated graphite product manufacturers. Market participants are expanding distribution capabilities and processing operations to capture growing demand from electric vehicle, steel, and industrial sectors. Companies are focusing on developing higher-value graphite products including battery-grade materials and specialty electrodes to differentiate offerings. Strategic partnerships with end users in automotive and manufacturing sectors are becoming increasingly important for securing long-term supply agreements. The market is witnessing consolidation as larger players seek to strengthen positions through capacity expansion and vertical integration along the graphite value chain.

Recent Developments:

-

March 2025: Metcar announced that its babbitt impregnated carbon graphite and M-310 nickel impregnated carbon graphite materials would be distributed globally through expanded partnership with Boulden Company. These materials serve critical applications in utilities, oil and gas, and petrochemical sectors, with Metcar's manufacturing facilities in Mexico strengthening capacity to supply engineered graphite solutions worldwide.

Mexico Graphite Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Natural Graphite, Synthetic Graphite (FLG) |

| Applications Covered | Electrodes, Refractories, Casting, and Foundries, Batteries, Lubricants, Others |

| End Use Industries Covered | Electronics, Metallurgy, Automotive, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico graphite market size was valued at USD 221.81 Million in 2025.

The Mexico graphite market is expected to grow at a compound annual growth rate of 17.24% from 2026-2034 to reach USD 928.37 Million by 2034.

Natural graphite dominated the market with a 58% share in 2025, driven by Mexico's substantial amorphous graphite deposits in Sonora state and cost advantages over synthetic alternatives for industrial applications.

Key factors driving the Mexico graphite market include accelerating electric vehicle manufacturing and battery demand, strategic positioning within North American critical mineral supply chains, expanding steel industry adoption of electric arc furnace technology, and nearshoring trends driving industrial investment.

Major challenges include regulatory uncertainty following mining law reforms, competition from synthetic graphite producers and emerging alternative anode materials, trade policy uncertainty affecting cross-border supply chains, and the suspension of new mining concessions limiting exploration of new deposits.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)