Mexico Green Technology and Sustainability Market Size, Share, Trends and Forecast by Component, Technology, Application, and Region, 2025-2033

Mexico Green Technology and Sustainability Market Overview:

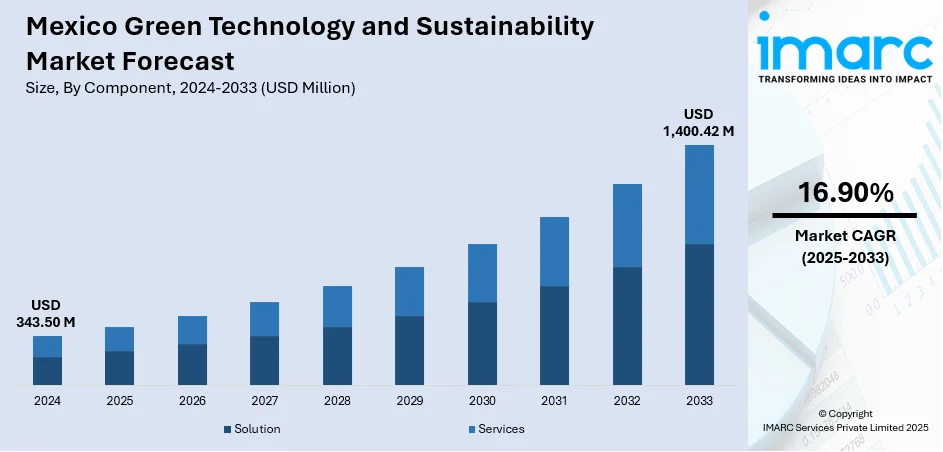

The Mexico green technology and sustainability market size reached USD 343.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,400.42 Million by 2033, exhibiting a growth rate (CAGR) of 16.90% during 2025-2033. Ambitious renewable energy targets, substantial investments in solar, wind, and green hydrogen projects, supportive government policies promoting electric vehicles (EVs) and sustainable agriculture, and innovative programs like Payments for Ecosystem Services that engage rural communities in conservation efforts are among the key factors bolstering the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 343.50 Million |

| Market Forecast in 2033 | USD 1,400.42 Million |

| Market Growth Rate 2025-2033 | 16.90% |

Mexico Green Technology and Sustainability Market Trends:

Rapid Expansion of Renewable Energy Capacity and Grid Modernization

Mexico's drive for decarbonization has spurred significant growth in renewable electricity capacity and supporting infrastructure. By the end of 2023, the country’s total installed power generation capacity reached 90.6 GW, largely fueled by solar, wind, and hydro expansions. Non-hydro renewables contributed 10.6 GW from solar photovoltaic (PV) and 6.9 GW from wind, with an additional 12.6 GW from hydropower, highlighting that nearly one-third of Mexico's energy mix now comes from clean sources. This progress aligns with the 2015 Energy Transition Law, which set a target for 35% of electricity to come from clean sources by 2024, up from 22% in 2021. To support this growth, the federal government announced a USD 23 billion investment in electricity infrastructure, grid upgrades, and renewable integration. These initiatives are improving the economics of renewables, lowering wholesale prices, and paving the way for a flexible, low-carbon grid.

To get more information on this market, Request Sample

Surging Adoption of Electric Vehicles and Charging Infrastructure

Mexico's green technology market is being significantly driven by the rapid growth in electric mobility and the expansion of charging networks. In 2023, sales of fully electric passenger vehicles reached a record 14,172 units, with 5,111 EVs sold in Q1 2024, signaling continued growth. More broadly, new vehicle sales with any degree of electrification, including hybrids, plug-in hybrids, and full electric, rose 44.3% in 2023 to 73,680 units, driven by increased consumer confidence and a broader vehicle selection. This surge in demand is attracting significant investment from OEMs, with Tesla’s planned Gigafactory and local expansions from BYD. Despite this, charging infrastructure lags behind, with just 1,400 public stations in 2023. To bridge this gap, Mexico aims to boost public chargers to 9,000 by 2024 and 112,000 by 2030. This growing EV ecosystem is fostering a positive cycle of emission reductions, improved air quality, and job creation in clean mobility and smart-grid sectors.

Mexico Green Technology and Sustainability Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, technology, and application.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

Technology Insights:

- Internet-of-Things

- Cloud Computing

- Artificial Intelligence and Analytics

- Digital Twin

- Cybersecurity

- Blockchain

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes internet-of-things, cloud computing, artificial intelligence and analytics, digital twin, cybersecurity, and blockchain.

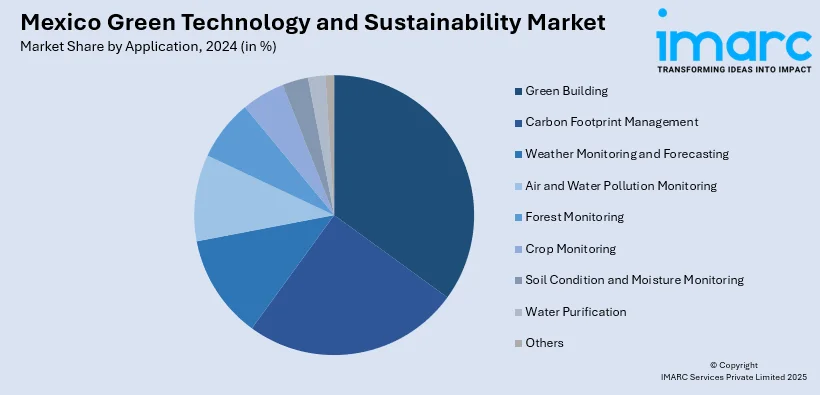

Application Insights:

- Green Building

- Carbon Footprint Management

- Weather Monitoring and Forecasting

- Air and Water Pollution Monitoring

- Forest Monitoring

- Crop Monitoring

- Soil Condition and Moisture Monitoring

- Water Purification

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes green building, carbon footprint management, weather monitoring and forecasting, air and water pollution monitoring, forest monitoring, crop monitoring, soil condition and moisture monitoring, water purification, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Green Technology and Sustainability Market News:

- December 2024: The World Meteorological Organization (WMO) launched the Severe Weather Forecasting Program (SWFP) in Central America, including Mexico, to enhance early warning systems and promote sustainability. This initiative uses advanced technologies, such as high-resolution weather models, satellite data, and real-time monitoring systems to enhance forecasting accuracy for severe weather events.

- June 2024: Walmart introduced advanced crop monitoring technology in Mexico and the U.S. to enhance sustainability and supply chain resilience. Partnering with Agritask, the initiative employs remote sensing and data analytics on blackberry and cherry farms, providing real-time, hyperlocal insights. This climate-smart approach aims to reduce food waste, improve produce quality, and adapt sourcing strategies amid changing weather patterns.

Mexico Green Technology and Sustainability Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Technologies Covered | Internet-of-Things, Cloud Computing, Artificial Intelligence and Analytics, Digital Twin, Cybersecurity, Blockchain |

| Applications Covered | Green Building, Carbon Footprint Management, Weather Monitoring and Forecasting, Air and Water Pollution Monitoring, Forest Monitoring, Crop Monitoring, Soil Condition and Moisture Monitoring, Water Purification, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico green technology and sustainability market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico green technology and sustainability market on the basis of component?

- What is the breakup of the Mexico green technology and sustainability market on the basis of technology?

- What is the breakup of the Mexico green technology and sustainability market on the basis of application?

- What is the breakup of the Mexico green technology and sustainability market on the basis of region?

- What are the various stages in the value chain of the Mexico green technology and sustainability market?

- What are the key driving factors and challenges in the Mexico green technology and sustainability market?

- What is the structure of the Mexico green technology and sustainability market and who are the key players?

- What is the degree of competition in the Mexico green technology and sustainability market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico green technology and sustainability market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico green technology and sustainability market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico green technology and sustainability industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)