Mexico Grid Energy Storage Market Size, Share, Trends and Forecast by Battery Chemistry, Ownership, Application, and Region, 2025-2033

Mexico Grid Energy Storage Market Overview:

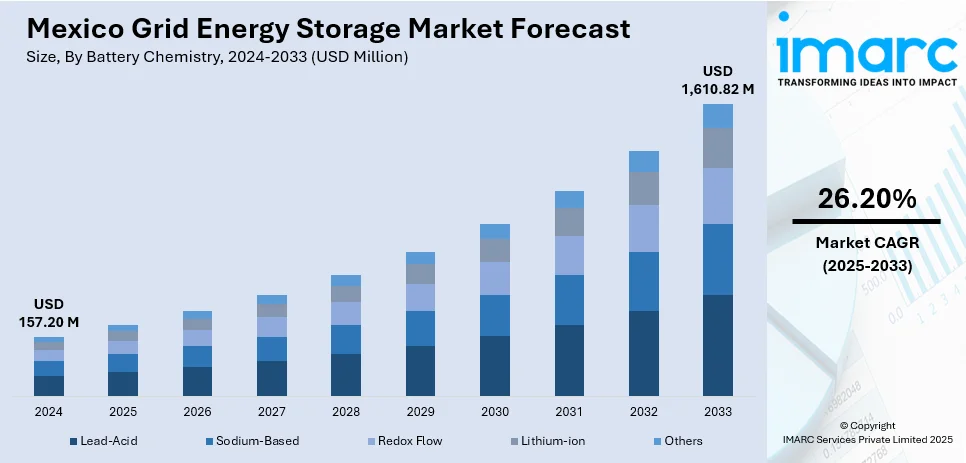

The Mexico grid energy storage market size reached USD 157.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,610.82 Million by 2033, exhibiting a growth rate (CAGR) of 26.20% during 2025-2033. The market is driven by factors such as increasing renewable energy adoption, the need for grid stability, government incentives, and a growing push towards carbon neutrality. These trends contribute significantly to the expansion of the Mexico grid energy storage market share and its long-term growth prospects.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 157.20 Million |

| Market Forecast in 2033 | USD 1,610.82 Million |

| Market Growth Rate 2025-2033 | 26.20% |

Mexico Grid Energy Storage Market Trends:

Expansion of Renewable Energy Integration

Mexico's transition to alternative energy sources such as wind and solar has spurred the demand for efficient energy storage technologies. Renewable energy supply is changeable and hence grid energy storage systems are required to ensure a reliable supply of power. Energy storage systems, particularly battery technologies, play an increasingly critical role in managing supply and demand, enabling more amounts of renewable energy to flow into the grid. With the government continued investment in decarbonization and sustainability, energy storage technologies like lithium-ion and flow batteries are gaining momentum, thus driving the Mexico grid energy storage market growth. Declines in the cost of energy storage systems as well as technological improvements are essential drivers of the Mexico grid storage market. For instance, in March 2025, Mexico introduced a 30% energy storage mandate for renewable energy plants, requiring the installation of grid-scale battery systems. This policy aims to boost renewable energy adoption and stabilize grid power. The government plans to add 574 MW of batteries by 2028, marking significant progress in Mexico's energy storage sector.

Government Policies and Incentives

Mexico's regulatory environment has become more supportive of energy storage solutions. The government has implemented various policies that promote renewable energy and grid storage systems, including financial incentives for energy storage investments. For instance, in March 2025, Mexico's Energy Regulatory Commission (CRE) introduced a new regulatory framework to integrate energy storage systems (ESS) into the National Electric System (SEN). This includes four modalities for ESS deployment, aiming to improve grid stability and support renewable energy adoption. The framework is expected to attract investments and enhance Mexico's energy transition efforts. Furthermore, the introduction of supportive frameworks, such as tax breaks and subsidy programs for storage technologies, has further fueled investments in the Mexico grid energy storage sector, contributing to a significant rise in its market share.

Technological Advancements and Cost Reductions

Technological innovations and reductions in the cost of energy storage systems are vital drivers of Mexico's grid storage market. The development of more efficient, longer-lasting, and cost-effective batteries has made energy storage increasingly accessible to both private and public sectors. Emerging technologies, such as advanced lithium-ion batteries and flow batteries, offer enhanced capacity and faster charge-discharge cycles, which further improve the economic feasibility of storage projects. As storage systems become more affordable, their adoption is expected to grow, leading to sustained Mexico grid energy storage market growth and a broader implementation of grid-scale projects across the country. For instance, Sungrow unveiled its next-gen PowerTitan 2.0 energy storage system at RE+ Mexico 2025, aimed at improving grid stability and facilitating renewable energy integration in Mexico. The system's modular design helps reduce installation time and operational costs. Sungrow is also committed to local partnerships, including the 200MW/880MWh BESS project in Latin America.

Mexico Grid Energy Storage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on battery chemistry, ownership, and application.

Battery Chemistry Insights:

- Lead-Acid

- Sodium-Based

- Redox Flow

- Lithium-ion

- Others

The report has provided a detailed breakup and analysis of the market based on the battery chemistry. This includes lead-acid, sodium-based, redox flow, lithium-ion, and others.

Ownership Insights:

- Third-party Owned

- Utility Owned

A detailed breakup and analysis of the market based on the ownership have also been provided in the report. This includes third-party owned and utility owned.

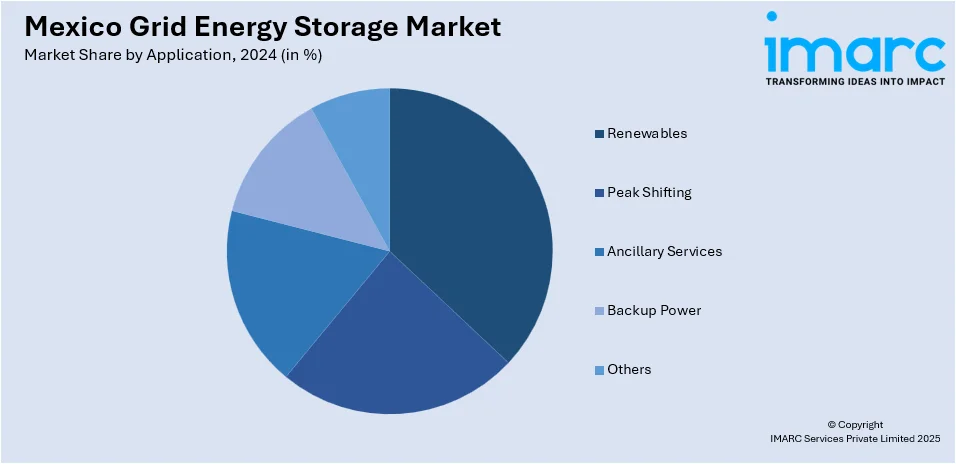

Application Insights:

- Renewables

- Peak Shifting

- Ancillary Services

- Backup Power

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes renewables, peak shifting, ancillary services, backup power, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Grid Energy Storage Market News:

- In May 2025, ABB launched its Battery Energy Storage Systems-as-a-Service (BESS-as-a-Service), a zero-CapEx solution designed to simplify clean energy adoption. This service allows businesses to deploy energy storage without upfront investment, offering flexible, operational expenditure models. The service helps optimize energy use, generate new revenue streams, and supports decarbonization efforts globally.

- In November 2024, Plus Power secured a 20-year contract with Public Service Company of New Mexico (PNM) for its 150 MW / 600 MWh Corazon Energy Storage project. Set to begin construction in 2026, the facility will enhance grid reliability, integrate renewable energy, and help PNM meet its clean energy goals by 2040.

Mexico Grid Energy Storage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Battery Chemistries Covered | Lead-Acid, Sodium-Based, Redox Flow, Lithium-ion, Others |

| Ownerships Covered | Third-party Owned, Utility Owned |

| Applications Covered | Renewables, Peak Shifting, Ancillary Services, Backup Power, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico grid energy storage market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico grid energy storage market on the basis of battery chemistry?

- What is the breakup of the Mexico grid energy storage market on the basis of ownership?

- What is the breakup of the Mexico grid energy storage market on the basis of application?

- What is the breakup of the Mexico grid energy storage market on the basis of region?

- What are the various stages in the value chain of the Mexico grid energy storage market?

- What are the key driving factors and challenges in the Mexico grid energy storage market?

- What is the structure of the Mexico grid energy storage market and who are the key players?

- What is the degree of competition in the Mexico grid energy storage market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico grid energy storage market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico grid energy storage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico grid energy storage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)