Mexico Grid Modernization Market Size, Share, Trends and Forecast by Component, Application, End-User, and Region, 2026-2034

Mexico Grid Modernization Market Summary:

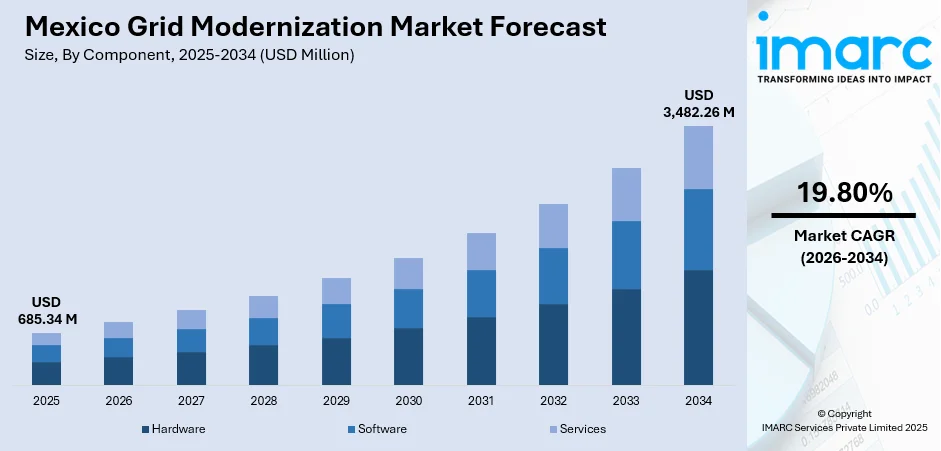

The Mexico grid modernization market size was valued at USD 685.34 Million in 2025 and is projected to reach USD 3,482.26 Million by 2034, growing at a compound annual growth rate of 19.80% from 2026-2034.

The Mexico grid modernization market is expanding rapidly as the country accelerates its transition toward a more resilient, efficient, and digitally integrated electricity infrastructure. Investment in smart grid technologies, advanced metering infrastructure, and distribution automation is driving market growth. The integration of renewable energy sources and the electrification of transport are creating substantial demand for modernized grid systems capable of managing bidirectional power flows and variable generation sources.

Key Takeaways and Insights:

-

By Component: Hardware dominates the market with a share of 52% in 2025, driven by substantial investments in smart meters, sensors, transformers, and automated switching equipment essential for grid digitalization and reliability enhancement.

-

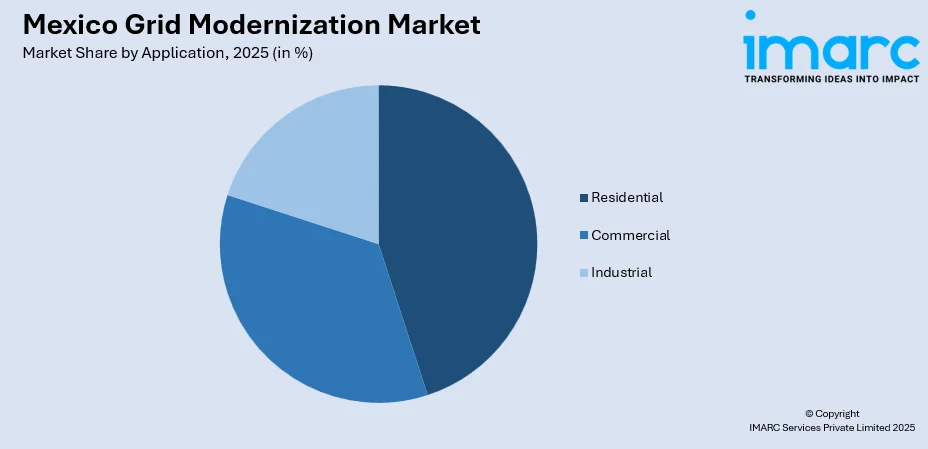

By Application: Residential leads the market with a share of 26% in 2025, supported by the widespread deployment of smart meters and demand response systems enabling households to optimize energy consumption and participate in grid balancing initiatives.

-

By End-User: Utilities represent the largest segment with a market share of 70% in 2025, as state-owned and private utilities invest heavily in transmission network upgrades, distribution automation, and grid management systems to meet growing electricity demand.

-

Key Players: The market exhibits a moderately concentrated competitive landscape with multinational technology corporations competing alongside regional system integrators. Major players focus on smart grid infrastructure, IoT-enabled solutions, AI-driven analytics, and cybersecurity to enhance grid efficiency and reliability.

To get more information on this market Request Sample

Mexico's grid modernization efforts are being driven by the federal government's commitment to energy security and the integration of renewable energy sources. The National Electric System Development Program (PRODESEN) outlines comprehensive plans for expanding and modernizing the transmission and distribution networks. The Federal Electricity Commission (CFE) has announced a multi-billion-dollar investment plan covering the period 2025-2030, targeting the construction of new transmission lines, substations, and distribution network upgrades. The country's growing manufacturing sector, driven by nearshoring trends, is placing unprecedented demands on the electricity grid, particularly in industrial corridors in northern Mexico. This industrial expansion, combined with urbanization and the electrification of transport, necessitates intelligent grid solutions that can ensure a stable, scalable, and reliable power supply while accommodating the integration of distributed energy resources.

Mexico Grid Modernization Market Trends:

Accelerated Deployment of Advanced Metering Infrastructure (AMI)

Mexico is witnessing a significant expansion of advanced metering infrastructure across residential, commercial, and industrial segments. Smart meters enable real-time energy monitoring, improve billing accuracy, and facilitate demand response programs. Distribution utilities are prioritizing AMI deployment to reduce technical and non-technical losses while enhancing customer engagement. The integration of AMI with distribution management systems allows for more efficient load management and faster outage detection, supporting the broader objective of creating a more responsive and resilient power grid.

Integration of Artificial Intelligence and IoT in Grid Operations

The adoption of artificial intelligence and Internet of Things technologies is transforming grid operations in Mexico. The Mexico smart grid market size reached USD 879.6 Million in 2024. Looking forward, the market is expected to reach USD 3,148.3 Million by 2033, exhibiting a growth rate (CAGR) of 13.6% during 2025-2033. AI-powered predictive maintenance systems are being deployed to identify potential equipment failures before they occur, reducing downtime and maintenance costs. IoT sensors throughout the transmission and distribution network enable real-time monitoring of grid conditions, facilitating rapid response to anomalies. These technologies support more sophisticated demand forecasting, optimized energy routing, and enhanced grid stability, particularly as variable renewable energy sources become a larger share of the generation mix.

Growing Investment in Energy Storage and Microgrid Solutions

Energy storage systems and microgrids are gaining prominence as essential components of Mexico's grid modernization strategy. Battery energy storage systems are being deployed to address grid stability challenges arising from renewable energy intermittency. The Mexico battery energy management systems market size reached USD 127.50 Million in 2024. Looking forward, the market is expected to reach USD 511.07 Million by 2033, exhibiting a growth rate (CAGR) of 16.68% during 2025-2033. Industrial and commercial sectors are increasingly investing in microgrids to ensure operational continuity and reduce dependence on the national grid during peak demand periods. These decentralized solutions enhance energy resilience and support the integration of distributed renewable generation, particularly in regions with limited grid infrastructure or high industrial demand.

Market Outlook 2026-2034:

The Mexico grid modernization market is poised for substantial growth over the forecast period, driven by government infrastructure investments, industrial expansion, and the imperative to integrate renewable energy sources. The federal government's 2025-2030 Strengthening and Expansion Plan for the National Electric System envisions significant capacity additions and infrastructure upgrades. The market generated a revenue of USD 685.34 Million in 2025 and is projected to reach a revenue of USD 3,482.26 Million by 2034, growing at a compound annual growth rate of 19.80% from 2026-2034.

Mexico Grid Modernization Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Component | Hardware | 52% |

| Application | Residential | 26% |

| End-User | Utilities | 70% |

Component Insights:

- Hardware

- Software

- Services

The hardware segment dominates with a market share of 52% of the total Mexico grid modernization market in 2025.

The hardware segment encompasses critical physical infrastructure including smart meters, sensors, automated switches, transformers, and control equipment. Mexico's ongoing grid modernization initiatives require substantial investment in hardware to replace aging infrastructure with intelligent systems capable of real-time monitoring and automated control. The deployment of advanced metering infrastructure across millions of connection points is driving demand for smart meters and associated communication equipment.

Transmission and distribution network upgrades necessitate significant hardware investments, including digital substations, fault detection equipment, and power quality monitoring devices. The integration of renewable energy sources requires specialized hardware for managing bidirectional power flows and maintaining grid stability. Industrial hubs in northern Mexico are particularly active in adopting modern grid hardware to support manufacturing operations and ensure reliable power supply for export-oriented industries.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Industrial

The residential segment leads with a share of 26% of the total Mexico grid modernization market in 2025.

The residential segment benefits from widespread smart meter deployment programs aimed at improving billing accuracy and reducing energy theft. Advanced metering infrastructure enables households to monitor their energy consumption in real-time and participate in demand response programs. The integration of rooftop solar systems in residential areas requires grid-compatible technologies to manage distributed generation and ensure seamless power flow between homes and the grid.

The growing urbanization in Mexico is driving residential electricity demand, necessitating modernized distribution networks capable of handling increased loads while maintaining power quality. In 2024, approximately 81.86% of Mexico’s total population resided in urban areas, reflecting a high level of urbanization across the country. Smart home integration is becoming more prevalent, with energy management systems allowing residents to optimize consumption patterns and reduce costs. Government initiatives promoting energy efficiency and renewable energy adoption in the residential sector are further supporting grid modernization investments targeted at household consumers.

End-User Insights:

- Utilities

- Independent Power Producers (IPPs)

- Government and Municipalities

The utilities segment exhibits a clear dominance with a 70% share of the total Mexico grid modernization market in 2025.

Utilities represent the primary investors in grid modernization, led by the Federal Electricity Commission (CFE), which operates the national transmission network and a significant portion of generation and distribution infrastructure. CFE’s extensive investment in upgrading transmission networks and modernizing distribution systems is fueling significant market growth. In addition, private distribution companies and regional operators are adopting smart grid technologies to enhance operational efficiency, optimize energy delivery, and improve overall service reliability.

The utility segment is focused on deploying distribution management systems, supervisory control and data acquisition (SCADA) systems, and advanced grid analytics platforms. These investments enable utilities to optimize grid performance, reduce technical losses, and improve response times to outages. The integration of renewable energy sources into the utility grid requires sophisticated management systems capable of balancing variable generation with demand, driving further investment in modern grid infrastructure.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Grid modernization in Northern Mexico is driven by industrial growth, urban expansion, and rising electricity demand in cities like Monterrey and Tijuana. Utilities are investing in smart meters, advanced distribution automation, and digital substations to enhance reliability and efficiency. The region’s proximity to the US also encourages the adoption of cutting-edge grid technologies, renewable integration, and cross-border energy projects to support industrial, commercial, and residential power requirements.

Central Mexico, anchored by Mexico City and Querétaro, is experiencing grid modernization due to high population density, expanding urban infrastructure, and rising energy consumption. Utilities focus on upgrading transmission lines, implementing smart grid solutions, and integrating distributed energy resources. Efforts target improved outage management, energy efficiency, and resilience in public and private facilities, while growing renewable energy adoption and government-led infrastructure initiatives accelerate modernization across the central region.

Southern Mexico’s grid modernization is fueled by rural electrification, expanding municipal infrastructure, and increased access to reliable electricity. Utilities are deploying smart meters, automated distribution networks, and renewable energy integration to improve service quality and operational efficiency. Investments focus on reducing technical losses, enhancing reliability in remote communities, and supporting socio-economic development. The modernization push also aligns with regional renewable energy projects and government programs promoting sustainable and resilient energy systems.

Market Dynamics:

Growth Drivers:

Why is the Mexico Grid Modernization Market Growing?

Government Investment in Electricity Infrastructure Expansion

The Mexican government is actively advancing the modernization of the national electricity infrastructure through strategic planning and targeted investment initiatives. The government of Tamaulipas is undertaking a significant energy infrastructure initiative aimed at enhancing the state’s electrical grid while capitalizing on its substantial wind energy resources. Plans include building nine new substations in strategic industrial areas, designed to boost power reliability, minimize outages, and support the expansion of the local energy sector. These projects underscore the state’s commitment to modernizing its electricity network and accommodating growing industrial and renewable energy demands. Efforts focus on expanding transmission networks, upgrading distribution systems, and enhancing overall grid reliability to meet rising electricity demand. Utilities are investing in new substations, transmission lines, and advanced distribution technologies. These initiatives are creating strong growth opportunities for providers of grid modernization solutions, supporting the adoption of smart grid technologies, automation, and digital infrastructure across all segments of the electricity value chain.

Industrial Expansion and Nearshoring-Driven Demand Growth

Mexico's industrial sector is experiencing significant growth driven by nearshoring trends as manufacturers relocate production facilities closer to North American markets. This industrial expansion is placing unprecedented demands on the electricity grid, particularly in manufacturing corridors in northern Mexico and central industrial zones. Data centers, automotive plants, electronics manufacturing facilities, and advanced manufacturing hubs require a reliable, high-quality power supply that existing infrastructure struggles to provide. The need to serve these high-value industrial customers is accelerating investment in grid modernization, including automated distribution systems, power quality equipment, and microgrid solutions that ensure operational continuity.

Renewable Energy Integration and Climate Commitments

Mexico's commitment to increasing the share of renewable energy in its generation mix is driving substantial investment in grid modernization. The integration of variable renewable sources such as solar and wind power requires advanced grid management systems capable of handling fluctuating supply while maintaining stability. Battery energy storage systems, virtual power plants, and dynamic grid controllers are being deployed to enhance grid flexibility and accommodate renewable energy variability. The government's target to achieve a higher share of clean energy generation necessitates modernized transmission infrastructure to connect renewable generation sites with demand centers, creating additional growth opportunities for the grid modernization market.

Market Restraints:

What Challenges the Mexico Grid Modernization Market is Facing?

High Capital Investment Requirements and Financing Constraints

Grid modernization projects require substantial upfront capital investment that can strain the financial resources of utilities and project developers. The comprehensive nature of smart grid deployment, encompassing hardware, software, and integration services, creates significant cost barriers. Access to financing and the ability to secure competitive rates for long-term infrastructure projects remain challenging, particularly for smaller utilities and independent operators seeking to modernize their systems.

Regulatory Uncertainty and Policy Framework Evolution

The evolving regulatory landscape in Mexico's electricity sector creates uncertainty for investors and project developers. Recent legislative changes affecting the structure of the power market and the role of private sector participation have introduced new considerations for grid modernization investments. The implementation of new regulations and the establishment of updated technical standards for grid equipment and operations require careful navigation by market participants.

Grid Congestion and Infrastructure Limitations in Key Regions

Significant portions of Mexico's transmission network operate near maximum capacity, creating bottlenecks that constrain the ability to deliver power to high-demand regions. Critical corridors serving industrial zones and urban centers face congestion issues that limit the effectiveness of generation additions. Addressing these infrastructure limitations requires coordinated planning and substantial investment in transmission capacity expansion alongside distribution modernization efforts.

Competitive Landscape:

The Mexico grid modernization market exhibits a moderately concentrated competitive structure, with multinational technology corporations and specialized energy infrastructure providers competing for market share. Leading players leverage their expertise in smart grid technologies, IoT-enabled solutions, artificial intelligence-driven analytics, and cybersecurity to differentiate their offerings. The market features strategic collaborations between global technology firms and regional system integrators, enabling comprehensive solution delivery across generation, transmission, and distribution segments. Key competitive factors include technological innovation, project execution capability, after-sales support, and the ability to customize solutions for local requirements. Market participants are increasingly focused on developing integrated platforms that combine hardware, software, and services to address the full spectrum of grid modernization needs.

Recent Developments:

-

In August 2025, CFE announced plans to invest USD 8.1 billion to strengthen the country's transmission network, including construction of 275 new transmission lines and 524 new electrical substations between 2025 and 2030.

-

In August 2024, CENACE partnered with Huawei to launch a 10 Gbps smart power network to modernize Mexico's electricity grid management and enhance real-time monitoring capabilities.

Mexico Grid Modernization Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Applications Covered | Residential, Commercial, Industrial |

| End-Users Covered | Utilities, Independent Power Producers (IPPs), Government and Municipalities |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The grid modernization market in Mexico was valued at USD 685.34 Million in 2025.

The Mexico grid modernization market is expected to grow at a compound annual growth rate of 19.80% from 2026-2034 to reach USD 3,482.26 Million by 2034.

The Hardware segment dominated the market with a 52% share in 2025, driven by substantial investments in smart meters, sensors, transformers, and automated equipment essential for grid digitalization and infrastructure modernization.

Key factors driving the Mexico grid modernization market include government investment in electricity infrastructure expansion, industrial growth driven by nearshoring trends, renewable energy integration requirements, and the need to modernize aging grid infrastructure.

Major challenges include high capital investment requirements, regulatory uncertainty, grid congestion in critical industrial corridors, cybersecurity concerns, and the complexity of integrating legacy systems with modern smart grid technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)