Mexico Grinding Wheels Market Size, Share, Trends and Forecast by Type, Material, and Region, 2026-2034

Mexico Grinding Wheels Market Summary:

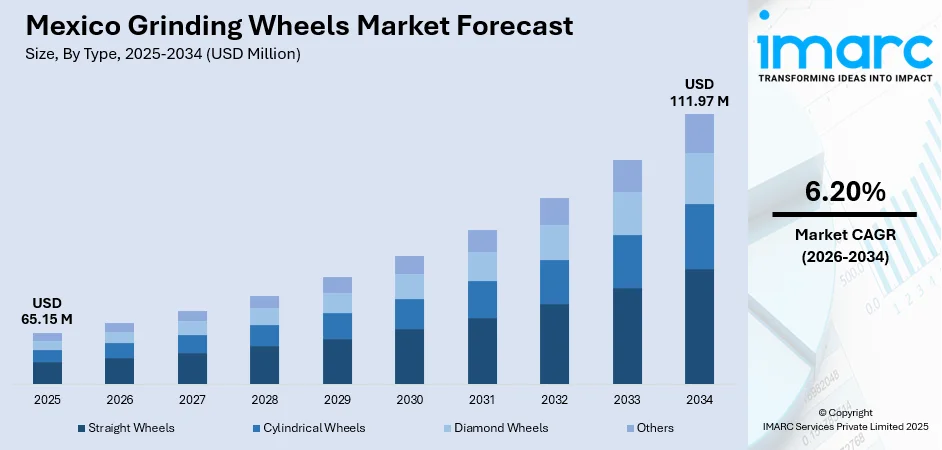

The Mexico grinding wheels market size was valued at USD 65.15 Million in 2025 and is projected to reach USD 111.97 Million by 2034, growing at a compound annual growth rate of 6.20% from 2026-2034.

The market is experiencing robust expansion driven by the flourishing automotive manufacturing sector, increasing demand for precision machining tools, and the adoption of advanced abrasive technologies across multiple industries. Mexico's strategic position as a major North American manufacturing hub and growing investments in industrial infrastructure are accelerating the demand for high-performance grinding solutions. The expanding metalworking and aerospace sectors are contributing to the rising Mexico grinding wheels market share.

Key Takeaways and Insights:

-

By Type: Straight wheels dominate the market with a share of 42.05% in 2025, driven by their widespread application in standard grinding operations across automotive, aerospace, and general manufacturing industries requiring precision surface finishing.

-

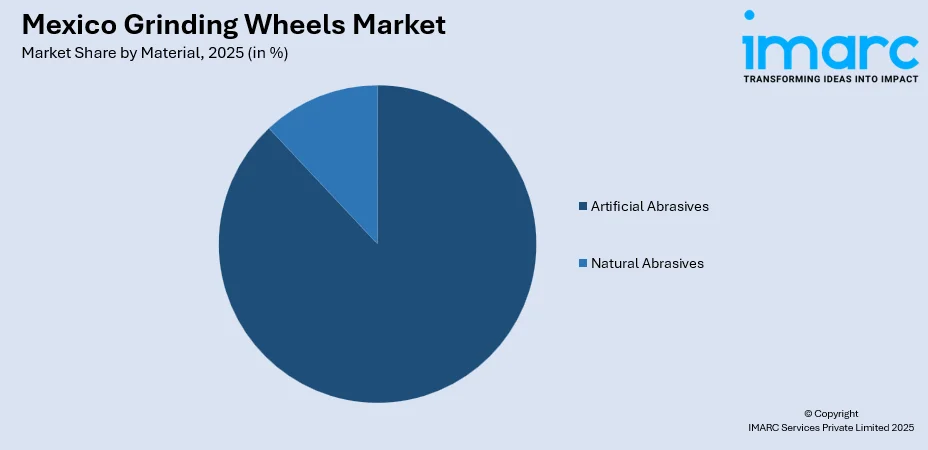

By Material: Artificial abrasives lead the market with a share of 88.07% in 2025, owing to their superior hardness, consistent performance, enhanced durability, and ability to achieve precise grinding results across diverse industrial applications.

-

Key Players: The Mexico grinding wheels market exhibits moderate competitive intensity characterized by the presence of multinational corporations and regional manufacturers. Key players focus on technological innovation, product differentiation, and strategic partnerships to strengthen their market positioning and address evolving customer requirements.

To get more information on this market Request Sample

The Mexico grinding wheels market is witnessing transformative growth fueled by the country's emergence as a global manufacturing powerhouse. Mexico's strategic position as a major North American manufacturing hub and growing investments in industrial infrastructure are accelerating the demand for high-performance grinding solutions. The market benefits from significant foreign direct investment flows, with Mexico recording USD 36.1 Billion in 2023, much of which was directed toward manufacturing expansion. The nearshoring trend has accelerated industrial growth, particularly in Northern Mexico where states like Nuevo León contribute nearly 89% of national manufacturing growth. Additionally, the adoption of Industry 4.0 technologies and smart manufacturing practices is elevating the demand for advanced grinding solutions that offer enhanced precision and efficiency, positioning the market for sustained long-term expansion.

Mexico Grinding Wheels Market Trends:

Technological Advancement in Abrasive Materials

The market is witnessing rapid technological evolution with the introduction of advanced abrasive materials including cubic boron nitride and ceramic abrasives that offer superior cutting efficiency and extended tool life. Manufacturers are developing customized grinding solutions tailored to specific industrial applications, enhancing precision and reducing operational downtime. In May 2024, UNITED GRINDING launched the HELITRONIC VISION 400 L, an innovative tool-grinding product designed to enhance automation and productivity, reflecting the industry's commitment to technological advancement.

Growing Demand from Electric Vehicle Manufacturing

The transition toward electric vehicle production is creating new opportunities for specialized grinding tools designed to process unique EV components and materials. Mexico's EV manufacturing sector has expanded significantly, requiring precision grinding solutions for battery components, electric motor parts, and lightweight structural elements. This shift is driving innovation in grinding wheel technology as manufacturers develop greener and more efficient solutions to meet evolving industry demands and sustainability requirements across the automotive supply chain.

Expansion of Industrial Automation and Smart Manufacturing

The adoption of automation and Industry 4.0 technologies is reshaping Mexico's manufacturing landscape, driving demand for grinding wheels compatible with CNC machines and robotic systems. Companies are investing in smart factories equipped with real-time data systems and IoT-enabled machinery to enhance productivity. FABTECH Mexico 2024 showcased this trend with over 27,000 square meters of exhibits and participation from more than 1,200 brands focused on advanced metalworking technology.

Market Outlook 2026-2034:

The Mexico grinding wheels market is positioned for sustained expansion driven by continuous growth in automotive and aerospace manufacturing, increasing infrastructure investments, and the accelerating nearshoring trend. President Claudia Sheinbaum's administration has outlined Plan México, an initiative targeting substantial investments over the coming years to establish Mexico as a hub for global supply chains. This policy framework, combined with Mexico's strategic USMCA trade advantages, well-developed logistics infrastructure, skilled workforce availability, and expanding industrial base, creates a favorable environment for continued market growth and development. The market generated a revenue of USD 65.15 Million in 2025 and is projected to reach a revenue of USD 111.97 Million by 2034, growing at a compound annual growth rate of 6.20% from 2026-2034.

Mexico Grinding Wheels Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Straight Wheels |

42.05% |

|

Material |

Artificial Abrasives |

88.07% |

Type Insights:

- Straight Wheels

- Cylindrical Wheels

- Diamond Wheels

- Others

The straight wheels dominate with a market share of 42.05% of the total Mexico grinding wheels market in 2025.

Straight wheels represent the largest segment in the Mexico grinding wheels market owing to their versatility and widespread application across multiple industrial sectors. These wheels are essential for surface grinding, tool sharpening, and precision finishing operations in automotive, aerospace, and general manufacturing industries. Mexico's automotive sector relies heavily on straight wheels for manufacturing engine components, transmission systems, and brake parts requiring precise surface finishes.

The segment's dominance is reinforced by the cost-effectiveness and broad applicability of straight wheels across various grinding processes. These tools offer consistent performance for cylindrical, surface, and centerless grinding operations, making them indispensable in Mexico's expanding manufacturing ecosystem. Their versatility enables manufacturers to achieve precise dimensional accuracy and superior surface quality standards required by automotive, aerospace, and general metalworking industries. The widespread availability and ease of maintenance further strengthen their market position.

Material Insights:

Access the comprehensive market breakdown Request Sample

- Artificial Abrasives

- Natural Abrasives

The artificial abrasives lead with a share of 88.07% of the total Mexico grinding wheels market in 2025.

Artificial abrasives command the overwhelming majority of the market due to their superior performance characteristics, including enhanced hardness, consistent quality, and customizable properties for specific industrial applications. Materials, such as aluminum oxide, silicon carbide, and synthetic diamond, offer exceptional cutting efficiency and durability compared to natural alternatives. Mexico emerges as the fastest-growing abrasives market in North America, driven by increasing foreign investments in manufacturing facilities.

The segment benefits from continuous technological innovation in abrasive material development, enabling manufacturers to produce grinding wheels tailored for high-precision applications in automotive, aerospace, and electronics industries. The availability of advanced synthetic materials allows for the creation of grinding wheels with superior thermal stability, enhanced cutting efficiency, and resistance to wear. These characteristics ensure consistent performance under demanding operating conditions, meeting the stringent quality requirements and dimensional accuracy standards of modern manufacturing processes.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents the largest regional market, driven by concentrated automotive and aerospace manufacturing clusters in states like Nuevo León, Coahuila, and Chihuahua. The region benefits from proximity to the United States border, well-developed industrial infrastructure, and substantial foreign direct investment flows.

Central Mexico, encompassing the Bajío region and industrial hubs like Querétaro and Guanajuato, exhibits strong demand for grinding wheels supported by thriving automotive manufacturing and metalworking industries. The region's skilled workforce and strategic location make it attractive for precision manufacturing operations.

Southern Mexico is experiencing emerging growth potential with infrastructure development projects including the Interoceanic Corridor of the Isthmus of Tehuantepec driving industrial expansion. The region presents opportunities for market penetration as manufacturing activities gradually extend beyond traditional northern and central hubs.

Market Dynamics:

Growth Drivers:

Why is the Mexico Grinding Wheels Market Growing?

Expansion of Automotive and Aerospace Manufacturing Sectors

The automotive industry serves as the primary growth catalyst for Mexico's grinding wheels market, with the country positioned as a leading passenger vehicle manufacturer globally. Mexico's automotive sector continues to expand rapidly, with industry associations projecting the country to strengthen its position among the top global vehicle producers in the coming years. This expansion necessitates extensive use of grinding wheels for manufacturing precision components including engine parts, transmission systems, braking components, and suspension elements. The aerospace industry further amplifies demand, with Mexico ranking as a significant global supplier of aircraft components requiring high-precision machining operations.

Nearshoring Trend and Foreign Direct Investment Growth

The nearshoring phenomenon has positioned Mexico as a preferred destination for companies relocating manufacturing operations closer to North American markets. This investment influx is driving the establishment of new production facilities and expansion of existing operations, directly increasing demand for grinding tools and precision machining equipment. Continued investment in industrial parks and manufacturing infrastructure supports market expansion, while favorable trade agreements and strategic geographic proximity to the United States enhance Mexico's competitive positioning.

Technological Innovation and Industry 4.0 Adoption

The integration of advanced manufacturing technologies and Industry 4.0 practices is transforming Mexico's industrial landscape and driving demand for sophisticated grinding solutions. Companies are investing in smart factories equipped with CNC machines, robotics, and real-time data analytics systems that require compatible high-performance grinding wheels. The development of artificial intelligence applications in grinding processes enables enhanced precision and efficiency, with AI-controlled machines capable of making real-time adjustments based on sensor input. This technological evolution is particularly evident in Nuevo León, which contributed nearly 89% of national manufacturing growth during the first half of 2025.

Market Restraints:

What Challenges the Mexico Grinding Wheels Market is Facing?

Raw Material Price Volatility

The market is pressured by fluctuating costs of aluminum oxide, silicon carbide, and synthetic diamonds. These variations increase manufacturing expenses and squeeze profit margins. Such volatility creates significant uncertainty for producers, ultimately impacting final product pricing and limiting market accessibility for end-users across various industrial sectors.

Trade Policy Uncertainty and Tariff Concerns

Evolving trade policies and potential tariffs create instability for Mexico’s manufacturing landscape. Shifting relationships and export costs, especially with the United States, threaten regional competitiveness and influence critical investment decisions. These geopolitical factors remain a primary concern, as they can significantly alter the market’s long-term growth trajectory.

Competition from Alternative Machining Technologies

Emerging precision technologies, such as laser cutting and additive manufacturing, exert competitive pressure on traditional grinding methods. While grinding wheels remain vital for many industrial operations, manufacturers must prioritize continuous innovation and technological integration to maintain their relevance against these rapidly evolving and increasingly efficient machining alternatives.

Competitive Landscape:

Mexico's grinding wheels market is moderately competitive, defined by a strategic mix of multinational giants and regional manufacturers. Market leaders maintain their edge through continuous product innovation, technological integration, and strategic partnerships. A primary focus is the development of customized grinding solutions specifically engineered for high-precision industries, such as the automotive and aerospace sectors. The market architecture features a distinct balance: established international brands dominate the premium segment with high-performance tools, while domestic manufacturers effectively compete by providing cost-effective alternatives for standard applications. This dual structure allows the market to cater to diverse industrial budgets and technical requirements. Furthermore, there is a growing emphasis on sustainability and environmental compliance. Companies are increasingly adopting eco-friendly manufacturing processes and green materials to meet tightening regulatory standards and satisfy the rising customer demand for responsible production. This evolution toward sustainable, high-tech manufacturing continues to shape the competitive landscape across the country.

Mexico Grinding Wheels Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Straight Wheels, Cylindrical Wheels, Diamond Wheels, Others |

| Materials Covered | Artificial Abrasives, Natural Abrasives |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico grinding wheels market size was valued at USD 65.15 Million in 2025.

The Mexico grinding wheels market is expected to grow at a compound annual growth rate of 6.20% from 2026-2034 to reach USD 111.97 Million by 2034.

Straight wheels dominate the segment with a 42.05% market share in 2025, driven by their widespread application in standard grinding operations across automotive, aerospace, and general manufacturing industries requiring precision surface finishing.

Key factors driving the Mexico grinding wheels market include the expansion of automotive and aerospace manufacturing sectors, nearshoring trends attracting foreign direct investment, technological innovation in abrasive materials, and adoption of Industry 4.0 manufacturing practices.

Major challenges include raw material price volatility affecting production costs, trade policy uncertainties and potential tariff implementations, competition from alternative machining technologies, and supply chain constraints impacting manufacturing operations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)