Mexico Guacamole Market Size, Share, Trends and Forecast by Form, End Use, Packaging Type, Distribution Channel, and Region, 2026-2034

Mexico Guacamole Market Summary:

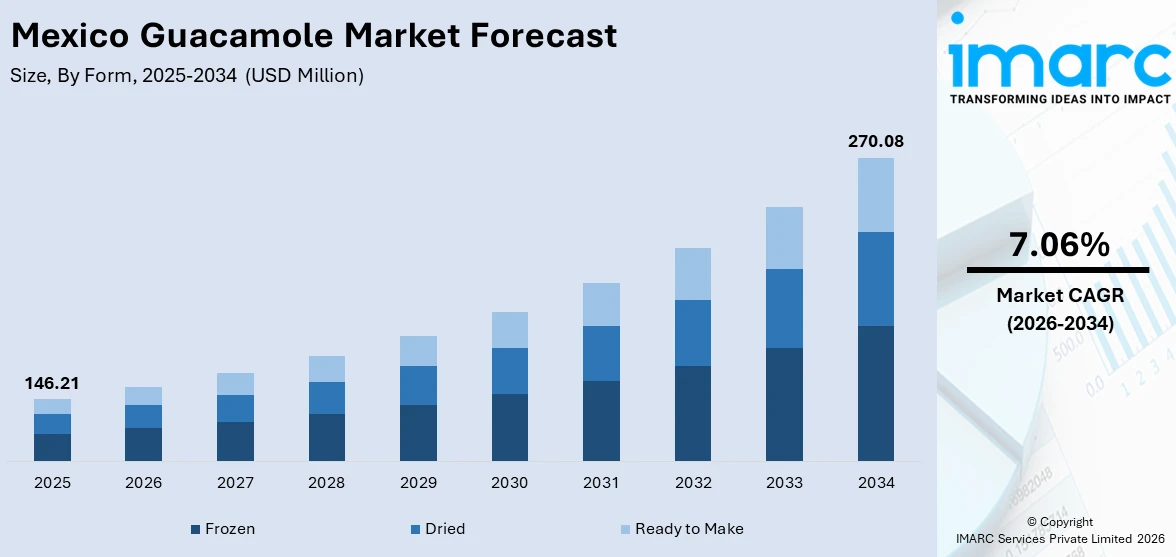

The Mexico guacamole market size was valued at USD 146.21 Million in 2025 and is projected to reach USD 270.08 Million by 2034, growing at a compound annual growth rate of 7.06% from 2026-2034.

The Mexico guacamole market is experiencing steady expansion driven by increasing health consciousness among consumers and the rising demand for convenient, ready-to-eat food products. The cultural significance of guacamole as a traditional Mexican condiment, combined with evolving dietary preferences favoring plant-based and nutrient-rich foods, continues to strengthen domestic consumption patterns. Growing urbanization and changing lifestyles are further accelerating the market's upward trajectory across all distribution channels.

Key Takeaways and Insights:

- By Form: Frozen dominates the market with a share of 49% in 2025, owing to its extended shelf life, ease of transportation, and year-round availability. Advanced preservation technologies enable manufacturers to maintain product freshness while meeting growing consumer demand for convenient storage options.

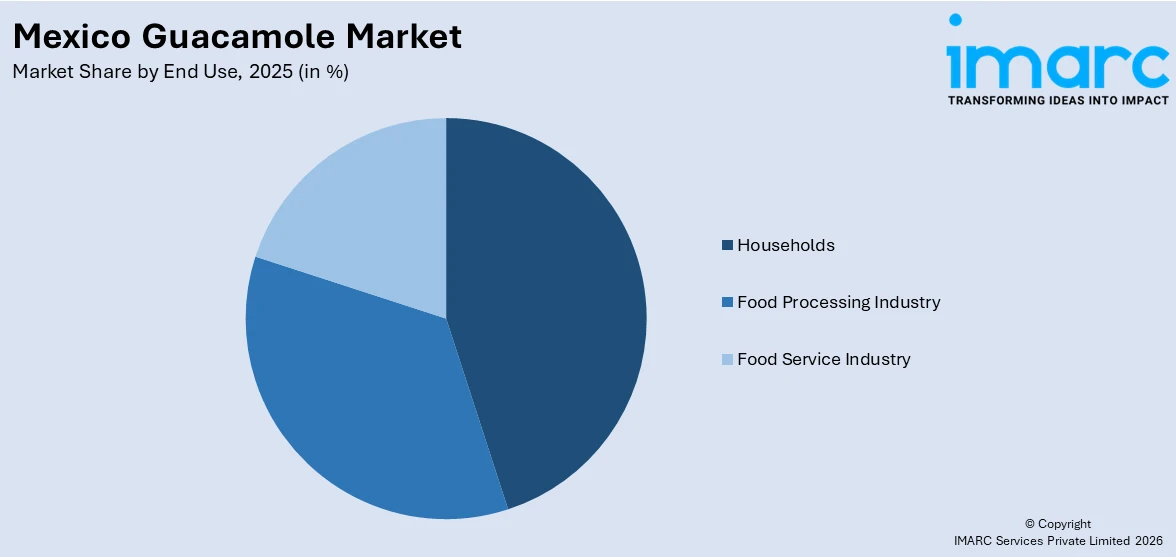

- By End Use: Households lead the market with a share of 45% in 2025. This dominance is driven by increasing at-home consumption trends, rising disposable incomes, and expanded retail availability of packaged guacamole products across supermarkets and convenience stores nationwide.

- By Packaging Type: Plastic containers exhibit a clear dominance in the market with 50% share in 2025, reflecting strong consumer preference for durable, lightweight, and resealable packaging that preserves product freshness and offers convenient portion control.

- By Distribution Channel: Business to consumer represents the largest segment with a market share of 71% in 2025, reflecting the core retail-driven business model that enables widespread product accessibility through supermarkets, hypermarkets, convenience stores, and emerging online platforms.

- Key Players: Key players drive the Mexico guacamole market by expanding production capacities, investing in advanced preservation technologies, and strengthening nationwide distribution networks. Their strategic focus on product innovation, quality enhancement, and partnerships with retail chains boosts consumer awareness and accelerates market penetration.

To get more information on this market Request Sample

The Mexico guacamole market is advancing as consumers increasingly embrace healthier, plant-based food options that align with evolving dietary preferences and wellness-focused lifestyles. As the birthplace of guacamole, Mexico maintains deep cultural connections to this avocado-based product, with consumption patterns embedded in traditional cuisine and modern culinary applications alike. The expansion of modern retail infrastructure, including supermarkets, hypermarkets, and convenience store chains, has significantly improved product accessibility across urban and semi-urban regions. According to the United States Department of Agriculture, Mexico's per capita avocado consumption grew nearly 10% in 2024 to approximately 12 kilograms, reflecting strong domestic demand that supports guacamole production. Technological advancements in High Pressure Processing have revolutionized the industry by extending product shelf life to 45-60 days without artificial preservatives, enabling broader distribution reach. Rising e-commerce penetration and the proliferation of food delivery platforms are creating additional consumption touchpoints, particularly among younger demographics seeking convenient meal solutions that complement their fast-paced urban lifestyles.

Mexico Guacamole Market Trends:

Adoption of High Pressure Processing Technology

The widespread adoption of High Pressure Processing technology is transforming guacamole manufacturing across Mexico. This non-thermal preservation method uses cold water pressure to inactivate harmful bacteria while maintaining the natural flavor, texture, and nutritional profile of avocados. Manufacturers are increasingly investing in HPP equipment to produce clean-label products without artificial preservatives, meeting growing consumer demand for natural food options. The technology extends shelf life significantly, enabling broader distribution and reducing food waste throughout the supply chain.

Rising Demand for Convenient Ready-to-Eat Products

Busy urban lifestyles and changing dietary habits are accelerating demand for convenient, ready-to-eat guacamole products in Mexico. Single-serve packaging formats and portion-controlled options are gaining popularity among time-constrained consumers seeking quick meal solutions. Food processors are responding by developing innovative packaging designs that enhance portability and ease of consumption. The trend toward snackification is encouraging manufacturers to position guacamole as a versatile accompaniment for various eating occasions beyond traditional Mexican dishes.

Expansion of E-Commerce and Digital Retail Channels

The rapid expansion of e-commerce platforms is reshaping guacamole distribution in Mexico. Online grocery retailers and food delivery applications are creating new consumption channels that offer enhanced convenience and broader product selection. Manufacturers are adapting packaging formats to withstand shipping requirements while maintaining product integrity. The digital transformation of retail is enabling brands to reach previously underserved geographic areas and younger consumer segments who prefer online shopping experiences over traditional store visits.

Market Outlook 2026-2034:

The Mexico guacamole market is positioned for robust growth during the forecast period, driven by favorable demographic trends, technological advancements, and expanding distribution infrastructure. Rising health consciousness among Mexican consumers continues to elevate demand for nutrient-rich, plant-based food products that offer convenient consumption options. The market generated a revenue of USD 146.21 Million in 2025 and is projected to reach a revenue of USD 270.08 Million by 2034, growing at a compound annual growth rate of 7.06% from 2026-2034. Strategic investments in cold chain logistics and processing facilities are enhancing manufacturers' capabilities to serve diverse market segments effectively. The proliferation of quick-service restaurants and casual dining establishments featuring guacamole-based menu items is creating sustained foodservice demand alongside retail growth.

Mexico Guacamole Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Form |

Frozen |

49% |

|

End Use |

Households |

45% |

|

Packaging Type |

Plastic Containers |

50% |

|

Distribution Channel |

Business to Consumer |

71% |

Form Insights:

- Frozen

- Dried

- Ready to Make

Frozen dominates with a market share of 49% of the total Mexico guacamole market in 2025.

The frozen guacamole segment maintains market leadership due to its superior shelf life characteristics and ability to preserve the natural taste and nutritional content of avocados for extended periods. Freezing technology effectively halts enzymatic browning while retaining the product's characteristic green color and creamy texture. Manufacturers leverage blast freezing techniques to lock in freshness at peak ripeness, ensuring consistent quality throughout the distribution chain. Advanced preservation methods have gained strong consumer acceptance as buyers increasingly recognize that frozen formats maintain product authenticity comparable to fresh alternatives.

The frozen format offers significant logistical advantages for manufacturers and retailers operating across Mexico's diverse geographic regions. Temperature-controlled storage and transportation enable year-round product availability regardless of seasonal avocado harvest fluctuations. Foodservice operators particularly value frozen guacamole for its operational convenience, reduced preparation time, and minimized food waste compared to fresh alternatives. The segment continues attracting investment as companies expand freezing capacity and develop innovative packaging solutions that enhance portability and portion control while preserving the natural flavors consumers expect from premium guacamole products.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Food Processing Industry

- Food Service Industry

- Households

Households lead with a share of 45% of the total Mexico guacamole market in 2025.

The household segment dominates Mexico's guacamole market as consumers increasingly incorporate ready-to-eat avocado products into daily meal preparation and snacking occasions. Rising disposable incomes and expanding middle-class populations are driving premium product purchases across urban and suburban areas. Modern retail expansion has significantly improved household access to diverse guacamole varieties through supermarkets, hypermarkets, and neighborhood convenience stores. Mexico's food retail sector reported sales exceeding USD 80 Billion in 2024 with annual growth surpassing 7%, reflecting robust consumer spending on packaged food products that simplify meal preparation while delivering authentic flavors.

Household consumption patterns reflect evolving lifestyle preferences favoring convenience without compromising taste quality or nutritional value. Single-serve and family-size packaging options cater to diverse household compositions and consumption occasions ranging from everyday meals to social gatherings. The proliferation of e-commerce platforms and grocery delivery applications has further accelerated household adoption by offering seamless purchasing experiences. Mexico numbered over 107 Million internet users as of early 2024 with internet penetration reaching 83.2%, enabling digital channels to capture growing shares of household grocery purchases and expanding guacamole accessibility across all demographic segments.

Packaging Type Insights:

- Glass Bottles

- Plastic Containers

- Stand Up Pouches

Plastic containers exhibit a clear dominance with 50% share of the total Mexico guacamole market in 2025.

Plastic containers maintain market leadership in guacamole packaging due to their versatility, cost-effectiveness, and superior barrier properties that protect product freshness. Rigid plastic formats offer excellent protection against oxygen exposure and physical damage during transportation and handling. Resealable lid designs enhance consumer convenience by enabling multiple usage occasions while maintaining product quality between servings. The Mexico plastic packaging market continues expanding driven by food sector demand, with rigid formats capturing significant market share as manufacturers prioritize durable, functional packaging solutions that meet diverse consumer needs across retail and foodservice channels.

Manufacturers are innovating plastic container designs to address evolving consumer preferences and sustainability concerns. Clear packaging materials enable product visibility that builds consumer confidence in freshness and quality assessment. Advanced manufacturing technologies allow precise portion sizing and customized container shapes that differentiate brands on retail shelves. Environmental consciousness is driving investment in recyclable mono-material structures and post-consumer recycled content integration. Companies are increasingly adopting sustainable materials to meet regulatory requirements and consumer expectations for environmentally responsible packaging alternatives that balance performance with ecological considerations.

Distribution Channel Insights:

- Business to Business

- Business to Consumer

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

Business to consumer represent the leading segment with 71% share of the total Mexico guacamole market in 2025.

The business-to-consumer segment dominates Mexico's guacamole distribution landscape through extensive retail network penetration across supermarkets, hypermarkets, convenience stores, and emerging online platforms. Modern trade formats offer consumers diverse product selections, competitive pricing, and promotional activities that drive purchase frequency. Supermarket chains leverage category management expertise to optimize shelf placement and maximize guacamole visibility within refrigerated sections. Convenience stores play a significant role in Mexico's retail market, capitalizing on high urban density and frequent small-basket shopping behaviors that favor impulse purchases of ready-to-eat products like guacamole.

Online retail channels are experiencing accelerated growth within the B2C segment as digital infrastructure improvements enhance consumer access to grocery delivery services. E-commerce platforms offer convenience-focused consumers seamless purchasing experiences with home delivery options that eliminate traditional shopping barriers. Mobile applications from leading retailers provide personalized promotions and subscription services that encourage repeat purchases. The Mexico online grocery market continues expanding rapidly as digital adoption penetrates deeper into metropolitan and secondary cities nationwide, creating new consumption touchpoints for packaged guacamole products across diverse demographic segments.

Regional Insights:

- North

- Center

- West

- East

North demonstrates strong guacamole consumption driven by proximity to the United States border and cross-cultural culinary influences. Industrial development and higher disposable incomes support premium product purchases. Modern retail infrastructure including international chains provides extensive product availability. Consumer preferences align closely with convenience-oriented formats that complement busy lifestyles in major metropolitan areas including Monterrey and border cities.

Center represents Mexico's largest consumer market anchored by Mexico City's massive urban population and economic activity. Dense retail networks and sophisticated distribution infrastructure enable comprehensive product accessibility. Traditional consumption patterns merge with modern convenience demands as households balance authentic culinary preparations with ready-to-eat alternatives. The region's diverse demographic composition supports varied product formats targeting different income segments and lifestyle preferences.

West benefits significantly from Michoacán and Jalisco's dominant avocado production that ensures fresh raw material availability for guacamole manufacturing. Processing facilities located near cultivation areas optimize supply chain efficiency and product freshness. Regional consumers maintain strong connections to traditional guacamole preparation methods while increasingly accepting packaged alternatives. Growing tourism sectors in coastal destinations create additional demand channels through hospitality and foodservice establishments.

East shows emerging growth potential as retail modernization expands product accessibility beyond traditional markets. Coastal economies and tourism development create diverse consumption occasions across household and foodservice channels. Consumer awareness of packaged guacamole products continues increasing through marketing efforts and improved distribution reach. Infrastructure investments are gradually enhancing cold chain capabilities that enable broader frozen and refrigerated product availability throughout the region.

Market Dynamics:

Growth Drivers:

Why is the Mexico Guacamole Market Growing?

Rising Health Consciousness and Nutritional Awareness

Increasing health consciousness among Mexican consumers is significantly driving guacamole market expansion as awareness of avocado's nutritional benefits continues spreading across demographic segments. Guacamole's profile as a nutrient-dense food containing healthy monounsaturated fats, dietary fiber, potassium, and essential vitamins aligns perfectly with growing consumer preferences for functional foods that support overall wellness. The shift toward plant-based dietary patterns and reduced consumption of processed foods with artificial ingredients favors guacamole's positioning as a natural, wholesome alternative to conventional dips and spreads. Nutritional education campaigns and media coverage highlighting avocado's cardiovascular health benefits have elevated consumer perception of guacamole beyond traditional condiment status toward recognition as a valuable dietary component. Healthcare professionals increasingly recommend avocado consumption as part of balanced nutrition plans, reinforcing positive market sentiment. The health-driven consumption trend shows particular strength among younger demographics and urban professionals who prioritize nutritional quality in food purchasing decisions.

Expansion of Modern Retail and Distribution Infrastructure

The rapid expansion of modern retail infrastructure across Mexico is creating unprecedented accessibility for packaged guacamole products in both urban centers and emerging markets. Supermarket chains, hypermarkets, and convenience store networks continue opening new locations that bring refrigerated and frozen guacamole options within convenient reach of increasingly larger consumer populations. Strategic retail investments in refrigeration equipment and category merchandising enhance product presentation and visibility that drives impulse purchases and trial among new consumers. The proliferation of organized retail formats is gradually shifting purchasing patterns away from traditional markets toward modern channels offering consistent product quality, competitive pricing, and promotional activities. Convenience stores play particularly important roles in Mexico's retail landscape by providing accessible purchase points for time-constrained consumers seeking quick meal components. Walmart de México y Centroamérica operated over 4,124 units across six countries as of mid-2025, demonstrating the scale of modern retail presence that supports packaged food distribution. Distribution network improvements including enhanced cold chain logistics enable manufacturers to maintain product freshness across extended geographic reach, effectively expanding addressable market size while preserving quality standards that build consumer confidence.

Growing Demand for Convenient Ready-to-Eat Food Products

Evolving lifestyle patterns characterized by urbanization, dual-income households, and increasingly hectic schedules are driving substantial demand for convenient, ready-to-eat guacamole products that simplify meal preparation without sacrificing quality or authentic flavors. Time-constrained consumers value pre-made guacamole options that eliminate labor-intensive avocado selection, ripeness assessment, and manual preparation while delivering consistent taste profiles comparable to homemade alternatives. The convenience trend extends across multiple consumption occasions including everyday meals, snacking moments, social gatherings, and home entertainment events where guacamole serves as a versatile accompaniment. Single-serve packaging formats address on-the-go consumption needs while family-sized containers cater to household meal occasions requiring larger quantities. Quick-service restaurants increasingly feature guacamole as menu components, normalizing prepared formats and building consumer familiarity with packaged products.

Market Restraints:

What Challenges the Mexico Guacamole Market is Facing?

Avocado Price Volatility and Supply Chain Disruptions

The guacamole market faces significant challenges from avocado price volatility driven by seasonal harvest fluctuations, weather-related disruptions, and supply chain instabilities. Climate conditions including droughts and elevated temperatures in major producing regions can constrain supply and elevate procurement costs for manufacturers. Price fluctuations of forty to sixty percent annually create margin pressures that challenge consistent product pricing strategies and profitability maintenance across the value chain.

Limited Shelf Life and Cold Chain Requirements

Fresh and refrigerated guacamole products face inherent shelf life limitations that restrict distribution reach and increase potential for product spoilage. Maintaining consistent cold chain temperatures throughout storage, transportation, and retail display requires substantial infrastructure investment that may be underdeveloped in certain geographic regions. These constraints can limit market penetration in rural and semi-urban areas where cold chain infrastructure remains less developed, restricting overall market growth potential.

Competition from Alternative Dips and Traditional Preparation

Packaged guacamole faces competition from alternative dip products including salsa, hummus, and bean-based options that offer comparable convenience with potentially longer shelf lives and lower price points. Additionally, strong cultural preferences for homemade guacamole preparation persist among consumers who value traditional recipes and fresh ingredient control. Overcoming these established consumption patterns requires continuous product innovation, quality improvements, and effective marketing that demonstrates comparable authenticity and superior convenience benefits.

Competitive Landscape:

The Mexico guacamole market exhibits a moderately fragmented competitive structure with established manufacturers competing alongside regional processors and emerging brands. Market participants differentiate through product quality, packaging innovation, distribution reach, and pricing strategies that address diverse consumer segments. Companies are increasingly investing in advanced processing technologies including High Pressure Processing to extend shelf life while maintaining clean-label positioning that appeals to health-conscious consumers. Strategic partnerships between manufacturers and retail chains enhance market penetration through dedicated shelf space and promotional support. Vertical integration initiatives connect processing operations with avocado cultivation to secure raw material supply and optimize cost structures across the value chain.

Mexico Guacamole Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Frozen, Dried, Ready to Make |

| End Uses Covered | Food Processing Industry, Food Service Industry, Households |

| Packaging Types Covered | Glass Bottles, Plastic Containers, Stand Up Pouches |

| Distribution Channels Covered |

|

| Region Covered | North, Center, West, East |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico guacamole market size was valued at USD 146.21 Million in 2025.

The Mexico guacamole market is expected to grow at a compound annual growth rate of 7.06% from 2026-2034 to reach USD 270.08 Million by 2034.

Frozen dominated the market with a share of 49%, owing to its extended shelf life, superior preservation of natural flavors, and ability to meet year-round consumer demand regardless of seasonal harvest fluctuations.

Key factors driving the Mexico guacamole market include rising health consciousness among consumers, expanding modern retail infrastructure, growing demand for convenient ready-to-eat products, and increasing household adoption of packaged food alternatives.

Major challenges include avocado price volatility driven by seasonal and climate factors, limited shelf life requiring cold chain infrastructure, competition from alternative dips, and persistent consumer preferences for traditional homemade preparation methods.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)