Mexico Hand Tools Market Size, Share, Trends and Forecast by Type, Distribution Channel, End User, and Region, 2025-2033

Mexico Hand Tools Market Overview:

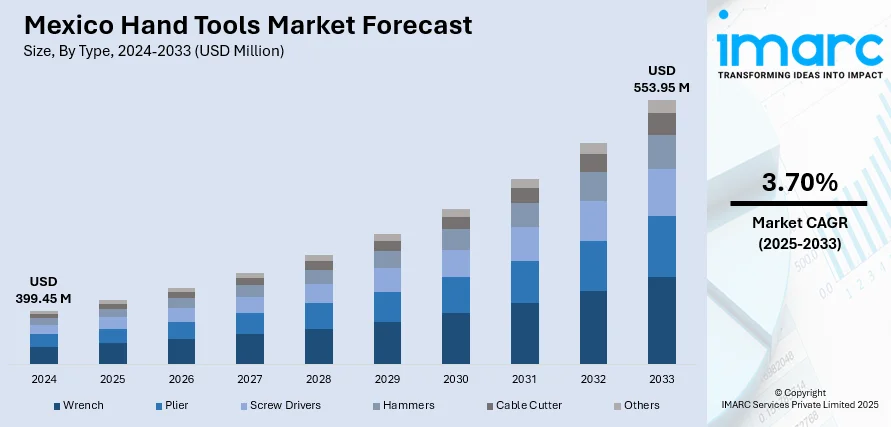

The Mexico hand tools market size reached USD 399.45 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 553.95 Million by 2033, exhibiting a growth rate (CAGR) of 3.70% during 2025-2033. The market is experiencing steady growth, driven by expanding construction, automotive, and manufacturing sectors. Increasing DIY activities and home improvement trends also support demand. Enhanced distribution networks and e-commerce accessibility make tools more available to both professionals and consumers, which further continues to strengthen the evolving Mexico hand tools market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 399.45 Million |

| Market Forecast in 2033 | USD 553.95 Million |

| Market Growth Rate 2025-2033 | 3.70% |

Mexico Hand Tools Market Trends:

Infrastructure Development and Construction Growth

Mexico’s ongoing infrastructure development, including roads, housing, commercial buildings, and public facilities, significantly fuels demand for hand tools. Government-backed projects, combined with private investment in urban development, create sustained needs for tools used in cutting, shaping, fastening, and measuring. These tools are essential on-site for both large and small-scale construction activities. As Mexico continues to modernize cities and expand industrial zones, the workforce relies heavily on reliable and efficient hand tools to maintain productivity. In addition, the push toward sustainable construction practices has introduced demand for specialized, precision-based tools. The increase in home construction, renovations, and infrastructure upgrades across the country makes the construction sector a central force behind the expanding Mexico hand tools market.

To get more information on this market, Request Sample

Industrial Expansion and Manufacturing Growth

Mexico’s industrial base, particularly in automotive, aerospace, and electronics manufacturing, plays a key role in propelling the hand tools market. Trade agreements like the USMCA and proximity to the U.S. have positioned Mexico as a manufacturing hub, drawing foreign investments and boosting factory operations. Hand tools are vital in this environment for assembly, maintenance, and repair tasks. High-quality, ergonomically designed tools are especially in demand for long-duration and precision work. Small and medium-sized manufacturers also depend on accessible hand tools for cost-effective operations. As industrial production scales up and technology adoption increases, the need for a diverse range of manual tools, complementing automated systems, grows as well. This industrial momentum makes manufacturing a strong factor driving the Mexico hand tools market growth.

Rise in DIY Culture and Home Improvement Trends

A growing interest in do-it-yourself (DIY) activities across Mexico is expanding the hand tools market. Influenced by economic factors, creative interests, and online tutorials, more individuals are taking on home repairs, decoration, gardening, and small construction projects. This trend is especially strong among younger adults and homeowners looking for cost-effective, personalized solutions. The availability of user-friendly, multipurpose toolkits in retail stores and online platforms supports this shift. Home improvement shows, influencers, and social media content have also played a major role in popularizing DIY culture. As this lifestyle trend becomes more embedded in urban and suburban communities, demand continues to grow for accessible, affordable, and ergonomic hand tools suited to non-professional use across a variety of tasks.

Mexico Hand Tools Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, distribution channel, and end user.

Type Insights:

- Wrench

- Plier

- Screw Drivers

- Hammers

- Cable Cutter

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes wrench, plier, screw drivers, hammers, cable cutter, and others.

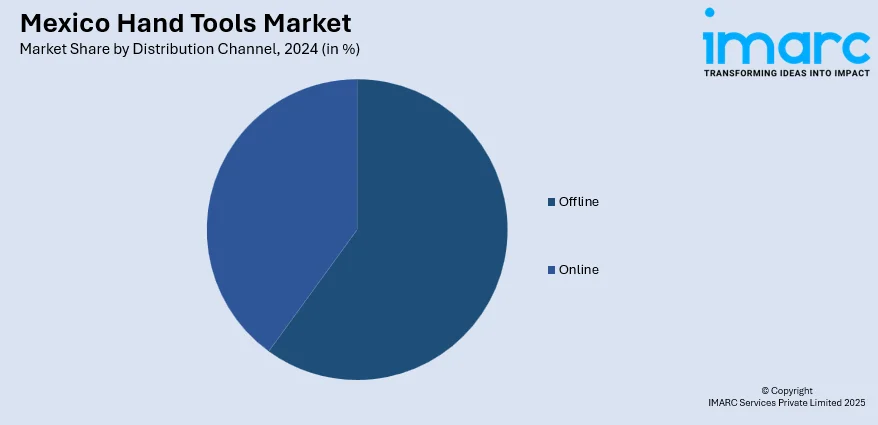

Distribution Channel Insights:

- Offline

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline and online.

End User Insights:

- DIY

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes DIY, commercial, and industrial.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Hand Tools Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Wrench, Plier, Screw Drivers, Hammers, Cable Cutter, Others |

| Distribution Channels Covered | Offline, Online |

| End Users Covered | DIY, Commercial, Industrial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico hand tools market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico hand tools market on the basis of type?

- What is the breakup of the Mexico hand tools market on the basis of distribution channel?

- What is the breakup of the Mexico hand tools market on the basis of end user?

- What is the breakup of the Mexico hand tools market on the basis of region?

- What are the various stages in the value chain of the Mexico hand tools market?

- What are the key driving factors and challenges in the Mexico hand tools market?

- What is the structure of the Mexico hand tools market and who are the key players?

- What is the degree of competition in the Mexico hand tools market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico hand tools market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico hand tools market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico hand tools industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)