Mexico Handbag Market Size, Share, Trends and Forecast by Product Type, Material Type, Distribution Channel, and Region, 2025-2033

Mexico Handbag Market Overview:

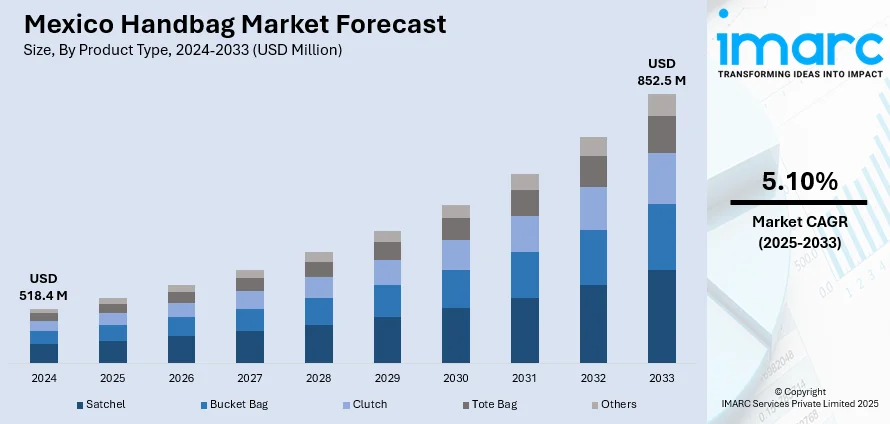

The Mexico handbag market size reached USD 518.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 852.5 Million by 2033, exhibiting a growth rate (CAGR) of 5.10% during 2025-2033. The market is driven by growing disposable incomes, heightening fashion awareness, and higher online retail penetration. With a combination of traditional craftsmanship and contemporary design appeal, with long-term expansion, serving both domestic consumers and export-led opportunities in international fashion markets.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 518.4 Million |

| Market Forecast in 2033 | USD 852.5 Million |

| Market Growth Rate 2025-2033 | 5.10% |

Mexico Handbag Market Trends:

Increasing Demand for Sustainable Handbags

Mexico's handbag industry over the last few years has seen a sharp move towards sustainability. Buyers are increasingly demanding eco-friendly products, and this has spread to handbags as well. With growing concerns regarding the environment, there is an increasing need for sustainable handbags made from organic cotton, recycled materials, and vegan leather. This change is being led by a wider global trend towards sustainability, with Mexican consumers preferring products that are sustainably sourced and made. Consequently, brands are changing their production methods to suit the demands of eco-friendly consumers. Sustainable handbags not only provide a lower environmental impact but also fit into the mounting trend of conscious consumerism in Mexico. For example, in October 2024, KOUA Mexico unveiled its "Acapulco – Waves of Change" handbag collection, after its first appearance at London Fashion Week in September. The collection focuses on sustainability, Mexican heritage, and social empowerment. Furthermore, the growing popularity of eco-friendly products is poised to have a positive impact on the overall of the Mexico handbag market growth, with amplified market share to the sector over the next few years.

Premium and Designer Handbags Rising

There has also been a boost in demand for premium and designer bags in Mexico's handbag industry. With an increase in disposable income, accelerating numbers of people are ready to pay for upmarket, premium-quality handbags. This is driven by intensified exposure of global fashion brands in Mexico and a change in consumer culture towards owning high-end, unique products. Mexican consumers are highly viewing handbags as not only accessories but as symbols of status and investments in long-term, high-quality goods. For instance, in November 2023, British fashion label Kurt Geiger opened its inaugural Mexican stores in Mexico City and Monterrey, showcasing its handbags, shoes, and accessories, to increase its presence in Latin America. Moreover, increased disposable income and popularity of luxury products have driven demand for designer handbags higher. This has accounted for much of the Mexico handbag market share, with upscale brands taking advantage of the increasing demand for high-end fashion. With the Mexican middle class still growing, the future for the premium handbag market looks good.

E-Commerce Fueling Handbag Sales

The move towards internet shopping is one of the biggest growths in the Mexican handbag market. The emergence of online shopping platforms has made it easier for consumers to access a diverse range of handbags, ranging from domestic brands to foreign brands, at the comfort of their homes. Ease of navigating through various collections, along with favorable online offers, has fastened the sale of handbags in Mexico's virtual world. As online penetration increases and digital payment modes gain popularity, e-commerce has become a major growth driver for handbag sales. Online shoppers are being targeted by retailers by improving their online shopping experience, providing hassle-free return policies, and incorporating digital marketing techniques to entice online shoppers. This realignment has considerably affected the Mexico handbag market outlook, accelerated the market's digitalization and extended its consumers to a wide customer base comprised of younger and technologically innovative shoppers.

Mexico Handbag Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, material type, and distribution channel.

Product Type Insights:

- Satchel

- Bucket Bag

- Clutch

- Tote Bag

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes satchel, bucket bag, clutch, tote bag, and others.

Material Type Insights:

- Leather

- Fabric

- Rubber

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes leather, fabric, rubber, and others.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Discount Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, departmental stores, specialty stores, discount stores, online stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Handbag Market News:

- In November 2024, Smashbox Cosmetics made an entrance into the world of fashion by partnering with Mexico City's own brand Ilka. Unveiled during Mercedes-Benz Fashion Week in Mexico City, the limited-edition range included handbags with Smashbox logos on them, bringing beauty and fashion together with interesting designs.

- In October 2024, Pineda Covalin released a new line of handbags, combining Mexican heritage with current fashion. Boasting clutches, crossbodies, and signature Yaab designs, each handbag has bold, culture-inspired artwork. Made from excellent materials, Pineda Covalin handbags honor eternal style and exquisite craftsmanship.

Mexico Handbag Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Satchel, Bucket Bag, Clutch, Tote Bag, Others |

| Material Types Covered | Leather, Fabric, Rubber, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Discount Stores, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico handbag market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico handbag market on the basis of product type?

- What is the breakup of the Mexico handbag market on the basis of material type?

- What is the breakup of the Mexico handbag market on the basis of distribution channel?

- What is the breakup of the Mexico handbag market on the basis of region?

- What are the various stages in the value chain of the Mexico handbag market?

- What are the key driving factors and challenges in the Mexico handbag?

- What is the structure of the Mexico handbag market and who are the key players?

- What is the degree of competition in the Mexico handbag market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico handbag market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico handbag market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico handbag industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)