Mexico Head-Up Display Market Size, Share, Trends and Forecast by Product Type, Conventional and Augmented Reality, Technology, Application, and Region, 2026-2034

Mexico Head-Up Display Market Summary:

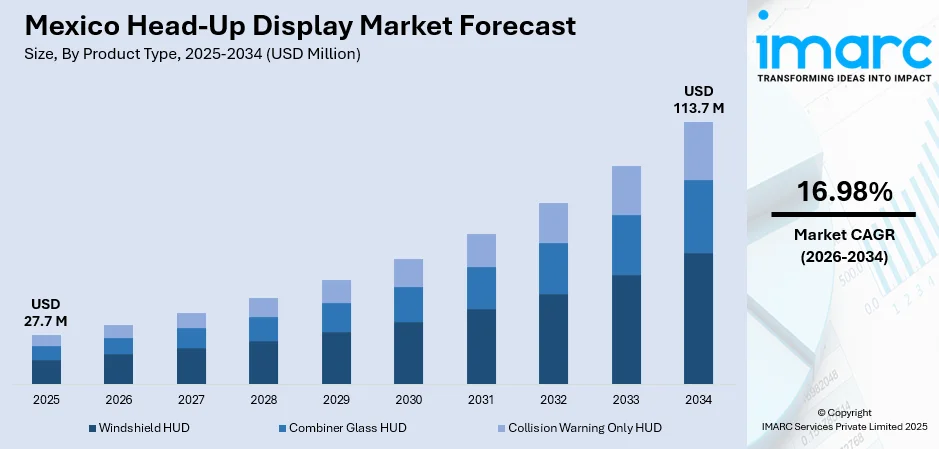

The Mexico head-up display market size was valued at USD 27.7 Million in 2025 and is projected to reach USD 113.7 Million by 2034, growing at a compound annual growth rate of 16.98% from 2026-2034.

In Mexico, the market is experiencing robust expansion, driven by the country's thriving automotive manufacturing sector and rising consumer demand for advanced in-vehicle technologies. The growing emphasis on driver safety features and the increasing integration of advanced driver assistance systems (ADAS) across passenger and commercial vehicles are accelerating head-up display (HUD) adoption. Additionally, the expanding presence of global automotive original equipment manufacturers (OEMs) and their Tier 1 suppliers in Mexico's manufacturing clusters is fostering localized technology development.

Key Takeaways and Insights:

-

By Product Type: Windshield HUD dominates the market with a share of 42% in 2025, owing to its seamless integration with vehicle windshields and superior visual clarity that keeps drivers focused on the road. Rising adoption across premium and mid-range vehicles is accelerating the market expansion.

-

By Conventional and Augmented Reality: Conventional HUD leads the market with a share of 60% in 2025. This dominance is driven by cost-effectiveness, established manufacturing infrastructure, and widespread OEM adoption for displaying essential driving information.

-

By Technology: Digital HUD exhibits a clear dominance in the market with 84% share in 2025, reflecting strong demand for advanced display capabilities, including customizable interfaces, higher resolution graphics, and enhanced integration with vehicle infotainment systems.

-

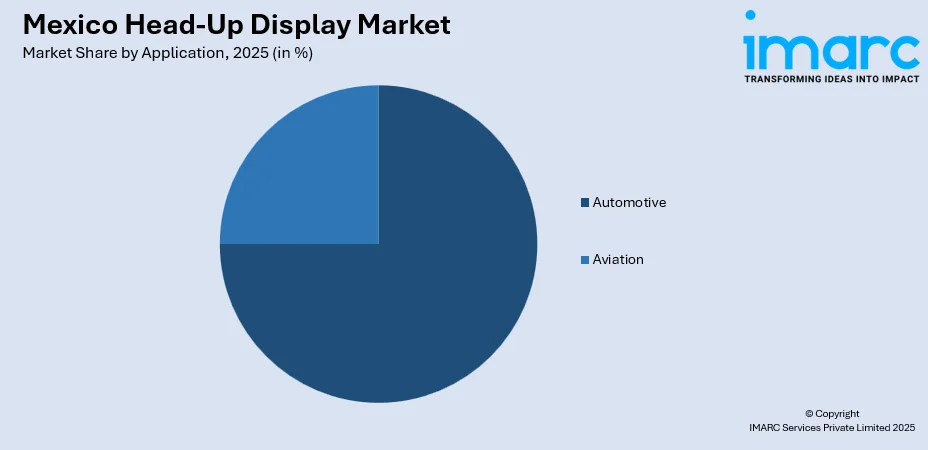

By Application: Automotive represents the largest segment with a market share of 75% in 2025, driven by Mexico's position as one of the largest vehicle producers across the globe and rising consumer preferences for safety-enhancing display technologies.

-

By Region: Central Mexico comprises the largest region with 35% share in 2025, supported by the concentration of major automotive manufacturing facilities in states like Puebla, Querétaro, and Guanajuato that house leading OEMs and advanced automotive electronics suppliers.

-

Key Players: Key players drive the Mexico head-up display market by expanding product portfolios, improving display technologies, and strengthening partnerships with automotive OEMs. Their investments in research and development (R&D) activities, manufacturing localization, and integration with ADAS boost adoption and ensure product availability across diverse vehicle segments.

To get more information on this market Request Sample

In Mexico, the market is witnessing accelerated growth, propelled by multiple converging factors. Mexico's automotive sector achieved record production levels, with total output reaching approximately 4 Million vehicles in 2024, reinforcing demand for HUDs across newly manufactured vehicles. The increasing penetration of ADAS in both premium and mid-segment vehicles is creating substantial opportunities for HUD integration. Consumer preferences are shifting towards connected and technology-enabled driving experiences, with growing awareness regarding road safety benefits offered by heads-up displays. The country's strategic position as a manufacturing hub for North American automotive supply chains attracts significant investments from global HUD technology providers. Furthermore, the expansion of electric vehicle (EV) production facilities across Mexico is generating demand for specialized HUD solutions tailored to EV dashboard architectures and energy management displays.

Mexico Head-Up Display Market Trends:

Integration of Augmented Reality (AR) Features in HUD Systems

The market is experiencing a significant shift towards AR-enhanced systems that overlay contextual navigation and hazard details directly onto the driver's field of vision. These advanced displays project dynamic route guidance aligned with actual road conditions, improving situational awareness and reducing driver distraction. Automotive manufacturers are increasingly incorporating AR-HUD technology to differentiate their vehicle offerings and meet consumer expectations for immersive digital cockpit experiences. The trend reflects broader industry movement towards intelligent vehicle interfaces that blend real-world driving environments with digital information overlays.

Expansion of HUD Adoption in Mid-Segment Vehicles

HUD technology is transitioning from exclusive luxury vehicle features towards broader adoption across mid-segment automobile categories in Mexico. Manufacturing cost reductions in projection systems and optical components are enabling automakers to offer HUD options in competitively priced vehicle models. This democratization of display technology is expanding the addressable market beyond premium segments, reaching price-conscious consumers who prioritize safety and technological features. The trend is particularly pronounced in the compact SUV and sedan categories that dominate Mexican consumer preferences and represent substantial sales volumes. As per industry reports, in 2024, the top-selling vehicle in Mexico was the Nissan Versa, a subcompact sedan, totaling 93,278 sales (+21.3%).

Growing Emphasis on Driver Safety and Distraction Reduction

Safety-focused vehicle technologies are gaining prominence in Mexico's automotive sector, with HUDs emerging as critical components in distraction mitigation strategies. HUD systems project essential driving information, including speed, navigation prompts, and collision warnings, directly within the driver's line of sight, removing the need to look away from the road. Regulatory focus on vehicle safety standards and growing consumer awareness regarding accident prevention benefits are driving demand for integrated display solutions. From January to March 2024, there were 3,519 accidents reported on federal highways in Mexico. Automotive manufacturers are positioning HUD technology as a standard safety feature rather than a premium optional accessory.

Market Outlook 2026-2034:

The Mexico head-up display market outlook remains highly favorable, supported by sustained automotive manufacturing growth and increasing technology adoption across vehicle categories. The market generated a revenue of USD 27.7 Million in 2025 and is projected to reach a revenue of USD 113.7 Million by 2034, growing at a compound annual growth rate of 16.98% from 2026-2034. Forward momentum will be driven by continued integration of HUD systems in domestically manufactured vehicles, expansion of EV production facilities requiring specialized display solutions, and strengthening partnerships between global technology providers and Mexican automotive clusters. The market will benefit from nearshoring trends that position Mexico as a strategic hub for advanced automotive electronics manufacturing serving North American demand.

Mexico Head-Up Display Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Windshield HUD | 42% |

| Conventional and Augmented Reality | Conventional HUD | 60% |

| Technology | Digital HUD | 84% |

| Application | Automotive | 75% |

| Region | Central Mexico | 35% |

Product Type Insights:

- Windshield HUD

- Combiner Glass HUD

- Collision Warning Only HUD

Windshield HUD dominates with a market share of 42% of the total Mexico head-up display market in 2025.

Windshield HUD leads the market because it offers a larger projection area and better visibility compared to combiner-based systems. Information is displayed directly within the driver’s natural line of sight, reducing distraction and improving reaction time. This makes windshield HUDs highly suitable for daily driving conditions, urban traffic, and long-distance travel.

Automakers prefer this format for integrating multiple data points, such as speed, navigation, and alerts, without cluttering the dashboard. Additionally, windshield HUD systems align well with the growing adoption of advanced driver assistance features. They support seamless integration with navigation, safety warnings, and vehicle status information. As vehicle interiors evolve toward digital and minimalistic designs, windshield HUDs enhance user experience while maintaining safety. Their compatibility with premium and mid-range vehicles further expands adoption, strengthening their leading position in the market.

Conventional and Augmented Reality Insights:

- Conventional HUD

- Augmented Reality Based HUD

Conventional HUD leads with a share of 60% of the total Mexico head-up display market in 2025.

Conventional HUDs present essential driving information at fixed focal distances, providing straightforward visualization of speed, navigation directions, and warning indicators. The technology benefits from established manufacturing processes and proven reliability across diverse operating conditions. Conventional systems maintain dominance due to their cost-effectiveness and compatibility with existing vehicle electrical architectures.

These display systems offer streamlined integration pathways for automotive manufacturers seeking to incorporate HUD technology without extensive dashboard redesign. Conventional HUDs deliver consistent performance across temperature extremes and varying lighting conditions characteristic of Mexican driving environments. Their mature supply chain infrastructure enables competitive pricing that supports adoption across multiple vehicle price segments, ranging from economy models to premium offerings, while ensuring adequate display quality for safety-critical information presentation.

Technology Insights:

- CRT Based HUD

- Digital HUD

- Optical Waveguide HUD

- Digital Micromirror Device (DMD) HUD

- Light Emitting Diode (LED) HUD

- Others

Digital HUD exhibits a clear dominance with a 84% share of the total Mexico head-up display market in 2025.

Digital HUDs leverage advanced projection technologies, including digital light processing, liquid crystal on silicon, and micro light-emitting diode (LED) systems, to deliver high-resolution graphics with enhanced brightness and color accuracy. These systems enable customizable display interfaces that can be updated through software modifications, supporting evolving consumer preferences and vehicle connectivity requirements.

The technology provides superior flexibility in displaying diverse information types simultaneously, from basic speed indicators to complex navigation overlays and ADAS warnings. Digital HUDs support over-the-air update capabilities that enable manufacturers to enhance display features throughout the vehicle lifecycle. Their compatibility with emerging vehicle architectures, particularly in EVs requiring battery and charging status displays, positions digital technology as the primary choice for forward-looking automotive platform development across Mexican manufacturing facilities.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Aviation

- Automotive

Automotive represents the leading segment with a 75% share of the total Mexico head-up display market in 2025.

The automotive sector drives overwhelming demand for safety systems, including HUDs, in Mexico. As per IMARC Group, the Mexico automotive safety systems market size reached USD 262.50 Million in 2024. Vehicle manufacturers operating in Mexico are increasingly incorporating HUD technology across their production lines to meet consumer expectations for advanced safety and convenience features. The concentration of major automotive OEMs across Mexican manufacturing clusters creates substantial demand for locally integrated display solutions.

Mexico's automotive industry benefits from integrated North American supply chains, facilitating technology transfer and component sourcing for HUD manufacturing. The sector's emphasis on vehicle electrification is generating specialized requirements for HUDs capable of presenting battery status, range information, and charging guidance. Continued investments in automotive manufacturing capacity across Mexica ensures sustained demand expansion for HUD systems integrated into both domestically produced vehicles and those manufactured for export to United States and Canadian markets.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Central Mexico dominates with a market share of 35% of the total Mexico head-up display market in 2025.

Central Mexico leads the market due to its high concentration of vehicle ownership and strong presence of urban mobility demand. Major cities in the region support higher adoption of technologically advanced vehicles, where HUD systems enhance driving convenience and safety. Dense traffic conditions increase the need for real-time driving information displayed within the driver’s line of sight. This environment encourages faster acceptance of HUD-equipped vehicles across private and fleet segments.

Additionally, Central Mexico benefits from a well-developed automotive ecosystem, including assembly plants and dealerships. The concentration of OEMs and advanced automotive electronics suppliers positions Central Mexico as the primary hub for HUD adoption and manufacturing. Consumers in the region show greater awareness about in-vehicle technologies and safety features, supporting demand for HUD systems. Strong dealership networks and service infrastructure improve availability and maintenance of HUD-equipped models. This combination of consumer readiness and industry presence reinforces Central Mexico’s leading position in the market.

Market Dynamics:

Growth Drivers:

Why is the Mexico Head-Up Display Market Growing?

Rising Adoption of Advanced In-Vehicle Technologies

The growing integration of advanced digital features in vehicles is driving the market expansion in Mexico. Consumers increasingly prefer vehicles equipped with connected infotainment, digital dashboards, and smart driver assistance features. HUD systems complement these technologies by offering seamless visual integration without cluttering interior displays. Automakers use HUDs to enhance user experience and differentiate models. Growing familiarity with digital interfaces increases consumer comfort with HUD technology. Integration with navigation, smartphone connectivity, and vehicle diagnostics further boosts demand. As vehicles evolve towards software-driven platforms, HUD adoption rises steadily. Consumers associate advanced displays with modernity and premium value. This shift towards connected vehicles continues to accelerate HUD penetration across both mid-range and high-end vehicle categories in Mexico. As per IMARC Group, the Mexico connected vehicles market is set to attain USD 3.87 Billion by 2033, exhibiting a growth rate (CAGR) of 14.30% during 2025-2033.

Increasing Vehicle Production and Model Upgrades

Growth in vehicle production and frequent model upgrades support the expansion of the market in Mexico. Automakers regularly refresh vehicle designs to remain competitive, introducing HUD systems as part of feature enhancements. Even mid-range models increasingly offer HUDs as optional or standard features. Rising domestic vehicle sales and replacement cycles expand the addressable market. Manufacturers use HUD technology to improve perceived innovation and safety appeal. Model upgrades targeting urban drivers and tech-savvy consumers further encourage adoption. As vehicle platforms become more standardized, HUD integration becomes more cost-efficient. This encourages broader deployment across product lines. Therefore, continuous vehicle launches and upgrades play a critical role in driving the market growth in Mexico. Tlaxcala joined Mexico’s EV sector by introducing the ‘Totalmente Tlaxcalteca’ (TT), a compact EV that costs MXD 100,000 (USD 5,450). The model was revealed at the Tlaxcala Automotive Forum 2025 and is set to launch in December 2025. Authorities emphasized that 80% of its parts were manufactured domestically.

Urban Traffic Density and Driving Complexity

Increasing traffic congestion and complex driving environments in Mexican cities are strong drivers of HUD adoption. Drivers require constant access to speed limits, navigation cues, and warning alerts without diverting attention from the road. HUD systems help manage information efficiently in high-density traffic conditions. Stop-and-go driving, frequent intersections, and navigation dependence increase the value of real-time visual assistance. Urban commuting patterns support demand for technologies that reduce stress and improve situational awareness. As city driving becomes more challenging, HUDs provide practical benefits. This functional relevance in urban environments significantly strengthens market demand. Growing urbanization continues to fuel HUD adoption across major Mexican cities. Additionally, ride-hailing and delivery vehicles operating extensively in urban areas benefit from HUDs to maintain efficiency and safety during prolonged driving hours. Increasing focus on reducing accidents and improving traffic flow further encourages adoption of HUD technology in congested city environments.

Market Restraints:

What Challenges the Mexico Head-Up Display Market is Facing?

High Implementation Costs and Price Sensitivity

HUD systems require significant investments in specialized optical components, projection units, and integration engineering that elevate vehicle production costs. The Mexican automotive market demonstrates considerable price sensitivity, with economy and compact vehicle segments representing substantial sales volumes where cost additions face consumer resistance. This pricing pressure constrains HUD adoption rates in lower-priced vehicle categories despite growing consumer interest in the technology.

Dashboard Space Constraints and Redesign Requirements

HUD system installation demands considerable space within vehicle cockpit architectures for projection hardware and optical pathways. Vehicle platforms that are not originally designed to accommodate HUD components require extensive dashboard redesign to integrate display technology properly. These engineering constraints limit retrofit opportunities and slow adoption across existing vehicle model lines, particularly for manufacturers prioritizing production efficiency over feature expansion.

Trade Policy Uncertainty and Supply Chain Disruption Risks

Mexico's automotive sector faces ongoing uncertainty regarding trade policies and tariff implications that affect component sourcing strategies and production planning. Potential disruptions to established supply chains for HUD components, many sourced from Asian manufacturers, create procurement challenges. These geopolitical factors introduce planning complexity that can delay investment decisions in advanced display technology integration across Mexican automotive facilities.

Competitive Landscape:

In Mexico, the market features a competitive landscape, characterized by global technology leaders and specialized display manufacturers serving the domestic automotive sector. Major players leverage their established relationships with automotive OEMs operating Mexican production facilities to secure HUD supply contracts. Companies compete through technological differentiation, offering advanced features, including AR capabilities, improved brightness specifications, and expanded field of view parameters. Strategic partnerships between display technology providers and vehicle manufacturers enable customized solutions tailored to specific platform requirements. The market benefits from technology transfer as international HUD suppliers establish localized engineering and manufacturing capabilities within Mexico's automotive clusters, intensifying competition while supporting innovations and cost optimization.

Mexico head-up display Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Windshield HUD, Combiner Glass HUD, Collison Warning Only HUD |

| Conventional and Augmented Realities Covered | Conventional HUD, Augmented Reality Based HUD |

| Technologies Covered |

|

| Applications Covered | Aviation, Automotive |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico head-up display market size was valued at USD 27.7 Million in 2025.

The Mexico head-up display market is expected to grow at a compound annual growth rate of 16.98% from 2026-2034 to reach USD 113.7 Million by 2034.

Windshield HUD dominated the market with a share of 42%, driven by its seamless integration with vehicle windshields, superior visual clarity, and growing adoption across premium and mid-range vehicle categories manufactured in Mexico.

Key factors driving the Mexico head-up display market include expanding automotive manufacturing capacity, rising consumer demand for advanced driver assistance technologies, growing EV production requiring specialized displays, and increasing emphasis on driver safety and distraction reduction.

Major challenges include high implementation costs affecting adoption in price-sensitive vehicle segments, dashboard space constraints requiring extensive redesign for HUD integration, trade policy uncertainty impacting component supply chains, and competition from alternative display technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)