Mexico Healthcare Asset Management Market Size, Share, Trends and Forecast by Product, Application, End User, and Region, 2025-2033

Mexico Healthcare Asset Management Market Overview:

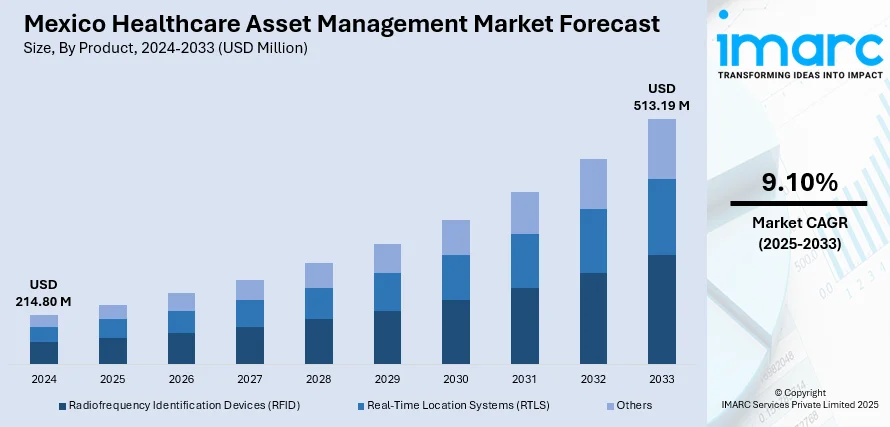

The Mexico healthcare asset management market size reached USD 214.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 513.19 Million by 2033, exhibiting a growth rate (CAGR) of 9.10% during 2025-2033. The market is advancing owing to the expansion of telemedicine, adoption of connected healthcare technologies, and the integration of customer relationship management (CRM) systems in hospitals. These developments require efficient tracking and utilization of medical assets to support remote diagnostics, real-time monitoring, and patient-centric services. Advanced asset management tools are becoming essential to optimize resources, enhance operational efficiency, and support the broader digital health transformation, thereby contributing to the expansion of the Mexico healthcare asset management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 214.80 Million |

| Market Forecast in 2033 | USD 513.19 Million |

| Market Growth Rate 2025-2033 | 9.10% |

Mexico Healthcare Asset Management Market Trends:

Integration of Telemedicine and Remote Healthcare Services

The growth of telemedicine and remote healthcare services in Mexico is catalyzing the demand for sophisticated asset management systems to manage the rising logistical and technological requirements. As the provision of healthcare moves beyond conventional clinical environments, providers need to handle a wider array of portable medical devices and diagnostic instruments. A key instance of this change is Salud Digna's 2024 partnership with Lunit, which incorporated AI-driven medical imaging technology in more than 230 clinics throughout Mexico and Central America. This program improved the precision of diagnoses in mammography and chest X-ray evaluations, aiding remote medical services. To effectively manage such equipment, asset management systems are essential, providing real-time tracking, global positioning system (GPS) monitoring, and centralized inventory management. With the expansion of telehealth, particularly in rural regions, these systems guarantee that vital equipment is accessible whenever and wherever necessary, maximizing resource utilization and enhancing quality patient care.

Growing Demand for Connected Healthcare Infrastructure

The increasing utilization of connected healthcare technologies in hospitals and care facilities is a key factor bolstering the Mexico healthcare asset management market growth. As per the IMARC Group, the Mexico connected healthcare market is expected to hit USD 1,595.6 Million in 2024 and grow at a CAGR of 22.23% to USD 10,586.4 Million by 2033, healthcare providers are making greater investments in digital infrastructure that improves operational visibility, patient monitoring, and equipment usage. The growing demand for immediate data and intelligent resource management is driving the need for sophisticated asset management solutions, such as radiofrequency identification (RFID) systems, IoT-enabled trackers, and cloud-connected platforms. As connected devices play a crucial role in remote monitoring, diagnostics, and emergency response, hospitals need to guarantee effective management of both physical and digital resources to facilitate uninterrupted care delivery. This transition aligns with the government's continuous digitization initiatives in public health systems, positioning healthcare asset management as a strategic priority for both private and public entities.

Increasing CRM Integration

The rising adoption of CRM systems in healthcare facilities is supporting the Mexico healthcare asset management market growth. With the Mexico healthcare CRM market hitting USD 262.5 Million in 2024 and anticipated to expand at a CAGR of 10.8% to USD 660.7 Million by 2033, hospitals and clinics are increasingly prioritizing improvements in patient engagement, communication, and service efficiency. This digital transformation necessitates efficient integration between CRM systems and asset monitoring tools to guarantee that medical devices, diagnostic equipment, and treatment facilities are accessible, operational, and synchronized with patient flow information. The necessity to align patient records with asset availability is encouraging providers to implement smart asset management solutions that provide real-time tracking, automated notifications, and analytical insights. This integration enhances operational efficiency while also fostering data-informed care delivery, particularly in extensive facilities managing significant patient loads.

Mexico Healthcare Asset Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, application, and end user.

Product Insights:

- Radiofrequency Identification Devices (RFID)

- Real-Time Location Systems (RTLS)

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes radiofrequency identification devices (RFID), real-time location systems (RTLS), and others.

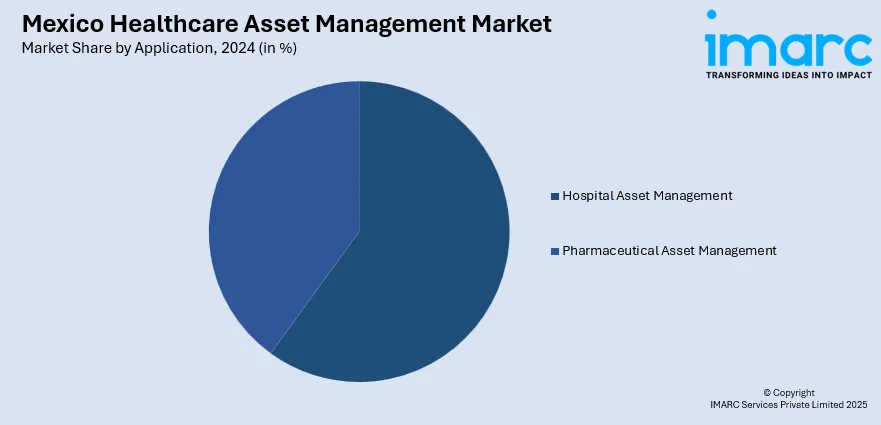

Application Insights:

- Hospital Asset Management

- Staff Management

- Equipment Tracking and Management

- Patient Management

- Others

- Pharmaceutical Asset Management

- Drug Anti-counterfeiting

- Supply Chain Management

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes hospital asset management (staff management, equipment tracking and management, patient management, and others) and pharmaceutical asset management (drug anti-counterfeiting and supply chain management).

End User Insights:

- Hospitals and Clinics

- Laboratories

- Pharmaceutical Companies

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals and clinics, laboratories, pharmaceutical companies, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Healthcare Asset Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Radiofrequency Identification Devices (RFID), Real-Time Location Systems (RTLS), Others |

| Applications Covered |

|

| End Users Covered | Hospitals and Clinics, Laboratories, Pharmaceutical Companies, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico healthcare asset management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico healthcare asset management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico healthcare asset management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The healthcare asset management market in Mexico was valued at USD 214.80 Million in 2024.

The Mexico healthcare asset management market is projected to exhibit a CAGR of 9.10% during 2025-2033, reaching a value of USD 513.19 Million by 2033.

Key factors driving the Mexico healthcare asset management market include increasing investments in hospital infrastructure, rising demand for efficient utilization of medical equipment, and the need to reduce operational costs. Adoption of digital asset tracking and management solutions to enhance equipment maintenance, compliance, and patient care is further supporting market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)