Mexico Healthcare Cloud Computing Market Size, Share, Trends and Forecast by Service Model, Cloud Deployment Model, Application, End User, and Region, 2025-2033

Mexico Healthcare Cloud Computing Market Overview:

The Mexico healthcare cloud computing market size reached USD 765.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,227.69 Million by 2033, exhibiting a growth rate (CAGR) of 12.61% during 2025-2033. Government digital health initiatives, electronic medical record integration, and real-time data sharing are advancing system-wide modernization. Regulatory improvements, scalable cloud infrastructure, and cost-efficiency goals are supporting institutional adoption. Telemedicine expansion, remote monitoring, wearable data integration, healthtech platform offerings, and analytics-driven care optimization are some of the factors positively impacting the Mexico healthcare cloud computing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 765.00 Million |

| Market Forecast in 2033 | USD 2,227.69 Million |

| Market Growth Rate 2025-2033 | 12.61% |

Mexico Healthcare Cloud Computing Market Trends:

Healthcare System Modernization and Public Health Digitalization Initiatives

A primary driver in this sector is the strategic modernization of Mexico’s healthcare system, which increasingly emphasizes data-driven service delivery and interoperability. Government-led digital health initiatives, such as the implementation of electronic medical records (EMRs) and national telehealth frameworks, are integrating cloud platforms to centralize data storage, standardize patient information, and improve administrative efficiency. These systems are being introduced across public institutions, including the Mexican Social Security Institute (IMSS) and the Institute for Social Security and Services for State Workers (ISSSTE), to enhance nationwide data accessibility and care coordination. Cloud infrastructure supports real-time data sharing between departments, reducing redundancy and enabling more accurate diagnostics. Public-private collaborations are also facilitating scalable cloud deployment through managed service models. On September 24, 2024, Microsoft announced a USD 1.3 Billion investment over three years to expand cloud and artificial intelligence infrastructure in Mexico, aiming to enhance connectivity and support 30,000 small and medium-sized businesses. The initiative includes training programs to reach 5 million Mexicans and a partnership with Viasat to bring internet access to over 150,000 underserved individuals by the end of 2025. Enhanced regulatory frameworks, including data localization policies and cybersecurity protocols, are being designed to support safe cloud adoption. Additionally, the need for cost-effective IT infrastructure amid constrained health budgets makes cloud-based solutions increasingly attractive for long-term sustainability. Across this transformation phase, Mexico healthcare cloud computing market growth reflects the convergence of digital policy and operational efficiency, reinforcing the role of cloud ecosystems in reshaping national healthcare delivery models.

.webp)

Increased Demand for Telemedicine, Data Analytics, and Remote Monitoring

The growing reliance on digital healthcare delivery models, particularly telemedicine and remote patient monitoring, is accelerating cloud technology adoption among private healthcare providers and tech-enabled clinics. Cloud platforms provide the scalability and agility required to handle fluctuating workloads in virtual consultations, appointment scheduling, and patient record management. As the population becomes more digitally engaged, especially in metropolitan areas, demand for remote services is increasing, creating pressure on providers to offer seamless, secure, and responsive digital care environments. Moreover, cloud-enabled analytics platforms are being used to derive clinical insights from large volumes of patient data, helping optimize treatment protocols, identify public health trends, and improve operational decision-making. On August 8, 2023, it was reported that 81% of Mexican businesses are adopting hybrid or multi-cloud strategies, primarily integrating public cloud with private or on-premise options to meet operational, compliance, and sustainability goals. Microsoft Azure leads the local market with 69% usage, while Google Cloud Platform holds a 36% share, highlighting its relevance in the expanding cloud ecosystem, especially with its new region in Querétaro. With 42% of companies planning to invest in cloud computing and 68% targeting improved sustainability, the healthcare sector in Mexico is well-positioned to leverage these trends for secure, scalable, and eco-aligned digital transformation. Wearable health devices and mobile health apps are contributing real-time patient data to the cloud, facilitating continuous care beyond traditional clinical settings. Startups and healthtech firms are introducing platform-as-a-service (PaaS) and software-as-a-service (SaaS) offerings tailored for hospitals and clinics of varying sizes. These innovations are enabling small and mid-tier providers to leverage advanced technologies without extensive capital investment. This digital shift is fostering a more responsive, data-integrated care environment across Mexico’s healthcare landscape.

Mexico Healthcare Cloud Computing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service model, cloud deployment model, application, and end user.

Service Model Insights:

- Software as a Service (SaaS)

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

The report has provided a detailed breakup and analysis of the market based on the service model. This includes Software as a Service (SaaS), Infrastructure as a Service (IaaS), and Platform as a Service (PaaS).

Cloud Deployment Model Insights:

- Private Cloud

- Public Cloud

- Hybrid Cloud

The report has provided a detailed breakup and analysis of the market based on the cloud deployment model. This includes private cloud, public cloud, and hybrid cloud.

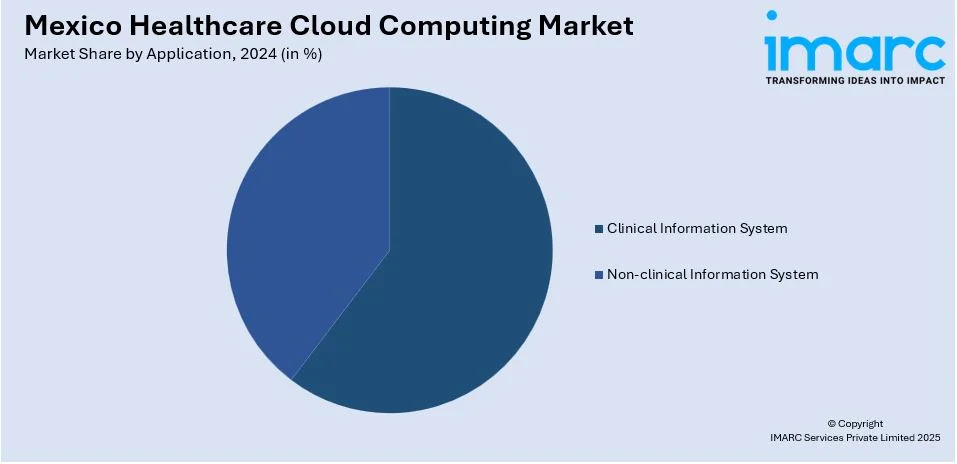

Application Insights:

- Clinical Information System

- Computerized Physician Order Entry

- Electronic Medical Records

- Radiology Information System

- Pharmacy Information System

- Others

- Non-clinical Information System

- Automatic Patient Billing

- Revenue Cycle Management

- Claims Management

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes clinical information system (computerized physician order entry, electronic medical records, radiology information system, pharmacy information system, and others) and non-clinical information system (automatic patient billing, revenue cycle management, claims management, and others).

End User Insights:

- Healthcare Providers

- Healthcare Payers

The report has provided a detailed breakup and analysis of the market based on the end user. This includes healthcare providers and healthcare payers.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has provided a comprehensive analysis of all major regional markets, including Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Healthcare Cloud Computing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Models Covered | Software as a Service (SaaS), Infrastructure as a Service (IaaS), Platform as a Service (PaaS) |

| Cloud Deployment Models Covered | Private Cloud, Public Cloud, Hybrid Cloud |

| Applications Covered |

|

| End Users Covered | Healthcare Providers, Healthcare Payers |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico healthcare cloud computing market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico healthcare cloud computing market on the basis of service model?

- What is the breakup of the Mexico healthcare cloud computing market on the basis of cloud deployment model?

- What is the breakup of the Mexico healthcare cloud computing market on the basis of application?

- What is the breakup of the Mexico healthcare cloud computing market on the basis of end user?

- What is the breakup of the Mexico healthcare cloud computing market on the basis of region?

- What are the various stages in the value chain of the Mexico healthcare cloud computing market?

- What are the key driving factors and challenges in the Mexico healthcare cloud computing market?

- What is the structure of the Mexico healthcare cloud computing market and who are the key players?

- What is the degree of competition in the Mexico healthcare cloud computing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico healthcare cloud computing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico healthcare cloud computing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico healthcare cloud computing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)