Mexico Healthcare IT Market Size, Share, Trends and Forecast by Product and Services, Component, Delivery Mode, End-User, and Region, 2025-2033

Mexico Healthcare IT Market Overview:

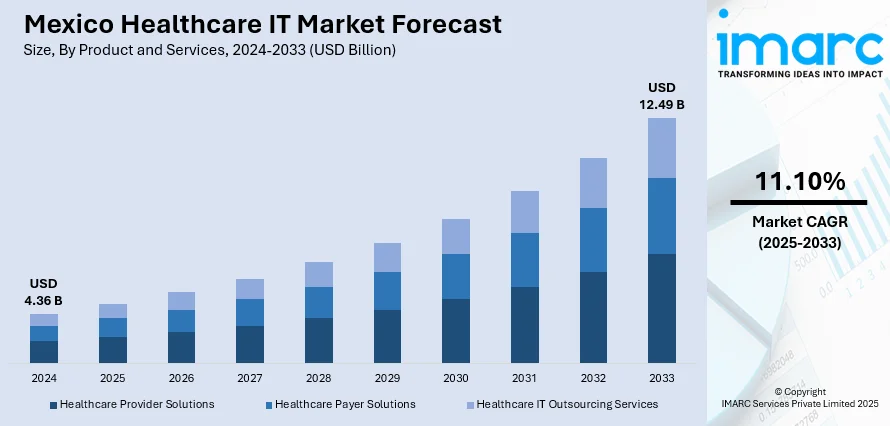

The Mexico healthcare IT market size reached USD 4.36 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 12.49 Billion by 2033, exhibiting a growth rate (CAGR) of 11.10% during 2025-2033. The market is growing rapidly, fueled by the instrumental role of the government funding allocated to digital health initiatives, which has resulted in a sharp increase in public-sector Electronic Health Record (EHR) deployments. This is complemented by the establishment of new regulations that require adherence to data privacy and interoperability standards, spurring investments in sophisticated EHR systems. The emphasis on healthcare modernization, such as the incorporation of digital health technologies to improve healthcare access and foster EMR adoption, is also driving the overall expansion of the Mexico healthcare IT market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.36 Billion |

| Market Forecast in 2033 | USD 12.49 Billion |

| Market Growth Rate 2025-2033 | 11.10% |

Mexico Healthcare IT Market Trends:

Government Initiatives and EHR Implementation

The government of Mexico has played a central role in driving healthcare IT innovation through policy reforms and strategic initiatives. The promulgation of the General Health Law has created a legal foundation that favors the use of electronic health technologies, such as Electronic Health Records (EHRs). Moreover, new standards introduced in 2023 required adherence to data privacy and interoperability requirements, further promoting investments in sophisticated EHR systems. These regulatory reforms have created a safe and interoperable environment, which protects patient information and can be exchanged smoothly between various healthcare networks.

Increased Telemedicine and Digital Health Solutions

Telemedicine has become an essential element of the healthcare IT infrastructure of Mexico, especially for rural and underprivileged populations which represents one of the major factors impelling the Mexico healthcare IT market growth . Government support for incorporating telemedicine into public healthcare systems has played a pivotal role in extending healthcare access and efficiency. In spite of difficulties like internet connectivity and digital literacy, telehealth solutions are becoming more popular, helping patients seek remote consultation with health experts. These increases are backed by the emerging trend of wearable health devices in the form of smartwatches and fitness monitors that facilitate preventive care by permitting users to check critical health factors. The inclusion of artificial intelligence in such devices provides tailored health information, adding to their worth in chronic disease management and patient monitoring. These innovations represent a move toward patient-centricity, using technology to enhance health outcomes and access.

Regulatory Developments and Data Privacy

Mexico's regulatory framework is adapting to meet the sophistication of digital health technologies. In 2023, the nation implemented new regulations requiring healthcare providers to adhere to data privacy and interoperability standards. These regulations seek to guarantee that Electronic Health Records (EHRs) not only secure patient data from breaches but also enable data exchange between healthcare entities without interruptions. The Federal Commission for the Protection Against Sanitary Risks (Cofepris) has a central role in monitoring the quality, effectiveness, and efficiency of health inputs, such as digital health services and medical devices. Moreover, the regulation of Software as a Medical Device (SaMD) under the Mexican Official Standard NOM-241-SSA1-2021 has set rules for the design and marketing of software for medical use. These regulatory developments are creating a safe and standardized platform for digital health innovations, encouraging trust between healthcare providers and patients.

Mexico Healthcare IT Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product and services, component, delivery mode, and end-user.

Product and Services Insights:

- Healthcare Provider Solutions

- Clinical Solutions

- Nonclinical Healthcare IT Solutions

- Healthcare Payer Solutions

- Pharmacy Audit and Analysis Systems

- Claims Management Solutions

- Analytics and Fraud Management Solutions

- Member Eligibility Management Solutions

- Provider Network Management Solutions

- Billing and Accounts (Payment) Management Solutions

- Customer Relationship Management Solutions

- Population Health Management Solutions

- Others

- Healthcare IT Outsourcing Services

- Provider HCIT Outsourcing Services

- Payer IT Outsourcing Services

- Operational IT Outsourcing Services

The report has provided a detailed breakup and analysis of the market based on the product and services. This includes healthcare provider solutions (clinical solutions and nonclinical healthcare IT solutions), healthcare payer solutions (pharmacy audit and analysis systems, claims management solutions, analytics and fraud management solutions, member eligibility management solutions, provider network management solutions, billing and accounts (payment) management solutions, customer relationship management solutions, population health management solutions, and others), and healthcare IT outsourcing services (provider HCIT outsourcing services, payer IT outsourcing services, and operational IT outsourcing services).

Component Insights:

- Software

- Hardware

- Services

A detailed breakup and analysis of the market based on the component has also been provided in the report. This includes software, hardware, and services.

Delivery Mode Insights:

- On-Premises

- Cloud-Based

The report has provided a detailed breakup and analysis of the market based on the delivery mode. This includes on-premises and cloud-based.

End-User Insights:

- Healthcare Providers

- Hospitals

- Ambulatory Care Centers

- Home Healthcare Agencies, Nursing Homes and Assisted Living Facilities

- Diagnostic and Imaging Centers

- Pharmacies

- Healthcare Payers

- Private Payers

- Public Payers

- Others

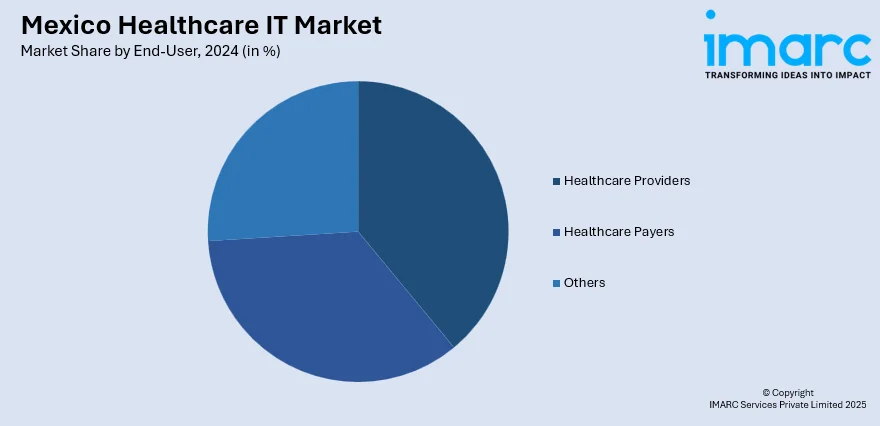

A detailed breakup and analysis of the market based on the end-user has also been provided in the report. This includes healthcare providers (hospitals, ambulatory care centers, home healthcare agencies, nursing homes and assisted living facilities, diagnostic and imaging centers, and pharmacies), healthcare payers (private payers, public payers), and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Healthcare IT Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product and Services Covered |

|

| Components Covered | Software, Hardware, Services |

| Delivery Modes Covered | On-Premises, Cloud-Based |

| End-Users Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico healthcare IT market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico healthcare IT market on the basis of product and services?

- What is the breakup of the Mexico healthcare IT market on the basis of component?

- What is the breakup of the Mexico healthcare IT market on the basis of delivery mode?

- What is the breakup of the Mexico healthcare IT market on the basis of end-user?

- What is the breakup of the Mexico healthcare IT market on the basis of region?

- What are the various stages in the value chain of the Mexico healthcare IT market?

- What are the key driving factors and challenges in the Mexico healthcare IT market?

- What is the structure of the Mexico healthcare IT market and who are the key players?

- What is the degree of competition in the Mexico healthcare IT market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico healthcare IT market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico healthcare IT market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico healthcare IT industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)