Mexico Healthy Snacks Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

Mexico Healthy Snacks Market Overview:

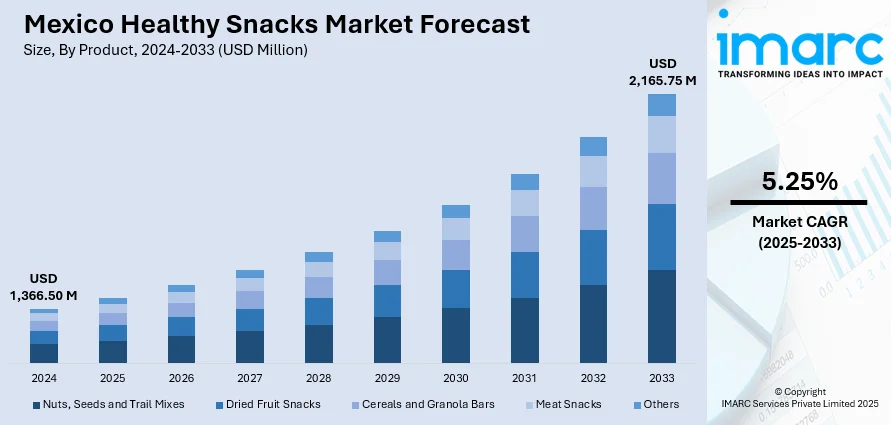

The Mexico healthy snacks market size reached USD 1,366.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,165.75 Million by 2033, exhibiting a growth rate (CAGR) of 5.25% during 2025-2033. The market is driven by health-focused policy reforms and consumer awareness, which are redirecting demand away from processed snacks toward functional alternatives. Urban retail development, combined with rising middle-class income and aspirational eating habits, is facilitating broader product access, thereby fueling the market. Digital commerce and influencer engagement are further personalizing snack choices and brand affinity, steadily augmenting the Mexico healthy snacks market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,366.50 Million |

| Market Forecast in 2033 | USD 2,165.75 Million |

| Market Growth Rate 2025-2033 | 5.25% |

Mexico Healthy Snacks Market Trends:

Growing Public Health Awareness and Nutritional Labeling Policies

The rising incidences of obesity, diabetes, and cardiovascular disorders in Mexico has led to a pronounced public health focus on nutrition and dietary reform. Government-led initiatives, such as front-of-pack warning labels for high sugar, sodium, and fat content, are reshaping consumer perceptions around traditional snack foods. As individuals become more aware of the health consequences of processed and calorically dense options, there is a growing shift toward nutrient-conscious snacking behaviors. Educational campaigns and nutritional guidelines promoted through schools and community health programs are also encouraging better food choices among children and adolescents. Mexico has launched a junk food ban in schools, with over 1,000 schools visited and 196,701 students assessed as part of the initiative, aiming to reach 11.8 million children. The 2023 National Health and Nutrition Survey found 37% of elementary students and 40% of adolescents are overweight or obese. As a result, consumers are increasingly prioritizing snacks that offer added health value, such as fiber-rich, low-sodium, or high-protein content. The rising prevalence of lifestyle diseases is pushing snack producers to reformulate products using natural sweeteners, whole grains, and functional ingredients. This regulatory and cultural shift is encouraging mainstream adoption of better-for-you options among middle-income households. Supermarkets and convenience stores are increasingly stocking shelves with healthier snack alternatives, including fruit bars, roasted legumes, and chia-based products. This confluence of government intervention and consumer re-education is creating a supportive environment for sustained Mexico healthy snacks market growth.

Digitally Enabled Health Trends and Direct-to-Consumer Growth

Mexico’s digital ecosystem is actively shaping consumer interaction with the healthy snacks segment, driven by rising smartphone penetration, online grocery platforms, and wellness-oriented social media content. Health-focused consumers are increasingly relying on mobile apps and websites to research nutritional content, discover new brands, and place recurring snack orders. Digital channels allow emerging brands to bypass traditional retail limitations and directly engage with health-conscious consumers through personalized subscriptions, bundled offers, and loyalty programs. E-commerce platforms, including both national players and global marketplaces, are amplifying the discoverability of niche snack products that cater to vegan, gluten-free, or diabetic-friendly needs. Moreover, influencers and fitness coaches are curating content around mindful eating, further validating healthy snacking as part of aspirational lifestyles. Local startups and bigger brands are capitalizing on this momentum by offering plant-based snacks, energy bites, and zero-sugar treats through flexible delivery models. On November 19, 2024, LALA® launched its LALA Gold high-protein yogurts, available in both drinkable and spoonable options. The drinkable version contains 25g of protein, 6g of fiber, and no added sugar per 10 oz serving, while the spoonable cups have 20g of protein and active probiotics. LALA Gold is offered in five flavors, designed to cater to health-conscious consumers looking for a nutritious snack. Digital marketing campaigns emphasize ingredient transparency and product benefits, creating stronger emotional connections with consumers. The convergence of digital commerce, wellness culture, and convenience is enabling a high-growth environment where consumer experimentation and brand loyalty flourish. These shifts are driving long-term structural changes in snack purchasing behavior across both urban and semi-urban regions.

Mexico Healthy Snacks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Nuts, Seeds and Trail Mixes

- Dried Fruit Snacks

- Cereals and Granola Bars

- Meat Snacks

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes nuts, seeds and trail mixes, dried fruit snacks, cereals and granola bars, meat snacks, and others.

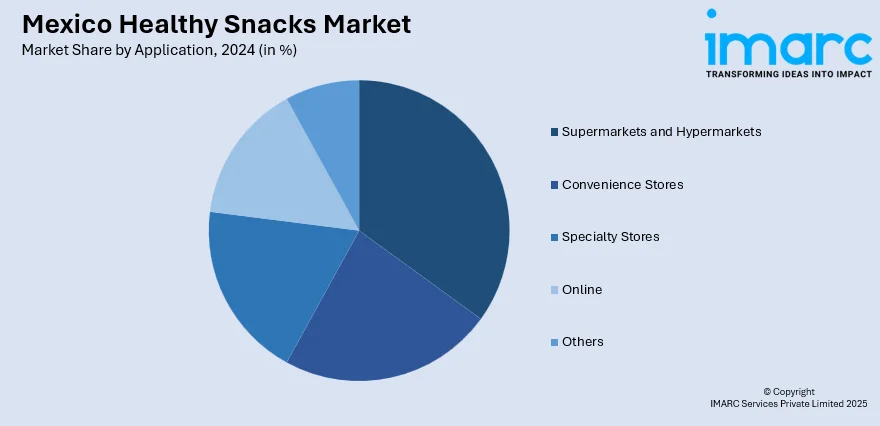

Application Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Healthy Snacks Market News:

- On March 3, 2025, Avocados From Mexico launched the "Good Fats Meet Great Taste" campaign in select Kroger stores to promote heart-healthy eating during National Nutrition Month. The campaign highlights the nutritional benefits of avocados, such as healthy fats and key vitamins, and supports the American Heart Association’s Healthy for Good Initiative.

Mexico Healthy Snacks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Nuts, Seeds, and Trail Mixes, Dried Fruit Snacks, Cereals and Granola Bars, Meat Snacks, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico healthy snacks market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico healthy snacks market on the basis of product?

- What is the breakup of the Mexico healthy snacks market on the basis of application?

- What is the breakup of the Mexico healthy snacks market on the basis of region?

- What are the various stages in the value chain of the Mexico healthy snacks market?

- What are the key driving factors and challenges in the Mexico healthy snacks market?

- What is the structure of the Mexico healthy snacks market and who are the key players?

- What is the degree of competition in the Mexico healthy snacks market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico healthy snacks market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico healthy snacks market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico healthy snacks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)