Mexico Heat Exchanger Tubes Market Size, Share, Trends and Forecast by Material Type, Product Type, Tube Configuration, Distribution Channel, End Use Industry, and Region, 2025-2033

Mexico Heat Exchanger Tubes Market Overview:

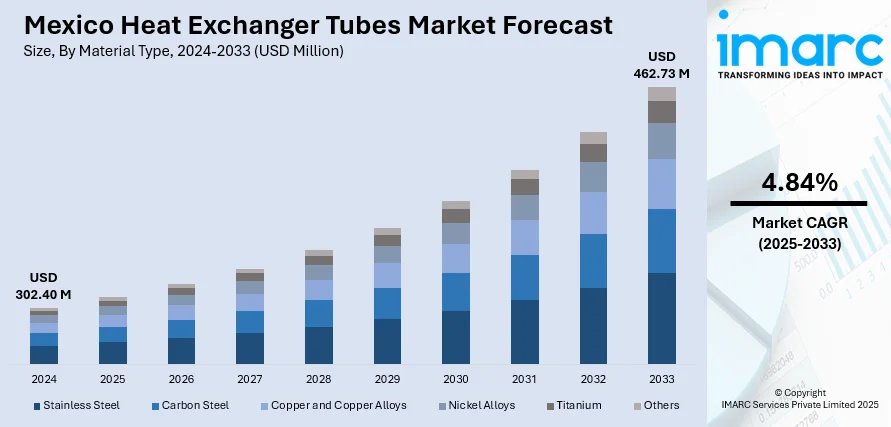

The Mexico heat exchanger tubes market size reached USD 302.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 462.73 Million by 2033, exhibiting a growth rate (CAGR) of 4.84% during 2025-2033. The rising energy efficiency need, industrialization, technological advancement, and growing infrastructure development are boosting the market growth. Moreover, environment policies, increasing automation, oil and gas, power generation, and manufacturing sector demand, and shifting towards green energy resources are boosting the market growth. Apart from this, green building activities, growing concern towards low-cost solutions, government support for energy-efficient technology, and ongoing emphasis on temperature control within the food and beverage industry are the factors driving the Mexico heat exchanger tubes market share

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 302.40 Million |

| Market Forecast in 2033 | USD 462.73 Million |

| Market Growth Rate 2025-2033 | 4.84% |

Mexico Heat Exchanger Tubes Market Trends:

Growing Demand for Energy-Efficient Systems

In Mexico, the demand for energy efficiency in different industries is one of the main drivers for the heat exchanger tubes industry. With companies and industries looking to contain their operational expenses and lower their carbon footprint, energy-saving systems have become a point of focus. A Science Direct report shows that industrial energy consumption represents almost 30% of the total energy consumption in the nation, pointing out the great potential to save energy using efficient technologies such as heat exchangers. Heat exchangers are key elements in such systems since they facilitate heat transfer between fluids without mixing, which is essential in maximizing the use of energy. Sectors like oil and gas, generation, and manufacturing depend significantly on heat exchangers for effective heat recovery and management. With the current energy reforms and environmental policies implemented in Mexico, there is a growing demand for technologies that enhance energy savings. Businesses are increasingly looking to invest in heat exchangers that result in improved performance and lower overall energy usage, further propelling the Mexico heat exchanger tubes market growth.

Industrialization and Infrastructure Development

Mexico's rapid industrialization and infrastructure growth are major contributors to the heat exchanger tubes industry. The recent decades have seen great growth in industries such as motor vehicles, manufacturing, and chemicals, which consume great amounts of heat exchanger tubes. With businesses expanding their operations and getting modernized, there is an increased need for advanced heat exchange units to render production processes cost-effective and cost-saving. Additionally, with new factories and manufacturing plants being built or redeveloped, the need for high-performance heat exchangers to perform production processes at maximum temperature conditions rises. Heat exchangers are a fundamental part of most industrial processes, ranging from the control of the temperature needed in reactors and boilers to power plant cooling systems. The automotive sector, for example, relies on them for engine cooling and other temperature control functions. With Mexico's infrastructure continuing to expand, with mega-projects such as new factories, power plants, and refineries on the horizon, heat exchanger tubes will be increasingly needed.

Advancements in Heat Exchanger Tube Designs and Automation

Advances in the tube design and heat exchanger innovation are also driving the market in Mexico. Using new materials, better designs for tubes, and the utilization of innovative manufacturing methods, heat exchangers are better in terms of performance and durability, enabling industries to enhance the performance of their processes as well as lower the cost of energy. Industrial process automation is a major trend over the past few years. Automation offers precision and dependability in the operation of the heat exchanger, such that there is enhanced energy management along with enhanced efficiency in heat transfer. Mexican businesses, mainly those in manufacturing, automotive, and petroleum and natural gas industries, are increasingly viewing automated solutions as more desirable in a bid to enhance their operations. Heat exchangers are getting smarter with the evolution of technologies, with features such as advanced self-monitoring systems that enable companies to detect issues before they become serious problems. In addition, technology innovations on the tubes such as corrosion-resistant alloys and enhanced coatings boost the life span of the heat exchanger at a lower cost of maintenance.

Mexico Heat Exchanger Tubes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on material type, product type, tube configuration, distribution channel, and end use industry.

Material Type Insights:

- Stainless Steel

- Carbon Steel

- Copper and Copper Alloys

- Nickel Alloys

- Titanium

- Others

The report has provided a detailed breakup and analysis of the market based on the material type. This includes stainless steel, carbon steel, copper and copper alloys, nickel alloys, titanium, and others.

Product Type Insights:

- Seamless Heat Exchanger Tubes

- Welded Heat Exchanger Tubes

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes seamless heat exchanger tubes and welded heat exchanger tubes.

Tube Configuration Insights:

- U-Tubes

- Straight Tubes

- Finned Tubes

The report has provided a detailed breakup and analysis of the market based on the tube configuration. This includes U-tubes, straight tubes, and finned tubes.

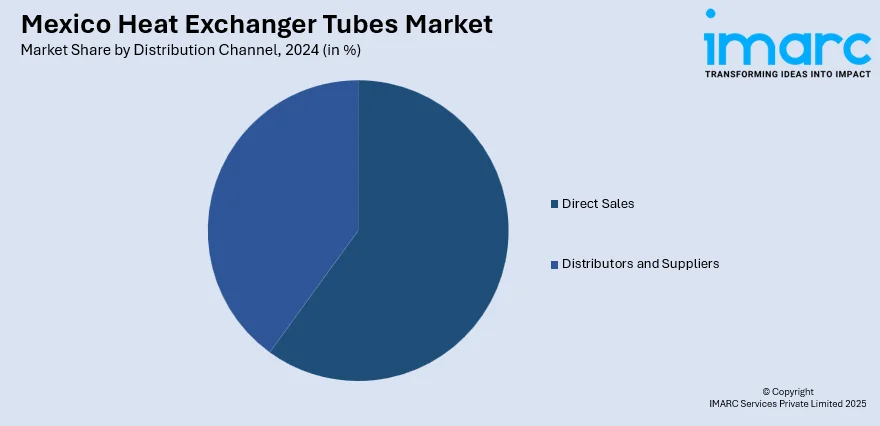

Distribution Channel Insights:

- Direct Sales

- Distributors and Suppliers

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes direct sales and distributors and suppliers.

End Use Industry Insights:

- Power Generation

- Oil and Gas

- Chemical and Petrochemical

- HVAC and Refrigeration

- Food and Beverage Processing

- Automotive and Aerospace

- Marine and Shipbuilding

- Pharmaceuticals

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes power generation, oil and gas, chemical and petrochemical, HVAC and refrigeration, food and beverage processing, automotive and aerospace, marine and shipbuilding, pharmaceuticals, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Heat Exchanger Tubes Market News:

- In 2023, NORAM Engineering fabricated a 4.1-meter diameter, 19.5-meter tall heat exchanger in Mexico, utilizing their patented Gas-to-Gas Split Flow technology to enhance operational efficiency in sulfuric acid plants.

Mexico Heat Exchanger Tubes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Stainless Steel, Carbon Steel, Copper and Copper Alloys, Nickel Alloys, Titanium, Others |

| Product Types Covered | Seamless Heat Exchanger Tubes, Welded Heat Exchanger Tubes |

| Tube Configurations Covered | U-Tubes, Straight Tubes, Finned Tubes |

| Distribution Channels Covered | Direct Sales, Distributors and Suppliers |

| End Use Industries Covered | Power Generation, Oil and Gas, Chemical and Petrochemical, HVAC and Refrigeration, Food and Beverage Processing, Automotive and Aerospace, Marine and Shipbuilding, Pharmaceuticals, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico heat exchanger tubes market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico heat exchanger tubes market on the basis of material type?

- What is the breakup of the Mexico heat exchanger tubes market on the basis of product type?

- What is the breakup of the Mexico heat exchanger tubes market on the basis of tube configuration?

- What is the breakup of the Mexico heat exchanger tubes market on the basis of distribution channel?

- What is the breakup of the Mexico heat exchanger tubes market on the basis of end use industry?

- What is the breakup of the Mexico heat exchanger tubes market on the basis of region?

- What are the various stages in the value chain of the Mexico heat exchanger tubes market?

- What are the key driving factors and challenges in the Mexico heat exchanger tubes market?

- What is the structure of the Mexico heat exchanger tubes market and who are the key players?

- What is the degree of competition in the Mexico heat exchanger tubes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico heat exchanger tubes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico heat exchanger tubes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico heat exchanger tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)