Mexico Heat Reflective Roof Coatings Market Size, Share, Trends and Forecast by Type, Resin Type, Application, and Region, 2025-2033

Mexico Heat Reflective Roof Coatings Market Overview:

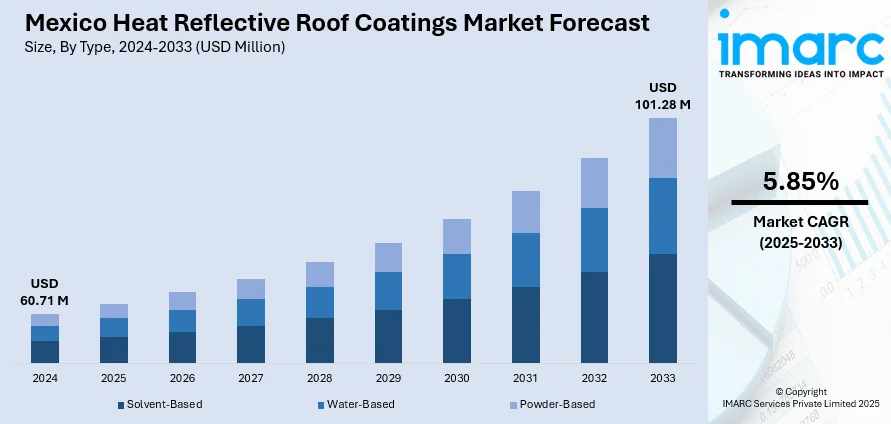

The Mexico heat reflective roof coatings market size reached USD 60.71 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 101.28 Million by 2033, exhibiting a growth rate (CAGR) of 5.85% during 2025-2033. The market is propelled by Mexico's endeavor for energy-efficient infrastructure, with increasing incorporation of reflective coatings within urban and industrial constructions. Residential demand is also rising as residential property owners look for affordable cooling methods in the context of growing temperatures. These coatings provide thermal comfort, lower energy consumption, and correspond to climate adaptation initiatives within industries. Implementation in new builds and retrofitting initiatives is progressively increasing. These aspects all collectively contribute to the increasing Mexico heat reflective roof coatings market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 60.71 Million |

| Market Forecast in 2033 | USD 101.28 Million |

| Market Growth Rate 2025-2033 | 5.85% |

Mexico Heat Reflective Roof Coatings Market Trends:

Increasing Integration in Energy-Efficient Urban Development

Heat reflective roof coatings in Mexico are being well supported by the increasing interest of the country in sustainable urban development. With urban areas facing increased temperatures and energy expenses, municipal and private builders are turning to reflective coatings in order to reduce indoor temperatures and decrease the need for air conditioning. As per the reports, in October 2024, NanoTech Materials' Cool Roof Coat was also selected by TIME as Best Invention for its potential to decrease HVAC energy consumption by as much as 50%, highlighting dramatic progress in green building technologies. Moreover, these coatings improve thermal performance in new construction and retrofitting initiatives, in line with energy efficiency targets in Mexico's urban regions. They also reinforce passive cooling techniques that are increasing in popularity in building design. Media campaigns and growing institutional backing for green construction are also propelling adoption. This transition highlights the role of reflective coatings within the larger climate-resilient infrastructure movement. The growth of sustainable urban planning and energy-efficient technologies is a major driver for Mexico heat reflective roof coatings market growth, particularly in regions experiencing extreme heat and high population density.

Take-Up Across Commercial and Industrial Infrastructure

Commercial and industrial infrastructure in Mexico are quickly embracing heat reflective roof coatings to control operating expenditures and achieve sustainability objectives. Warehouses, factories, and office facilities usually receive high solar intensities, which can result in indoor excess heat accumulation. Reflective coatings serve as an effective solution by reflecting solar radiation and maintaining internal temperatures stable without significant structural modifications. This not only lowers heating, ventilation, and air conditioning (HVAC) system loads but also aids in the durability of roofing material through the reduction of thermal stress and ultraviolet (UV) degradation. Industrial complexes in northern and central Mexico, with their high ambient temperatures, are especially predisposed toward such coatings. Furthermore, tax credits and regulatory guidelines supporting energy-efficient retrofits have resulted in increasing stakeholder adoption across the logistics, food processing, and heavy manufacturing sectors. Through this strategic deployment in large-scale facilities, Mexico heat reflective roof coatings growth is becoming a priority in long-term facility planning.

Growth in Residential Use due to Climate Adaptation

Mexico's residential building industry is increasingly adopting heat reflective roof coatings as part of overall climate adaptation strategies. As more frequent heatwaves and increased temperature impacts are experienced throughout much of the nation, homeowners and builders alike are looking for passive cooling techniques to enhance indoor comfort without considerable increases in energy use. Reflective coatings provide an affordable, low-maintenance option for both city and rural dwellings. New residential developments, especially in central and southern regions, are incorporating these coatings as standard or optional features, a trend that indicates a change in consumer preference toward environmental sustainability. Local and government housing schemes are also promoting the use of reflective roofing as an add-on to thermal efficiency packages. As more families experience the physical benefits of keeping their homes cooler inside and lowering their utility bills, the demand keeps increasing. This universal adoption within private homes is contributing significantly to Mexico heat reflective roof coatings growth, particularly in weather-susceptible communities.

Mexico Heat Reflective Roof Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, resin type, and application.

Type Insights:

- Solvent-Based

- Water-Based

- Powder-Based

The report has provided a detailed breakup and analysis of the market based on the type. This includes solvent-based, water-based, and powder-based.

Resin Type Insights:

- Epoxy

- Polyester

- Silicon

- Acrylic

A detailed breakup and analysis of the market based on the resin type have also been provided in the report. This includes epoxy, polyester, silicon, and acrylic.

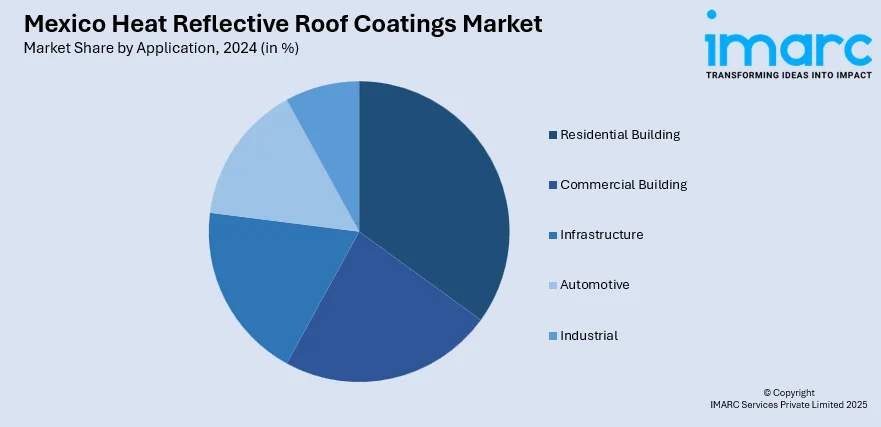

Application Insights:

- Residential Building

- Commercial Building

- Infrastructure

- Automotive

- Industrial

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential building, commercial building, infrastructure, automotive, and industrial.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Heat Reflective Roof Coatings Market News:

- In February 2024, Mérida introduced the 'Green Roof' program that grants home owners of solar roofs or roof gardens an additional 15% discount on monthly property charges. The program promotes green roofing to mitigate urban heat and pollution, advancing climate action and environmental resilience for residential spaces.

Mexico Heat Reflective Roof Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Solvent-Based, Water-Based, Powder-Based |

| Resin Types Covered | Epoxy, Polyester, Silicon, Acrylic |

| Applications Covered | Residential Building, Commercial Building, Infrastructure, Automotive, Industrial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico heat reflective roof coatings market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico heat reflective roof coatings market on the basis of type?

- What is the breakup of the Mexico heat reflective roof coatings market on the basis of resin type?

- What is the breakup of the Mexico heat reflective roof coatings market on the basis of application?

- What is the breakup of the Mexico heat reflective roof coatings market on the basis of region?

- What are the various stages in the value chain of the Mexico heat reflective roof coatings market?

- What are the key driving factors and challenges in the Mexico heat reflective roof coatings?

- What is the structure of the Mexico heat reflective roof coatings market and who are the key players?

- What is the degree of competition in the Mexico heat reflective roof coatings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico heat reflective roof coatings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico heat reflective roof coatings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico heat reflective roof coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)