Mexico Heavy Machinery Components Market Size, Share, Trends and Forecast by Component Type, Material Type, Machinery Type, Sales Channel, End Use Industry, and Region, 2025-2033

Mexico Heavy Machinery Components Market Overview:

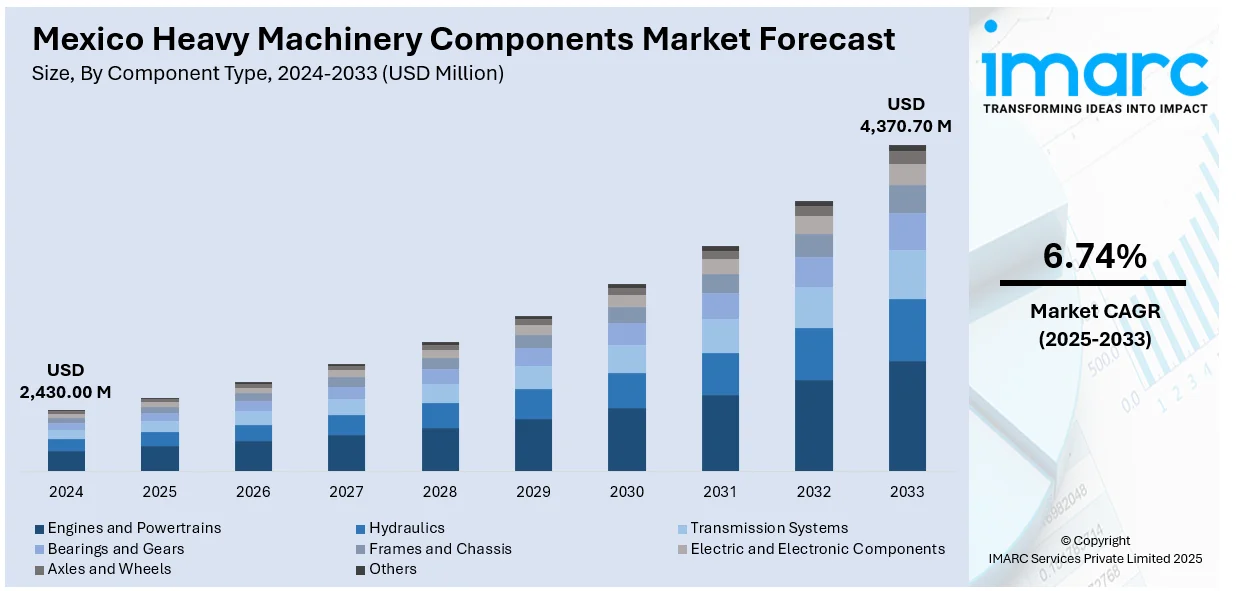

The Mexico heavy machinery components market size reached USD 2,430.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,370.70 Million by 2033, exhibiting a growth rate (CAGR) of 6.74% during 2025-2033. Energy-efficient steel production and increased certification standards are driving demand for precision-grade components in Mexico’s manufacturing sector. These trends support industrial growth and enhance product reliability, contributing to the expansion of the Mexico heavy machinery components market share across key application segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,430.00 Million |

| Market Forecast in 2033 | USD 4,370.70 Million |

| Market Growth Rate 2025-2033 | 6.74% |

Mexico Heavy Machinery Components Market Trends:

Focus on Energy-Efficient Production

The increasing preference for sustainable and cost-conscious steel production is contributing to the evolution of Mexico’s heavy machinery components market. As manufacturers seek better efficiency and lower environmental impact, energy-saving metallurgical innovations are gaining momentum. Electric Arc Furnaces (EAFs), particularly those with scrap preheating features, have become central to this shift. These technologies not only reduce energy consumption but also ensure a consistent flow of high-grade steel required for precision-heavy machinery parts. In May 2024, TYASA and Primetals Technologies celebrated 10 years of continuous operation of the world’s first EAF Quantum in Mexico. The facility completed 77,000 heats and demonstrated the long-term benefits of advanced scrap-preheating technology. This achievement underlines how cleaner, efficient steelmaking supports the component industry by supplying dependable material inputs. Such operational efficiencies are translating into faster production timelines and greater reliability for local component suppliers. By reducing energy use per heat and increasing yield, the EAF Quantum has improved the availability of precision steel grades needed in large machinery, construction equipment, and industrial tools. The emphasis on energy-smart steel production is not just an environmental response but a competitive edge for Mexico’s heavy machinery ecosystem, where material quality and delivery time have become key business priorities.

Rising Emphasis on Quality Certifications

A growing focus on global quality benchmarks and safety standards is reshaping the manufacturing landscape for heavy machinery components in Mexico. Companies are aligning their production with international compliance requirements to cater to both domestic and export-oriented sectors. This is leading to increased investments in product testing, materials validation, and third-party certifications. Manufacturers are now expected to offer components that meet precise tolerances, durability benchmarks, and environmental safety norms, especially for applications in automotive, construction, and industrial machinery. In November 2024, UL Solutions expanded its laboratory facility in Querétaro, adding new testing capabilities for automotive components and industrial materials. The facility also received certification as a Volkswagen partner lab, allowing it to serve OEMs and tier suppliers with validated testing and faster certification timelines. This expansion strengthens Mexico’s ability to produce high-precision components that meet the rigorous expectations of global brands. It also offers localized compliance support, which accelerates market readiness and improves trust in locally produced machinery parts. As more multinational companies source components from Mexico, the presence of certified labs enables domestic suppliers to match global quality levels. This trend is directly contributing to Mexico heavy machinery components market growth, positioning the country as a reliable source of certified, performance-validated components for global and regional manufacturing needs.

Mexico Heavy Machinery Components Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on component type, material type, machinery type, sales channel, and end use industry.

Component Type Insights:

- Engines and Powertrains

- Hydraulics

- Pumps

- Valves

- Cylinders

- Transmission Systems

- Bearings and Gears

- Frames and Chassis

- Electric and Electronic Components

- Axles and Wheels

- Others

The report has provided a detailed breakup and analysis of the market based on the component type. This includes engines and powertrains, hydraulics (pumps, valves, and cylinders), transmission systems, bearings and gears, frames and chassis, electric and electronic components, axles and wheels, and others.

Material Type Insights:

- Steel

- Aluminum

- Cast Iron

- Composites

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes steel, aluminum, cast iron, composites, and others.

Machinery Type Insights:

- Construction Equipment

- Mining Equipment

- Agriculture Equipment

- Industrial Machinery

- Oil and Gas Equipment

- Others

The report has provided a detailed breakup and analysis of the market based on the machinery type. This includes construction equipment, mining equipment, agriculture equipment, industrial machinery, oil and gas equipment, and others.

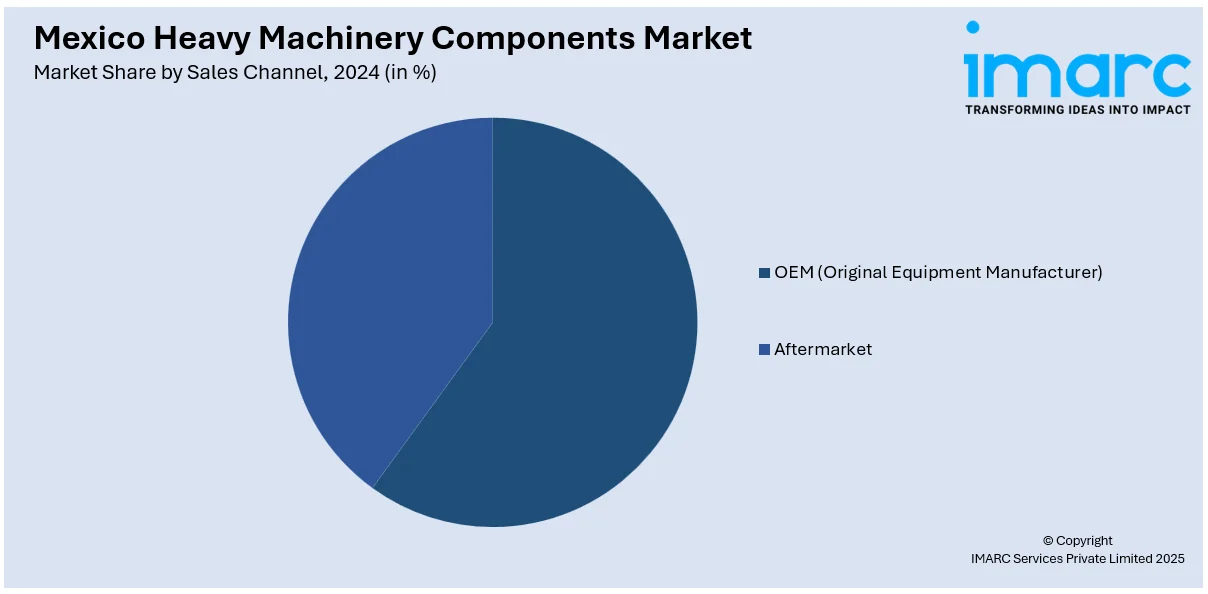

Sales Channel Insights:

- OEM (Original Equipment Manufacturer)

- Aftermarket

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes OEM (original equipment manufacturer) and aftermarket.

End Use Industry Insights:

- Construction and Infrastructure

- Mining and Metallurgy

- Agriculture

- Manufacturing

- Oil and Gas

- Energy and Power

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes construction and infrastructure, mining and metallurgy, agriculture, manufacturing, oil and gas, energy and power, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Heavy Machinery Components Market News:

- April 2025: ESEASA expanded its heavy machinery fleet in Mexico by acquiring five Liebherr mobile cranes, including two LTM 1650-8.1 units. This bolstered demand for advanced crane components, supporting growth in wind, oil, and infrastructure projects, and strengthening Mexico’s heavy machinery components market.

- June 2024: Bobcat began construction on a USD 300 Million, 700,000 sq. ft. facility in Salinas Victoria, Mexico. Aimed at producing compact loaders, the project strengthened local demand for heavy machinery components and signaled rising investment and production capacity in Mexico’s equipment manufacturing sector.

Mexico Heavy Machinery Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered |

|

| Material Types Covered | Steel, Aluminum, Cast Iron, Composites, Others |

| Machinery Types Covered | Construction Equipment, Mining Equipment, Agriculture Equipment, Industrial Machinery, Oil and Gas Equipment, Others |

| Sales Channels Covered | OEM (Original Equipment Manufacturer), Aftermarket |

| End Use Industries Covered | Construction and Infrastructure, Mining and Metallurgy, Agriculture, Manufacturing, Oil and Gas, Energy and Power, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico heavy machinery components market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico heavy machinery components market on the basis of component type?

- What is the breakup of the Mexico heavy machinery components market on the basis of material type?

- What is the breakup of the Mexico heavy machinery components market on the basis of machinery type?

- What is the breakup of the Mexico heavy machinery components market on the basis of sales channel?

- What is the breakup of the Mexico heavy machinery components market on the basis of end use industry?

- What is the breakup of the Mexico heavy machinery components market on the basis of region?

- What are the various stages in the value chain of the Mexico heavy machinery components market?

- What are the key driving factors and challenges in the Mexico heavy machinery components market?

- What is the structure of the Mexico heavy machinery components market and who are the key players?

- What is the degree of competition in the Mexico heavy machinery components market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico heavy machinery components market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico heavy machinery components market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico heavy machinery components industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)