Mexico Home Furnishings Market Size, Share, Trends and Forecast by Product, Price, Distribution Channel, and Region, 2026-2034

Mexico Home Furnishings Market Summary:

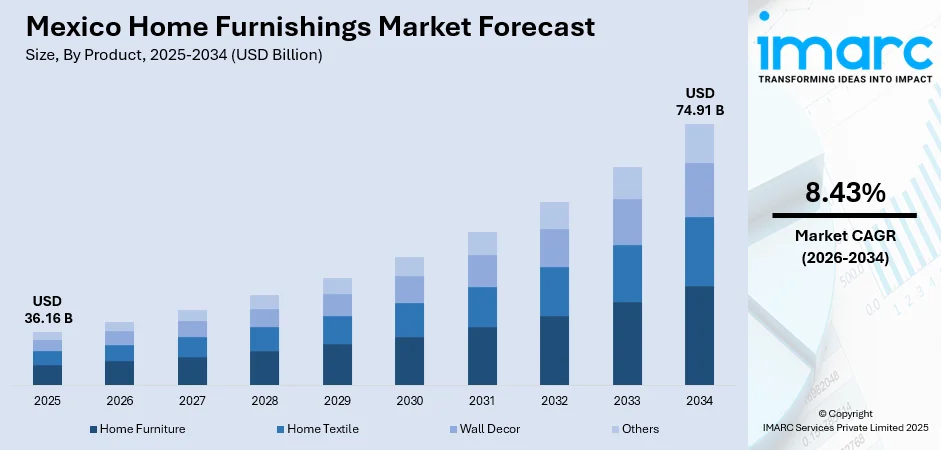

The Mexico home furnishings market size was valued at USD 36.16 Billion in 2025 and is projected to reach USD 74.91 Billion by 2034, growing at a compound annual growth rate of 8.43% from 2026-2034.

The Mexico home furnishings market is experiencing sustained expansion, driven by rapid urbanization across metropolitan areas, rising disposable incomes among the growing middle-class population, and evolving consumer preferences towards modern interior aesthetics. The proliferation of digital retail platforms has changed buying habits, enabling consumers to access a diverse range of home furnishing products from domestic and international brands. Additionally, the increasing emphasis on sustainable and eco-friendly furnishings, coupled with the integration of smart furniture technologies, is reshaping consumer demand patterns.

Key Takeaways and Insights:

-

By Product: Home furniture dominates the market with a share of 48.05% in 2025, owing to the growing demand for multifunctional living and dining room furniture, increased housing construction activities, and consumer preference for aesthetically appealing wooden furniture pieces that combine traditional craftsmanship with modern design sensibilities.

-

By Price: Mass leads the market with a share of 72.04% in 2025, owing to the expanding middle-class population seeking affordable yet stylish home furnishing solutions, the proliferation of value-oriented retail chains, and consumer preference for cost-effective furniture options that deliver quality without premium pricing.

-

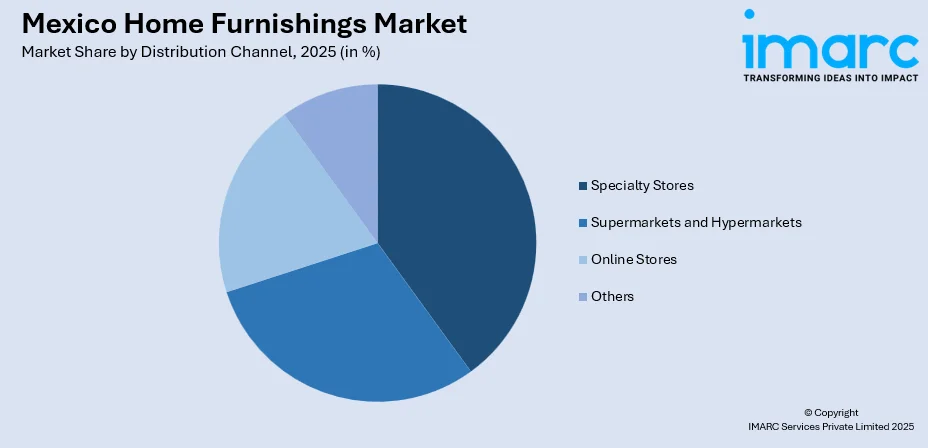

By Distribution Channel: Specialty stores represent the largest segment with a market share of 28.05% in 2025, reflecting consumer preference for personalized shopping experiences, expert product guidance, and the ability to physically examine furniture quality, design, and craftsmanship before making significant purchasing decisions.

-

By Region: Central Mexico comprises the largest region with 34% share in 2025, driven by the concentration of Mexico's urban population in Mexico City metropolitan area, higher household disposable incomes, established retail infrastructure, and the presence of major domestic and international home furnishing brands catering to diverse consumer segments.

-

Key Players: Key players drive the Mexico home furnishings market by expanding product portfolios, enhancing omnichannel distribution strategies, and investing in sustainable manufacturing practices. Their focus on localized production, digital transformation, and strategic partnerships strengthens market positioning and ensures consistent product availability across diverse consumer segments.

To get more information on this market Request Sample

The Mexico home furnishings market is witnessing transformative growth, propelled by the country's dynamic economic landscape and shifting consumer demographics. Rapid urbanization has fundamentally altered residential living patterns, with compact apartments and modern housing developments driving the demand for space-efficient and multifunctional furniture solutions. The expansion of e-commerce platforms has revolutionized how Mexican consumers discover and purchase home furnishing products, providing unprecedented access to diverse product offerings and competitive pricing. According to IMARC Group, the Mexico e-commerce market was valued at USD 54.4 Billion in 2025, significantly influencing home furnishing purchasing behaviors through digital channels. The growing influence of international interior design trends, amplified through social media platforms, is shaping consumer preferences towards contemporary aesthetics while maintaining appreciation for traditional Mexican craftsmanship. Furthermore, the nearshoring trend has attracted substantial manufacturing investments, strengthening domestic production capabilities and supply chain efficiency.

Mexico Home Furnishings Market Trends:

Smart Furniture and Space-Saving Solutions

The integration of technology into home furnishings represents a growing trend, with smart furniture solutions gaining traction among Mexican consumers. Products featuring integrated charging ports, adjustable settings, and connectivity features compatible with smart home systems appeal particularly to tech-savvy urban dwellers. Additionally, the demand for modular and multifunctional furniture has intensified, especially in metropolitan areas where compact living spaces require innovative designs such as convertible sofas, foldable desks, and storage-integrated furniture pieces. As per IMARC Group, the Mexico modular furniture market size reached USD 1.70 Billion in 2024.

Sustainability and Eco-Friendly Furnishings

Sustainability has emerged as a defining trend in the Mexico home furnishings market, with consumers demonstrating growing preference for eco-friendly products crafted from reclaimed wood, organic textiles, and natural dyes. Local craftsmanship in ceramics, textiles, and handmade items appeals to Mexican consumers who desire authenticity and cultural ties. Retailers and manufacturers are incorporating environmental certifications to validate sustainable claims, while digital platforms enable artisans to showcase their work nationally, supporting both environmental consciousness and heritage preservation.

Digital Transformation and E-Commerce Expansion

The Mexico home furnishings market is experiencing a significant digital transformation, as consumers increasingly embrace online shopping platforms for furniture purchases. As per industry reports, in 2023, Mexico's online sales amounted to USD 74 Billion and are expected to reach USD 176.8 Billion by 2026. E-commerce channels offer extensive product selections, virtual room planning tools, and augmented reality (AR) applications that enable customers to visualize furniture in their living spaces. Major retailers have developed sophisticated omnichannel strategies, integrating physical showrooms with digital platforms to provide seamless shopping experiences that combine tactile product evaluation with online convenience and delivery services.

Market Outlook 2026-2034:

The Mexico home furnishings market demonstrates robust growth potential throughout the forecast period, supported by favorable demographic trends and economic expansion. Continued urbanization, rising household formation rates, and increasing consumer spending on home improvement are expected to sustain market momentum. The market generated a revenue of USD 36.16 Billion in 2025 and is projected to reach a revenue of USD 74.91 Billion by 2034, growing at a compound annual growth rate of 8.43% from 2026-2034. Strategic investments from international retailers and domestic manufacturing capabilities enhancement through nearshoring initiatives position the market for sustained expansion.

Mexico Home Furnishings Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Home Furniture |

48.05% |

|

Price |

Mass |

72.04% |

|

Distribution Channel |

Specialty Stores |

28.05% |

|

Region |

Central Mexico |

34% |

Product Insights:

- Home Furniture

- Home Textile

- Wall Decor

- Others

Home furniture dominates with a market share of 48.05% of the total Mexico home furnishings market in 2025.

The home furniture segment maintains market leadership, driven by sustained housing construction activities and evolving consumer preferences for contemporary interior aesthetics. Living room and dining room furniture categories command significant demand as Mexican households prioritize multifunctional spaces that accommodate modern lifestyle requirements. The segment benefits from the availability of diverse material options, including traditional wood varieties and innovative sustainable alternatives that appeal to environmentally conscious consumers.

Mexican furniture manufacturers have leveraged traditional woodworking expertise while incorporating modern design elements to create products that resonate with domestic and international markets. In November 2024, IKEA inaugurated its largest store in Mexico, spanning 37,000 square meters in Guadalajara, featuring over 8,400 products and representing a significant investment of approximately USD 147 Million in the country's furniture retail infrastructure. While exploring collaborations with additional Mexican furniture manufacturers, IKEA Guadalajara is poised to become a prime spot for quality home furnishings, blending Scandinavian aesthetics with a Mexican flair to cater to a burgeoning, design-savvy community. The segment's growth trajectory is supported by rising disposable incomes and the expansion of omnichannel distribution networks.

Price Insights:

- Mass

- Premium

Mass leads with a share of 72.04% of the total Mexico home furnishings market in 2025.

The mass segment dominates the Mexico home furnishings market, as affordability remains a primary purchasing consideration for the majority of Mexican households. The expanding middle-class population demonstrates strong preference for value-oriented furniture solutions that balance quality, functionality, and aesthetic appeal without commanding premium prices. Retailers have responded by developing extensive product portfolios catering to budget-conscious consumers while maintaining acceptable quality standards through efficient manufacturing processes.

The proliferation of large-format retail chains and discount furniture outlets has significantly enhanced accessibility to mass-segment home furnishing products across Mexico's diverse geographic regions. In April 2024, Home Depot, the renowned home improvement chain, announced an investment of MXN 2.86 Billion (USD 172.16 Million) in Mexico, expanding its store count towards 150 locations to serve value-oriented consumers. This investment reflects the segment's substantial growth potential and strategic importance for major retailers.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

Specialty stores exhibit a clear dominance with a 28.05% share of the total Mexico home furnishings market in 2025.

Specialty stores maintain market leadership in the distribution channel segment as consumers value personalized shopping experiences and expert product guidance when making significant furniture purchases. These retail establishments offer curated product selections, professional interior design consultations, and the opportunity for customers to physically evaluate furniture quality, comfort, and craftsmanship. The tactile nature of furniture purchasing favors specialty retailers who can provide comprehensive product demonstrations and after-sales services.

Specialty furniture retailers have implemented sophisticated omnichannel strategies, combining traditional showroom advantages with digital capabilities to enhance customer engagement. Many specialty stores have developed lifestyle-oriented showroom concepts that display furniture in realistic room settings, helping customers visualize products within their home environments. According to the National Chamber of Commerce, the number of specialized home textile stores in Monterrey increased by 40% between 2022 and 2023, reflecting the channel's continued expansion across major metropolitan areas.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Central Mexico represents the leading segment with a 34% share of the total Mexico home furnishings market in 2025.

Central Mexico dominates the regional landscape, driven by the concentration of Mexico's urban population within the Mexico City metropolitan area and surrounding states. The region benefits from higher household disposable incomes, established retail infrastructure, and the presence of major domestic and international home furnishing retailers. The demographic density and economic activity in Central Mexico create substantial demand for diverse home furnishing products across all price segments and distribution channels.

The region's real estate development activities, including residential and commercial construction projects, generate consistent demand for furniture and interior furnishing solutions. In July 2024, Mexican firms JSa and Mta+v collaborated to design a curvilinear housing complex in Mexico City, featuring three volumes encircling a central spiral staircase that ascended to a rooftop garden. The presence of flagship stores from global retailers alongside traditional Mexican furniture manufacturers provides consumers with extensive product choices spanning mass-market to premium categories.

Market Dynamics:

Growth Drivers:

Why is the Mexico Home Furnishings Market Growing?

Rapid Urbanization and Expanding Residential Construction

Rapid urbanization is a major factor driving the Mexico home furnishings market, supported by continuous growth in residential construction. As per macrotrends, in Mexico, the urban population for 2023 reached 105,844,290. Expansion of apartments, housing complexes, and mixed-use developments increases demand for furniture, décor, and functional home accessories. New homeowners typically invest in complete furnishing solutions, including living room, bedroom, kitchen, and storage products. Urban lifestyles also favor space-efficient and multifunctional furniture, boosting replacement and upgrade cycles. As cities expand, demand rises not only from new homes but also from renovation and remodeling activities in older properties. Growing population density encourages modern interior layouts, increasing consumption of contemporary furnishings. Real estate development across urban and peri-urban areas ensures a steady pipeline of demand. This sustained housing growth creates consistent opportunities for manufacturers and retailers. As residential infrastructure continues to expand nationwide, home furnishings remain a core consumption category supporting long-term market growth.

Changing Consumer Lifestyles and Interior Design Preferences

Changing lifestyles and evolving interior design preferences strongly influence the Mexico home furnishings market. Consumers increasingly prioritize modern, functional, and visually appealing living spaces. Exposure to global design trends through digital platforms shapes preferences for contemporary, minimalist, and multifunctional furniture. Work-from-home culture increases demand for home office furniture, ergonomic seating, and organized storage solutions. Smaller living spaces drive interest in modular and space-saving designs. Consumers also seek coordinated furniture collections that enhance overall home aesthetics. Increased focus on comfort, organization, and personalization fuels frequent upgrades. Seasonal décor changes and lifestyle transitions, such as marriage or relocation, further support purchases. As homes become multifunctional spaces for work, leisure, and social interaction, demand for versatile furnishings grows. These evolving preferences continuously reshape consumption patterns, making lifestyle change a significant market driver.

Growth of Organized Retail and E-Commerce Channels

The expansion of organized retail and e-commerce platforms is significantly driving the market growth in Mexico. Large-format furniture stores and specialty home décor outlets improve product accessibility and customer experience. Consumers benefit from wide product assortments, transparent pricing, and professional display layouts. Online platforms further simplify browsing, customization, and price comparison, encouraging higher purchase confidence. Digital channels also enable access to urban and semi-urban consumers previously underserved by physical stores. Home delivery, installation services, and flexible return policies reduce purchase barriers. Promotional campaigns and financing options, including digital wallets, offered through organized retailers, stimulate demand. As per IMARC Group, the Mexico digital wallet market size reached USD 2.6 Billion in 2024. Integration of online and offline retail enhances convenience and reach. As consumers increasingly prefer structured and reliable purchasing environments, organized retail and e-commerce continue to strengthen market penetration across Mexico’s home furnishings sector.

Market Restraints:

What Challenges the Mexico Home Furnishings Market is Facing?

Rising Raw Material Costs and Inflation

Fluctuations in raw material prices, driven by inflationary pressures, impact production costs across the home furnishings industry. Wood, textiles, and metal components experience periodic price volatility that affects manufacturer margins and ultimately influences consumer pricing. These cost pressures challenge manufacturers seeking to maintain competitive pricing while preserving product quality standards.

Intense Competition from International Players

The Mexico home furnishings market faces intense competitive pressure from international retailers and imported products, particularly from Asian manufacturers offering competitive pricing. Domestic producers must balance quality and pricing considerations while differentiating through design innovation and local market understanding. The competitive landscape creates pricing pressures that challenge smaller manufacturers and traditional artisanal producers.

Supply Chain Disruptions and Logistics Challenges

In Mexico, supply chain complexities continue to challenge the home furnishings industry, affecting inventory management, delivery timelines, and operational efficiency. Logistics infrastructure limitations in certain regions impact distribution capabilities and product availability. These challenges require ongoing investments in supply chain optimization and distribution network enhancement to ensure consistent market service.

Competitive Landscape:

The Mexico home furnishings market exhibits a fragmented competitive landscape, characterized by the presence of international retail chains, domestic manufacturers, and regional specialty retailers. Major international players have established significant market presence through strategic store expansion, product localization, and omnichannel distribution strategies. Domestic manufacturers leverage traditional craftsmanship heritage and local market expertise to differentiate their offerings. The competitive environment encourages continuous innovations in product design, sustainable manufacturing practices, and customer service excellence. Strategic investments in digital capabilities, supply chain optimization, and manufacturing efficiency enable market participants to strengthen competitive positioning while meeting evolving consumer expectations.

Recent Developments:

-

In September 2025, OPPEIN Mexico officially opened its new showroom, covering two floors committed to whole home furnishings. Assured in providing excellent furnishings to nearby shoppers, the brand was committed to becoming the go-to place for individuals looking for ideal homes.

Mexico Home Furnishings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Home Furniture, Home Textile, Wall Decor, Others |

| Prices Covered | Mass, Premium |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | Northern Mexico, Northern Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico home furnishings market size was valued at USD 36.16 Billion in 2025.

The Mexico home furnishings market is expected to grow at a compound annual growth rate of 8.43% from 2026-2034 to reach USD 74.91 Billion by 2034.

Home furniture dominated the market with a share of 48.05%, driven by sustained housing construction activities, consumer preferences for multifunctional furniture designs, and the availability of diverse product options spanning traditional craftsmanship to contemporary aesthetics.

Key factors driving the Mexico home furnishings market include rapid urbanization and housing development, rising disposable incomes among the expanding middle-class population, growth in e-commerce and digital retail channels, and increasing consumer preference for sustainable and eco-friendly home furnishing products.

Major challenges include rising raw material costs driven by inflationary pressures, intense competition from international players and imported products, supply chain disruptions and logistics complexities, and the need for continuous investment in digital transformation and omnichannel distribution capabilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)