Mexico Home Furniture Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2026-2034

Mexico Home Furniture Market Summary:

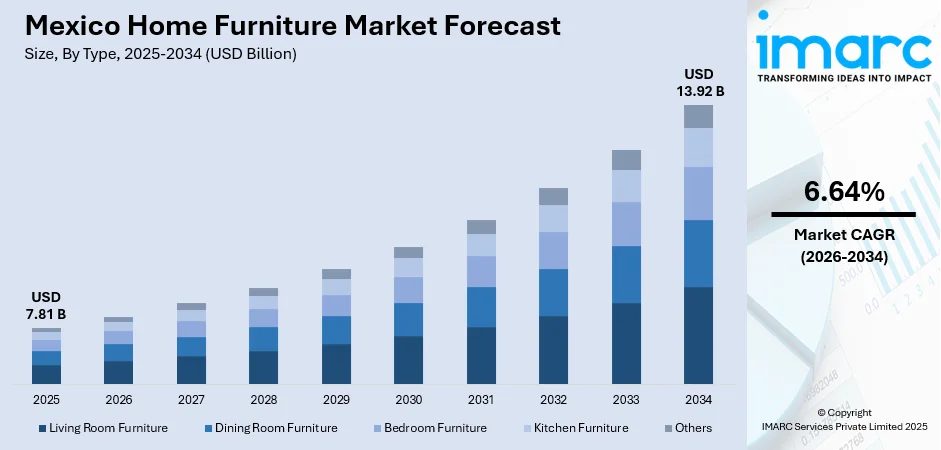

The Mexico home furniture market size was valued at USD 7.81 Billion in 2025 and is projected to reach USD 13.92 Billion by 2034, growing at a compound annual growth rate of 6.64% from 2026-2034.

The market is experiencing stable expansion driven by rapid urbanization, rising disposable incomes, and evolving consumer preferences toward modern and functional living spaces. Mexico's growing middle class is increasingly investing in quality home furnishings that combine aesthetic appeal with practical functionality. The residential construction boom in metropolitan areas, coupled with the expansion of e-commerce platforms offering diverse furniture options, is creating new growth avenues for manufacturers and retailers across the country.

Key Takeaways and Insights:

- By Type: Bedroom furniture dominates the market with a share of 32% in 2025, driven by growing consumer preference for comfortable and aesthetically designed sleeping solutions that maximize space utilization in compact urban residences.

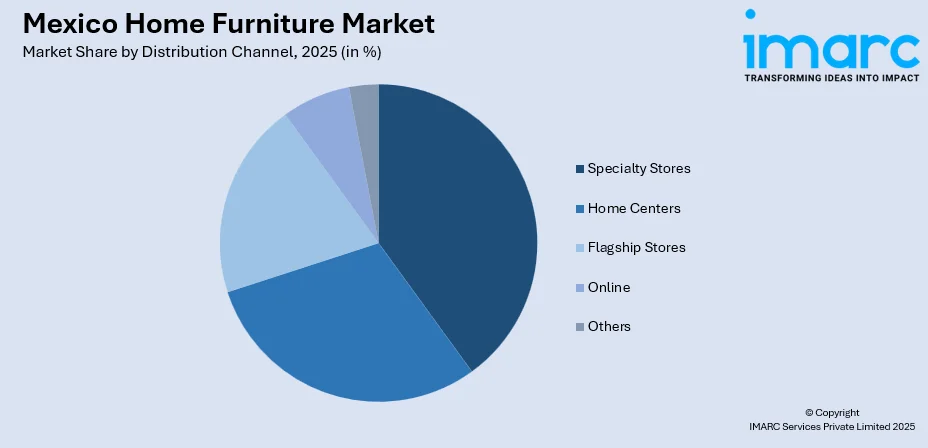

- By Distribution Channel: Specialty stores lead the market with a share of 38% in 2025, owing to personalized customer service, curated product selections, and the tactile shopping experience that allows customers to evaluate furniture quality firsthand.

- By Region: Central Mexico represents the largest segment with a market share of 45% in 2025, reflecting the concentration of population, economic activity, and housing development in the Mexico City metropolitan area and surrounding states.

- Key Players: Key players in the Mexico home furniture market are strengthening their competitive positions through strategic store expansions, digital transformation initiatives, and product portfolio diversification. Market participants are investing in omnichannel retail strategies and sustainable manufacturing practices to capture evolving consumer preferences.

To get more information on this market Request Sample

The Mexico home furniture market demonstrates strong fundamentals supported by favorable demographic trends and economic development. Urban centers are experiencing sustained housing demand, directly fueling furniture consumption. The market landscape is characterized by increasing competition between domestic manufacturers and international brands seeking to capture market share. Consumers are gravitating toward multifunctional furniture designs that optimize limited living spaces while maintaining contemporary aesthetics. The integration of technology in furniture retail, including augmented reality applications for virtual room planning, is enhancing the shopping experience and enabling customers to visualize products within their homes before purchasing. Rising urbanization continues driving residential furniture demand as households prioritize comfortable and stylish living environments. Government housing initiatives supporting homeownership among middle-income households are creating sustained demand for home furnishing products across various price segments, while evolving lifestyle preferences encourage investment in quality furniture that reflects personal style and functional requirements.

Mexico Home Furniture Market Trends:

Rise of E-commerce and Digital Retail Platforms

The digital transformation of furniture retail is reshaping how Mexican consumers discover and purchase home furnishings. Online platforms are leveraging advanced technologies including augmented reality and virtual showrooms to provide immersive shopping experiences. The convenience of home delivery, competitive pricing, and extensive product catalogs are accelerating e-commerce adoption among urban consumers. Major retailers are expanding their digital presence nationwide, enhancing logistics networks and delivery capabilities to meet growing online demand. This shift toward digital channels reflects evolving consumer preferences for convenient shopping options that allow product comparison and seamless purchasing from home.

Smart Furniture and Technological Integration

Technological advancements are introducing smart furniture solutions that cater to modern lifestyle requirements and connected home ecosystems. Furniture with built-in charging connections, movable settings, and smart home system-compatible communication capabilities are some of these advances. Mexican consumers, particularly tech-savvy younger demographics, are increasingly seeking furniture that combines functionality with technological convenience. Manufacturers are responding by developing IoT-enabled products that enhance user experience while addressing space optimization needs in urban apartments.

Sustainable and Eco-Friendly Materials Adoption

Environmental consciousness is driving demand for sustainably sourced and eco-friendly furniture options among Mexican consumers. Manufacturers are incorporating recycled materials, responsibly sourced wood, and environmentally friendly production processes to meet evolving preferences. The shift toward sustainable practices aligns with global environmental standards and regulatory requirements. Government initiatives promoting circular economy principles are encouraging manufacturers to adopt greener production methods and material sourcing strategies. This growing emphasis on sustainability reflects broader consumer awareness about environmental responsibility and preference for products that minimize ecological impact.

Market Outlook 2026-2034:

The Mexico home furniture market outlook remains positive, supported by sustained urbanization, rising household formation rates, and increasing consumer spending on home improvement. The nearshoring trend is attracting furniture manufacturing investments as companies seek to establish production closer to North American markets. Digital retail channels will continue gaining prominence while traditional specialty stores maintain relevance through personalized service offerings. The market generated a revenue of USD 7.81 Billion in 2025 and is projected to reach a revenue of USD 13.92 Billion by 2034, growing at a compound annual growth rate of 6.64% from 2026-2034.

Mexico Home Furniture Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Bedroom Furniture | 32% |

| Distribution Channel | Specialty Stores | 38% |

| Region | Central Mexico | 45% |

Type Insights:

- Living Room Furniture

- Dining Room Furniture

- Bedroom Furniture

- Kitchen Furniture

- Others

Bedroom furniture dominates with a market share of 32% of the total Mexico home furniture market in 2025.

The bedroom furniture segment maintains market leadership driven by consumer prioritization of sleep quality and personal comfort. Mexican households are increasingly investing in premium mattresses, ergonomic bed frames, and space-efficient storage solutions that maximize functionality in compact living spaces. The segment benefits from rising awareness about sleep health and the trend toward creating personalized sanctuary spaces within homes. Manufacturers are introducing innovative designs featuring built-in storage compartments and modular configurations to address urban space constraints prevalent in metropolitan residential developments.

Consumer preferences are shifting toward bedroom furniture that combines aesthetic appeal with practical functionality, particularly among younger demographics establishing new households. The growing real estate development in metropolitan areas is generating sustained demand for complete bedroom sets. Additionally, the rise of remote work has increased time spent at home, prompting consumers to invest in comfortable bedroom environments. Government housing programs supporting homeownership among middle-income families continue facilitating household formation and subsequent furniture purchases across urban centers.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Home Centers

- Flagship Stores

- Specialty Stores

- Online

- Others

Specialty stores lead with a share of 38% of the total Mexico home furniture market in 2025.

Specialty stores maintain distribution leadership by offering curated product selections, expert consultation services, and personalized shopping experiences that resonate with Mexican consumers. These retail outlets provide tactile engagement opportunities allowing customers to evaluate furniture quality, comfort, and craftsmanship before purchasing. The channel benefits from established trust relationships and the ability to offer customization options that meet specific customer requirements. Specialty retailers are enhancing their competitive positioning through exclusive brand partnerships and design consultation services.

The resilience of specialty stores reflects Mexican consumer preferences for in-person shopping experiences, particularly for significant home furnishing investments. Retailers are adopting omnichannel strategies that integrate physical showrooms with digital platforms, offering customers seamless shopping journeys. Major urban centers including Mexico City, Guadalajara, and Monterrey host diverse specialty store clusters catering to various consumer segments. The channel continues evolving through enhanced visual merchandising, interior design services, and financing options that facilitate furniture purchases across income levels.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Central Mexico exhibits a clear dominance with a 45% share of the total Mexico home furniture market in 2025.

Central Mexico dominates the home furniture market owing to the concentration of Mexico's largest metropolitan area and surrounding densely populated states. The region's economic significance, characterized by higher disposable incomes and extensive retail infrastructure, drives substantial furniture consumption across both premium and value segments. Real estate development in the metropolitan zone continues generating demand for residential furnishings as new housing projects attract first-time homeowners. The presence of major furniture retailers, specialty stores, and e-commerce fulfillment centers ensures comprehensive product accessibility and diverse purchasing options throughout the region.

Urban density and housing development patterns in Central Mexico favor furniture designs optimized for space efficiency and multifunctional utility. The region attracts significant retail investment, with international brands establishing flagship stores to capture market share. Mexico City's infrastructure plan for 2024 allocated USD 1.13 Billion for priority development projects, including urban improvements that support residential construction. Consumer preferences in the region trend toward contemporary designs influenced by global interior design movements while maintaining appreciation for traditional Mexican craftsmanship.

Market Dynamics:

Growth Drivers:

Why is the Mexico Home Furniture Market Growing?

Accelerating Urbanization and Housing Development

Mexico's rapid urbanization trajectory is fundamentally reshaping housing demand and driving furniture consumption across metropolitan areas. With majority of the population residing in urban centers, cities are expanding to accommodate residential growth through both horizontal and vertical development. The migration from rural to urban areas in pursuit of economic opportunities continues fueling household formation and subsequent furniture purchases. Housing construction activity, particularly in cities like Mexico City, Guadalajara, and Monterrey, generates consistent demand for complete home furnishing solutions. The construction sector recorded growth of 15.6% in 2023, reaching its historical maximum in constant peso terms, reflecting robust residential development activity that directly supports furniture market expansion.

Rising Disposable Incomes and Middle-Class Expansion

Economic development and income growth are empowering Mexican consumers to invest in quality home furnishings that enhance living standards and reflect personal style preferences. The expanding middle class demonstrates increasing willingness to allocate household budgets toward furniture upgrades and home improvement projects. Rising purchasing power enables consumers to explore premium product categories and international brands previously beyond reach. Additionally, growing remittance flows amplify household budgets in recipient communities, supporting furniture purchases across diverse socioeconomic segments. This financial empowerment translates into sustained demand for both essential and aspirational furniture products.

E-commerce Platform Expansion and Digital Accessibility

The proliferation of e-commerce platforms is democratizing furniture access by enabling consumers across geographic locations to browse extensive product catalogs and complete purchases conveniently. Digital retail channels offer competitive pricing, doorstep delivery, and financing options that facilitate furniture acquisition for diverse consumer segments. Technology integration, including virtual showrooms and augmented reality applications, enhances online shopping experiences by allowing customers to visualize products within their living spaces. Major platforms continue expanding logistics networks and product offerings to capture growing online demand.

Market Restraints:

What Challenges the Mexico Home Furniture Market is Facing?

Raw Material Price Volatility and Supply Chain Disruptions

Fluctuations in raw material costs, particularly for wood, metal, and upholstery materials, create pricing pressures that affect manufacturer margins and consumer affordability. Global supply chain disruptions have increased procurement complexity and extended lead times for imported components. Manufacturers face challenges in maintaining competitive pricing while absorbing elevated input costs and logistics expenses.

Competition from Imported Products

Domestic furniture manufacturers face competitive pressure from imported products, particularly from Asian sources offering lower price points. Price-sensitive consumer segments may opt for imported alternatives despite potential quality variations. The competitive landscape requires domestic producers to differentiate through design innovation, quality assurance, and localized service offerings.

Regional Infrastructure Disparities

Distribution infrastructure limitations in certain regions constrain market reach and increase logistics costs for furniture retailers. Rural and remote areas may lack adequate transportation networks and retail presence, limiting consumer access to diverse furniture options. These infrastructure gaps create uneven market development across geographic segments and constrain overall growth potential.

Competitive Landscape:

The Mexico home furniture market exhibits a fragmented competitive structure with numerous domestic manufacturers, international brands, and specialty retailers competing across various price segments. Market participants are differentiating through product innovation, omnichannel retail strategies, and enhanced customer service offerings. International players are expanding physical presence while investing in e-commerce capabilities to capture market share. Domestic manufacturers leverage local craftsmanship traditions and regional distribution networks to maintain competitive positioning. Strategic partnerships between retailers and technology providers are enabling enhanced shopping experiences through digital tools and visualization technologies.

Mexico Home Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Living Room Furniture, Dining Room Furniture, Bedroom Furniture, Kitchen Furniture, Others |

| Distribution Channels Covered | Home Centers, Flagship Stores, Specialty Stores, Online, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico home furniture market size was valued at USD 7.81 Billion in 2025.

The Mexico home furniture market is expected to grow at a compound annual growth rate of 6.64% from 2026-2034 to reach USD 13.92 Billion by 2034.

Bedroom furniture dominates the market with a share of 32%, driven by consumer prioritization of sleep quality, growing preference for ergonomic sleeping solutions, and increasing investments in personal comfort and bedroom aesthetics.

Key factors driving the Mexico home furniture market include accelerating urbanization and housing development, rising disposable incomes among the expanding middle class, e-commerce platform expansion, and growing consumer preference for modern and functional furniture designs.

Major challenges include raw material price volatility affecting manufacturer margins, competitive pressure from imported products offering lower price points, regional infrastructure disparities limiting distribution reach, and supply chain disruptions impacting procurement timelines.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)