Mexico Home Infusion Therapy Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

Mexico Home Infusion Therapy Market Overview:

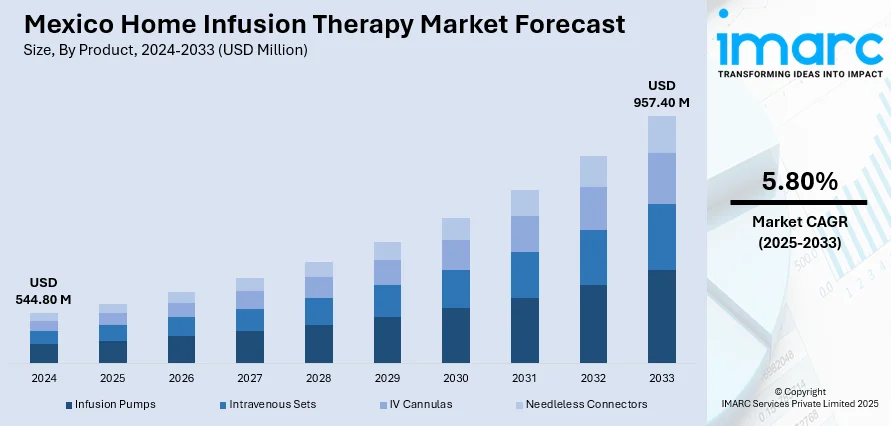

The Mexico home infusion therapy market size reached USD 544.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 957.40 Million by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. The market is witnessing significant growth due to rising chronic disease prevalence, increased healthcare cost sensitivity, and growing demand for home-based medical care. Technological advancements in infusion devices and improved healthcare infrastructure are supporting this shift. Greater insurance coverage and specialist support are enhancing patient access, thereby contributing to the rising Mexico home infusion therapy market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 544.80 Million |

| Market Forecast in 2033 | USD 957.40 Million |

| Market Growth Rate 2025-2033 | 5.80% |

Mexico Home Infusion Therapy Market Trends:

Rising Chronic Illnesses

Mexico is witnessing a steady rise in chronic health conditions such as cancer, diabetes, and autoimmune diseases, which require consistent and often complex medical treatments. According to data published by the OECD, cancer is projected to cause 46,200 premature deaths each year in Mexico. By 2050, it is expected to account for one in 14 deaths before the age of 75. This increase in cancer-related deaths will lower the average life expectancy by 0.9 years, raise healthcare costs by MXN 10.6 billion, and reduce workforce productivity by the equivalent of 138,000 full-time jobs. Many of these treatments involve intravenous drug delivery, traditionally administered in hospital settings. However, the growing preference for comfort, convenience, and reduced healthcare costs is prompting a shift toward home infusion therapy. Cancer patients undergoing chemotherapy, diabetics needing insulin, and individuals with immune deficiencies receiving immunoglobulin therapy are increasingly opting for at-home care. This model allows for greater flexibility in treatment schedules and minimizes the risks associated with frequent hospital visits, such as infections or long wait times. As the chronic disease burden rises across age groups, particularly in urban areas, home infusion therapy is emerging as a vital component of ongoing medical care, contributing to the expansion of the market in Mexico.

Increased Focus on Elderly Care

Mexico’s aging population is growing steadily, with a rising number of elderly individuals requiring ongoing care for chronic conditions such as cardiovascular disease, arthritis, cancer, and diabetes. According to the data published by the Pan American Health Organization (PAHO), in 2024, Mexico's population reached 130 861 007, increasing 32.7% since 2000. Those aged 65+ comprised 8.2% of the population, up 3.2 percentage points. The dependency ratio was 48.7 passive people per 100 actives. Life expectancy rose to 75.3 years, a 2.7-year increase since 2000. These health issues often necessitate regular infusion-based therapies, which can be difficult for older patients to manage through frequent hospital visits. Home infusion therapy offers a more practical and comfortable solution by delivering essential treatments—such as hydration, antibiotics, pain management, and nutritional support—directly in the patient’s home. This not only enhances quality of life but also reduces the risk of hospital-acquired infections and cuts down on healthcare costs. Family caregivers and professional home care services play a critical role in supporting this model. As demand for senior-focused healthcare solutions increases, it is becoming a key factor driving the Mexico home infusion therapy market growth.

Mexico Home Infusion Therapy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

The report has provided a detailed breakup and analysis of the market based on the product. This includes infusion pumps (elastomeric, electromechanical, gravity, and others), intravenous sets, IV cannulas, and needleless connectors.

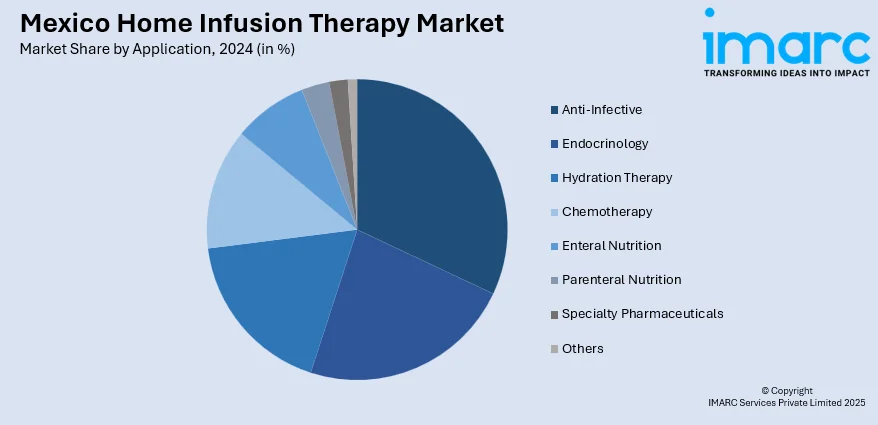

Application Insights:

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes anti-infective, endocrinology (diabetes and others), hydration therapy (athletes and others), chemotherapy, enteral nutrition, parenteral nutrition, specialty pharmaceuticals, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Home Infusion Therapy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Applications Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico home infusion therapy market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico home infusion therapy market on the basis of product?

- What is the breakup of the Mexico home infusion therapy market on the basis of application?

- What is the breakup of the Mexico home infusion therapy market on the basis of region?

- What are the various stages in the value chain of the Mexico home infusion therapy market?

- What are the key driving factors and challenges in the Mexico home infusion therapy market?

- What is the structure of the Mexico home infusion therapy market and who are the key players?

- What is the degree of competition in the Mexico home infusion therapy market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico home infusion therapy market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico home infusion therapy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico home infusion therapy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)