Mexico Hosiery Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2025-2033

Mexico Hosiery Market Overview:

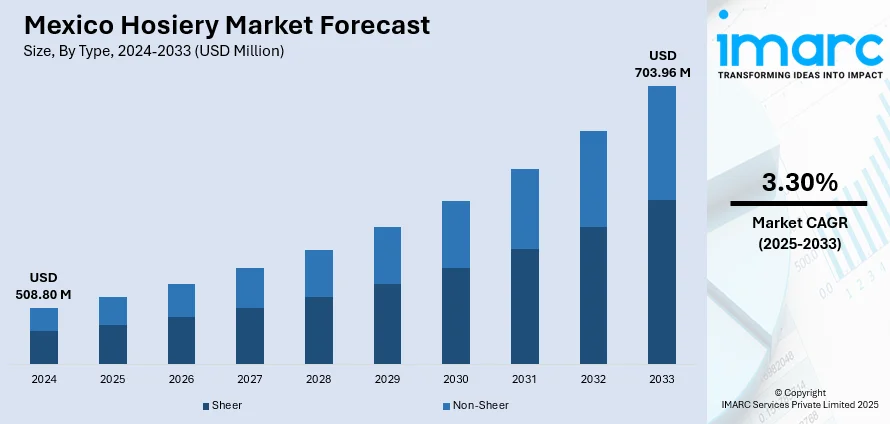

The Mexico hosiery market size reached USD 508.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 703.96 Million by 2033, exhibiting a growth rate (CAGR) of 3.30% during 2025-2033. The market is driven by increasing female workforce participation paired with a growing emphasis on functional, fashionable wardrobe staples. The expansion of modern retail and e-commerce channels is streamlining product availability and enhancing customer experience across regions, thereby fueling the market. In addition to this, the rising awareness of health-supportive hosiery is diversifying product demand, further augmenting the Mexico hosiery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 508.80 Million |

| Market Forecast in 2033 | USD 703.96 Million |

| Market Growth Rate 2025-2033 | 3.30% |

Mexico Hosiery Market Trends:

Urban Fashion Trends and Women’s Workforce Participation

The rise of urban-centric fashion in Mexico is directly influencing hosiery consumption, especially in metropolitan areas such as Mexico City, Guadalajara, and Monterrey. As more women enter professional sectors, there is an increasing preference for formal attire incorporating sheer tights, patterned stockings, and compression wear. The Mexican tights and leggings market is projected to generate USD109.34 Million in revenue in 2025, with a 1.67% annual growth rate from 2025 to 2029. Per capita revenue is expected to be USD 0.84, with the market volume reaching 47.5 million pieces by 2029. Hosiery has evolved from a seasonal accessory to a functional fashion staple, suitable for work, travel, and social settings. Domestic and global brands are introducing new collections with contemporary designs, color tones suited to diverse skin types, and durable weaves to appeal to working women and fashion-conscious consumers. Retail outlets and department stores promote hosiery as part of complete styling, driving up cross-category sales. Moreover, the influence of Latin American beauty standards, emphasizing polished and elegant aesthetics, is encouraging women to incorporate hosiery into their daily wardrobe. A greater focus on inclusive sizing and comfortable fits also helps cater to diverse demographics. This intersection of workplace demand and fashion-forward sensibilities continues to shape product offerings, helping brands align with lifestyle expectations. Collectively, these dynamics contribute to Mexico hosiery market growth as hosiery shifts from functional wear to a marker of both personal style and professionalism.

Retail Modernization and Growth of Online Channels

Mexico’s expanding retail landscape is enabling wider consumer access to a diverse range of hosiery options. Organized retail chains, specialty fashion stores, and international fast-fashion outlets are rapidly increasing their footprints, particularly in Tier 1 and Tier 2 cities. These outlets provide curated assortments of hosiery categorized by use, formal, casual, athletic, or therapeutic, thereby enhancing the buying experience. Simultaneously, e-commerce penetration is gaining pace as younger demographics turn to online platforms for fashion purchases. Leading marketplaces and direct-to-consumer (DTC) brands are optimizing logistics and offering extensive hosiery collections with localized delivery and return options. Bilingual product descriptions, size guides, and visual lookbooks enable consumers to make informed decisions, increasing conversion rates. Additionally, subscription models for essentials such as nude pantyhose or compression socks are seeing traction among repeat customers. The digitization of retail has also supported niche products, including seamless tights, maternity compression wear, and eco-conscious alternatives. This shift in consumer purchasing behavior is reflected in the country’s broader trade performance. As per industry reports, in 2024, the total trade value of tights and hosiery in Mexico amounted to USD 477 Million, with international sales accounting for USD 214 Million and imports reaching USD 263 Million. Baja California was a dominant player, leading both in international sales (USD 159 Million) and imports (USD 161 Million), while the United States remained the country’s primary trade partner, accounting for USD 196 Million in exports.

Mexico Hosiery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end use.

Type Insights:

- Sheer

- Non-Sheer

The report has provided a detailed breakup and analysis of the market based on the type. This includes sheer and non-sheer.

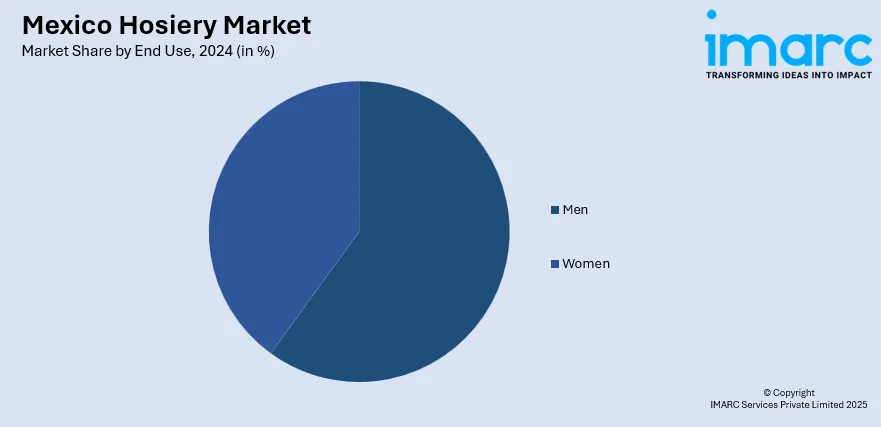

End Use Insights:

- Men

- Women

The report has provided a detailed breakup and analysis of the market based on the end use. This includes hosiery products for men and women.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Hosiery Market News:

- Busi Giovanni, a leading Italian manufacturer specializing in the production of high-quality stockings, socks, and tights, announced that it would exhibit its range of machines at Exintex 2024 in Puebla, Mexico, from February 27 to March 1, 2024. The company will showcase 10 different models of sock-knitting machinery, all designed and made in Italy, through its exclusive Mexican agent, Blutec.

Mexico Hosiery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Sheer, Non-Sheer |

| End Uses Covered | Men, Women |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico hosiery market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico hosiery market on the basis of type?

- What is the breakup of the Mexico hosiery market on the basis of end use?

- What is the breakup of the Mexico hosiery market on the basis of region?

- What are the various stages in the value chain of the Mexico hosiery market?

- What are the key driving factors and challenges in the Mexico hosiery market?

- What is the structure of the Mexico hosiery market and who are the key players?

- What is the degree of competition in the Mexico hosiery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico hosiery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico hosiery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico hosiery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)