Mexico Hot Melt Adhesive Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

Mexico Hot Melt Adhesive Market Overview:

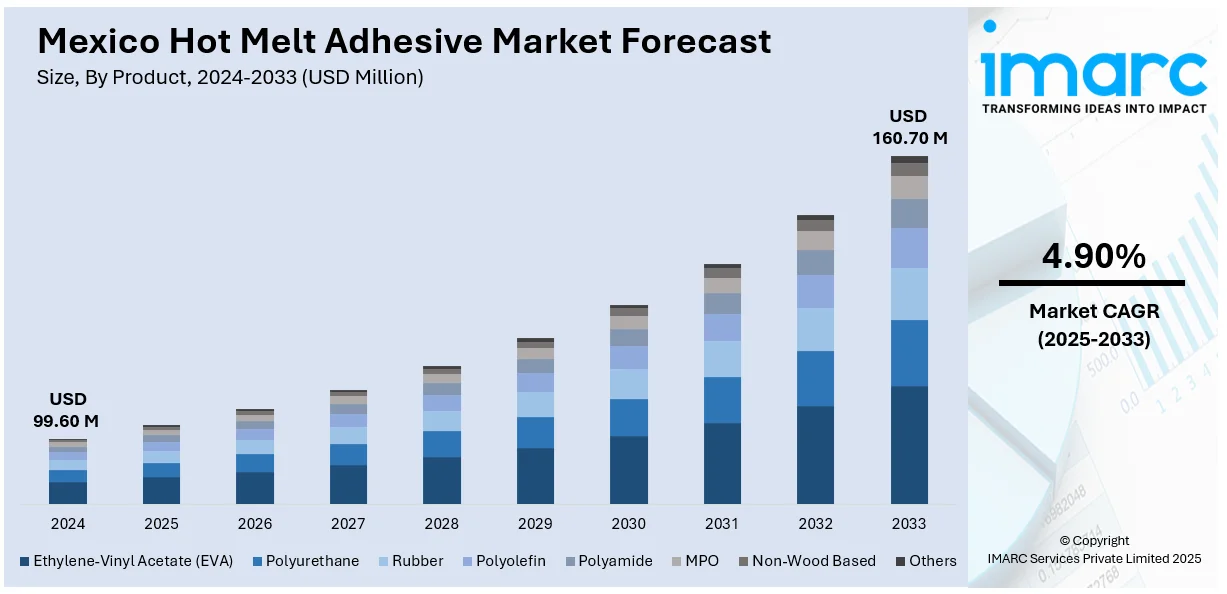

The Mexico hot melt adhesive market size reached USD 99.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 160.70 Million by 2033, exhibiting a growth rate (CAGR) of 4.90% during 2025-2033. Rising demand from the packaging and automotive industries, increasing adoption of sustainable and bio-based adhesive solutions, growth in manufacturing and exports, and expansion of local production facilities by global players like Henkel are among the key factors driving the hot melt adhesives market in Mexico.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 99.60 Million |

| Market Forecast in 2033 | USD 160.70 Million |

| Market Growth Rate 2025-2033 | 4.90% |

Mexico Hot Melt Adhesive Market Trends:

Growth of the Automotive Industry in Mexico

The expansion of the Mexican automotive sector is central to the demand for hot melt adhesives. With its low-cost labor, robust trade relationships, and strategic location next to the US market, Mexico has emerged as one of the largest automobile manufacturers in North America and an important hub for international automobile makers. This growth has resulted in a huge demand for high-performance bonding solutions applied to automotive parts including interior panels, headlights, seat assembly, and electronics. Hot melt adhesives are preferred due to their quick curing times, aggressive bonding abilities, and environmental resistance, making them perfectly suitable for automotive applications. Additionally, the greater emphasis on light vehicles for improved fuel economy also recommends the use of adhesive-based assembly technology over conventional mechanical fastening. Furthermore, the presence of key OEMs and Tier 1 suppliers in places such as Aguascalientes, Guanajuato, and Puebla continues to stimulate demand for high-performance adhesives.

Surge in Packaging Industry Demand

The packaging industry is a key contributor to the Mexican hot melt adhesive market. Packaging is a major function in sectors such as food and beverage, pharmaceuticals, e-commerce, and consumer goods. With escalating demand for packaged products within the domestic as well as international markets, there has been a sudden surge in demand for effective packaging solutions, particularly for flexible packaging, carton sealing, and labeling. Hot melt adhesives have diverse applications in the packaging sector as they can easily and reliably bond numerous substrates quickly, which is a necessity on high-speed packaging lines. E-commerce and retail industries' growth has additionally pushed demand for effective packaging solutions that can endure transportation stresses without compromising product integrity. In Mexico, with its growing status as a manufacturing center and significant export leader, hot melt adhesives are crucial to guaranteeing the quality and safety of products along the supply chain. Consumer demand for sustainable and recyclable packaging is also driving companies to implement hot melt adhesives that fit into these environmentally friendly objectives.

Mexico Hot Melt Adhesive Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, and application.

Product Insights:

- Ethylene-Vinyl Acetate (EVA)

- Polyurethane

- Rubber

- Polyolefin

- Polyamide

- MPO

- Non-Wood Based

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes ethylene-vinyl acetate (EVA), polyurethane, rubber, polyolefin, polyamide, MPO, non-wood based, and others.

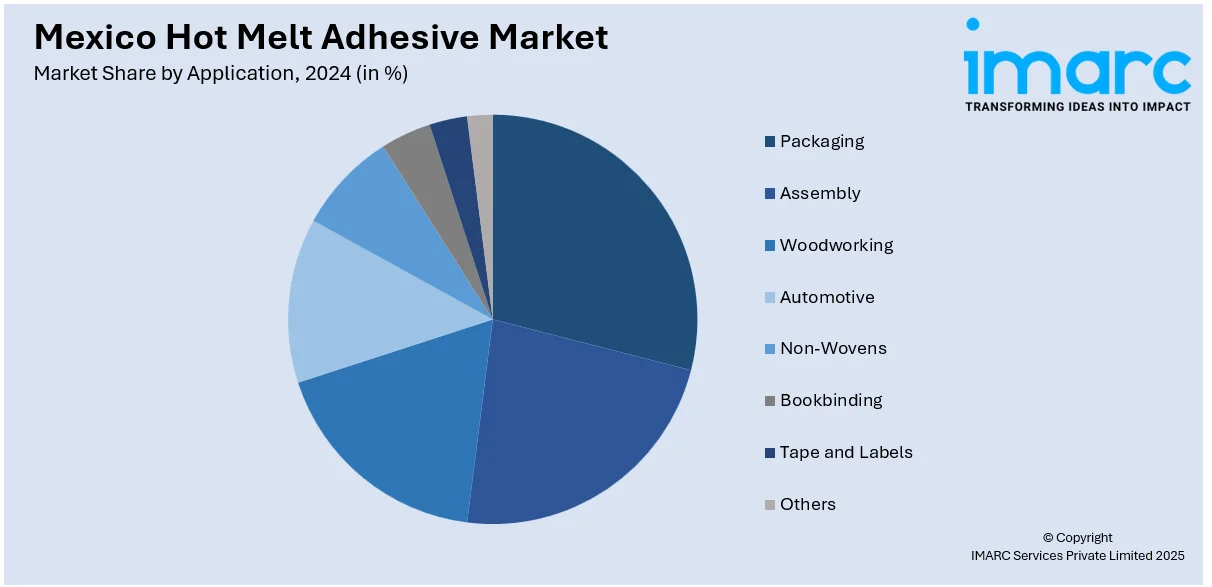

Application Insights:

- Packaging

- Assembly

- Woodworking

- Automotive

- Non-Wovens

- Bookbinding

- Tape and Labels

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes packaging, assembly, woodworking, automotive, non-wovens, bookbinding, tape and labels, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Hot Melt Adhesive Market News:

- November 2024: Packsize partnered with Henkel Adhesive Technologies to launch Eco-Pax, a bio-based hot melt adhesive designed to reduce carbon emissions without compromising performance. This innovation is being implemented across Packsize's global operations, including in Mexico, where Henkel's Consumer Goods Adhesives division operates. Eco-Pax aims to replace traditional fossil-based adhesives, contributing to a more sustainable packaging industry.

- August 2024: Humanscale launched its first branded online store for refurbished office furniture through its "Refreshed" program. This initiative supports sustainability by reducing landfill waste and promoting a circular economy. Refurbishment occurs at Humanscale's Nogales, Mexico factory, where chairs are restored for resale. This development bolsters the regional furniture market, which positively impacts the demand for hot melt adhesives.

- June 2022: Henkel inaugurated an adhesives plant in Guadalupe, Nuevo León, spanning nearly 30,000 square meters. The facility produces pressure-sensitive and non-pressure-sensitive hot melts under the Technomelt brand, including the high-performance SUPRA and energy-efficient COOL product lines. Additionally, it manufactures adhesives under the Easyflow brand, designed to enhance production efficiency and reduce material handling.

Mexico Hot Melt Adhesive Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Ethylene-Vinyl Acetate (EVA), Polyurethane, Rubber, Polyolefin, Polyamide, MPO, Non-Wood Based, Others |

| Applications Covered | Packaging, Assembly, Woodworking, Automotive, Non-Wovens, Bookbinding, Tape and Labels, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico hot melt adhesive market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico hot melt adhesive market on the basis of product?

- What is the breakup of the Mexico hot melt adhesive market on the basis of application?

- What is the breakup of the Mexico hot melt adhesive market on the basis of region?

- What are the various stages in the value chain of the Mexico hot melt adhesive market?

- What are the key driving factors and challenges in the Mexico hot melt adhesive?

- What is the structure of the Mexico hot melt adhesive market and who are the key players?

- What is the degree of competition in the Mexico hot melt adhesive market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico hot melt adhesive market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico hot melt adhesive market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico hot melt adhesive industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)