Mexico Hot Sauce Market Size, Share, Trends and Forecast by Product Type, Application, Packaging, Distribution Channel, End Use, and Region, 2025-2033

Mexico Hot Sauce Market Overview:

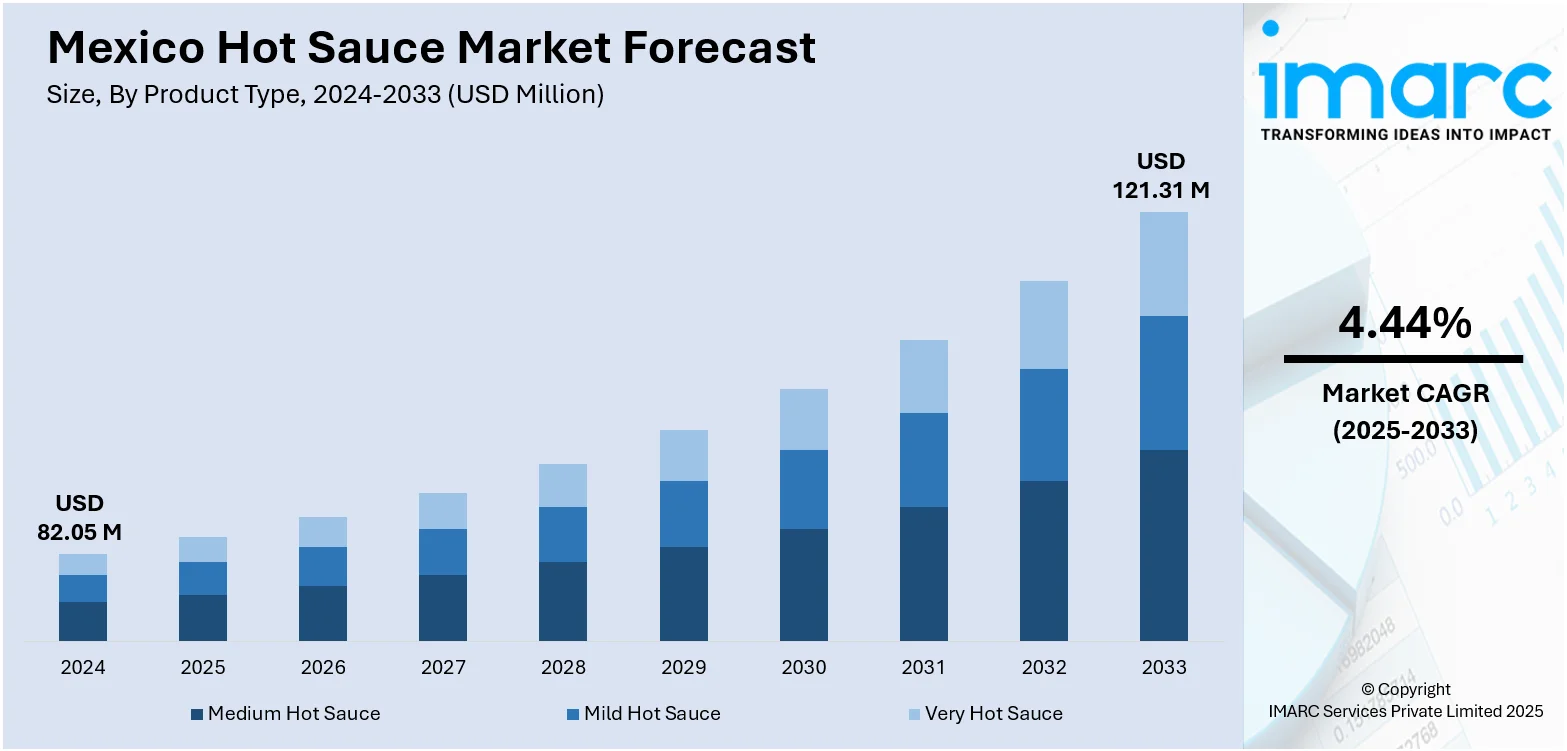

The Mexico hot sauce market size reached USD 82.05 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 121.31 Million by 2033, exhibiting a growth rate (CAGR) of 4.44% during 2025-2033. At present, consumers are increasingly favoring spicy, bold, and traditional flavors rooted in the nation's vibrant food culture. Besides this, the expansion of distribution channels in both urban and rural areas, which provide products for access by a larger consumer population, is supporting the market growth. Additionally, the heightened international demand for authentic Mexican food is expanding the Mexico hot sauce market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 82.05 Million |

| Market Forecast in 2033 | USD 121.31 Million |

| Market Growth Rate 2025-2033 | 4.44% |

Mexico Hot Sauce Market Trends:

Growing Consumer Demand for Spicy and Conventional Flavors

The hot sauce market in Mexico is experiencing rapid growth as consumers increasingly favor spicy, bold, and traditional flavors rooted in the nation's vibrant food culture. The rich culinary history of Mexico, which includes its extensive utilization of chili peppers and regional spice mixtures, is driving demand for real condiments such as hot sauce. This taste is not unique to in-country consumers but extends to international markets, as Mexican foods are increasingly popular on a global scale. Hot sauce is being considered a necessary condiment to a vast array of menu items, both in the home and in foodservice outlets. This continuous movement is prompting manufacturers to create an expanding array of flavor profiles, heat points, and regional chili-based products to meet regional tastes. By constantly providing products that resonate with shifting tastes, manufacturers are taking advantage of the cultural and sensory appeal of hot sauces, cementing their place in both traditional and contemporary culinary environments. In 2025, Cholula®, the leading Mexican Hot Sauce globally*, introduced 11 new products featuring its distinctive balanced heat, allowing you to effortlessly replicate a taco truck experience at home. Designed with genuine quality, ease of use, and adaptability, the expansion honors the vibrant legacy of Cholula. Featuring cooking sauces that deliver high-quality, restaurant-style taste, seasoning blends inspired by beloved Latin dishes, and popular toppings, they elevate any meal significantly.

To get more information on this market, Request Sample

Adding Distribution Channels and Retail Coverage

The expansion of distribution channels in both urban and rural areas, which provide products for access by a larger consumer population, is supporting the Mexico hot sauce market growth. Large supermarket chains, convenience stores, specialty food stores, and internet sites are all giving shelf space to hot sauce manufacturers, both artisanal and premium, increasingly. This increased retail footprint is facilitating brands to access new market segments such as younger consumers and health-conscious buyers looking for additive-free or organic options. Further, e-commerce sites are emerging as significant sales channels, providing wider options and home delivery conveniences. These sites are making it possible for small and medium enterprises (SMEs) to enter the market without the burden of overhead costs of traditional retail. With vendors constantly refining their product mixes from customer information and preferences, hot sauce manufacturers are reaping the rewards of greater exposure and market access. IMARC Group predicts that the Mexico e-commerce market is projected to attain USD 176.6 Billion by 2033.

Increased Demand for Export and Global Acceptance of Mexican Food

The hot sauce market in Mexico is gaining upward traction as international demand for authentic Mexican food keeps growing. Mexican hot sauces are becoming known for their distinct flavor profiles, traditional recipes, and incorporation of indigenous chili varieties, which are gaining popularity with overseas customers. Export business is increasing, with manufacturers eyeing major markets in North America, Europe, and Asia where demand for ethnic and specialty foods is growing. Hot sauce brands from Mexico are using country-of-origin marketing, cultural branding, and labels like Hecho en México to enhance their pull in global markets. Furthermore, shifting global food trends toward the use of spicier, more assertive flavors and clean-label products are going hand-in-hand with the fundamental characteristics of Mexican hot sauces. As international foodservice chains and restaurant companies introduce Mexican offerings to their menus, demand for genuine condiments such as hot sauce is gradually rising, and Mexico's position in the global spicy condiments market is further solidified.

Mexico Hot Sauce Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, application, packaging, distribution channel, and end use.

Product Type Insights:

- Medium Hot Sauce

- Mild Hot Sauce

- Very Hot Sauce

The report has provided a detailed breakup and analysis of the market based on the product type. This includes medium hot sauce, mild hot sauce, and very hot sauce.

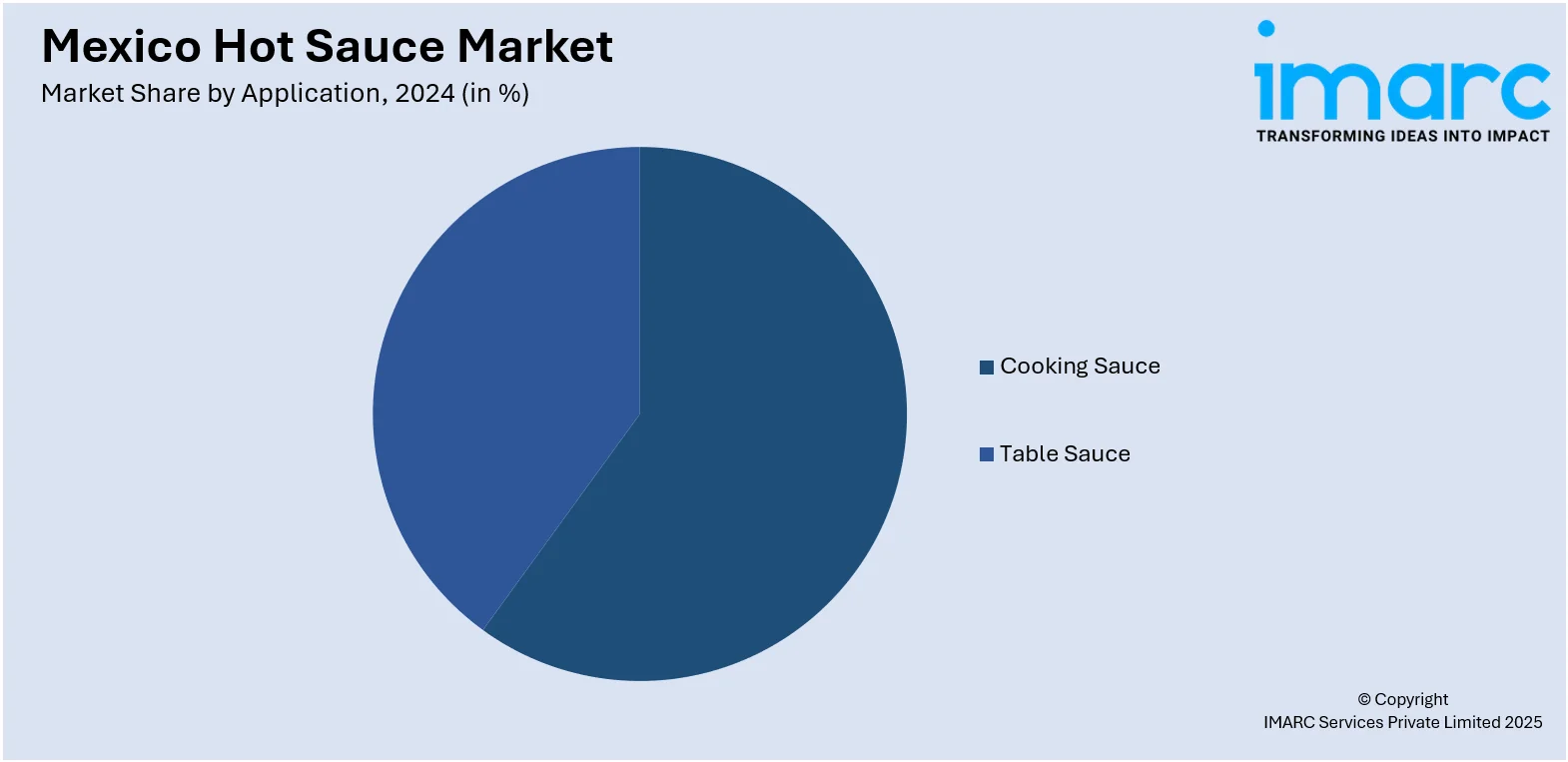

Application Insights:

- Cooking Sauce

- Table Sauce

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cooking sauce and table sauce.

Packaging Insights:

- Jars

- Bottles

- Others

A detailed breakup and analysis of the market based on the packaging have also been provided in the report. This includes jars, bottles, and others.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Traditional Grocery Retailers

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, traditional grocery retailers, online stores, and others.

End Use Insights:

- Commercial

- Household

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes commercial and household.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Hot Sauce Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Medium Hot Sauce, Mild Hot Sauce, Very Hot Sauce |

| Applications Covered | Cooking Sauce, Table Sauce |

| Packagings Covered | Jars, Bottles, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Traditional Grocery Retailers, Online Stores, Others |

| End Uses Covered | Commercial, Household |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico hot sauce market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico hot sauce market on the basis of product type?

- What is the breakup of the Mexico hot sauce market on the basis of application?

- What is the breakup of the Mexico hot sauce market on the basis of packaging?

- What is the breakup of the Mexico hot sauce market on the basis of distribution channel?

- What is the breakup of the Mexico hot sauce market on the basis of end use?

- What is the breakup of the Mexico hot sauce market on the basis of region?

- What are the various stages in the value chain of the Mexico hot sauce market?

- What are the key driving factors and challenges in the Mexico hot sauce market?

- What is the structure of the Mexico hot sauce market and who are the key players?

- What is the degree of competition in the Mexico hot sauce market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico hot sauce market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico hot sauce market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico hot sauce industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)