Mexico HVAC Market Share, Trends and Forecast by Product Type, End User, and Region, 2025-2033

Mexico HVAC Market Size and Share:

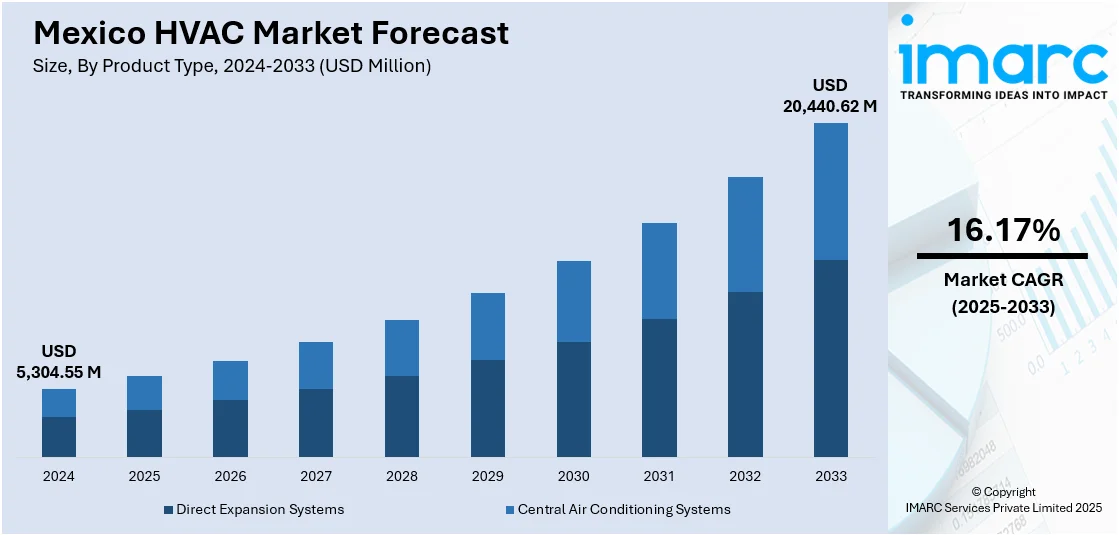

The Mexico HVAC market size was valued at USD 5,304.55 Million in 2024. Looking forward, the market is projected to reach USD 20,440.62 Million by 2033, exhibiting a CAGR of 16.17% during 2025-2033. The market is driven by expanding commercial infrastructure and the rising demand for energy-efficient systems. Also, growing industrial manufacturing and the adoption of precision-controlled HVACs are fueling system innovation. Additionally, climate variability across regions reinforces demand for adaptive, cost-effective temperature control. Investments in green buildings, government support for energy efficiency, and nearshoring-induced manufacturing expansion are further augmenting the Mexico HVAC market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5,304.55 Million |

| Market Forecast in 2033 | USD 20,440.62 Million |

| Market Growth Rate 2025-2033 | 16.17% |

The HVAC market IN Mexico is primarily driven by the growing demand for energy-efficient solutions in residential, commercial, and industrial sectors. In March 2025, Mabe, a leading Mexican home appliance manufacturer, revealed a USD 668 Million investment to refurbish and expand its 15 factories in Mexico, focusing on enhancing its home appliance production capabilities. This investment, part of Mabe’s strategy to innovate and strengthen its industrial capacity, aims to boost the national supply of home appliances, particularly refrigerators, gas and electric ranges, and dryers. In line with this, the rising awareness about environmental sustainability and energy conservation is prompting consumers to adopt green HVAC technologies, which is a key growth-inducing factor. Moreover, the rapid urbanization and increasing construction activities are driving the need for advanced air conditioning and ventilation systems, further boosting market growth.

In addition to this, the government’s supportive regulations and incentives for energy-efficient systems are creating lucrative opportunities for market expansion. Besides this, the growing demand for smart HVAC systems that integrate IoT and automation technologies is shaping the market. Also, the expanding middle-class population and rising disposable incomes are positively impacting the market, as consumers seek improved comfort and air quality. The market is further driven by technological advancements, which are enhancing the performance and efficiency of HVAC systems. In August 2025, Webasto Americas partnered with PLC Marine World S.A. as the exclusive Master Distributor for Webasto's marine HVAC systems, including air conditioning and sunroof solutions, across Mexico. This strategic alliance enhances Webasto's market presence in Mexico, providing faster logistics, expert local support, and an expanded network of certified dealers. With a centralized warehouse in Mérida, Yucatán, PLC Marine World S.A. ensures immediate availability of marine HVAC products and comprehensive after-sales service. Apart from this, the increasing awareness about indoor air quality and the implementation of stringent regulations on air quality standards are propelling the HVAC industry in Mexico.

Mexico HVAC Market Trends:

Industrialization and Growing Manufacturing Output

Mexico’s ascent as a competitive manufacturing and export hub, particularly under the influence of nearshoring trends, has intensified the demand for reliable HVAC systems across various industrial verticals. Facilities in sectors such as automotive, electronics, food processing, and pharmaceuticals require climate control solutions to safeguard equipment functionality, preserve product integrity, and maintain operational safety. The Mexico automotive industry remains a critical pillar of the national economy, accounting for approximately 4.7% of Mexico's GDP as of 2024. Manufacturers are increasingly deploying specialized HVAC systems tailored to industrial environments, including clean rooms and high-temperature production zones. The emphasis on precision control, along with regulatory compliance for worker safety and product quality, is driving industrial users to shift toward systems offering long-term efficiency, adaptability to high-load environments, and low maintenance requirements. Additionally, government efforts to attract global supply chains through fiscal incentives and policy reforms have led to the expansion of industrial parks and logistics zones.

As per recent analysis reports, approximately 40% of commercial HVAC systems sold by major U.S. manufacturers, including Trane, Carrier, Johnson Controls, and Lennox, are produced in Mexico and benefit from tariff protection under the USMCA. This production shift insulates the Mexico HVAC sector from the steep import tariffs levied on goods from China (up to 104%) and other Asian countries such as Japan (24%), South Korea (25%), Taiwan (32%), and Vietnam (46%). As U.S. firms pivot manufacturing toward Mexico to maintain cost efficiency, the policy landscape continues to bolster Mexico HVAC market growth. These developments necessitate climate systems designed for round-the-clock operations and temperature-sensitive processes. Notably, multi-zone HVAC installations and integrated air purification systems are gaining preference in line with sector-specific quality assurance norms. In this context, the convergence of manufacturing modernization, policy support, and system innovation has significantly enhanced HVAC relevance across industrial operations throughout Mexico.

Expanding Commercial Real Estate and Infrastructure Developments

The increasing number of commercial infrastructure projects across urban centers in Mexico is creating a sustained demand for heating, ventilation, and air conditioning systems. In April 2025, the Mexican government unveiled a comprehensive infrastructure investment plan, committing over MXN 620 billion(approximately USD 36.7 billion) to upgrade energy and transportation systems. This expanding industrial base is a key driver of HVAC demand across factories and logistics facilities. Office complexes, hospitality spaces, retail environments, and mixed-use developments are prioritizing energy-efficient HVAC technologies to meet both comfort requirements and regulatory benchmarks, , which is one of the major Mexico HVAC market trends. Growing foreign investments in real estate and heightened activity in Mexico’s construction sector, particularly in the post-pandemic recovery period, have compelled developers to adopt modern HVAC solutions that support environmental certifications and operational efficiency. Moreover, smart HVAC integrations, including remote monitoring and automated climate control, are witnessing increased incorporation in new commercial builds. While residential applications remain relevant, commercial demand offers a higher rate of system upgrades and new installations, particularly in high-density economic zones.

Cross-sector support for green building norms and state incentives for energy optimization are further shaping the procurement behavior of infrastructure stakeholders. The Mexico HVAC market forecast indicates cumulative effects of these real estate trends will position HVAC systems as foundational to structural planning and indoor climate management strategies. On June 12, 2024, Alliance Air, a subsidiary of Daikin Applied, announced a USD 121 Million investment to construct a 460,000-square-foot energy-efficient HVAC manufacturing facility in Tijuana, Mexico. The new plant is projected to generate over 1,150 permanent jobs and will focus on delivering sustainable cooling solutions for North America’s rapidly growing data center market. This expansion reinforces Mexico as a strategic production hub for next-gen, energy-efficient systems. As the urban footprint of cities such as Mexico City, Guadalajara, and Monterrey expands, so does the importance of scalable, adaptive HVAC infrastructure. This ongoing transformation plays a key role in the expansion of the market as efficient temperature control becomes central to commercial competitiveness.

Mexico HVAC Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and end user.

Analysis by Product Type:

- Direct Expansion Systems

- Central Air Conditioning Systems

Direct expansion (DX) systems are widely used in residential and small commercial settings due to their efficient cooling and easy installation. The growth of this segment is driven by the increasing demand for energy-efficient cooling solutions in residential areas, especially in the wake of rising temperatures and the need for cost-effective, space-saving HVAC options. DX systems are popular in Mexico’s smaller buildings and homes, where installation flexibility is critical. These systems also offer quick cooling, making them a preferred choice in regions with high cooling demands, further driving the segment’s market growth.

Central air conditioning systems dominate larger commercial spaces and high-end residential properties due to their ability to cool large areas efficiently. As urbanization continues in Mexico, there’s growing demand for centralized cooling in both commercial and industrial sectors. These systems provide consistent, effective cooling with advanced features such as zoning and energy efficiency, aligning with the rising demand for energy-efficient solutions. The increasing construction of commercial office spaces, malls, and industrial facilities is propelling the growth of central air conditioning systems, making them a critical segment for the market’s expansion in the coming years.

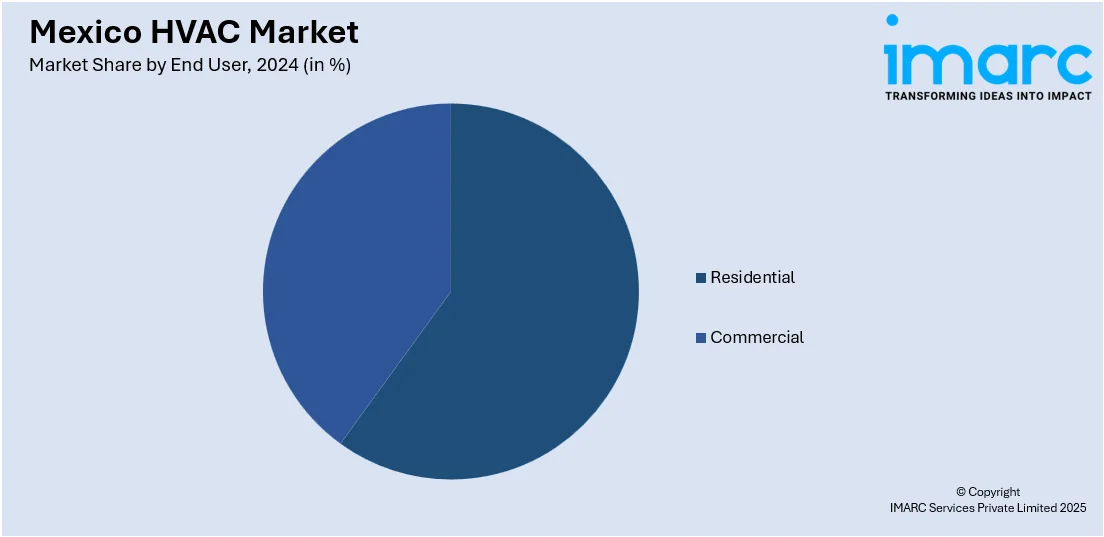

Analysis by End User:

- Residential

- Commercial

The residential HVAC segment in Mexico is seeing substantial growth, driven by rising temperatures and a growing middle class seeking comfort and convenience. As disposable incomes rise, consumers are increasingly investing in energy-efficient air conditioning systems for their homes, particularly in urban areas where the demand for cooling solutions is higher. This shift toward residential air conditioning is driven by factors like higher standards of living, growing awareness of health and comfort, and the need for energy-efficient solutions to cope with Mexico’s hot climate. Consequently, the residential segment is expected to grow significantly over the forecast period.

The commercial segment of the HVAC market in Mexico is expanding rapidly due to the increasing number of commercial buildings, such as offices, malls, and hotels, which require centralized cooling systems. Businesses are prioritizing energy-efficient and sustainable cooling solutions to reduce operational costs and enhance environmental responsibility. The rapid expansion of commercial infrastructure, particularly in major cities, is driving the demand for advanced HVAC solutions. Commercial users are increasingly opting for systems that offer better control, reliability, and integration with smart technologies, fueling growth in this segment and contributing to the overall Mexico HVAC market outlook.

Regional Analysis:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico’s HVAC market is one of the largest regional markets, owing to the region’s proximity to the U.S. and its industrial and commercial developments. The increasing demand for cooling solutions in both commercial and residential buildings in this region is fueled by higher temperatures and the growing construction of new buildings. The region benefits from its robust industrial and commercial sectors, which require both residential and commercial HVAC solutions. Northern Mexico's integration with the U.S. economy, coupled with high urbanization, is expected to continue driving the demand for advanced HVAC systems, making it a key market for growth.

Central Mexico is seeing a surge in demand for HVAC solutions due to rapid urbanization and industrial development. The growth of the real estate and construction industries, particularly in cities like Mexico City, is contributing to the need for advanced air conditioning systems. The residential segment in Central Mexico is growing due to the region’s rising population and urban expansion. As the region’s middle class continues to grow, demand for modern and efficient HVAC solutions will continue to rise, making it a significant market for both residential and commercial products.

Southern Mexico, with its warmer climate and growing infrastructure needs, presents a growing market for HVAC systems, particularly for residential and small commercial applications. Although the region is less industrialized compared to the northern areas, there is increasing demand for HVAC systems due to improved living standards and higher temperatures. With government initiatives focusing on rural and regional development, this segment is seeing an uptick in new construction projects and residential cooling needs. The expansion of both commercial and residential sectors in cities like Oaxaca and Chiapas will drive the demand for air conditioning solutions in the coming years.

Competitive Landscape:

Key players in Mexico's HVAC market are implementing several strategies to foster growth and maintain competitiveness. These include expanding manufacturing capabilities, leveraging trade agreements, and focusing on energy-efficient solutions. By enhancing production capacities and optimizing supply chains, companies aim to meet the increasing demand driven by urbanization and climate conditions. Additionally, aligning with international standards and regulations ensures compliance and access to broader markets. Emphasizing sustainability through energy-efficient products not only caters to regulatory requirements but also appeals to environmentally conscious consumers. Through these initiatives, companies are positioning themselves to capitalize on the growing opportunities within the rapidly expanding HVAC sector in Mexico.

The report provides a comprehensive analysis of the competitive landscape in the Mexico HVAC market with detailed profiles of all major companies.

Latest News and Developments:

- September 2025: COMSA secured three new railway contracts in Mexico City with a total value of EUR 35 million (around 760 million pesos), further reinforcing its footprint in the country. The projects are centered on modernizing urban transport infrastructure and promoting electromobility solutions. They will cover railway track upgrades, along with the installation of electrical systems, hydraulic networks, and HVAC systems, underscoring COMSA’s dedication to sustainable and electrified urban mobility.

- September 2025: LG Electronics Mexico delivered a fully customized HVAC solution designed to match the scale and complexity of the Cittadela Residential Project. The installation included 1,414 climate control units in total, featuring 951 ducted single-split systems, 418 inverter wall-mounted mini-splits, and a selection of single package units. These systems were specifically chosen for their ability to deliver powerful, energy-efficient performance while operating at low noise levels, an essential factor in creating a comfortable residential environment.

- March 2024: Blue Ridge, a leading provider of supply chain planning solutions, has announced a strategic alliance with HARDI LATAM, a key association representing Heating, Air-Conditioning, and Refrigeration Distributors (HVACR) across Mexico and Latin America. This partnership signifies Blue Ridge’s official entry into the Mexican and Latin American markets with substantial growth opportunities, while also reinforcing its long-standing collaboration with HARDI US.

- January 2024: LG Electronics inaugurated a new scroll compressor production line in Monterrey, Nuevo León to strengthen regional HVAC manufacturing and address North American supply chain vulnerabilities. The new line will produce Gen 3 Scroll Compressors featuring low-GWP refrigerants, supporting upcoming 2025 environmental regulations and boosting LG's sustainability profile. This strategic investment enhances local capabilities and reinforces Mexico’s role in eco-conscious compressor manufacturing.

Mexico HVAC Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Direct Expansion Systems, Central Air Conditioning Systems |

| End Users Covered | Residential, Commercial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico HVAC market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico HVAC market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico HVAC industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The market in the region was valued at USD 5,304.55 Million in 2024.

The Mexico HVAC market is projected to exhibit a CAGR of 16.17% during 2025-2033, reaching a value of USD 20,440.62 Million by 2033.

The market is driven by expanding commercial infrastructure, rising demand for energy-efficient systems, increasing industrial manufacturing, and adoption of precision-controlled HVACs. Climate variability across regions reinforces demand for adaptive temperature control, while investments in green buildings and government support for energy efficiency are also key drivers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)