Mexico Hydraulics Pneumatics and Actuator Market Size, Share, Trends and Forecast by Type, Functionality, Component, End Use Industry, and Region, 2026-2034

Mexico Hydraulics Pneumatics and Actuator Market Summary:

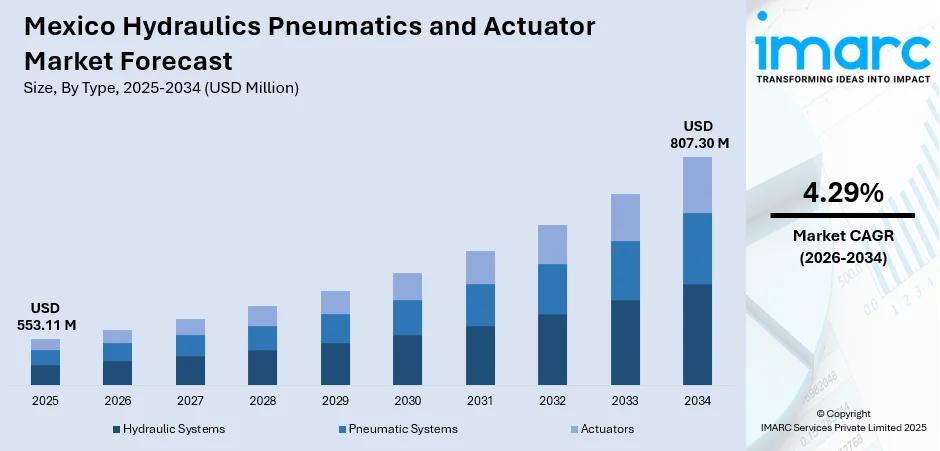

The Mexico hydraulics pneumatics and actuator market size reached USD 553.11 Million in 2025 and is projected to reach USD 807.30 Million by 2034, growing at a compound annual growth rate of 4.29% from 2026-2034.

The Mexico hydraulics pneumatics and actuator market is experiencing robust growth driven by the country's expanding manufacturing sector and rising industrial automation adoption. The market benefits from Mexico's strategic position as a major automotive and aerospace manufacturing hub in North America, where hydraulic and pneumatic systems are essential for precision motion control and power transmission applications across diverse industrial processes.

Key Takeaways and Insights:

- By Type: Hydraulic systems dominate the market with a share of 55% in 2025, driven by their superior force generation capabilities and widespread deployment in heavy machinery, construction equipment, and industrial presses across Mexico's manufacturing corridors.

- By Functionality: Power transmission leads the market with a share of 45% in 2025, owing to the critical role of fluid power systems in transferring mechanical energy across automotive assembly lines, material handling operations, and heavy-duty processing facilities.

- By Component: Pumps represent the largest segment with a market share of 25% in 2025, as they serve as the heart of hydraulic and pneumatic systems, converting mechanical power into fluid energy essential for operating cylinders, motors, and actuators.

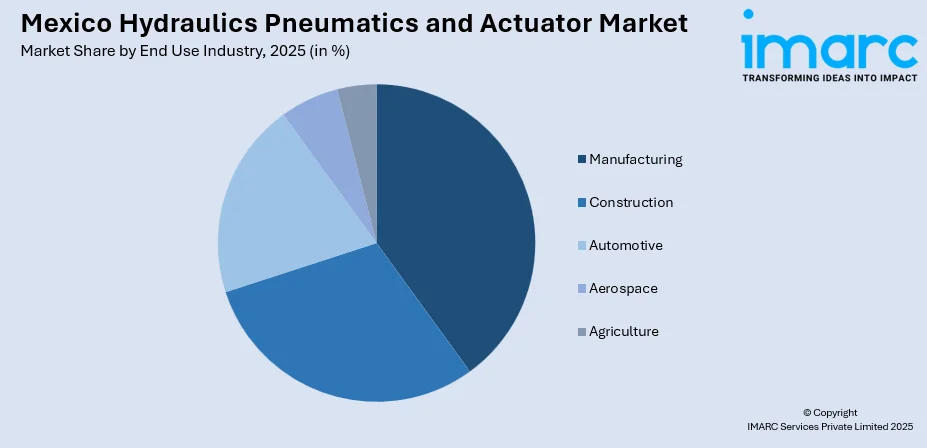

- By End Use Industry: Manufacturing dominates with a market share of 40% in 2025, reflecting Mexico's status as a global manufacturing powerhouse with extensive automotive, electronics, and aerospace production facilities requiring precision motion control systems.

- Key Players: The Mexico hydraulics pneumatics and actuator market exhibits a moderately consolidated competitive landscape, with established multinational corporations competing alongside regional distributors. Market participants focus on technological innovation, energy-efficient solutions, and after-sales service networks to strengthen their market positioning.

To get more information on this market Request Sample

The Mexico hydraulics pneumatics and actuator market is witnessing a significant transformation driven by the nearshoring trend and expanding foreign direct investment in the country's manufacturing sector. Mexico's strategic location, favorable trade agreements under USMCA, and competitive labor costs have attracted substantial investments from global automotive and aerospace manufacturers, creating sustained demand for advanced motion control systems. The government's Industry 4.0 initiatives and Plan Mexico 2025 are accelerating automation adoption across industrial facilities, with pneumatic and hydraulic systems playing crucial roles in robotic assembly lines, material handling equipment, and precision manufacturing processes. In June 2024, Bobcat, a major equipment manufacturer, commenced construction on a facility in Salinas Victoria, Mexico, signaling continued investment in the country's heavy machinery sector. Furthermore, the integration of IoT-enabled monitoring systems and smart diagnostics in hydraulic and pneumatic equipment is enhancing operational efficiency and predictive maintenance capabilities across Mexican industrial facilities.

Mexico Hydraulics Pneumatics and Actuator Market Trends:

Growing Adoption of Energy-Efficient Fluid Power Systems

The rising focus on reducing energy consumption in industrial operations is shaping the direction of the Mexico hydraulics pneumatics and actuator market. Manufacturers across various sectors are seeking compact, efficient, and reliable motion control systems that help reduce operational costs and enhance system performance. Companies are increasingly adopting variable frequency drives and advanced servo-actuated pneumatic systems that enable closed-loop control using standard air lines, reducing energy use while simplifying actuator electrification across manufacturing facilities.

Integration of Smart Technologies and Industry 4.0 Connectivity

The integration of Internet of Things connectivity with hydraulic and pneumatic systems is transforming operational capabilities across Mexican industries. The Mexico Internet of Things market size reached USD 15,339.0 Million in 2024. Looking forward, the market is expected to reach USD 46,079.0 Million by 2033, exhibiting a growth rate (CAGR) of 13% during 2025-2033. Smart sensors and real-time monitoring solutions enable predictive maintenance, optimize process parameters, and minimize unplanned downtime. Advanced distributed control systems with high-performance drive technology are being deployed to enhance speed control, torque accuracy, and system uptime in continuous operation environments, directly addressing the need for efficient production and lower operational losses.

Expansion of Automation in Automotive and Aerospace Manufacturing

The automotive and aerospace sectors in Mexico continue to drive substantial demand for hydraulic and pneumatic equipment. According to the industry report, Mexico has strengthened its standing in the global automotive industry, securing a spot within the world’s top ten vehicle-manufacturing nations. It currently holds the seventh position, following major producers such as China, the United States, Japan, India, South Korea, and Germany. According to figures from the National Institute of Statistics and Geography (Inegi), Mexico’s light-vehicle output reached nearly four million units in 2024, reflecting notable year-over-year growth. A significant share of this production was concentrated among five major automakers, General Motors, Nissan, Stellantis, Ford, and Volkswagen, which together accounted for most vehicles built during the year. Mexico also solidifies its position as a major aerospace manufacturing hub. The need for precision actuators, pneumatic tools, and hydraulic presses in assembly operations continues to expand. Technical universities are introducing specialized courses in industrial robotics and automation, preparing the workforce for advanced manufacturing environments.

Market Outlook 2026-2034:

The Mexico hydraulics pneumatics and actuator market demonstrates strong growth potential supported by continued industrial expansion and automation investments. The nearshoring trend is expected to maintain momentum as companies relocate production closer to North American markets, creating sustained demand for fluid power equipment. Government initiatives supporting manufacturing modernization and workforce development in automation technologies are expected to further propel market expansion. The market generated a revenue of USD 553.11 Million in 2025 and is projected to reach a revenue of USD 807.30 Million by 2034, growing at a compound annual growth rate of 4.29% from 2026-2034.

Mexico Hydraulics Pneumatics and Actuator Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Hydraulic Systems | 55% |

| Functionality | Power Transmission | 45% |

| Component | Pumps | 25% |

| End Use Industry | Manufacturing | 40% |

Type Insights:

- Hydraulic Systems

- Pneumatic Systems

- Actuators

The hydraulic systems segment dominates with a market share of 55% of the total Mexico hydraulics pneumatics and actuator market in 2025.

Hydraulic systems maintain the largest market share due to their unmatched capability for generating high force outputs required in heavy industrial applications. These systems are extensively deployed across construction equipment, mining machinery, and industrial presses where substantial power density is essential for operations. The robust performance characteristics of hydraulic equipment make it indispensable for applications requiring precise control over heavy loads and sustained force generation. For instance, in November 2025, Continental, an NFPA member, unveiled its new hydraulics manufacturing plant in Aguascalientes, Mexico. Spanning 900,000 square feet, the facility enhances ContiTech’s production footprint across the Americas and aims to reinforce regional supply chains while boosting the company’s ability to respond swiftly to customer demands.

The continued expansion of Mexico's construction and mining sectors further reinforces demand for hydraulic systems. Infrastructure development projects, including port expansions, highway construction, and urban development initiatives, drive the procurement of hydraulic-powered excavators, loaders, and cranes. Additionally, the mining industry's focus on critical minerals exploration creates sustained requirements for hydraulic equipment in extraction and material handling operations.

Functionality Insights:

- Power Transmission

- Motion Control

- Force Generation

The power transmission segment leads with a share of 45% of the total Mexico hydraulics pneumatics and actuator market in 2025.

Power transmission functionality dominates the market as industrial facilities increasingly rely on fluid power systems to transfer mechanical energy across complex manufacturing processes. The automotive sector's assembly lines, material handling systems, and packaging operations depend heavily on hydraulic and pneumatic power transmission for efficient equipment operation. These systems enable the seamless transfer of power to multiple workstations while maintaining precision control over production sequences.

The growing sophistication of manufacturing operations in Mexico's industrial clusters drives demand for advanced power transmission solutions. Modern production facilities require integrated systems capable of delivering consistent power output while accommodating variable speed requirements and complex motion profiles. The adoption of distributed control systems enhances power transmission efficiency by enabling real-time optimization of energy distribution across interconnected equipment networks.

Component Insights:

- Pumps

- Valves

- Cylinders

- Compressors

- Actuator Control Systems

The pumps segment exhibits a clear dominance with a 25% share of the total Mexico hydraulics pneumatics and actuator market in 2025.

Pumps serve as the foundational component of hydraulic systems, converting mechanical input into pressurized fluid flow that powers downstream equipment. The diverse requirements of Mexico's industrial sectors necessitate various pump configurations, including gear pumps, piston pumps, and vane pumps, each optimized for specific pressure ranges and flow characteristics. The reliability and efficiency of pump systems directly impact overall system performance, driving continued investment in high-quality pump components.

The increasing emphasis on energy efficiency is accelerating the adoption of variable displacement pumps and smart pump systems with integrated monitoring capabilities. These advanced pump solutions enable demand-based flow adjustment, reducing energy consumption while maintaining operational performance. The aftermarket segment also contributes significantly to pump sales as industrial facilities prioritize preventive maintenance and component replacement programs.

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Manufacturing

- Construction

- Automotive

- Aerospace

- Agriculture

The manufacturing segment represents the largest segment with a market share of 40% of the total Mexico hydraulics pneumatics and actuator market in 2025.

Mexico's manufacturing sector drives the largest share of hydraulics pneumatics and actuator demand, reflecting the country's position as a global manufacturing powerhouse. The sector encompasses automotive production facilities, electronics assembly plants, consumer goods manufacturers, and industrial equipment producers, all relying on fluid power systems for diverse applications. Pneumatic actuators power assembly line tools, hydraulic presses shape metal components, and automated systems coordinate complex production sequences across manufacturing facilities.

The nearshoring wave has brought substantial foreign direct investment into Mexico's manufacturing sector, with approximately two hundred foreign companies announcing investment plans in recent periods. This investment influx accelerates the deployment of advanced automation solutions incorporating hydraulic and pneumatic systems. The integration of Industry 4.0 technologies enables manufacturing facilities to achieve higher productivity levels while maintaining quality standards demanded by global supply chains.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico’s market is driven by an extensive manufacturing and maquiladora ecosystem, particularly in automotive, aerospace, electronics, and metalworking. High factory automation levels boost demand for precision actuators, pneumatic handling systems, hydraulic presses, and motion-control components. Cross-border supply chain integration with the U.S. encourages adoption of advanced, energy-efficient systems. Expansion of logistics, warehousing, and industrial parks also strengthens demand for lifting, material-handling, and robotic automation equipment.

Central Mexico benefits from concentrated automotive, appliance, packaging, and food-processing industries, all requiring reliable fluid-power systems for assembly, molding, forming, and automated production lines. The region’s dense industrial base increases demand for pneumatic cylinders, servo actuators, hydraulic drives, and high-performance valves. Infrastructure upgrades, growth in construction machinery, and modernization of manufacturing facilities further accelerate adoption of integrated hydraulic-pneumatic solutions, motion-control technologies, and maintenance-oriented component replacement.

Southern Mexico’s market is shaped by growing investment in energy, mining, agriculture, and infrastructure development. Hydraulic systems are widely used in drilling rigs, mining equipment, heavy construction machinery, and agricultural machinery, driving steady component demand. Emerging industrial zones and renewable-energy projects require actuators, control valves, and robust hydraulic assemblies for turbines, lifting systems, and site-development equipment. Limited local manufacturing boosts demand for imported durable fluid-power products suited to challenging operating conditions.

Market Dynamics:

Growth Drivers:

Why is the Mexico Hydraulics Pneumatics and Actuator Market Growing?

Expanding Industrial Automation and Smart Manufacturing Adoption

The rapid adoption of industrial automation technologies across Mexican manufacturing facilities represents a primary growth driver for the hydraulics pneumatics and actuator market. The Mexico industrial automation components market size reached USD 3.47 Billion in 2024. Looking forward, the market is expected to reach USD 7.30 Billion by 2033, exhibiting a growth rate (CAGR) of 8.60% during 2025-2033. Companies are investing substantially in automated production systems to enhance efficiency, reduce operational costs, and maintain competitiveness in global markets. The government's Industry 4.0 initiatives and supportive policies encourage manufacturers to modernize their facilities with advanced motion control systems that incorporate smart pneumatic and hydraulic components. Technical education programs are expanding to include specializations in industrial robotics and automation, ensuring workforce readiness for increasingly automated production environments. The IMMEX program enables duty-free importation of automation equipment for export-oriented manufacturers, lowering the cost barrier for adopting advanced hydraulic and pneumatic systems in production facilities.

Rising Foreign Direct Investment and Nearshoring Momentum

Mexico's emergence as a premier nearshoring destination is generating sustained demand for hydraulic and pneumatic equipment across multiple industries. The country recorded substantial foreign direct investment inflows driven by companies seeking to relocate production closer to North American markets. Trade agreements, including USMCA, provide favorable conditions for manufacturers establishing operations in Mexico, creating new demand for industrial equipment, including fluid power systems. Regional manufacturing hubs in states including Nuevo León, Querétaro, Guanajuato, and Baja California are attracting advanced manufacturing investments requiring sophisticated motion control solutions. The automotive sector continues expanding with major vehicle manufacturers increasing production capacity and electric vehicle component manufacturing, each application requiring precision hydraulic and pneumatic equipment for assembly operations.

Infrastructure Development and Construction Sector Expansion

Substantial government investment in infrastructure development is creating significant demand for hydraulic equipment in construction and heavy machinery applications. Transportation infrastructure projects, including highway expansion, port modernization, and railway development, require excavators, loaders, cranes, and other hydraulic-powered construction equipment. Urban development initiatives across major metropolitan areas drive demand for construction machinery equipped with hydraulic systems for earth moving, material handling, and structural work. The mining sector's focus on critical minerals exploration for clean energy technologies generates additional requirements for hydraulic equipment in extraction operations. The Mexico mining market size reached USD 32.26 Million in 2025. The market is projected to reach USD 47.6 Million by 2034, growing at a CAGR of 4.42% during 2026-2034. Government budget allocations for infrastructure investment signal continued expansion of construction activities that depend on hydraulic systems for efficient equipment operation.

Market Restraints:

What Challenges the Mexico Hydraulics Pneumatics and Actuator Market is Facing?

Currency Volatility and Import Cost Pressures

Mexico's reliance on imported hydraulic and pneumatic components exposes the market to currency fluctuation risks that impact equipment procurement costs. The Mexican peso has experienced significant volatility against major currencies, affecting the affordability of imported fluid power equipment for domestic manufacturers. These exchange rate pressures create budgeting challenges for industrial facilities planning equipment upgrades or expansion projects requiring hydraulic and pneumatic systems.

Skilled Workforce Availability for Advanced Automation

The shortage of skilled technicians proficient in advanced automation technologies presents challenges for companies deploying sophisticated hydraulic and pneumatic systems. While technical education programs are expanding, the rapid pace of automation adoption outpaces workforce development in some industrial regions. This skills gap can delay equipment installation, limit operational optimization, and increase maintenance costs for facilities operating complex fluid power systems.

Competition from Electric Actuator Technologies

The gradual shift toward electric actuators in certain applications represents a competitive challenge for traditional hydraulic and pneumatic systems. Electric actuators offer advantages including improved energy efficiency, reduced maintenance requirements, and enhanced precision in positioning applications. Some manufacturers are transitioning to electric solutions for applications previously served by pneumatic or hydraulic equipment, particularly in light-duty automation and precision motion control scenarios.

Competitive Landscape:

The Mexico hydraulics pneumatics and actuator market features a moderately consolidated competitive structure characterized by the presence of established multinational corporations alongside regional distributors and service providers. Leading global manufacturers maintain strong market positions through comprehensive product portfolios, technical support networks, and established relationships with major industrial end-users. These companies invest in localized service capabilities and distribution partnerships to address customer requirements across Mexico's geographically dispersed industrial regions. Market participants compete on factors including product reliability, energy efficiency, technical support responsiveness, and total cost of ownership considerations. The aftermarket segment represents a significant competitive arena where service networks, spare parts availability, and maintenance expertise differentiate market participants and influence customer loyalty decisions.

Recent Developments:

- In June 2025, Hydraulics inaugurated a new manufacturing facility in Monterrey, Nuevo León, Mexico. This state-of-the-art plant strengthens Hengli’s global service network, and once fully operational, it is expected to significantly support the growth and industrial development of the local market and neighboring regions.

Mexico Hydraulics Pneumatics and Actuator Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hydraulic Systems, Pneumatic Systems, Actuators |

| Functionalities Covered | Power Transmission, Motion Control, Force Generations |

| Components Covered | Pumps, Valves, Cylinders, Compressors, Actuator Control Systems |

| End Use Industries Covered | Manufacturing, Construction, Automotive, Aerospace, Agriculture |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico hydraulics pneumatics and actuator market size was valued at USD 553.11 Million in 2025.

The Mexico hydraulics pneumatics and actuator market is expected to grow at a compound annual growth rate of 4.29% from 2026-2034 to reach USD 807.30 Million by 2034.

Hydraulic systems dominated with a 55% market share in 2025, driven by their superior force generation capabilities and widespread deployment across construction equipment, mining machinery, and industrial manufacturing applications throughout Mexico.

Key factors driving the Mexico hydraulics pneumatics and actuator market include expanding industrial automation adoption, rising foreign direct investment through nearshoring trends, infrastructure development projects, and government initiatives supporting manufacturing modernization.

Major challenges include currency volatility affecting import costs, skilled workforce availability for advanced automation systems, competition from electric actuator technologies, and infrastructure limitations in certain industrial regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)