Mexico Hydroelectric Power Market Size, Share, Trends and Forecast by Type of Hydroelectric Plant, Component, End Use, and Region, 2025-2033

Mexico Hydroelectric Power Market Overview:

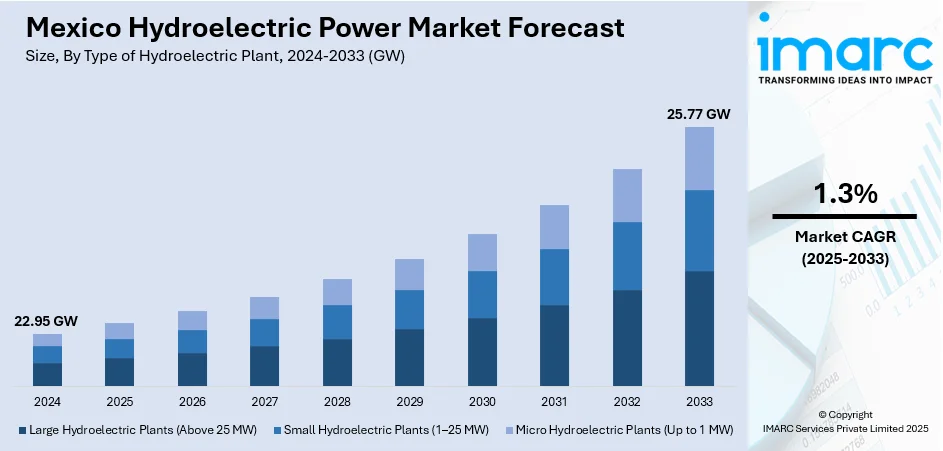

The Mexico hydroelectric power market size reached 22.95 GW in 2024. Looking forward, IMARC Group expects the market to reach 25.77 GW by 2033, exhibiting a growth rate (CAGR) of 1.3% during 2025-2033. The country's renewable energy targets, government incentives, rising demand for clean energy, and the need for energy security are some of the factors contributing to Mexico hydroelectric power market share. Additionally, the abundant water resources and increasing investment in infrastructure contribute to its growth and development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 22.95 GW |

| Market Forecast in 2033 | 25.77 GW |

| Market Growth Rate 2025-2033 | 1.3% |

Mexico Hydroelectric Power Market Trends:

Advancements in Hydroelectric Optimization

Mexico’s hydroelectric power market has seen substantial improvements in efficiency and sustainability with the implementation of advanced enterprise optimization platforms. These systems have significantly enhanced energy and water management processes, driving cost savings and better resource utilization. Since the adoption of probabilistic optimization methods, hydroelectric operations have become more effective, notably reducing flood risks in key regions and improving flood control. The shift has also contributed to a reduction in reliance on natural gas imports, supporting energy security. These advancements reflect the growing importance of integrating technology into infrastructure management, not only boosting economic savings but also promoting environmental sustainability and resilience in the face of climate challenges. These factors are intensifying the Mexico hydroelectric power market growth. For example, in August 2024, PSR, using the FICO platform enterprise optimization, enhanced Mexico's energy and water management systems. Since 2021, CENACE has optimized hydroelectric operations, saving the government over USD 300 Million in 2022 and improving flood control in Tabasco. The shift to probabilistic optimization has reduced flood risks, enhanced energy security, and contributed to a 4% decrease in natural gas imports. PSR’s innovation earned the 2024 FICO Decision Award for ESG Champion.

To get more information on this market, Request Sample

Optimizing Hydroelectric Operations for Greater Efficiency

The integration of advanced optimization technologies in hydroelectric systems is reshaping energy and water resource management. By utilizing sophisticated platforms for enterprise resource optimization, operations are becoming more streamlined and adaptive. These technologies improve the accuracy of water flow forecasting and energy demand prediction, resulting in better synchronization of energy production with consumption needs. This approach not only reduces operational costs but also enhances the management of environmental risks, such as flood control, by enabling more precise water usage. The shift to optimized resource management also supports energy security by minimizing dependency on external energy sources. As the sector evolves, these advancements highlight the growing importance of adopting technology to improve sustainability, reduce environmental impacts, and ensure more efficient resource use. This evolution represents a significant step toward a future where energy systems are both more reliable and environmentally responsible, fostering long-term resilience and sustainability in the hydroelectric sector.

Mexico Hydroelectric Power Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type of hydroelectric plant, component, and end use.

Type of Hydroelectric Plant Insights:

- Large Hydroelectric Plants (Above 25 MW)

- Small Hydroelectric Plants (1–25 MW)

- Micro Hydroelectric Plants (Up to 1 MW)

The report has provided a detailed breakup and analysis of the market based on the type of hydroelectric plant. This includes large hydroelectric plants (above 25 MW), small hydroelectric plants (1–25 MW), and micro hydroelectric plants (up to 1 MW).

Component Insights:

- Turbines

- Generators

- Transformers

- Control Systems

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes turbines, generators, transformers, and control systems.

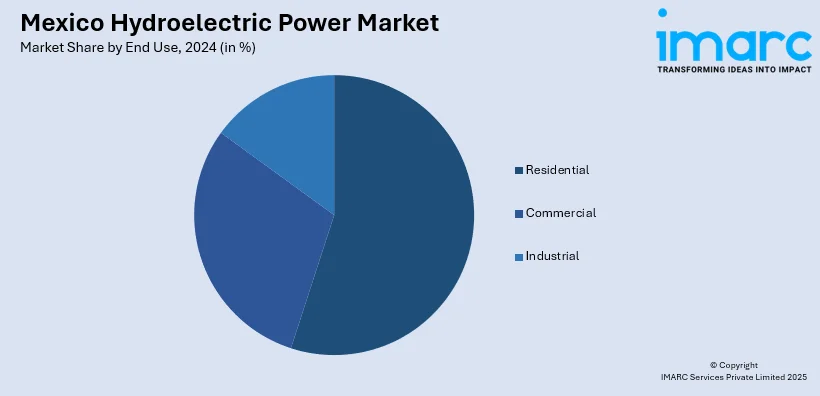

End Use Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Hydroelectric Power Market News:

- In February 2025, Mexico’s president launched the National Electric System Expansion Plan 2025-30, which includes the launch of 16 hydroelectric projects, adding 535.6 MW to Mexico’s power capacity. These projects, inherited from the previous administration, are part of a broader strategy to increase renewable energy output. The plan also allocates significant investments in transmission and distribution infrastructure to support the growth of hydropower and other renewable energy sources in the country.

Mexico Hydroelectric Power Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | GW |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types of Hydroelectric Plants Covered | Large Hydroelectric Plants (Above 25 MW), Small Hydroelectric Plants (1–25 MW), Micro Hydroelectric Plants (Up to 1 MW) |

| Components Covered | Turbines, Generators, Transformers, Control Systems |

| End Uses Covered | Residential, Commercial, Industrial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico hydroelectric power market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico hydroelectric power market on the basis of type of hydroelectric plant?

- What is the breakup of the Mexico hydroelectric power market on the basis of component?

- What is the breakup of the Mexico hydroelectric power market on the basis of end use?

- What is the breakup of the Mexico hydroelectric power market on the basis of region?

- What are the various stages in the value chain of the Mexico hydroelectric power market?

- What are the key driving factors and challenges in the Mexico hydroelectric power market?

- What is the structure of the Mexico hydroelectric power market and who are the key players?

- What is the degree of competition in the Mexico hydroelectric power market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico hydroelectric power market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico hydroelectric power market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico hydroelectric power industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)