Mexico Hydroponics Market Size, Share, Trends and Forecast by Type, Crop Type, Equipment, and Region, 2025-2033

Mexico Hydroponics Market Overview:

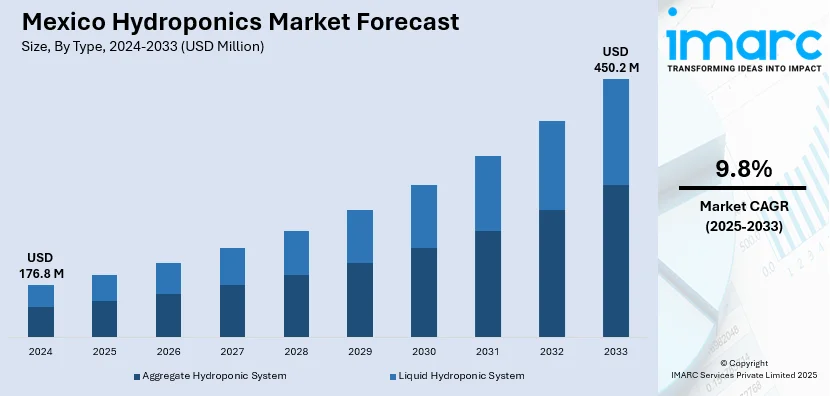

The Mexico hydroponics market size reached USD 176.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 450.2 Million by 2033, exhibiting a growth rate (CAGR) of 9.8% during 2025-2033. The rising demand for pesticide-free produce, increasing urbanization, limited arable land, growing awareness of resource-efficient farming, expanding export potential, government support for sustainable agriculture, and adoption of advanced farming technologies are driving market expansion and encouraging investment in controlled-environment agriculture across major urban and peri-urban regions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 176.8 Million |

| Market Forecast in 2033 | USD 450.2 Million |

| Market Growth Rate 2025-2033 | 9.8% |

Mexico Hydroponics Market Trends:

Expansion of High-Value Crop Cultivation for Export Markets

The shift toward high-value crop cultivation, particularly for export-oriented production is propelling Mexico hydroponics market growth. According to an industry report, Mexico ranks among the top three agricultural exporters to the United States, with average annual exports reaching approximately USD 41.6 Billion during the 2020–2024 period. Notably, the country supplies nearly one-third of all U.S. horticultural imports, including a wide range of fruits, vegetables, and alcoholic beverages. Therefore, Mexican hydroponic farms are increasingly producing strawberries, bell peppers, cherry tomatoes, cucumbers, and leafy greens, crops in high demand in North America and Europe. These products benefit from hydroponic systems due to their sensitivity to soil-borne diseases and environmental fluctuations, which are better controlled in soilless, monitored environments. Exporters benefit from the predictable quality and residue-free nature of hydroponically grown produce, enabling them to comply with stringent phytosanitary and quality standards in target markets. Strategic proximity to the U.S. border also allows for efficient cold chain logistics, reducing transit time and spoilage. In addition to this, certifications such as Global G.A.P. and USDA Organic further add value to hydroponically produced goods, making them more competitive in international markets. All these factors are significantly augmenting the Mexico hydroponics market share.

Increasing Urbanization and Demand for Localized Food Production

The rapid pace of urbanization in Mexico is contributing to the increased adoption of advanced agricultural practices, with hydroponic farming emerging as a viable solution in densely populated regions such as Mexico City, Guadalajara, and Monterrey. As per industry reports, approximately 80% of the national population now resides in urban areas, underscoring the growing importance of localized food production systems. The expansion of urban settlements has heightened concerns regarding the timely availability of fresh, high-quality produce, primarily due to extended transportation routes, diminished shelf life, and elevated consumer expectations related to food safety and nutritional value. Within this context, hydroponics offers a strategic response by enabling efficient, soil-less cultivation in controlled environments situated closer to end markets. Furthermore, hydroponic systems offer a solution by enabling food production within urban and peri-urban environments, often in underutilized spaces like rooftops, warehouses, or vertical farming structures. This model minimizes distribution time and costs while supporting year-round cultivation. Moreover, urban consumers, especially within higher income segments, are increasingly seeking pesticide-free, traceable, and nutrient-rich produce, features that hydroponically grown crops are well-positioned to deliver, which is enhancing Mexico hydroponics market outlook. Municipal authorities and private developers are also integrating urban agriculture into sustainability initiatives, offering incentives and policy support for compact, soil-less farming technologies. The synergy between urban growth and hydroponics is facilitating decentralized food systems and reshaping supply chain models across Mexico’s metropolitan regions.

Mexico Hydroponics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, crop type, and equipment.

Type Insights:

- Aggregate Hydroponic System

- Closed System

- Opened System

- Liquid Hydroponic System

The report has provided a detailed breakup and analysis of the market based on the type. This includes aggregate hydroponic system (closed system and opened system) and liquid hydroponic system.

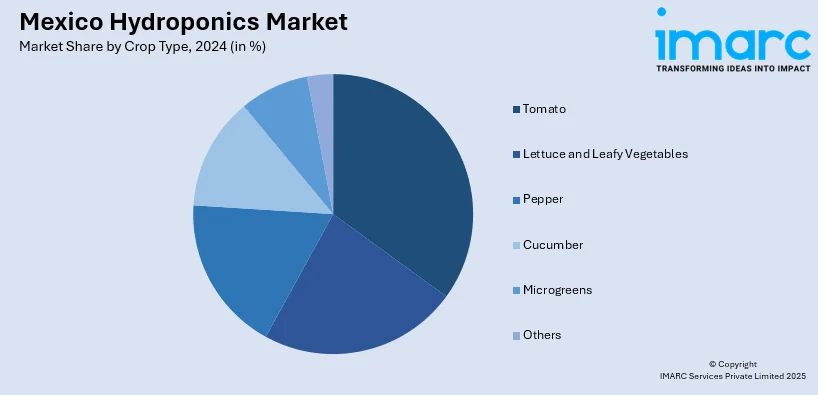

Crop Type Insights:

- Tomato

- Lettuce and Leafy Vegetables

- Pepper

- Cucumber

- Microgreens

- Others

A detailed breakup and analysis of the market based on the crop type have also been provided in the report. This includes tomato, lettuce and leafy vegetables, pepper, cucumber, microgreens, and others.

Equipment Insights:

- HVAC

- LED Grow Light

- Irrigation Systems

- Material Handling

- Control Systems

- Others

The report has provided a detailed breakup and analysis of the market based on the equipment. This includes HVAC, LED grow light, irrigation systems, material handling, control systems, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Hydroponics Market News:

- September 2024: Globalmex International Inc., under its Magic Sun brand, announced the launch of high-tech hydroponic greenhouse-grown Roma tomatoes in central Mexico. This initiative utilizes advanced hydroponic systems and strategic high-elevation locations and aims to ensure consistent quality and resilience against adverse weather conditions. The new crop complements Magic Sun’s existing offerings of conventional and USDA-certified organic greenhouse tomatoes, providing a comprehensive range to meet diverse customer needs.

- September 2024: J. Huete Greenhouses announced the completion of a 1.5-hectare high-tech greenhouse in Mexico, specifically designed for hydroponic strawberry production. The facility incorporates ceiling-hung growing systems to optimize vertical space and enhance operational efficiency. It is equipped with advanced climate control and irrigation technologies. The greenhouse aims to increase yields while reducing labor intensity and operational costs.

Mexico Hydroponics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Crop Types Covered | Tomato, Lettuce and Leafy Vegetables, Pepper, Cucumber, Microgreens, Others |

| Equipments Covered | HVAC, LED Grow Light, Irrigation Systems, Material Handling, Control Systems, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico hydroponics market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico hydroponics market on the basis of type?

- What is the breakup of the Mexico hydroponics market on the basis of crop type?

- What is the breakup of the Mexico hydroponics market on the basis of equipment?

- What is the breakup of the Mexico hydroponics market on the basis of region?

- What are the various stages in the value chain of the Mexico hydroponics market?

- What are the key driving factors and challenges in the Mexico hydroponics market?

- What is the structure of the Mexico hydroponics market and who are the key players?

- What is the degree of competition in the Mexico hydroponics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico hydroponics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico hydroponics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico hydroponics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)