Mexico Hydropower Equipment Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Mexico Hydropower Equipment Market Overview:

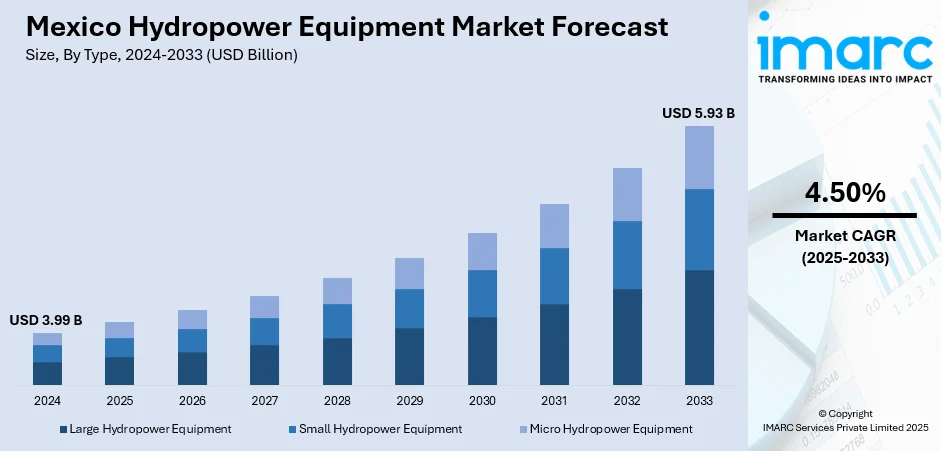

The Mexico hydropower equipment market size reached USD 3.99 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.93 Billion by 2033, exhibiting a growth rate (CAGR) of 4.50% during 2025-2033. Increasing demand for renewable energy, government initiatives supporting clean energy, favorable environmental policies, and the need for energy security are some of the factors contributing to Mexico hydropower equipment market share. Technological advancements and investments in infrastructure further boost market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.99 Billion |

| Market Forecast in 2033 | USD 5.93 Billion |

| Market Growth Rate 2025-2033 | 4.50% |

Mexico Hydropower Equipment Market Trends:

Growth in Hydropower Sector

Mexico is increasing its hydropower capacity, currently accounting for 0.90% of the global total with a focus on modernizing and rehabilitating existing plants. Key projects in the pipeline include large-scale plants like Infiernillo, Malpaso, and La Angostura, which will add significant capacity to the grid. These efforts aim to boost the nation's renewable energy generation, aligning with broader goals to enhance sustainability. The development and upgrade of hydropower infrastructure are crucial to meeting rising energy demands while reducing carbon emissions. This shift reflects Mexico’s commitment to a cleaner energy mix and its reliance on hydropower as a central part of its renewable energy strategy. These factors are intensifying the Mexico hydropower equipment market growth. For example, as per industry reports, in 2023, Mexico's hydro capacity represented 0.90% of the global total, contributing to the 1,407 GW installed globally. The nation's largest upcoming hydropower projects include Infiernillo (1,200 MW), Malpaso (1,080 MW), La Angostura (900 MW), Ingeniero Carlos Ramirez Ulloa (600 MW), and Angel Albino Corzo (420 MW), all developed by Comision Federal de Electricidad. These projects, mostly under rehabilitation and modernization, reflect Mexico's commitment to expanding renewable energy capacity through hydropower.

To get more information on this market, Request Sample

Advancements in Hydropower Equipment Production

Recent innovations in Mexico’s hydropower sector are focusing on enhancing operational efficiency. The introduction of advanced machinery, such as positioners at mechanical workshops, is driving productivity improvements, reducing delivery times, and improving equipment quality. These advancements reflect the industry’s commitment to innovation and meeting the growing demand for hydropower solutions. As Mexico continues to invest in renewable energy, such technological developments are expected to play a vital role in supporting future hydropower projects, ensuring that the sector remains competitive and capable of meeting energy demands with high-quality, efficient solutions. For instance, in June 2024, ANDRITZ Mexico recently inaugurated a new 100-150 ton positioner at its mechanical workshop, enhancing operational efficiency in the hydropower sector. This innovation would boost productivity, improve quality, and reduce delivery times, supporting the company’s ongoing commitment to innovation and high-quality solutions in Mexico’s growing hydropower equipment market. The event was attended by key industry leaders, underscoring the importance of this development for future hydropower projects.

Mexico Hydropower Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Large Hydropower Equipment

- Small Hydropower Equipment

- Micro Hydropower Equipment

The report has provided a detailed breakup and analysis of the market based on the type. This includes large hydropower equipment, small hydropower equipment, and micro hydropower equipment.

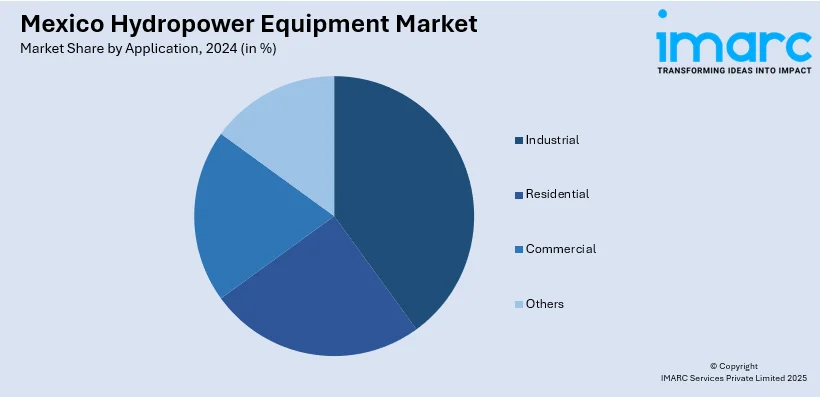

Application Insights:

- Industrial

- Residential

- Commercial

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes industrial, residential, commercial, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Hydropower Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Large Hydropower Equipment, Small Hydropower Equipment, Micro Hydropower Equipment |

| Applications Covered | Industrial, Residential, Commercial, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico hydropower equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico hydropower equipment market on the basis of type?

- What is the breakup of the Mexico hydropower equipment market on the basis of application?

- What is the breakup of the Mexico hydropower equipment market on the basis of region?

- What are the various stages in the value chain of the Mexico hydropower equipment market?

- What are the key driving factors and challenges in the Mexico hydropower equipment market?

- What is the structure of the Mexico hydropower equipment market and who are the key players?

- What is the degree of competition in the Mexico hydropower equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico hydropower equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico hydropower equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico hydropower equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)