Mexico Identity Verification Market Size, Share, Trends and Forecast by Type, Component, Deployment Mode, Organization Size, Vertical, and Region, 2025-2033

Mexico Identity Verification Market Overview:

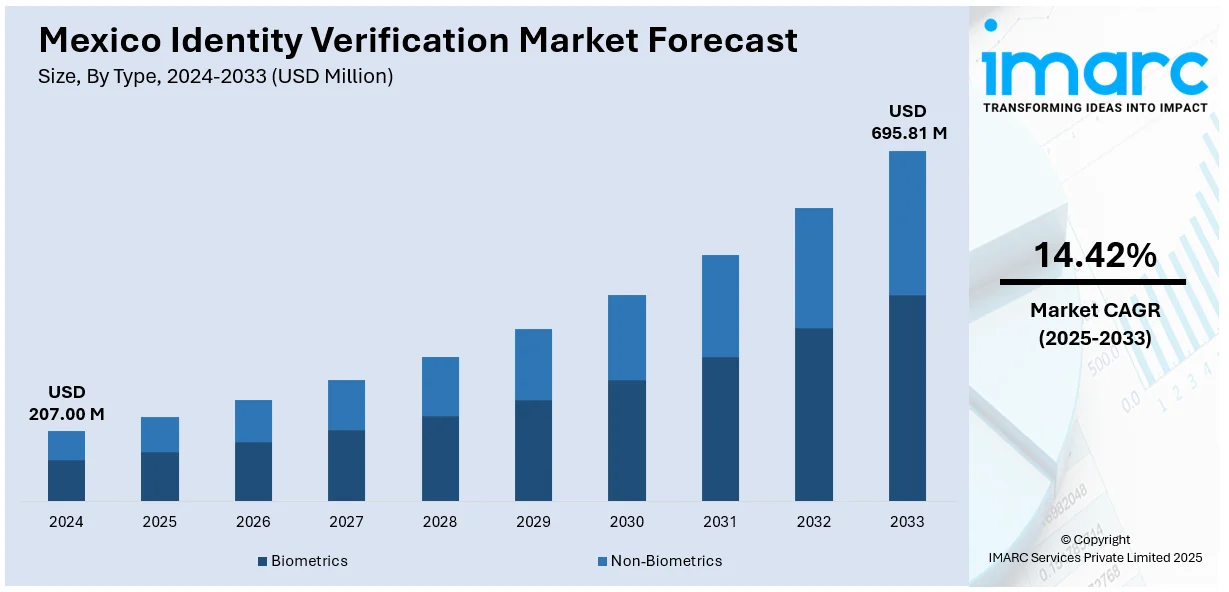

The Mexico identity verification market size reached USD 207.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 695.81 Million by 2033, exhibiting a growth rate (CAGR) of 14.42% during 2025-2033. The market is driven by regulatory frameworks, such as the implementation of stricter Know Your Customer (KYC) requirements, which further accelerate the adoption of advanced identity verification solutions across various sectors, including banking, e-commerce, and healthcare. In addition to this, increasing demand for secure digital transactions, rising cybersecurity concerns, and the growth of online services are some of the major factors augmenting Mexico identity verification market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 207.00 Million |

| Market Forecast in 2033 | USD 695.81 Million |

| Market Growth Rate 2025-2033 | 14.42% |

Mexico Identity Verification Market Trends:

Rise in Digital Transformation and E-Commerce

With Mexico increasingly embracing digital transformation, the need for online transactions and services is growing rapidly. E-commerce, in particular, has grown considerably, with consumers increasingly turning to online purchases and digital payments. At least one digital purchase is made weekly by four out of ten Mexican customers, with most online shoppers between 25–and 34 years old, according to an industry report. Consequently, companies are investing more in sophisticated identity verification products like biometrics, AI-driven authentication, and document verification technologies to secure transactions and safeguard user data. This boom is prompting stronger and more effective identity verification tools to prevent fraud and facilitate secure transactions. Moreover, growth in digital wallets and mobile payments also fuels the demand for trusted identity solutions as online users want to make sure that users are authenticated without compromising ease of use. This, in turn, is fueling Mexico identity verification market growth. Besides this, in order to establish customer trust and minimization of the risk of fraud, Mexican businesses are investing heavily in advanced identity verification technology to secure sensitive information, enhance user experience, and deliver on the promises of both consumers and regulators.

Adoption of Biometric and AI-driven Solutions

Biometric recognition and AI-based verification solutions are becoming increasingly popular in the market. With the increasing sophistication of identity theft and fraud, conventional approaches like passwords and PINs are viewed as vulnerable. Therefore, biometric technology like fingerprint scanning, facial recognition, and voice recognition is used as the preferred choice to authenticate identities in Mexico. The technologies provide higher security and ease of use since they enable people to prove their identities instantly and accurately. Apart from this, the combination of artificial intelligence (AI) and identity verification technologies aids in smoothing out the process, making it more efficient while eliminating human mistakes and improving the capability to detect fraud. AI software can study and cross-correlate data from various sources to identify disparities or possible threats of fraud. As per industry reports, Mexico's Veracruz state is witnessing high demand for the biometric variant of the Unique Population Registry Code (CURP), with 70 daily requests for the Civil Registry. The revised CURP comes with biometric information such as photos, iris scans, and fingerprints to enhance security and cut down on identity theft. Veracruz, with more than 8 million inhabitants, is the first state to launch this system, which is voluntary but in which most residents are willing to enroll. This trend in Veracruz is in line with a wider movement within the market where biometric systems are increasingly adopted to streamline processes and ensure greater security in official documents and transactions.

Mexico Identity Verification Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, component, deployment mode, organization size, and vertical.

Type Insights:

- Biometrics

- Non-Biometrics

The report has provided a detailed breakup and analysis of the market based on the type. This includes biometrics and non-biometrics.

Component Insights:

- Solutions

- Services

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes solutions and services.

Deployment Mode Insights:

- On-premises

- Cloud-based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Organization Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small and medium-sized enterprises and large enterprises.

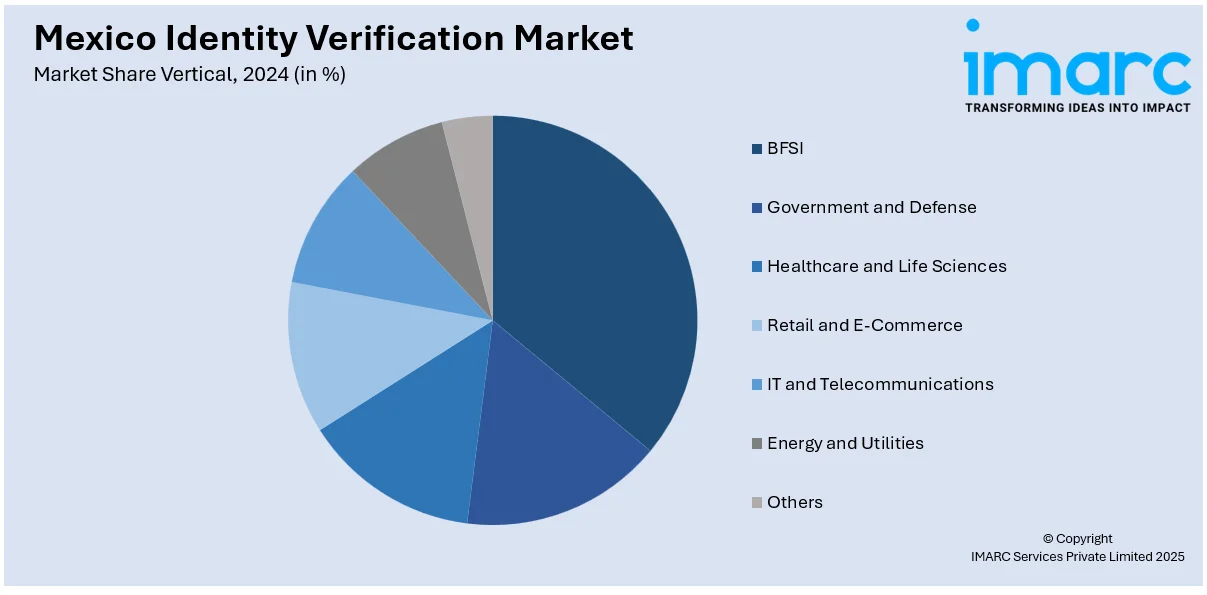

Vertical Insights:

- BFSI

- Government and Defense

- Healthcare and Life Sciences

- Retail and E-Commerce

- IT and Telecommunications

- Energy and Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes BFSI, government and defense, healthcare and life sciences, retail and e-commerce, IT and telecommunications, energy and utilities, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Identity Verification Market News:

- On April 29, 2025, Mexico announced the launch of "Llave MX," a new biometric national identity document incorporating fingerprints, iris scans, and facial photographs to enhance security and streamline government services. This updated version of the Unique Population Registry Code (CURP) aims to simplify administrative processes and promote digital governance.

Mexico Identity Verification Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Biometrics, Non-Biometrics |

| Components Covered | Solutions, Services |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Verticals Covered | BFSI, Government and Defense, Healthcare and Life Sciences, Retail and E-Commerce, IT and Telecommunications, Energy and Utilities, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico identity verification market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico identity verification market on the basis of type?

- What is the breakup of the Mexico identity verification market on the basis of component?

- What is the breakup of the Mexico identity verification market on the basis of deployment mode?

- What is the breakup of the Mexico identity verification market on the basis of organization size?

- What is the breakup of the Mexico identity verification market on the basis of vertical?

- What is the breakup of the Mexico identity verification market on the basis of region?

- What are the various stages in the value chain of the Mexico identity verification market?

- What are the key driving factors and challenges in the Mexico identity verification market?

- What is the structure of the Mexico identity verification market and who are the key players?

- What is the degree of competition in the Mexico identity verification market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico identity verification market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico identity verification market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico identity verification industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)